UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

10-Q

X QUARTERLY

REPORT PURSUANT SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE

ACT OF 1934

For

the quarterly period ended June 30, 2014

TRANSITION

REPORT UNDER SECTION 13 OR 15(D) OF THE SECURITIES

EXCHANGE

ACT OF 1934

For

the transition period from _______________ to _______________

Commission

File # 333-165373

SUPERNOVA

ENERGY, INC.

(Exact

name of small business issuer as specified in its charter)

Nevada

(State

or other jurisdiction of incorporation or organization)

98-0628594

(IRS

Employer Identification Number)

153

W. Lake Mead Pkwy.,

Ste

2240

Henderson

NV 89015

(Address

of principal executive offices)

(702)

839-4029

(Issuer’s

telephone number)

Indicate

by check mark whether the registrant(1) has filed all reports required by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 day. [X } Yes [ ] No

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act.

Large

accelerated filer [ ]

Non-accelerated

filer [ ]

| Small reporting

company [ X ] |

Indicate

by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). [ ] Yes [X ]

No

Indicate

the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date. The

issuer had 31,726,585 shares of common stock and 874,400 shares of preferred stock (with 100:1 conversion and voting rights)

issued and outstanding as of August 19, 2014.

TABLE

OF CONTENTS

| |

|

|

| |

|

Page |

| PART

I – FINANCIAL INFORMATION |

|

| Item

1. |

Financial

Statements |

3 |

| Item

2. |

Management’s

Discussion and Analysis of Financial Condition and Plan of Operations |

9 |

| Item

3. |

Quantitative

and Qualitative Disclosures About Market Risk |

13 |

| |

|

|

| Item

4. |

Controls

and Procedures |

13 |

| |

|

|

| PART

II – OTHER INFORMATION |

|

| Item

1. |

Legal

Proceedings |

14 |

| Item

1A. |

Risk

Factors |

14 |

| Item

2. |

Unregistered

Sale of Equity Securities and Use of Proceeds |

14 |

| Item

3. |

Defaults

Upon Senior Securities |

15 |

| Item

4. |

Submission

of Matters to a Vote of Security Holders |

15 |

| Item

5. |

Other

Information |

15 |

| Item

6. |

Exhibits |

15 |

| |

|

|

| SIGNATURES |

|

16 |

PART

I — FINANCIAL INFORMATION

| Item

1. Financial Statements |

| SUPERNOVA ENERGY, INC. |

| (Formely Northumberland Resources, Inc.) |

| Balance Sheets |

| | |

| |

|

| | |

| |

|

| | |

June 30, | |

December 31, |

| | |

2014 | |

2013 |

| | |

(Unaudited) | |

|

| ASSETS | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 7,354 | | |

$ | 2,035 | |

| Prepaid expenses | |

| 689 | | |

| 3,314 | |

| Deposits | |

| 1,400 | | |

| 1,400 | |

| | |

| | | |

| | |

| Total Current Assets | |

| 9,443 | | |

| 6,749 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT | |

| | | |

| | |

| Oil and gas properties (full cost method) | |

| | | |

| | |

| Proved | |

| 625,335 | | |

| 1,058,517 | |

| Unproved | |

| 396,325 | | |

| 264,717 | |

| Support equipment | |

| 267,630 | | |

| 229,864 | |

| Total property, plant and equipment | |

| 1,289,290 | | |

| 1,553,098 | |

| Accumulated depletion and depreciation | |

| (739,099 | ) | |

| (834,336 | ) |

| Total Property, Plant and Equipment, net | |

| 550,191 | | |

| 718,762 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 559,634 | | |

$ | 725,511 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | |

| | | |

| | |

| | |

| | | |

| | |

| CURRENT LIABILITIES | |

| | | |

| | |

| Accounts payable and accrued expenses | |

$ | 244,093 | | |

$ | 118,461 | |

| Accounts payable and accrued expenses, related parties | |

| 54,000 | | |

| 67,500 | |

| Notes payable | |

| 5,000 | | |

| 5,000 | |

| Notes payable, related parties | |

| 123 | | |

| 123 | |

| Convertible notes payable | |

| — | | |

| — | |

| Derivative liability | |

| — | | |

| — | |

| | |

| | | |

| | |

| Total Current Liabilities | |

| 303,216 | | |

| 191,084 | |

| | |

| | | |

| | |

| LONG TERM LIABILITIES | |

| | | |

| | |

| | |

| | | |

| | |

| Asset retirement obligations, net | |

| 149,532 | | |

| 151,353 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 452,748 | | |

| 342,437 | |

| | |

| | | |

| | |

| STOCKHOLDERS' EQUITY | |

| | | |

| | |

| Preferred stock, 2,000,000 shares authorized at par | |

| | | |

| | |

| value of $0.10; 809,400 shares issued and outstanding | |

| 87,440 | | |

| 80,940 | |

| Common stock, 198,000,000 shares authorized at | |

| | | |

| | |

| par value of $0.001; 31,726,585 and 31,726,585 | |

| | | |

| | |

| shares issued and outstanding, respectively | |

| 31,727 | | |

| 31,727 | |

| Additional paid-in capital | |

| 2,527,727 | | |

| 2,469,227 | |

| Accumulated deficit | |

| (2,540,008 | ) | |

| (2,198,820 | ) |

| | |

| | | |

| | |

| Total Stockholders' Equity | |

| 106,886 | | |

| 383,074 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY | |

$ | 559,634 | | |

$ | 725,511 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of these financial statements | |

| SUPERNOVA ENERGY, INC. |

| (Formerly Northumberland Resources, Inc.) |

| Condensed Statements of Operations |

| (Unaudited) |

| | |

| |

| |

| |

|

| | |

For the Three Months Ended | |

For the Six Months Ended |

|

| | |

June 30, | |

June 30, |

|

| | |

2014 | |

2013 | |

2014 | |

2013 |

| | |

| |

| |

| |

|

| REVENUES | |

$ | 115,344 | | |

$ | 40,157 | | |

$ | 138,423 | | |

$ | 79,475 | |

| | |

| | | |

| | | |

| | | |

| | |

| OPERATING EXPENSES | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Depletion, depreciation, amortization | |

| | | |

| | | |

| | | |

| | |

| and accretion expense | |

| 121,755 | | |

| 64,946 | | |

| 168,895 | | |

| 128,785 | |

| Lease operating expenses | |

| 67,792 | | |

| 128,020 | | |

| 122,026 | | |

| 181,931 | |

| Professional fees | |

| 75,096 | | |

| 76,475 | | |

| 155,637 | | |

| 145,207 | |

| General and administrative expenses | |

| 21,983 | | |

| 28,956 | | |

| 32,930 | | |

| 43,387 | |

| | |

| | | |

| | | |

| | | |

| | |

| Total Operating Expenses | |

| 286,626 | | |

| 298,397 | | |

| 479,488 | | |

| 499,310 | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS FROM OPERATIONS | |

| (171,282 | ) | |

| (258,240 | ) | |

| (341,065 | ) | |

| (419,835 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| OTHER EXPENSES | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Gain (loss) on derivative liability | |

| — | | |

| — | | |

| — | | |

| 11,136 | |

| Interest expense | |

| — | | |

| — | | |

| (123 | ) | |

| (2,232 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| Total Other Expenses | |

| — | | |

| — | | |

| (123 | ) | |

| 8,904 | |

| | |

| | | |

| | | |

| | | |

| | |

| LOSS BEFORE INCOME TAXES | |

| (171,282 | ) | |

| (258,240 | ) | |

| (341,188 | ) | |

| (410,931 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| PROVISION FOR INCOME TAXES | |

| — | | |

| — | | |

| — | | |

| — | |

| | |

| | | |

| | | |

| | | |

| | |

| NET LOSS | |

$ | (171,282 | ) | |

$ | (258,240 | ) | |

$ | (341,188 | ) | |

$ | (410,931 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC AND DILUTED LOSS | |

| | | |

| | | |

| | | |

| | |

| PER COMMON SHARE | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| | |

| | | |

| | | |

| | | |

| | |

| BASIC AND DILUTED WEIGHTED | |

| | | |

| | | |

| | | |

| | |

| AVERAGE NUMBER OF COMMON | |

| | | |

| | | |

| | | |

| | |

| SHARES OUTSTANDING | |

| 31,726,585 | | |

| 31,467,725 | | |

| 31,726,585 | | |

| 31,357,177 | |

| The accompanying notes are an integral part of these condensed financial statements. |

| SUPERNOVA ENERGY, INC. |

| (Formerly Northumberland Resources, Inc.) |

| Condensed Statements of Cash Flows |

| (Unaudited) |

| | |

| |

|

| | |

For the Six Months Ended |

|

| | |

June 30, |

|

| | |

2014 | |

2013 |

| OPERATING ACTIVITIES | |

| | | |

| | |

| Net loss | |

$ | (341,188 | ) | |

$ | (410,931 | ) |

| Adjustments to reconcile net loss to | |

| | | |

| | |

| net cash used by operating activities: | |

| | | |

| | |

| Depreciation, depletion, amortization | |

| | | |

| | |

| and accretion | |

| 168,895 | | |

| 128,785 | |

| Change in derivative liability | |

| — | | |

| (11,136 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Prepaid expenses | |

| 2,625 | | |

| (21,500 | ) |

| Accounts payable - related parties | |

| 239,132 | | |

| — | |

| Accounts payable and accrued expenses | |

| (13,500 | ) | |

| 57,934 | |

| | |

| | | |

| | |

| Net Cash Used in Operating Activities | |

| 55,964 | | |

| (256,848 | ) |

| | |

| | | |

| | |

| INVESTING ACTIVITIES | |

| | | |

| | |

| Purchase of oil and gas properties | |

| — | | |

| — | |

| Capitalized exploration and development costs | |

| (28,234 | ) | |

| (104,766 | ) |

| Purchase of well operating equipment | |

| (87,411 | ) | |

| (18,324 | ) |

| | |

| | | |

| | |

| Net Cash Used in Investing Activities | |

| (115,645 | ) | |

| (123,090 | ) |

| | |

| | | |

| | |

| FINANCING ACTIVITIES | |

| | | |

| | |

| Common stock issued for cash | |

| — | | |

| 400,000 | |

| Preferred stock issued for cash | |

| 65,000 | | |

| — | |

| Repayment of notes payable | |

| — | | |

| (18,000 | ) |

| | |

| | | |

| | |

| Net Cash Provided by Financing Activities | |

| 65,000 | | |

| 382,000 | |

| | |

| | | |

| | |

| NET INCREASE IN CASH | |

| 5,319 | | |

| 2,062 | |

| CASH AT BEGINNING OF PERIOD | |

| 2,035 | | |

| 1,026 | |

| | |

| | | |

| | |

| CASH AT END OF PERIOD | |

$ | 7,354 | | |

$ | 3,088 | |

| | |

| | | |

| | |

| SUPPLEMENTAL DISCLOSURES OF | |

| | | |

| | |

| CASH FLOW INFORMATION | |

| | | |

| | |

| | |

| | | |

| | |

| CASH PAID FOR: | |

| | | |

| | |

| | |

| | | |

| | |

| Interest | |

$ | — | | |

$ | — | |

| Income Taxes | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| NON-CASH FINANCING AND INVESTING ACTIVITES | |

$ | — | | |

$ | — | |

| | |

| | | |

| | |

| Common stock issued for debt | |

$ | — | | |

$ | 109,644 | |

| Common stock issued for subscription receivable | |

$ | — | | |

$ | 15,000 | |

| Sale of oil and gas properties | |

$ | 379,453 | | |

$ | 173,831 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| The accompanying notes are an integral part of these condensed financial statements. | | |

SUPERNOVA

ENERGY, INC.

(Formerly

Northumberland Resources, Inc.

Notes

to Condensed Financial Statements

June

30, 2014 and December 31, 2013

(Unaudited)

NOTE

1 – CONDENSED FINANCIAL STATEMENTS

The

accompanying financial statements have been prepared by the Company without audit. In the opinion of management, all

adjustments (which include only normal recurring adjustments) necessary to present fairly the financial position, results of operations,

and cash flows at June 30, 2014, and for all periods presented herein, have been made.

Certain

information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles

generally accepted in the United States of America have been condensed or omitted. It is suggested that these condensed

financial statements be read in conjunction with the financial statements and notes thereto included in the Company’s December

31, 2013 audited financial statements. The results of operations for the period ended June 30, 2014 and 2013 are not

necessarily indicative of the operating results for the full year.

NOTE

2 - GOING CONCERN

The

Company's financial statements are prepared using generally accepted accounting principles in the United States of America applicable

to a going concern which contemplates the realization of assets and liquidation of liabilities in the normal course of business.

The Company has not yet established an ongoing source of revenues sufficient to cover its operating costs and allow it to continue

as a going concern. The ability of the Company to continue as a going concern is dependent on the Company obtaining adequate capital

to fund operating losses until it becomes profitable. If the Company is unable to obtain adequate capital, it could be forced

to cease operations.

In

order to continue as a going concern, the Company will need, among other things, additional capital resources. Management's plan

is to obtain such resources for the Company by obtaining capital from management and significant shareholders sufficient to meet

its minimal operating expenses and seeking equity and/or debt financing. However management cannot provide any assurances that

the Company will be successful in accomplishing any of its plans.

The

ability of the Company to continue as a going concern is dependent upon its ability to successfully accomplish the plans described

in the preceding paragraph and eventually secure other sources of financing and attain profitable operations. The accompanying

financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

NOTE

3 – SIGNIFICANT ACCOUNTING POLICIES

Use

of Estimates

The

preparation of financial statements in conformity with accounting principles generally accepted in the United States of America

requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of

the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results could differ

from those estimates.

Recent

Accounting Pronouncements

The

Company has evaluated recent accounting pronouncements and their adoption has not had or is not expected to have a material impact

on the Company’s financial position or statements.

Oil

and Gas Properties

The

Company uses the full cost method of accounting for oil and natural gas properties. Under this method, all acquisition, exploration

and development costs, including certain payroll, asset retirement costs, other internal costs, and interest incurred for the

purpose of finding oil and natural gas reserves, are capitalized. Internal costs that are capitalized are directly attributable

to acquisition, exploration and development activities and do not include costs related to production, general corporate overhead

or similar activities. Costs associated with production and general corporate activities are expensed in the period incurred.

Proceeds from the sale of oil and natural gas properties are applied to reduce the capitalized costs of oil and natural gas properties

unless the sale would significantly alter the relationship between capitalized costs and proved reserves, in which case a gain

or loss is recognized.

SUPERNOVA

ENERGY, INC.

(Formerly

Northumberland Resources, Inc.

Notes

to Condensed Financial Statements

June

30, 2014 and December 31, 2013

(Unaudited)

NOTE

3 – SIGNIFICANT ACCOUNTING POLICIES (CONTINUED)

Oil

and Gas Properties (Continued)

Capitalized

costs associated with impaired properties and capitalized costs related to properties having proved reserves, plus the estimated

future development costs, and asset retirement costs under Financial Accounting Standards Board (“FASB”) Accounting

Standards Codification (“ASC”) Topic 410 “Asset Retirement and Environmental Obligations” (FASB

ASC 410), are amortized using the unit-of-production method based on proved reserves. Capitalized costs of oil and natural gas

properties, net of accumulated amortization and deferred income taxes, are limited to the total of estimated future net cash flows

from proved oil and natural gas reserves, discounted at ten percent, plus the cost of unevaluated properties.

There

are many factors, including global events that may influence the production, processing, marketing and price of oil and natural

gas. A reduction in the valuation of oil and natural gas properties resulting from declining prices or production could adversely

impact depletion rates and capitalized cost limitations. Capitalized costs associated with properties that have not been evaluated

through drilling or seismic analysis, including exploration wells in progress, are excluded from the unit-of-production amortization.

Exclusions are adjusted annually based on drilling results and interpretative analysis.

Sales

of oil and natural gas properties are accounted for as adjustments to the net full cost pool with no gain or loss recognized,

unless the adjustment would significantly alter the relationship between capitalized costs and proved reserves. If it is determined

that the relationship is significantly altered, the corresponding gain or loss will be recognized in the statements of operations.

Costs

of oil and gas properties are depleted using the unit-of-production method. For the six-month periods ended June 30, 2014 and

2013, the Company recognized $134,853 and $97,829, respectively of depletion expense related to oil and gas production.

Ceiling

Test

Ceiling

Test - In applying the full cost method and in accordance with ASC 932, the Company

performs an impairment test (ceiling test) at each reporting date, whereby the carrying value of property and equipment is compared

to the value of its proved reserves discounted at a ten percent interest rate of future net revenues, based on current economic

and operating conditions, plus the cost of properties not being amortized, plus the lower of cost or fair market value of unproved

properties included in costs being amortized, less the income tax effects related to book and tax basis differences of the properties.

The Company has recorded no impairment expense in connection with the full cost ceiling test calculation for the six-month periods

ending June 30, 2014 and 2013, respectively.

Revenue

Recognition

Revenues

from the sale of oil and natural gas are recognized according to the sales method, which is when the product is delivered at a

fixed or determinable price, title has transferred, and collectability is reasonably assured. For oil sales, this occurs

when the customer takes delivery of oil from the operators’ storage tanks.

Asset

Retirement Obligations

The

Company records the fair value of a liability for an asset retirement obligation in the period in which it is incurred and a corresponding

increase in the carrying amount of the related long-lived asset. The liability is accreted to its present value each period, and

the capitalized cost is depreciated over the useful life of the related asset. If the liability is settled for an amount other

than the recorded amount, a gain or loss is recognized.

SUPERNOVA

ENERGY, INC.

(Formerly

Northumberland Resources, Inc.

Notes

to Condensed Financial Statements

June

30, 2014 and December 31, 2013

(Unaudited)

NOTE

4 – OIL AND GAS PROPERTIES

On

February 5, 2013 the Company sold a 30 percent gross working interest and a 30 percent net revenue interest in six oil and gas

leases located in Pratt County, Kansas for $100,000. This amount was deducted from funds payable from the Company to the purchasing

entity on July 18, 2013. Pursuant to this transaction the Company transferred a 30 percent interest in all related support equipment

and asset retirement obligations.

On

February 1, 2014 the Company entered into a Purchase and Sale Agreement whereby it agreed to sell 100 percent of its working interest

in two oil and gas leases located in Cowley and Stafford counties, Kansas. As consideration for this transaction, the buyer agreed

to forgive $113,500 in Company debts due to the buyer.

During

the six months ended June 30, 2014 and the year ended December 31, 2013, the Company incurred development costs including certain

work-over costs and other improvements to its wells. The Company paid $29,383and $119,149, respectively for these improvements,

which have been capitalized to the book value of the wells.

Through

June 30, 2014, the Company established an asset retirement obligation of $102,611 for the wells acquired by the Company, which

was capitalized to the value of the oil and gas properties. The wells have an estimated useful life of 25 years. Total accretion

expense on the asset retirement obligation was $46,921, leaving an ending net balance of $149,532 at June 30, 2014.

NOTE

5 – NOTES PAYABLE

As

of December 31, 2011 the Company owed $123 to a related party. During the year ended December 31, 2012 the Company borrowed $18,000

from related parties, and in 2013 repaid the entire $18,000 open balances. On August 21, 2013 the Company borrowed an additional

$5,000 from the related party, with principal due in full on August 21, 2014, along with an additional $500 in accrued interest.

As of June 30, 2014 the Company had an aggregate total of $5,123 in notes payable to related parties.

NOTE

6 – STOCKHOLDERS’ EQUITY

On

October 21, 2013 the Company elected to reduce its authorized number of common shares from 200,000,000 to 100,000,000. On September

15, 2013 the Company authorized a reverse-split of its common stock on a one-share-for-two-shares basis. All references to common

stock have been restated so as to retroactively incorporate the effects of this transaction.

During

the year ended December 31, 2013 the Company issued 109,950 shares of common stock upon the conversion of a $100,000 convertible

note payable and related accrued interest payable. The Company also issued 502,084 shares of common stock for cash at $1.20 per

share, resulting in total cash proceeds of $465,000.

On

February 26, 2014 the Company issued 65,000 shares of preferred stock for cash at $1.00 per share, resulting in total cash proceeds

of $65,000. The preferred shares have 1:100 conversion and voting rights.

NOTE

7 – SUBSEQUENT EVENTS

In

accordance with ASC 855-10, the Company’s management has reviewed all material events and there are no additional material

subsequent events to report.

ITEM

2. MANAGEMENT’S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Forward-looking

statements

This

quarterly report on Form 10-Q contains “forward-looking statements” relating to the registrant which represent the

registrant’s current expectations or beliefs, including statements concerning registrant’s operations, performance,

financial condition and growth. For this purpose, any statement contained in this quarterly report on Form 10-Q that are

not statements of historical fact are forward-looking statements. Without limiting the generality of the foregoing, words such

as “may”, “anticipation”, “intend”, “could”, “estimate”, or “continue”

or the negative or other comparable terminology are intended to identify forward-looking statements. These statements by their

nature involve substantial risks and uncertainties, such as credit losses, dependence on management and key personnel and variability

of quarterly results, ability of registrant to continue its growth strategy and competition, certain of which are beyond the registrant’s

control. Should one or more of these risks or uncertainties materialize or should the underlying assumptions prove incorrect,

actual outcomes and results could differ materially from those indicated in the forward-looking statements.

The

following discussion and analysis should be read in conjunction with the information set forth in the Company’s audited

financial statements for the period ended December 31, 2013.

Overview

We

are in the business of precious minerals exploration and oil and gas exploration and production. The Company was incorporated

in the State of Nevada on June 22, 2009.

On

March 31st, 2011 Northumberland (NHUR) was a successful bidder at the Evenson Oil Production Auction in Wichita, Kansas. NHUR

acquired the Mason, Thompson, Keyes and Harrell leases inclusive of all production and improvements. The leases were purchased

at auction from Reh Oil & Gas LLC. The leases of 280 acres located in the Sawyer field in Pratt County Kansas and 120 acres

located in the Wildcat field, filed in Pratt County Kansas, were purchased for Two Hundred Sixty Thousand Dollars.

The

Company’s Articles of Incorporation are being amended to reflect a decrease in the number of common shares from Two Billion

(2,000,000,000) to One Hundred Ninety Eight Million (198,000,000) and the creation of a preferred stock in the amount of Two Million

(2,000,000) shares with voting and conversion rights of 1 for 100. The Amendment was adopted pursuant to written consent of stockholders

holding a majority of the voting power of the outstanding capital stock of the Company. On October 15, 2013 the Company reduced

its authorized number of common shares to 100,000,000 common and 2,000,000 preferred.

On

March 1, 2011, the Company purchased a 100 percent working interest on a 70 percent net revenue interest in certain oil and gas

leases and related well operating equipment in Pratt County, Kansas for $260,000. Of this total, $149,000 was allocated to oil

and gas leases, and the remaining $111,000 was allocated to the purchased well operating equipment. Subsequent to acquiring the

interests in these leases the Company has incurred $23,310 of exploration costs and $60,702 of development costs which have been

capitalized to the value of oil and gas properties.

On

June 11, 2011, the Company purchased a 30 percent working interest on an 24.45 percent net revenue interest in an unproved oil

and gas well located in Cowley County, KS. The Company paid $17,220 for the lease on 640 acres at $85 per acre. Subsequent to

acquiring the interest in these wells the Company incurred an additional $119,350 of exploration costs and $110,531 of development

costs on the property which have been capitalized to the value of oil and gas properties.

On

July 7, 2011, the Company purchased a 20 percent working interest on an 16.41 percent net revenue interest in a proved and producing

oil and gas well located in Cowley County, KS. The Company paid $45,000 to acquire the leases and incurred an additional $26,881

of development costs which were capitalized to the value of oil and gas properties under.

On

September 27, 2011, the Company purchased two leases and related well operating equipment located in Pratt County for $72,500.

Of this total, $22,500 was allocated to oil and gas leases, and the remaining $50,000 was allocated to the purchased well operating

equipment. The leases carry a 100 percent working interest of 70 percent net revenue interest. Subsequent to purchase the Company

capitalized $990 in exploration costs and $18,363 in development costs relating to these leases.

On

September 27, 2011, the Company also purchased a 23 percent interest in a net revenue interest ranging from 18.66 to 19.65 percent

in three leases in Barton and Stafford Counties, Kansas for $220,800. The three leases combined contain slightly

more than 564 net acres. In total there are seven active wells located in these leases. There

are four oil producing wells, two disposal wells and one injection well. Subsequent to purchase the Company capitalized $2,326

in development costs relating to these leases.

On

December 19, 2011, the company purchased a 15 percent interest in net revenue interests ranging from 12.675 percent to 13.125

percent in four leases in Cowley County, Kansas for $75,600. The four leases combined contain approximately 720 acres. The Company

has incurred no exploration or development costs with respect to these properties as of December 31, 2011.

On

February 9, 2012, the Company purchased a 30 percent gross working interest and a 26.25 percent net revenue interest in six unproved

oil and gas leases in Cowley County, Kansas for $140,400. The six leases combined contain approximately 1,025 acres.

On

May 14, 2012 the Company purchased a 35 percent gross working interest and a 28 percent net revenue interest in 98 acres of unproved

oil and gas leases in Stafford County, Kansas for $12,569. Concurrent with this purchase, the Company paid $19,174 in additional

development costs, and $66,181 for support equipment, for an aggregate purchase price of $97,924.

On

May 14, 2012 the Company purchased a 13 percent gross working interest and a 10 percent net revenue interest in 70 acres of unproved

oil and gas leases in Butler County, Kansas for $17,208. Concurrent with this purchase, the Company paid $27,261 in additional

development costs, and $17,542 for support equipment, for an aggregate purchase price of $62,011.

On

February 5, 2013 the Company sold a 30 percent gross working interest and a 30 percent net revenue interest in six oil and gas

leases located in Pratt County, Kansas for $100,000. Pursuant to this transaction the Company transferred a 30 percent interest

in all related support equipment and asset retirement obligations.

On

February 1, 2014 the Company entered into a Purchase and Sale Agreement whereby it agreed to sell 100 percent of its working interest

in two oil and gas leases located in Cowley and Stafford counties, Kansas. As consideration for this transaction, the buyer agreed

to forgive $113,500 in Company debts due to the buyer.

During

the six months ended June 30, 2014 and the year ended December 31, 2013, the Company incurred development costs including certain

work-over costs and other improvements to its wells. The Company paid $29,383and $119,149, respectively for these improvements,

which have been capitalized to the book value of the wells.

Through

June 30, 2014, the Company established an asset retirement obligation of $102,611 for the wells acquired by the Company, which

was capitalized to the value of the oil and gas properties. The wells have an estimated useful life of 25 years. Total accretion

expense on the asset retirement obligation was $46,921, leaving an ending net balance of $149,532 at June 30, 2014.

Effective

April 1, 2012, Chris Knowles was elected as an additional director of the Company, bringing the total number of directors to three.

On January 1, 2013 Mr. Knowles resigned as Director of the Company.

On

January 7, 2013, Ryan Kerr was appointed to serve as a replacement director in the stead of Chris Knowles. Mr. Kerr resigned his

position as a director on August 9, 2013.

Plan

of Operation

Our

plan of operations is to further develop our recent oil and gas acquisitions in Kansas and carry out further exploration and acquisition

in the oil and gas sectors. NHUR has upgraded the facilities on its acquired Mason, Thompson, Keyes and Harrell D, Sanders, Asmussen

and Carver leases with the objective to improve current oil and gas production.

Results

of Operations for the Three Months Ended June 30, 2014 and 2013

Revenues

We

had revenues of $115,344 during the three months ended June 30, 2014, compared to $40,157 in revenues during the corresponding

period in 2013. Our revenues increased from 2014 to 2013 due primarily to increased production from our proven wells during the

period. Revenues were from oil and gas production occurring at previously purchased property sites.

Expenses

We

incurred operating expenses in the amount of $286,626 during the three months ended June 30, 2014, compared to $298,397 for the

corresponding period in 2013. The 2014 operating expenses consisted primarily of $21,983 in general and administrative expenses

such as office expenses, $75,096 in professional fees, $67,792 in lease operating expenses and $121,755 in depletion, depreciation,

amortization, and accretion expenses. This compares to lease operating costs of $128,020, professional fees of $76,475, and general

and administrative expenses of $28,956, and $64,946 in depletion, depreciation, amortization and accretion expense during the

corresponding period in 2013. We expect our operating costs to continue to increase in the next 12 months.

Net

Loss

We

incurred a net loss of $171,282 during the three months ended June 30, 2014, compared to a net loss of $258,240 during the

corresponding period in 2013. This translates to a loss per share of $0.01 and $0.01 for the three months ended June 30, 2014

and 2013, respectively.

Results

of Operations for the Six Months Ended June 30, 2014 and 2013

Revenues

We

had revenues of $138,423 during the three months ended June 30, 2014, compared to $79,475 in revenues during the corresponding

period in 2013. Our revenues increased from 2014 to 2013 due primarily to increased production from our proven wells during the

period. Revenues were from oil and gas production occurring at previously purchased property sites.

Expenses

We

incurred operating expenses in the amount of $479,488 during the six months ended June 30, 2014, compared to $499,310 for the

corresponding period in 2013. The 2014 operating expenses consisted primarily of $32,930 in general and administrative expenses

such as office expenses, $155,637 in professional fees, $122,026 in lease operating expenses and $168,895 in depletion, depreciation,

amortization, and accretion expenses. This compares to lease operating costs of $181,931, professional fees of $145,207, and general

and administrative expenses of $43,387, and $128,785 in depletion, depreciation, amortization and accretion expense during the

corresponding period in 2013. We expect our operating costs to continue to increase in the next 12 months.

Other

Expenses

We

incurred interest expense in the amount of $123 during the six months ended June 30, 2014. This compares to interest expense of

$2,232 and an $11,136 gain on derivative liability during the corresponding period of 2013.

Net

Loss

We

incurred a net loss of $341,188 during the six months ended June 30, 2014, compared to a net loss of $410,931 during the

corresponding period in 2013. This translates to a loss per share of $0.01 and $0.01 for the six months ended June 30, 2014 and

2013, respectively.

LIQUIDITY

AND CAPITAL RESOURCES

Since

its inception, the Company has financed its cash requirements from the sale of common stock. Uses of funds have included activities

to establish our business, professional fees and other general and administrative expenses.

The

Company’s principal sources of liquidity as of June 30, 2014 consisted of $7,354 in cash.

We

believe the Company will have adequate resources to implement its strategic objectives in upcoming quarters. Due to our lack of

operating history and present inability to generate revenues, however, our auditors have stated their opinion that there currently

exists substantial doubt about our ability to continue as a going concern.

Material

Events and Uncertainties

Our

operating results are difficult to forecast. Our prospects should be evaluated in light of the risks, expenses and difficulties

commonly encountered by comparable exploration stage companies.

There

can be no assurance that we will successfully address such risks, expenses and difficulties.

On

March 1, 2011, the Company purchased a 100 percent working interest on a 70 percent net revenue interest in certain oil and gas

leases and related well operating equipment in Pratt County, Kansas for $260,000. Of this total, $149,000 was allocated to oil

and gas leases, and the remaining $111,000 was allocated to the purchased well operating equipment. Subsequent to acquiring the

interests in these leases the Company has incurred $23,310 of exploration costs and $60,702 of development costs which have been

capitalized to the value of oil and gas properties.

On

June 11, 2011, the Company purchased a 30 percent working interest on a 24.45 percent net revenue interest in an unproved oil

and gas well located in Cowley County, KS. The Company paid $17,220 for the lease on 640 acres at $85 per acre. Subsequent to

acquiring the interest in these wells the Company incurred an additional $119,350 of exploration costs and $110,531 of development

costs on the property which have been capitalized to the value of oil and gas properties.

On

July 7, 2011, the Company purchased a 20 percent working interest on a 16.41 percent net revenue interest in a proved and producing

oil and gas well located in Cowley County, KS. The Company paid $45,000 to acquire the leases and incurred an additional $26,881

of development costs which were capitalized to the value of oil and gas properties under.

On

September 27, 2011 we purchased at auction two leases with the multiple acquisition of an additional 1040 acres of productive

oil and gas leases. The two leases located in Pratt County, KS consist of six wells with a 100% Working Interest of 82% Net Revenue

Interest. These six wells leases are directly adjacent to our existing leases and will integrate the 6 fields and maximize efficiency

and production. Included in the purchase is a gas compression station which will enhance flows from current operations. The

purchase price associated with the Pratt County acquisition was $72,500.

On

September 27, 2011, the Company also purchased a 23 percent interest in a net revenue interest ranging from 18.66 to 19.65 percent

in three leases in Barton and Stafford Counties, Kansas for $220,800. The three leases combined contain slightly more than 564

net acres. In total there are seven active wells located in these leases. There are four oil producing wells, two disposal wells

and one injection well. Subsequent to purchase the Company capitalized $2,326 in development costs relating to these leases.”

On

December 19, 2011, the company purchased a 15 percent interest in net revenue interests ranging from 12.675 percent to 13.125

percent in four leases in Cowley County, Kansas for $75,600. The four leases combined contain approximately 720 acres. Subsequent

to purchase the Company capitalized $65,741 in development costs relating to these leases.

On

February 9, 2012, the Company purchased a 30 percent gross working interest and a 26.25 percent net revenue interest in six unproved

oil and gas leases in Cowley County, Kansas for $140,400. The six leases combined contain approximately 1,025 acres. Subsequent

to purchase the company capitalized $1,488 in support equipment and $26,351 in development costs.

On

May 14, 2012 the Company purchased a 35 percent gross working interest and a 28 percent net revenue interest in 98 acres of unproved

oil and gas leases in Stafford County, Kansas for $12,569. Concurrent with this purchase, the Company paid $22,673 in additional

development costs, and $66,181 for support equipment, for an aggregate purchase price of $101,387. As of December 31, 2012, pursuant

to a ceiling test analysis, the Company recognized an impairment expense on these leases in the amount of $6,484.

On

May 14, 2012 the Company purchased a 13 percent gross working interest and a 10 percent net revenue interest in 70 acres of unproved

oil and gas leases in Butler County, Kansas for $17,208. Concurrent with this purchase, the Company paid $27,401 in additional

development costs, and $18,021 for support equipment, for an aggregate purchase price of $62,630. Subsequent to purchase the Company

capitalized $479 in support equipment. As of December 31, 2012, pursuant to a ceiling test analysis, the Company recognized an

impairment expense on these leases in the amount of $7,464.

On

February 5, 2013 the Company sold a 30 percent gross working interest and a 30 percent net revenue interest in six oil and gas

leases located in Pratt County, Kansas for $100,000. This amount is classified as a note receivable at June 30, 2013. Pursuant

to this transaction the Company transferred a 30 percent interest in all related support equipment and asset retirement obligations.

On

July 2, 2013 we plugged the Asmussen 16-2 and on July 13, 2013 drilled the Asmussen 16-3 well.

On

February 1, 2014 the Company entered into a Purchase and Sale Agreement whereby it agreed to sell 100 percent of its working interest

in two oil and gas leases located in Cowley and Stafford counties, Kansas. As consideration for this transaction, the buyer agreed

to forgive $113,500 in Company debts due to the buyer.

On

June 28, 2014 Dr. Fortunato Villamagna resigned from the Board of Directors.

On

June 28, 2014, I-Quest, Inc. the majority shareholder of the corporation of which Dr. Villamagna was President, entered into a

Stock Purchase Agreement with Wexford Industries, LTD. under which I-Quest, Inc. agreed to sell its 475,000 Preferred shares (convertible

to 47,500,000 common shares and with equivalent voting rights) for One Hundred Fifteen Thousand Dollars within 90 days of the

execution of the agreement.

ITEM

3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

We

are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required

under this item.

Item

4. Controls and Procedures

EVALUATION

OF DISCLOSURE CONTROLS AND PROCEDURES

As

of June 30, 2014, under the direction of the Chief Executive Officer and Chief Financial Officer, the Company evaluated the effectiveness

of the design and operation of our disclosure controls and procedures, as defined in Rule 13a — 15(e) under the Securities

Exchange Act of 1934, as amended. Based on the evaluation of these controls and procedures required by paragraph (b)

of Sec. 240.13a-15 or 240.15d-15 the disclosure controls and procedures have been found to be ineffective. The company intends,

prior to the next fiscal year as the company's finances improve, to hire additional accounting staff and implement additional

controls.

The

Company maintains a set of disclosure controls and procedures designed to ensure that information required to be disclosed by

us in our reports filed under the securities Exchange Act, is recorded, processed, summarized, and reported within the time periods

specified by the SEC’s rules and forms. Disclosure controls are also designed with the objective of ensuring

that this information is accumulated and communicated to our management, including our Chief Executive Officer and Chief Financial

Officer, as appropriate, to allow timely decisions regarding required disclosure.

Evaluation

of Internal Control Over Financial Reporting

Management

conducted an evaluation of the effectiveness of the Company’s internal control over financial reporting as of June 30, 2014. In

making this assessment, management used the criteria established in Internal Control-Integrated Framework issued by the Committee

of Sponsoring Organizations of the Treadway Commission, or COSO. The COSO framework summarizes each of the components of a company’s

internal control system, including (i) the control environment, (ii) risk assessment, (iii) control activities,

(iv) information and communication, and (v) monitoring. In management’s assessment of the effectiveness of internal

control over financial reporting (as defined in Exchange Act Rule 13a-15(f)) as required by Exchange Act Rule 13a-15(c), our management

concluded as of the end of the fiscal year covered by this Quarterly Report on Form 10-Q that our internal control over financial

reporting has not been effective. The company intends, prior to the next fiscal year as the company's finances improve, to hire

additional accounting staff and implement additional controls.

As

defined by Auditing Standard No. 5, “An Audit of Internal Control Over Financial Reporting that is Integrated with an Audit

of Financial Statements and Related Independence Rule and Conforming Amendments,” established by the Public Company Accounting

Oversight Board ("PCAOB"), a material weakness is a deficiency or combination of deficiencies that results more than

a remote likelihood that a material misstatement of annual or interim financial statements will not be prevented or detected.

In connection with the assessment described above, management identified the following control deficiencies that represent material

weaknesses as of June 30, 2014:

| i) |

Lack of segregation

of duties. At this time, our resources and size prevent us from being able to employ sufficient resources to enable

us to have adequate segregation of duties within our internal control system. Management will periodically reevaluate

this situation. |

| ii) |

Lack of an independent

audit committee. Although we have an audit committee it is not comprised solely of independent directors. We may establish

an audit committee comprised solely of independent directors when we have sufficient capital resources and working capital

to attract qualified independent directors and to maintain such a committee. |

| iii) |

Insufficient number

of independent directors. At the present time, our Board of Directors does not consist of a majority of independent directors,

a factor that is counter to corporate governance practices as set forth by the rules of various stock exchanges. |

Our

management determined that these deficiencies constituted material weaknesses. Due to a lack of financial resources,

we are not able to, and do not intend to, immediately take any action to remediate these material weaknesses. We will not be able

to do so until we acquire sufficient financing to do so. We will implement further controls as circumstances, cash

flow, and working capital permit. Notwithstanding the assessment that our ICFR was not effective and that there were

material weaknesses as identified in this report, we believe that our financial statements fairly present our financial position,

results of operations and cash flows for the years covered thereby in all material respects.

CHANGES

IN INTERNAL CONTROLS.

There

was no change in our internal controls or in other factors that could affect these controls during our last fiscal quarter that

has materially affected, or is reasonably likely to materially affect our internal control over financial reporting.

The

Company has not taken any steps at this time to address these weaknesses but will formulate a plan before fiscal year ending December

31, 2014.

PART

II – OTHER INFORMATION

ITEM

1. LEGAL PROCEEDINGS

There

is no litigation pending or threatened by or against us.

ITEM

1A. RISK FACTORS

We

are a smaller reporting company as defined by Rule 12b-2 of the Exchange Act and are not required to provide the information required

under this item.

ITEM

2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

On

February 15, 2013 we received $100,000 from ThorFinn Partners for the issuance of 83,334 post-split shares of the Company’s

stock at $1.20 per share.

On

February 26, 2014 we received $50,000 from an unrelated investor for 50,000 preferred shares at $1.00 per share.

On

May 21, 2014 we received $15,000 from an unrelated investor for 15,000 preferred shares at $1.00 per share.

ITEM

3. DEFAULTS UPON SENIOR SECURITIES

The

Company has no senior securities outstanding.

ITEM

4. MINE SAFETY DISCLOSURES

None

ITEM

5. OTHER INFORMATION

None

ITEM

6. EXHIBITS

EXHIBIT

INDEX

| Number

Exhibit Description |

| 3.1 Articles of Incorporation of Supernova

Energy, Inc.* |

3.2

Bylaws of Supernova Energy, Inc.*

3.3

Certificate of Change with Nevada Secretary of State. Incorporated by reference in 8K filed 9/16/11.

10.0

Materials Contracts-leases and ThorFinn documents. Incorporated by reference in 10Q filed 5/21/12.

10.1

Purchase Agreement and Investors Rights Agreement with Thorfinn Partners. Incorporated by reference in 8K filed 5/02/12.

10.2

Property acquisitions. Incorporated by reference in 8K filed 10/03/11 and August 14, 2012.

10.3

Convertible Debenture September 26, 2011 Incorporated by reference in 10Q/a filed 11/25/11.

10.4

Addendum to ThorFinn Partners Purchase Agreement dated 3/19/13.

14.1

Code of Ethics, Corporate Charters and Governances. Incorporated by reference in 8K filed 5/02/12.

31.1

Certificate of principal executive officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley

Act of 2002

31.2

Certificate of principal financial officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 302 of the Sarbanes-Oxley

Act of 2002

32.1

Certificate of principal executive officer and principal financial officer pursuant to 18 U.S.C. Section 1350, as adopted pursuant

to Section 906 of the Sarbanes-Oxley Act of 2002.

*

Filed as an exhibit to our registration statement on Form S-1 filed March 9, 2010 and incorporated herein by

this reference

SIGNATURES

Pursuant to

the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

/s/ Peter

Hewitt

Peter

Hewitt

President,

Secretary, CEO, CFO (Principal Executive and Accounting Officer)

August

19, 2014

EXHIBIT 31.1

CERTIFICATION PURSUANT TO

18 U.S.C. ss 1350, AS ADOPTED PURSUANT

TO

SECTION 302 OF THE SARBANES-OXLEY ACT

OF 2002

I, Peter Hewitt, certify that:

1. I have reviewed this quarterly report on Form 10-Q of

Supernova Energy Inc.

2. Based on my knowledge, this quarterly report does not

contain any untrue statement of a material fact or omit to date a material fact necessary to make the statements made, in light

of the circumstances under which such statements were made, not misleading with respect to the period covered by this quarterly

report;

3. Based on my knowledge, the financial statements, and other

financial information included in this quarterly report, fairly present in all material respects the financial condition, results

of operations and cash flows of the small business issuer as of, and for, the periods presented in this quarterly report;

4. The small business issuer’s

other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls and procedures (as defined

in Exchange Act Rules 13a-15(e) and 15d-15(3)) and internal control over financial reporting (as defined in Exchange Act Rules

13a-15(f) and 15d-15(f) for the small business issuer and have:

- Designed such disclosure controls and

procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information

relating to the small business issuer, including its consolidated subsidiaries, is made known to us by others within those entities,

particularly during the period in which the report is being prepared;

- Designed such internal control over

financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with generally accepted accounting principles;

- Evaluated the effectiveness of the

small business issuer’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness

of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

- Disclosed in this report any change

in the small business issuer’s internal control over financial reporting that occurred during the small business issuer’s

most recent fiscal quarter (the small business issuer’s fourth fiscal quarter in the case of an annual report) that has materially

affected, or is reasonably likely to materially affect, the small business issuer’s internal control over financial reporting;

and

5. The small business issuer's other certifying officers

and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the small business issuer's

auditors and the audit committee of the small business issuer's board of directors (or persons performing the equivalent functions):

(a) all significant deficiencies and material weaknesses

in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the small

business issuer's ability to record, process, summarize and report financial information; and

(b) any fraud, whether or not material, that involves management

or other employees who have a significant role in the small business issuer's internal controls and procedures for financial reporting.

Date: August 19, 2014

/S/ Peter Hewitt

Signature: Peter Hewitt

Title: President, Secretary, CEO, CFO

Principal Executive Officer

EXHIBIT 31.2

CERTIFICATION

I, Peter Hewitt, certify that:

1.

I have reviewed this Quarterly Report on Form 10-Q of Supernova Energy Inc.;

2.

Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary

to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to

the period covered by this report;

3.

Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all

material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented

in the report;

4.

The registrant’s other certifying officer(s) and I are responsible for establishing and maintaining disclosure controls

and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting

(as defined in Exchange Act Rules 13a-15(f) and 15(d) - 15(f)) for the registrant and have:

(a) Designed such disclosure controls

and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material

information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities,

particularly during the period in which this report is being prepared;

(b) Designed such internal control over

financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide

reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external

purposes in accordance with generally accepted accounting principles;

(c) Evaluated the effectiveness of the

registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the

disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d) Disclosed in this report any change

in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal

quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably

likely to materially affect, the registrant’s internal control over financial reporting; and

5.

The registrant’s other certifying officer(s) and I have disclosed, based on our most recent evaluation of internal control

over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors

(or persons performing the equivalent functions):

(a) All significant deficiencies and

material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely

affect the registrant’s ability to record, process, summarize and report financial information; and

(b) Any fraud, whether or not material,

that involves management or other employees who have a significant role in the registrant’s internal control over financial

reporting.

Date: August 19, 2014

| /s/ Peter Hewitt |

|

| Peter Hewitt |

|

| Chief Financial Officer |

|

| (Principal Accounting Officer) |

|

EXHIBIT 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY

ACT OF 2002

The undersigned hereby certify, pursuant to 18 U.S.C. Section 1350,

as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that, to their knowledge, the Quarterly Report on Form 10-Q

for the period ended June 30, 2014 of Supernova Energy, Inc. (the “Company”) fully complies with the requirements of

Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, and the information contained in such periodic

report fairly presents, in all material respects, the financial condition and results of operations of the Company as of, and for,

the periods presented in such report.

Very truly yours,

| |

|

| |

|

| /s/ Peter Hewitt |

|

| Peter Hewitt |

|

| Chief Executive and Financial Officer |

|

| |

|

| |

|

| Dated: August 19, 2014 |

|

| |

|

| |

|

| |

|

A signed original of this written statement

required by Section 906 of the Sarbanes-Oxley Act of 2002 has been provided to Supernova Energy, Inc. and will be furnished

to the Securities and Exchange Commission or its staff upon request.

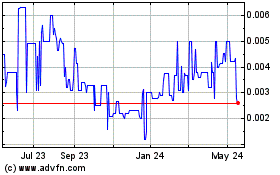

Supernova Energy (CE) (USOTC:SPRN)

Historical Stock Chart

From Jan 2025 to Feb 2025

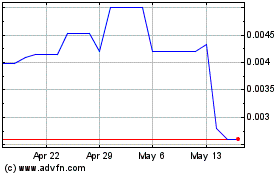

Supernova Energy (CE) (USOTC:SPRN)

Historical Stock Chart

From Feb 2024 to Feb 2025