Current Report Filing (8-k)

23 June 2022 - 6:01AM

Edgar (US Regulatory)

0001737372

false

0001737372

2022-06-10

2022-06-10

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 10, 2022

SYSOREX, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

000-55924 |

|

68-0319458 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

13880 Dulles Corner Lane, Suite 120

Herndon, Virginia |

|

20171 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (800) 929-3871

N/A

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01. Other Events.

As previously disclosed

in the Current Report on Form 8-K filed on March 30, 2022 by Sysorex, Inc. (“Company”), on March 24, 2022, the Company executed

Heads of Terms (“Heads of Terms”) with Ostendo Technologies, Inc. (“Ostendo” or “Purchaser”) which

includes certain binding and non-binding provisions. Pursuant to the Heads of Terms, the Company and Ostendo agreed to certain terms related

to the Company’s sale of approximately 75% of its Ethereum mining assets and certain associated real property to Ostendo for $68,400,000

of Ostendo preferred stock, subject to the terms of the Heads of Terms, and subject to definitive terms to be set forth in definitive

transaction agreements to be executed by the parties. Pursuant to the terms of the Heads of Terms, the closing of the transaction was

to occur no later than May 24, 2022, unless mutually extended in writing by the parties.

On June 10, 2022, the

Company executed an Amendment No. 1 to Heads of Terms (“Amendment 1”) with Ostendo and the Company’s wholly owned subsidiary

TTM Digital Assets & Technologies, Inc. (“Seller”, and together with the Company, the “Seller Parties”). Pursuant

to the Amendment 1, the parties agreed to amend and restate certain terms contained in the Heads of Terms, including:

| 1) | The closing of the transaction is to occur no later than June 30, 2022, unless mutually extended in writing

by the parties. |

| 2) | The definition of “TTM Assets” was amended and restated to read “(i) all of the Seller

Parties’ GPUs and related assets, supporting equipment and software (including software licenses, if any), in each case wherever

located, (ii) the Company’s equity interests in Style Hunter, Inc. (excluding options to purchase equity interests), (iii) the real

estate comprising the Lockport, NY location, and (iv) any other assets directly or indirectly used in the operation of the Seller Parties’

crypto mining business.” |

| 3) | The first sentence of the section of the Heads of Terms entitled “Purchase Price Consideration”

was amended and restated to read: “The Purchase Price shall be comprised of the issuance to the Seller of 4,697,917 fully paid,

non-assessable shares of the Purchaser valued at $45,100,000.00.” |

The foregoing description

of the Amendment No. 1 to Heads of Terms is qualified in its entirety by reference to the Amendment No. 1 to Heads of Terms, which is

filed as Exhibit 99.2 to this Current Report on Form 8-K and incorporated by reference into this Item 8.01.

Item 9.01. Financial

Statements and Exhibits.

(d) Exhibits.

| (1) | Filed as an exhibit to the Company’s Current Report on Form

8-K, filed with the SEC on March 30, 2022. |

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: June 22, 2022 |

SYSOREX, INC. |

| |

|

|

| |

By: |

/s/ Wayne Wasserberg |

| |

Name: |

Wayne Wasserberg |

| |

Title: |

Chief Executive Officer |

2

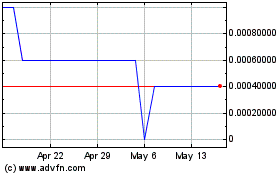

Sysorex (CE) (USOTC:SYSX)

Historical Stock Chart

From Nov 2024 to Dec 2024

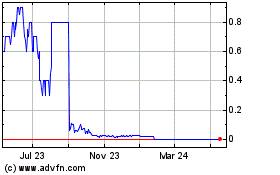

Sysorex (CE) (USOTC:SYSX)

Historical Stock Chart

From Dec 2023 to Dec 2024

Real-Time news about Sysorex Inc (CE) (OTCMarkets): 0 recent articles

More Sysorex, Inc. News Articles