UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of February 2025

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its

charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Teck Resources Limited |

|

| |

(Registrant) |

|

| |

|

|

|

| |

|

|

|

| Date: February 19, 2025 |

By: |

/s/ Amanda R. Robinson |

|

| |

|

Amanda R. Robinson |

|

| |

|

Corporate Secretary |

|

EXHIBIT 99.1

News Release

| For Immediate Release |

Date: February 19,

2025 |

| 25-05-TR |

|

Teck Reports Unaudited

Fourth Quarter Results for 2024

Record annual copper production and $1.8

billion returned to shareholders this year

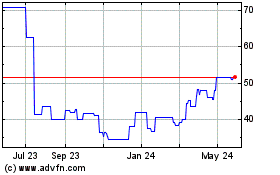

Vancouver, B.C. – Teck Resources Limited (TSX:

TECK.A and TECK.B, NYSE: TECK) (Teck) today announced its unaudited fourth quarter results for 2024.

"2024 was a transformational year as we repositioned Teck as

a pure-play energy transition metals company with the sale of the steelmaking coal business and record annual copper production,"

said Jonathan Price, President and CEO. "Our copper production in the fourth quarter set a new quarterly production record with strong

performance at QB, and we continued to return cash to shareholders through share buybacks and dividends that totaled $1.8 billion in 2024.

Our strong financial position, ongoing returns to shareholders and value accretive copper growth strategy position us for long-term value

creation."

Highlights

| · | Adjusted EBITDA1 of $835 million in Q4 2024

was driven by record copper production as Quebrada Blanca (QB) continued to ramp-up, achieving design throughput rates by the end of the

year, as well as strong base metals pricing. Copper and zinc sales volumes each increased by 24% compared to the same period last year.

Our profit from continuing operations before taxes was $256 million in Q4 2024. |

| · | Adjusted profit from continuing operations attributable to

shareholders1 was $232 million, or $0.45 per share, in Q4 2024. Our profit from continuing operations attributable to

shareholders was $385 million. |

| · | We returned $1.8 billion to shareholders through share buybacks

and dividends in 2024, of which $549 million was completed in the fourth quarter. As at February 19, 2025, we have completed $1.45 billion

of our authorized buyback program of $3.25 billion. |

| · | We reduced our debt by US$196 million in Q4 2024, including

a scheduled semi-annual repayment on the QB project financing facility. In 2024, we reduced our debt by US$1.8 billion. |

| · | Our liquidity as at February 19, 2025 is $11.3 billion,

including $7.1 billion of cash. We generated cash flows from operations of $1.3 billion in Q4 and we had a net cash1 position

of $2.1 billion at December 31, 2024. |

| · | We achieved our third consecutive quarter of record copper

production with 122,100 tonnes produced in Q4 2024, of which 60,700 tonnes were from QB. With the ramp-up of QB, we achieved record annual

copper production of 446,000 tonnes in 2024, up 50% from last year. |

| · | Our copper business generated gross profit before depreciation

and amortization1 of $732 million in the fourth quarter, up 160% from a year ago, with strong sales volumes of 124,900

tonnes and higher copper prices. Gross profit from our copper business was $299 million in the fourth quarter. |

| · | Our zinc business generated gross profit before depreciation

and amortization1 of $320 million in the fourth quarter, up 112% from a year ago, supported by strong zinc prices and

sales volumes from Red Dog. Gross profit from our zinc business was $243 million in the fourth quarter. |

| · | Two of three of QB's labour unions, representing 78% of QB's

workforce, and Antamina's labour union each ratified new three-year collective bargaining agreements during Q4 2024. |

| · | Our High-Potential Incident (HPI) Frequency rate continued

to remain low at 0.12 in 2024. |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

Financial Summary Q4 2024

Financial Metrics (CAD$

in millions, except per share data) | |

Q4 2024 | |

Q4 2023 |

| Revenue | |

$ | 2,786 | | |

$ | 1,843 | |

| Gross profit | |

$ | 542 | | |

$ | 152 | |

| Gross profit before depreciation and amortization1 | |

$ | 1,052 | | |

$ | 432 | |

| Profit (loss) from continuing operations before taxes | |

$ | 256 | | |

$ | (324 | ) |

| Adjusted EBITDA1 | |

$ | 835 | | |

$ | 321 | |

| Profit (loss) from continuing operations attributable to shareholders | |

$ | 385 | | |

$ | (167 | ) |

| Adjusted profit from continuing operations attributable to shareholders1 | |

$ | 232 | | |

$ | 23 | |

| Basic earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) |

| Diluted earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) |

| Adjusted basic earnings per share from continuing operations1 | |

$ | 0.45 | | |

$ | 0.04 | |

| Adjusted diluted earnings per share from continuing operations1 | |

$ | 0.45 | | |

$ | 0.04 | |

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

Key Updates

Executing on Our Copper Growth Strategy

| · | We achieved record copper production of 446,000 tonnes in

2024, up 50% from 2023, supported by the ramp-up of QB. We expect our annual 2025 copper production to further increase to between 490,000

and 565,000 tonnes as QB continues to ramp-up, consistent with our previously disclosed guidance issued on January 20, 2025. |

| · | Increased QB copper production of 60,700 tonnes in the fourth

quarter, compared to 52,500 tonnes in the third quarter of 2024. Annual copper production in 2024 from QB was 207,800 tonnes, within our

previously disclosed guidance range of 200,000 to 210,000 tonnes. |

| · | We achieved design mill throughput rates at QB by the end

of 2024, as expected, with record daily production achieved throughout the fourth quarter. We also saw an improvement in grades, as expected,

and recoveries in the fourth quarter as compared with the third quarter of 2024, driving increased production in the fourth quarter. |

| · | We had scheduled planned maintenance in January 2025 at QB

for minor modifications; however, we extended the scheduled shutdown to 18 days to conduct maintenance and reliability work, and complete

additional tailings lifts as part of the operational ramp-up. Since production recommenced, we have been processing transition ores which

was expected in the first quarter of 2025 in our mine plan. We continue to expect to see an overall increase in ore grades in 2025 over

2024 as we carry out the scheduled mine plan. Consistent with our operating plan, we expect to continue to have quarterly maintenance

shutdowns. Our previously disclosed 2025 annual copper production for QB is unchanged at between 230,000 and 270,000 tonnes. |

| · | In the fourth quarter, we continued to make progress in advancing

our copper growth strategy, reinforcing our commitment to long-term value creation through a balanced approach of growth investments and

shareholder returns. Our focus remains on advancing our near-term projects – Highland Valley Copper Mine Life Extension (HVC MLE),

Zafranal, San Nicolás - for potential sanction decisions in 2025, and advancing optimization of QB, with a strong focus on identifying

near-term growth opportunities for debottlenecking within the current asset base. All growth projects must meet stringent criteria, delivering

attractive risk-adjusted returns and competing for capital in alignment with Teck’s capital allocation framework. |

| 2 | Teck Resources Limited 2024 Fourth Quarter News Release |

Safety and Sustainability Leadership

| · | Our High-Potential Incident (HPI) Frequency rate continued

to remain low at 0.12 in 2024. |

| · | On October 30, 2024, Teck was named to the Forbes list of

the World’s Top Companies for Women 2024, an employee-driven ranking of multinational corporations from 37 countries around the

world. |

| · | On November 15, 2024, Teck was named one of Canada’s

Top 100 Employers for the eighth consecutive year by Mediacorp Canada’s Top Employers program, which recognizes companies for exceptional

human resource programs and innovative workplace policies. |

| · | On December 2, 2024, we released our Climate Change and Nature

2024 Report, which for the first time combines the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) with

the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD) to deliver an integrated report covering both climate

and nature-related aspects of our business. |

Guidance

| · | On January 20, 2025, we disclosed our 2025 annual guidance,

which is unchanged in this news release. |

| · | Our guidance is outlined in summary below and our usual guidance

tables, including three-year production guidance, can be found on pages 25–28 of Teck’s fourth quarter results for 2024 at

the link below. |

| 3 | Teck Resources Limited 2024 Fourth Quarter News Release |

| 2025 Guidance –

Summary |

Current |

| Production Guidance |

|

| Copper (000’s tonnes) |

490 – 565 |

| Zinc (000’s tonnes) |

525 – 575 |

| Refined zinc (000’s tonnes) |

190 – 230 |

| Sales Guidance – Q1 2025 |

|

| Red Dog zinc in concentrate sales (000’s tonnes) |

75 – 90 |

| Unit Cost Guidance |

|

| Copper net cash unit costs (US$/lb.)1 |

1.65 – 1.95 |

| Zinc net cash unit costs (US$/lb.)1 |

0.45 – 0.55 |

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information. |

All dollar amounts expressed in this news release are in Canadian dollars

unless otherwise noted.

Click here to view Teck’s

full fourth quarter results for 2024.

WEBCAST

Teck will host an Investor Conference

Call to discuss its Q4/2024 financial results at 11:00 AM Eastern time, 8:00 AM Pacific time, on February 20,

2025. A live audio webcast of the conference call, together with supporting presentation slides, will be available at our website

at www.teck.com. The webcast will be archived at www.teck.com.

REFERENCE

Emma Chapman, Vice President, Investor Relations: +44 207.509.6576

Dale Steeves, Director, External Communications: +1 236.987.7405

| 4 | Teck Resources Limited 2024 Fourth Quarter News Release |

USE OF NON-GAAP FINANCIAL MEASURES AND RATIOS

Our annual financial statements are prepared in accordance with IFRS®

Accounting Standards as issued by the International Accounting Standards Board (IASB). Our interim financial results are prepared

in accordance with IAS 34, Interim Financial Reporting (IAS 34). This document refers to a number of non-GAAP financial measures

and non-GAAP ratios which are not measures recognized under IFRS Accounting Standards and do not have a standardized meaning prescribed

by IFRS Accounting Standards or by Generally Accepted Accounting Principles (GAAP) in the United States.

The non-GAAP financial measures and non-GAAP ratios described below

do not have standardized meanings under IFRS Accounting Standards, may differ from those used by other issuers, and may not be comparable

to similar financial measures and ratios reported by other issuers. These financial measures and ratios have been derived from our financial

statements and applied on a consistent basis as appropriate. We disclose these financial measures and ratios because we believe they assist

readers in understanding the results of our operations and financial position and provide further information about our financial results

to investors. These measures should not be considered in isolation or used as a substitute for other measures of performance prepared

in accordance with IFRS Accounting Standards.

Adjusted profit from continuing operations attributable to shareholders –

For adjusted profit attributable to shareholders, we adjust profit (loss) attributable to shareholders as reported to remove the after-tax

effect of certain types of transactions that reflect measurement changes on our balance sheet or are not indicative of our normal operating

activities.

EBITDA – EBITDA is profit before net finance expense,

provision for income taxes, and depreciation and amortization.

Adjusted EBITDA – Adjusted EBITDA is EBITDA before

the pre-tax effect of the adjustments that we make to adjusted profit from continuing operations attributable to shareholders as described

above.

Adjusted profit from continuing operations attributable to shareholders,

EBITDA, and Adjusted EBITDA highlight items and allow us and readers to analyze the rest of our results more clearly. We believe that

disclosing these measures assists readers in understanding the ongoing cash generating potential of our business in order to provide liquidity

to fund working capital needs, service outstanding debt, fund future capital expenditures and investment opportunities, and pay dividends.

Adjusted basic earnings per share from continuing operations –

Adjusted basic earnings per share from continuing operations is adjusted profit from continuing operations attributable to shareholders

divided by average number of shares outstanding in the period.

Adjusted diluted earnings per share from continuing operations –

Adjusted diluted earnings per share from continuing operations is adjusted profit from continuing operations attributable to shareholders

divided by average number of fully diluted shares in a period.

Gross profit before depreciation and amortization –

Gross profit before depreciation and amortization is gross profit with depreciation and amortization expense added back. We believe this

measure assists us and readers to assess our ability to generate cash flow from our reportable segments or overall operations.

Total cash unit costs – Total cash unit costs for

our copper and zinc operations includes adjusted cash costs of sales, as described below, plus the smelter and refining charges added

back in determining adjusted revenue. This presentation allows a comparison of total cash unit costs, including smelter charges, to the

underlying price of copper or zinc in order to assess the margin for the mine on a per unit basis.

| 5 | Teck Resources Limited 2024 Fourth Quarter News Release |

Net cash unit costs – Net cash unit costs of principal

product, after deducting co-product and by-product margins, are also a common industry measure. By deducting the co- and by-product margin

per unit of the principal product, the margin for the mine on a per unit basis may be presented in a single metric for comparison to other

operations.

Adjusted cash cost of sales – Adjusted cash cost

of sales for our copper and zinc operations is defined as the cost of the product delivered to the port of shipment, excluding depreciation

and amortization charges, any one-time collective agreement charges or inventory write-down provisions and by-product cost of sales. It

is common practice in the industry to exclude depreciation and amortization as these costs are non-cash and discounted cash flow valuation

models used in the industry substitute expectations of future capital spending for these amounts.

| 6 | Teck Resources Limited 2024 Fourth Quarter News Release |

Profit (Loss) from Continuing Operations Attributable to Shareholders

and Adjusted Profit from Continuing Operations Attributable to Shareholders

| | |

Three

months ended December

31 | |

Year

ended December

31 |

| Item | |

2024 | |

2023 | |

2024 | |

2023 |

| Net Income (CAD$ in millions) | |

$ | 385 | | |

($ | 167 | ) | |

($ | 467 | ) | |

($ | 118 | ) |

| Asset impairment | |

| — | | |

| — | | |

| 828 | | |

| — | |

| QB variable consideration to IMSA and Codelco | |

| 23 | | |

| 69 | | |

| 32 | | |

| 95 | |

| Environmental costs | |

| (6 | ) | |

| 84 | | |

| 3 | | |

| 88 | |

| Share-based compensation | |

| 5 | | |

| (13 | ) | |

| 72 | | |

| 63 | |

| Labour settlement | |

| 25 | | |

| — | | |

| 19 | | |

| 7 | |

| Commodity derivatives | |

| (29 | ) | |

| (20 | ) | |

| (65 | ) | |

| 9 | |

| Foreign exchange (gains) losses | |

| (208 | ) | |

| 8 | | |

| (137 | ) | |

| (8 | ) |

| Tax items | |

| (51 | ) | |

| — | | |

| 178 | | |

| 69 | |

| Other | |

| 88 | | |

| 62 | | |

| 142 | | |

| 84 | |

| Total | |

$ | 232 | | |

$ | 23 | | |

$ | 605 | | |

$ | 289 | |

| EPS (Basic) | |

$ | 0.75 | | |

($ | 0.32 | ) | |

($ | 0.90 | ) | |

($ | 0.23 | ) |

| EPS (Diluted) | |

$ | 0.75 | | |

($ | 0.32 | ) | |

($ | 0.90 | ) | |

($ | 0.23 | ) |

| Adjusted EPS (Basic) | |

$ | 0.45 | | |

$ | 0.04 | | |

$ | 1.17 | | |

$ | 0.56 | |

| Adjusted EPS (Diluted) | |

$ | 0.45 | | |

$ | 0.04 | | |

$ | 1.16 | | |

$ | 0.55 | |

| 7 | Teck Resources Limited 2024 Fourth Quarter News Release |

Reconciliation of Basic Earnings (Loss) per share from Continuing Operations

to Adjusted Basic Earnings per share from Continuing Operations

| | |

Three

months ended December

31 | |

Year

ended December

31 |

| Item | |

2024 | |

2023 | |

2024 | |

2023 |

| EPS (Basic) | |

$ | 0.75 | | |

($ | 0.32 | ) | |

($ | 0.90 | ) | |

($ | 0.23 | ) |

| Asset impairment | |

| — | | |

| — | | |

| 1.60 | | |

| — | |

| QB variable consideration to IMSA and Codelco | |

| 0.05 | | |

| 0.13 | | |

| 0.06 | | |

| 0.18 | |

| Environmental costs | |

| (0.01 | ) | |

| 0.16 | | |

| 0.01 | | |

| 0.17 | |

| Share-based compensation | |

| 0.01 | | |

| (0.03 | ) | |

| 0.14 | | |

| 0.12 | |

| Labour settlement | |

| 0.05 | | |

| — | | |

| 0.04 | | |

| 0.01 | |

| Commodity derivatives | |

| (0.06 | ) | |

| (0.04 | ) | |

| (0.13 | ) | |

| 0.02 | |

| Foreign exchange (gains) losses | |

| (0.41 | ) | |

| 0.02 | | |

| (0.27 | ) | |

| (0.01 | ) |

| Tax items | |

| (0.10 | ) | |

| — | | |

| 0.34 | | |

| 0.13 | |

| Other | |

| 0.17 | | |

| 0.12 | | |

| 0.28 | | |

| 0.17 | |

| Total | |

$ | 0.45 | | |

$ | 0.04 | | |

$ | 1.17 | | |

$ | 0.56 | |

Reconciliation of Diluted Earnings (Loss) per share from Continuing Operations

to Adjusted Diluted Earnings per share from Continuing Operations

| | |

Three months ended

December 31 | |

Year ended

December 31 |

| Item | |

2024 | |

2023 | |

2024 | |

2023 |

| EPS (Basic) | |

$ | 0.75 | | |

($ | 0.32 | ) | |

($ | 0.90 | ) | |

($ | 0.23 | ) |

| Asset impairment | |

| — | | |

| — | | |

| 1.58 | | |

| — | |

| QB variable consideration to IMSA and Codelco | |

| 0.04 | | |

| 0.13 | | |

| 0.06 | | |

| 0.18 | |

| Environmental costs | |

| (0.01 | ) | |

| 0.16 | | |

| 0.01 | | |

| 0.17 | |

| Share-based compensation | |

| 0.01 | | |

| (0.02 | ) | |

| 0.14 | | |

| 0.12 | |

| Labour settlement | |

| 0.05 | | |

| — | | |

| 0.04 | | |

| 0.01 | |

| Commodity derivatives | |

| (0.06 | ) | |

| (0.04 | ) | |

| (0.13 | ) | |

| 0.02 | |

| Foreign exchange (gains) losses | |

| (0.41 | ) | |

| 0.02 | | |

| (0.26 | ) | |

| (0.01 | ) |

| Tax items | |

| (0.10 | ) | |

| — | | |

| 0.34 | | |

| 0.13 | |

| Other | |

| 0.18 | | |

| 0.11 | | |

| 0.28 | | |

| 0.16 | |

| Total | |

$ | 0.45 | | |

$ | 0.04 | | |

$ | 1.16 | | |

$ | 0.55 | |

| 8 | Teck Resources Limited 2024 Fourth Quarter News Release |

Reconciliation of EBITDA and Adjusted EBITDA

| | |

Three months ended

December 31 | |

Year

ended December

31 |

| Item | |

2024 | |

2023 | |

2024 | |

2023 |

| Profit (loss) from continuing operations before taxes | |

$ | 256 | | |

($ | 324 | ) | |

($ | 718 | ) | |

($ | 75 | ) |

| Finance expense net of finance income | |

| 141 | | |

| 25 | | |

| 719 | | |

| 50 | |

| Depreciation and amortization | |

| 523 | | |

| 292 | | |

| 1,726 | | |

| 925 | |

| EBITDA | |

| 920 | | |

| (7 | ) | |

| 1,727 | | |

| 900 | |

| Asset impairment | |

| — | | |

| — | | |

| 1,053 | | |

| — | |

| QB variable consideration to IMSA and Codelco | |

| 37 | | |

| 115 | | |

| 51 | | |

| 156 | |

| Environmental costs | |

| (8 | ) | |

| 115 | | |

| — | | |

| 119 | |

| Share-based compensation | |

| 5 | | |

| (15 | ) | |

| 91 | | |

| 81 | |

| Labour settlement | |

| 38 | | |

| — | | |

| 29 | | |

| 11 | |

| Commodity derivatives | |

| (40 | ) | |

| (27 | ) | |

| (90 | ) | |

| 12 | |

| Foreign exchange (gains) losses | |

| (235 | ) | |

| 18 | | |

| (146 | ) | |

| (9 | ) |

| Other | |

| 118 | | |

| 122 | | |

| 218 | | |

| 166 | |

| Adjusted EBITDA | |

$ | 835 | | |

$ | 321 | | |

$ | 2,933 | | |

$ | 1,436 | |

Reconciliation of Gross Profit Before Depreciation and Amortization

| | |

Three months ended

December 31 | |

Year ended

December 31 |

| Item | |

2024 | |

2023 | |

2024 | |

2023 |

| Gross profit | |

$ | 542 | | |

$ | 152 | | |

$ | 1,607 | | |

$ | 1,112 | |

| Depreciation and amortization | |

| 510 | | |

| 280 | | |

| 1,665 | | |

| 861 | |

| Gross profit before depreciation and amortization | |

$ | 1,052 | | |

$ | 432 | | |

$ | 3,272 | | |

$ | 1,973 | |

| |

| Reported as: |

| Copper | |

| | | |

| | | |

| | | |

| | |

| Quebrada Blanca | |

$ | 304 | | |

($ | 79 | ) | |

$ | 766 | | |

($ | 61 | ) |

| Highland Valley Copper | |

$ | 100 | | |

$ | 101 | | |

$ | 471 | | |

$ | 391 | |

| Antamina | |

$ | 275 | | |

$ | 228 | | |

$ | 1,038 | | |

$ | 899 | |

| Carmen de Andacollo | |

$ | 52 | | |

$ | 34 | | |

$ | 121 | | |

$ | 44 | |

| Other | |

$ | 1 | | |

($ | 3 | ) | |

$ | 5 | | |

($ | 8 | ) |

| Total Copper | |

$ | 732 | | |

$ | 281 | | |

$ | 2,401 | | |

$ | 1,265 | |

| | |

| | | |

| | | |

| | | |

| | |

| Zinc | |

| | | |

| | | |

| | | |

| | |

| Trail Operations | |

$ | 15 | | |

$ | 12 | | |

$ | 12 | | |

$ | 103 | |

| Red Dog | |

$ | 303 | | |

$ | 141 | | |

$ | 851 | | |

$ | 611 | |

| Other | |

$ | 2 | | |

($ | 2 | ) | |

$ | 8 | | |

($ | 6 | ) |

| Total Zinc | |

$ | 320 | | |

$ | 151 | | |

$ | 871 | | |

$ | 708 | |

| Gross profit before depreciation and amortization | |

$ | 1,052 | | |

$ | 432 | | |

$ | 3,272 | | |

$ | 1,973 | |

| 9 | Teck Resources Limited 2024 Fourth Quarter News Release |

CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking information and

forward-looking statements as defined in applicable securities laws (collectively referred to as forward-looking statements). These statements

relate to future events or our future performance. All statements other than statements of historical fact are forward-looking statements.

The use of any of the words “anticipate”, “plan”, “continue”, “estimate”, “expect”,

“may”, “will”, “project”, “predict”, “potential”, “should”, “believe”

and similar expressions is intended to identify forward-looking statements. These statements involve known and unknown risks, uncertainties

and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking statements.

These statements speak only as of the date of this news release.

These forward-looking statements include, but are not limited to,

statements concerning: our focus and strategy, including being a pure-play energy transition metals company; anticipated global and regional

supply, demand and market outlook for our commodities; our business, assets, and strategy going forward, including with respect to future

and ongoing project development; our ability to execute our copper growth strategy in a value accretive manner; the expected use of proceeds

from the sale of our steelmaking coal business, including the timing and format of any cash returns to shareholders; the anticipated benefits

of the sale of our steelmaking coal business; our expectations regarding the continued ramp-up and future optimization and debottlenecking

of QB2, including the occurrence, timing and length of required maintenance shutdowns; expectations regarding inflationary pressures and

our ability to manage controllable operating expenditures; expectations with respect to the potential impact of any tariffs, countervailing

duties or other trade restrictions; expectations with respect to execution of our copper growth strategy, including the timing and occurrence

of any sanction decisions and prioritization and amount of planned growth capital expenditures; expectations regarding advancement of

our copper growth portfolio projects, including advancement of study, permitting, execution planning, detailed engineering and design,

risk mitigation, and advanced early works, community and Indigenous engagement, completion of updated cost estimates, tendering processes,

and timing for receipt of permits related to QB debottlenecking, the HVC Mine Life Extension, San Nicolás, and Zafranal projects,

as applicable; expectations with respect to timing and outcome of the regulatory approvals process for the HVC Mine Life Extension, including

with respect to the dispute resolution process underway; expectations with respect to the construction of an exploration access road and

advancement of prefeasibility study work in the Red Dog district; expectations regarding timing and amount of income tax payments and

our effective tax rate; liquidity and availability of borrowings under our credit facilities; requirements to post and our ability to

obtain additional credit for posting security for reclamation at our sites; all guidance appearing in this document including but not

limited to the production, sales, cost, unit cost, capital expenditure, capitalized production stripping, operating outlook, and other

guidance under the headings “Guidance” and "Outlook" and as discussed elsewhere in the various reportable segment

sections; our expectations regarding inflationary pressures and increased key input costs; and expectations regarding the adoption of

new accounting standards and the impact of new accounting developments.

These statements are based on a number of assumptions, including,

but not limited to, assumptions disclosed elsewhere in this document and assumptions regarding general business and economic conditions,

interest rates, commodity and power prices; acts of foreign or domestic governments and the outcome of legal proceedings; the imposition

of tariffs, import or export restrictions, or other trade barriers by foreign or domestic governments; the continued operation of QB2

in accordance with our expectations; the possibility that the anticipated benefits from the sale of our steelmaking coal business are

not realized in the time frame anticipated or at all as a result of changes in general economic and market conditions, including credit,

market, currency, operational, commodity, liquidity and funding risks generally and relating specifically to the transaction; the possibility

that our business may not perform as expected or in a manner consistent with historical performance; the supply and demand for, deliveries

of, and the level and volatility of prices of copper and zinc and our other metals and minerals, as well as steel, crude oil, natural

gas and other petroleum products; the timing of the receipt of permits and other regulatory and governmental approvals for our development

projects and other operations, including mine extensions; positive results from the studies on our expansion and development projects;

our ability to secure adequate transportation, including rail and port services, for our products; our costs of production and our production

and productivity levels, as well as those of our competitors; continuing availability of water and power resources for our operations;

changes in credit market conditions and conditions in financial markets generally; the availability of funding to refinance our borrowings

as they become due or to finance our development projects on reasonable terms; availability of letters of credit and other forms of financial

assurance acceptable to regulators for reclamation and other bonding requirements; our ability to procure equipment and operating supplies

in sufficient quantities and on a timely basis; the availability of qualified employees and contractors for our operations, including

our new developments and our ability to attract and retain skilled employees; the satisfactory negotiation of collective agreements with

unionized employees; the impact of changes in Canadian-U.S. dollar, Canadian dollar-Chilean Peso and other foreign exchange rates on our

costs and results; engineering and construction timetables and capital costs for our development and expansion projects; our ability to

develop technology and obtain the benefits of technology for our operations and development projects; closure costs; environmental compliance

costs; market competition; the accuracy of our mineral reserve and resource estimates (including with respect to size, grade and recoverability)

and the geological, operational and price assumptions on which these are based; tax benefits and statutory and effective tax rates; the

outcome of our copper, zinc and lead concentrate treatment and refining charge negotiations with customers; the resolution of environmental

and other proceedings or disputes; our ability to obtain, comply with and renew permits, licenses and leases in a timely manner; and our

ongoing relations with our employees and with our business and joint venture partners.

| 10 | Teck Resources Limited 2024 Fourth Quarter News Release |

Statements regarding the availability of our credit facilities are

based on assumptions that we will be able to satisfy the conditions for borrowing at the time of a borrowing request and that the facilities

are not otherwise terminated or accelerated due to an event of default. Assumptions regarding the costs and benefits of our projects include

assumptions that the relevant project is constructed, commissioned and operated in accordance with current expectations. Expectations

regarding our operations are based on numerous assumptions regarding the operations. Our Guidance tables include disclosure and footnotes

with further assumptions relating to our guidance, and assumptions for certain other forward-looking statements accompany those statements

within the document. Statements concerning future production costs or volumes are based on numerous assumptions regarding operating matters

and on assumptions that demand for products develops as anticipated, that customers and other counterparties perform their contractual

obligations, that operating and capital plans will not be disrupted by issues such as mechanical failure, unavailability of parts and

supplies, labour disturbances, interruption in transportation or utilities, or adverse weather conditions, and that there are no material

unanticipated variations in the cost of energy or supplies. The foregoing list of assumptions is not exhaustive. Events or circumstances

could cause actual results to vary materially.

Factors that may cause actual results to vary materially include,

but are not limited to, changes in commodity and power prices; changes in market demand for our products; changes in interest and currency

exchange rates; acts of governments and the outcome of legal proceedings; the imposition of tariffs, import or export restrictions, or

other trade barriers by foreign or domestic governments; inaccurate geological and metallurgical assumptions (including with respect to

the size, grade and recoverability of mineral reserves and resources); operational difficulties (including failure of plant, equipment

or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of labour, materials and equipment);

government action or delays in the receipt of government approvals; changes in royalty or tax rates; industrial disturbances or other

job action; adverse weather conditions; unanticipated events related to health, safety and environmental matters; union labour disputes;

any resurgence of COVID-19 and related mitigation protocols; political risk; social unrest; failure of customers or counterparties (including

logistics suppliers) to perform their contractual obligations; changes in our credit ratings; unanticipated increases in costs to construct

our development projects; difficulty in obtaining permits; inability to address concerns regarding permits or environmental impact assessments;

and changes or further deterioration in general economic conditions. The amount and timing of capital expenditures is depending upon,

among other matters, being able to secure permits, equipment, supplies, materials and labour on a timely basis and at expected costs.

Certain operations and projects are not controlled by us; schedules and costs may be adjusted by our partners, and timing of spending

and operation of the operation or project is not in our control. Certain of our other operations and projects are operated through joint

arrangements where we may not have control over all decisions, which may cause outcomes to differ from current expectations. Ongoing monitoring

may reveal unexpected environmental conditions at our operations and projects that could require additional remedial measures. Production

at our QB and Red Dog Operations may also be impacted by water levels at site. Sales to China may be impacted by general and specific

port restrictions, Chinese regulation and policies, and normal production and operating risks.

| 11 | Teck Resources Limited 2024 Fourth Quarter News Release |

We assume no obligation to update forward-looking statements except

as required under securities laws. Further information concerning risks, assumptions and uncertainties associated with these forward-looking

statements and our business can be found in our Annual Information Form for the year ended December 31, 2023 filed under our profile on

SEDAR+ (www.sedarplus.ca) and on EDGAR (www.sec.gov) under

cover of Form 40-F, as well as subsequent filings that can also be found under our profile.

Scientific and technical information in this quarterly report regarding

our material properties was reviewed, approved and verified by Rodrigo Alves Marinho, P.Geo., a contractor of Teck and a Qualified Person

as defined under National Instrument 43-101.

| 12 | Teck Resources Limited 2024 Fourth Quarter News Release |

EXHIBIT 99.2

News Release

| For Immediate Release |

Date: February 19,

2025 |

| 25-05-TR |

|

Teck Reports Unaudited Fourth Quarter Results for

2024

Record annual copper production and $1.8 billion

returned to shareholders this year

Vancouver, B.C. – Teck Resources Limited (TSX: TECK.A and TECK.B,

NYSE: TECK) (Teck) today announced its unaudited fourth quarter results for 2024.

"2024 was a transformational year as we repositioned Teck as a pure-play

energy transition metals company with the sale of the steelmaking coal business and record annual copper production," said Jonathan

Price, President and CEO. "Our copper production in the fourth quarter set a new quarterly production record with strong performance

at QB, and we continued to return cash to shareholders through share buybacks and dividends that totaled $1.8 billion in 2024. Our strong

financial position, ongoing returns to shareholders and value accretive copper growth strategy position us for long-term value creation."

Highlights

| • | Adjusted EBITDA1 of $835 million in Q4 2024 was

driven by record copper production as Quebrada Blanca (QB) continued to ramp-up, achieving design throughput rates by the end of the year,

as well as strong base metals pricing. Copper and zinc sales volumes each increased by 24% compared to the same period last year. Our

profit from continuing operations before taxes was $256 million in Q4 2024. |

| • | Adjusted profit from continuing operations attributable to

shareholders1 was $232 million, or $0.45 per share, in Q4 2024. Our profit from continuing operations attributable to shareholders

was $385 million. |

| • | We returned $1.8 billion to shareholders through share buybacks

and dividends in 2024, of which $549 million was completed in the fourth quarter. As at February 19, 2025, we have completed $1.45 billion

of our authorized buyback program of $3.25 billion. |

| • | We reduced our debt by US$196 million in Q4 2024, including

a scheduled semi-annual repayment on the QB project financing facility. In 2024, we reduced our debt by US$1.8 billion. |

| • | Our liquidity as at February 19, 2025 is $11.3 billion,

including $7.1 billion of cash. We generated cash flows from operations of $1.3 billion in Q4 and we had a net cash1 position

of $2.1 billion at December 31, 2024. |

| • | We achieved our third consecutive quarter of record copper

production with 122,100 tonnes produced in Q4 2024, of which 60,700 tonnes were from QB. With the ramp-up of QB, we achieved record annual

copper production of 446,000 tonnes in 2024, up 50% from last year. |

| • | Our copper business generated gross profit before depreciation

and amortization1 of $732 million in the fourth quarter, up 160% from a year ago, with strong sales volumes of 124,900 tonnes

and higher copper prices. Gross profit from our copper business was $299 million in the fourth quarter. |

| • | Our zinc business generated gross profit before depreciation

and amortization1 of $320 million in the fourth quarter, up 112% from a year ago, supported by strong zinc prices and sales

volumes from Red Dog. Gross profit from our zinc business was $243 million in the fourth quarter. |

| • | Two of three of QB's labour unions, representing 78% of QB's

workforce, and Antamina's labour union each ratified new three-year collective bargaining agreements during Q4 2024. |

| • | Our High-Potential Incident (HPI) Frequency rate continued

to remain low at 0.12 in 2024. |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further

information. |

All

dollar amounts expressed in this news release are in Canadian dollars unless otherwise noted.

| Reference: |

Emma Chapman, Vice President, Investor Relations |

+44 207.509.6576 |

| |

|

|

| |

Dale Steeves, Director, External Communications |

+1 236.987.7405 |

Additional

corporate information is available at www.teck.com.

Financial Summary Q4 2024

Financial Metrics (CAD$ in millions, except per share data) | |

Q4 2024 | |

Q4 2023 |

| Revenue | |

$ | 2,786 | | |

$ | 1,843 | |

| Gross profit | |

$ | 542 | | |

$ | 152 | |

| Gross profit before depreciation and amortization1 | |

$ | 1,052 | | |

$ | 432 | |

| Profit (loss) from continuing operations before taxes | |

$ | 256 | | |

$ | (324 | ) |

| Adjusted EBITDA1 | |

$ | 835 | | |

$ | 321 | |

| Profit (loss) from continuing operations attributable to shareholders | |

$ | 385 | | |

$ | (167 | ) |

| Adjusted profit from continuing operations attributable to shareholders1 | |

$ | 232 | | |

$ | 23 | |

| Basic earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) |

| Diluted earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) |

| Adjusted basic earnings per share from continuing operations1 | |

$ | 0.45 | | |

$ | 0.04 | |

| Adjusted diluted earnings per share from continuing operations1 | |

$ | 0.45 | | |

$ | 0.04 | |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

Key Updates

Executing on Our Copper Growth Strategy

| • | We achieved record copper production of 446,000 tonnes in

2024, up 50% from 2023, supported by the ramp-up of QB. We expect our annual 2025 copper production to further increase to between 490,000

and 565,000 tonnes as QB continues to ramp-up, consistent with our previously disclosed guidance issued on January 20, 2025. |

| • | Increased QB copper production of 60,700 tonnes in the fourth

quarter, compared to 52,500 tonnes in the third quarter of 2024. Annual copper production in 2024 from QB was 207,800 tonnes, within our

previously disclosed guidance range of 200,000 to 210,000 tonnes. |

| • | We achieved design mill throughput rates at QB by the end

of 2024, as expected, with record daily production achieved throughout the fourth quarter. We also saw an improvement in grades, as expected,

and recoveries in the fourth quarter as compared with the third quarter of 2024, driving increased production in the fourth quarter. |

| • | We had scheduled planned maintenance in January 2025 at QB

for minor modifications; however, we extended the scheduled shutdown to 18 days to conduct maintenance and reliability work, and complete

additional tailings lifts as part of the operational ramp-up. Since production recommenced, we have been processing transition ores which

was expected in the first quarter of 2025 in our mine plan. We continue to expect to see an overall increase in ore grades in 2025 over

2024 as we carry out the scheduled mine plan. Consistent with our operating plan, we expect to continue to have quarterly maintenance

shutdowns. Our previously disclosed 2025 annual copper production for QB is unchanged at between 230,000 and 270,000 tonnes. |

| 2 | Teck Resources Limited 2024 Fourth Quarter News Release |

| • | In the fourth quarter, we continued to make progress in advancing

our copper growth strategy, reinforcing our commitment to long-term value creation through a balanced approach of growth investments and

shareholder returns. Our focus remains on advancing our near-term projects – Highland Valley Copper Mine Life Extension (HVC MLE),

Zafranal, San Nicolás - for potential sanction decisions in 2025, and advancing optimization of QB, with a strong focus on identifying

near-term growth opportunities for debottlenecking within the current asset base. All growth projects must meet stringent criteria, delivering

attractive risk-adjusted returns and competing for capital in alignment with Teck’s capital allocation framework. |

Safety and Sustainability Leadership

| • | Our High-Potential Incident (HPI) Frequency rate continued

to remain low at 0.12 in 2024. |

| • | On October 30, 2024, Teck was named to the Forbes list of

the World’s Top Companies for Women 2024, an employee-driven ranking of multinational corporations from 37 countries around the

world. |

| • | On November 15, 2024, Teck was named one of Canada’s

Top 100 Employers for the eighth consecutive year by Mediacorp Canada’s Top Employers program, which recognizes companies for exceptional

human resource programs and innovative workplace policies. |

| • | On December 2, 2024, we released our Climate Change and Nature

2024 Report, which for the first time combines the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD) with

the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD) to deliver an integrated report covering both climate

and nature-related aspects of our business. |

Guidance

| • | On January 20, 2025, we disclosed our 2025 annual guidance,

which is unchanged in this news release. |

| • | Our guidance is outlined in summary below and our usual guidance

tables, including three-year production guidance, can be found on pages 25–28. |

| 2025 Guidance – Summary |

Current |

| Production Guidance |

|

| Copper (000’s tonnes) |

490 – 565 |

| Zinc (000’s tonnes) |

525 – 575 |

| Refined zinc (000’s tonnes) |

190 – 230 |

| Sales Guidance – Q1 2025 |

|

| Red Dog zinc in concentrate sales (000’s tonnes) |

75 – 90 |

| Unit Cost Guidance |

|

| Copper net cash unit costs (US$/lb.)1 |

1.65 – 1.95 |

| Zinc net cash unit costs (US$/lb.)1 |

0.45 – 0.55 |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP Financial Measures and Ratios” for further information. |

| 3 | Teck Resources Limited 2024 Fourth Quarter News Release |

This news release is dated as at February 19, 2025. Unless the

context otherwise dictates, a reference to “the company” or “us,” “we” or “our” refers

to Teck and its subsidiaries. Additional information, including our Annual Information Form and Management’s Discussion and Analysis

for the year ended December 31, 2023, is available on SEDAR+ at www.sedarplus.ca.

This document contains forward-looking statements and forward-looking

information. Please refer to the cautionary language under the heading “CAUTIONARY STATEMENT ON FORWARD-LOOKING STATEMENTS”

below.

Overview

| • | Our profitability improved significantly in the fourth quarter

compared to the same period a year ago primarily as a result of higher base metal prices and increased copper and zinc in concentrate

sales volumes. These items were partly offset by higher finance expense and depreciation and amortization expense due to the depreciation

of the QB assets and no longer capitalizing interest on the QB2 project, starting in 2024, as anticipated. In the fourth quarter, our

profit from continuing operations attributable to shareholders was $385 million compared with a $167 million loss from continuing operations

attributable to shareholders in the fourth quarter of 2023, as profitability last year was impacted by elevated operating costs at QB

during the initial ramp-up phase. |

| • | Copper sales volumes of 124,900 tonnes in the fourth quarter

increased by 24% compared with a year ago, driven by record production volumes. Zinc in concentrate sales volumes of 204,000 tonnes in

the fourth quarter increased by 24% compared with a year ago, as a portion of Red Dog shipments scheduled for the third quarter were deferred

into the fourth quarter of 2024 due to weather conditions. Red Dog zinc in concentrate sales of 184,000 tonnes in the fourth quarter were

at the high end of our previously disclosed guidance range of between 155,000 and 185,000 tonnes. |

| • | In the fourth quarter, London Metal Exchange (LME) copper

prices increased by 13% compared with a year ago, and averaged US$4.17 per pound, and LME zinc prices increased by 22%, averaging US$1.38

per pound. However, base metal prices declined at the end of the year with spot copper and zinc prices closing at US$3.95 and US$1.35

per pound, respectively, as at December 31, 2024, resulting in $144 million of negative settlement pricing adjustments in the fourth quarter,

primarily related to copper. |

| Average Prices and Exchange Rates | |

Three months ended

December 31, | |

Change |

| | |

2024 | |

2023 | |

|

| Copper (LME cash – US$/pound) | |

$ | 4.17 | | |

$ | 3.70 | | |

| 13 | % |

| Zinc (LME cash – US$/pound) | |

$ | 1.38 | | |

$ | 1.13 | | |

| 22 | % |

| Average exchange rate (CAD$ per US$1.00) | |

$ | 1.40 | | |

$ | 1.36 | | |

| 3 | % |

| • | We achieved our third consecutive quarter of record copper

production with 122,100 tonnes produced in the fourth quarter, an increase of 18,700 tonnes compared with the same period a year ago as

a result of QB production ramping-up to design throughput rates by the end of the year. Copper production from QB was 60,700 tonnes in

the fourth quarter compared with 52,500 tonnes in the third quarter of 2024, as quarterly production continued to increase with ramp-up

progressing. |

| • | Zinc in concentrate production of 146,400 tonnes in the fourth

quarter decreased by 19% compared to a year ago primarily due to lower grades at Red Dog and Antamina, as expected in their respective

mine plans, as well as a planned maintenance shutdown at Red Dog. |

| 4 | Teck Resources Limited 2024 Fourth Quarter News Release |

| • | Our general and administration costs decreased by $29 million,

or 33%, to $59 million in the fourth quarter compared to the same period last year. Research and innovation expense decreased by $5 million

in the fourth quarter compared with a year ago and decreased by $67 million in 2024 as compared with 2023. The reduction of these corporate

costs is the result of the implementation of structural cost reductions across our business in 2024, which were further accelerated following

the sale of the steelmaking coal business in the third quarter of 2024. |

| • | Our finance income increased to $97 million in the fourth

quarter compared with $19 million a year ago reflecting investment income on our elevated cash balance as a result of the receipt of proceeds

from the sale of the steelmaking coal business. A large portion of our cash balance is held in US dollars, and as a result of the significant

weakening of the Canadian dollar in the fourth quarter, $235 million of foreign exchange gains were recognized in the fourth quarter compared

with $18 million of losses in the same period last year. |

| • | We remain highly focused on managing our controllable operating

expenditures. Our underlying key mining drivers such as strip ratios and haul distances remain relatively stable. Inflation on key input

costs, including the cost of certain key supplies and mining equipment, labour and contractors, and changing diesel prices, are included

in our 2025 annual capital expenditure, capitalized stripping and unit cost guidance. |

| • | The potential imposition of tariffs and countervailing restrictions

between the United States and Canada is a fluid and rapidly evolving situation that is being closely monitored by Teck. We primarily sell

refined zinc and lead, and specialty metals such as germanium, indium, and sulphur products from Canada into the United States from our

Trail Operations in B.C. Teck does not currently sell our copper or zinc concentrate into the United States. We will continue to actively

monitor the situation and work to mitigate any potential impacts on our business. |

| • | During the fourth quarter, our Red Dog operation successfully

obtained the United States Army Corps of Engineers 404 permit, a critical step allowing the construction of the exploration access road

for long-term vehicle access to the Aktigiruq and Anarraaq resource areas. This permit marks a major achievement in the project’s

development, enabling the next phase of exploration and resource assessment to proceed as planned. |

| • | During 2024, we completed the sale of 23% of the steelmaking

coal business, EVR, to Nippon Steel Corporation and POSCO for upfront proceeds of US$1.3 billion and the remaining 77% of EVR to Glencore

for proceeds of US$7.3 billion. Upon closing of the transactions, we announced our intention to allocate the transaction proceeds consistent

with our Capital Allocation Framework. This included total cash returns to shareholders of $3.5 billion, a debt reduction program of up

to $2.75 billion, approximately $1.0 billion allocated to pay taxes and transaction costs and cash retained for our value accretive copper

projects. |

| • | In 2024, we executed $1.25 billion of our authorized share

buyback program of $3.25 billion. In addition under our debt reduction program, we deployed proceeds from the sale of the steelmaking

coal business and reduced our debt by US$1.6 billion through a bond tender offer for our public notes in July and other debt repayments

in the second half of 2024. |

| • | As a result of the completion of the sale of our steelmaking

coal business, results from that business have been presented in our Q4 2024 News Release and Condensed Interim Consolidated Financial

Statements as discontinued operations for all periods reported. |

| 5 | Teck Resources Limited 2024 Fourth Quarter News Release |

Profit (Loss) from Continuing Operations Attributable

to Shareholders and Adjusted Profit from Continuing Operations Attributable to Shareholders

In the fourth quarter, our profit from continuing operations attributable

to shareholders was $385 million, or $0.75 per share, compared to a loss of $167 million, or $0.32 per share, in the same period last

year. The increase compared with a year ago is primarily due to higher copper and zinc prices, increased copper and zinc in concentrate

sales volumes, and significant foreign exchange gains arising from the weakening Canadian dollar, as outlined above.

Adjusted profit from continuing operations attributable to shareholders1

in the fourth quarter, taking into account the items identified in the table below, was $232 million, or $0.45 per share, compared with

$23 million, or $0.04 per share, in the fourth quarter of 2023. The most significant after tax adjustment to profit in the fourth quarter

of 2024, reflected in the table below, is $208 million of foreign exchange gains.

| | |

Three months ended

December 31, | |

Year ended

December 31, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Profit (loss) from continuing operations attributable to shareholders | |

$ | 385 | | |

$ | (167 | ) | |

$ | (467 | ) | |

$ | (118 | ) |

| Add (deduct) on an after-tax basis: | |

| | | |

| | | |

| | | |

| | |

| Asset impairment | |

| — | | |

| — | | |

| 828 | | |

| — | |

| QB variable consideration to IMSA and Codelco | |

| 23 | | |

| 69 | | |

| 32 | | |

| 95 | |

| Environmental costs | |

| (6 | ) | |

| 84 | | |

| 3 | | |

| 88 | |

| Share-based compensation | |

| 5 | | |

| (13 | ) | |

| 72 | | |

| 63 | |

| Labour settlement | |

| 25 | | |

| — | | |

| 19 | | |

| 7 | |

| Commodity derivatives | |

| (29 | ) | |

| (20 | ) | |

| (65 | ) | |

| 9 | |

| Foreign exchange (gains) losses | |

| (208 | ) | |

| 8 | | |

| (137 | ) | |

| (8 | ) |

| Tax items | |

| (51 | ) | |

| — | | |

| 178 | | |

| 69 | |

| Other | |

| 88 | | |

| 62 | | |

| 142 | | |

| 84 | |

| Adjusted profit from continuing operations attributable to shareholders1 | |

$ | 232 | | |

$ | 23 | | |

$ | 605 | | |

$ | 289 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) | |

$ | (0.90 | ) | |

$ | (0.23 | ) |

| Diluted earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) | |

$ | (0.90 | ) | |

$ | (0.23 | ) |

| Adjusted basic earnings per share from continuing operations1 | |

$ | 0.45 | | |

$ | 0.04 | | |

$ | 1.17 | | |

$ | 0.56 | |

| Adjusted diluted earnings per share from continuing operations1 | |

$ | 0.45 | | |

$ | 0.04 | | |

$ | 1.16 | | |

$ | 0.55 | |

Note:

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

In addition to the items identified in the table above, our results include

gains and losses due to changes in market prices in respect of pricing adjustments. Pricing adjustments resulted in $95 million of after-tax

losses ($144 million, before tax) in the fourth quarter, or $0.19 per share.

| 6 | Teck Resources Limited 2024 Fourth Quarter News Release |

| FINANCIAL OVERVIEW | |

Three months ended

December 31, | |

Year ended

December 31, |

| (CAD$ in millions, except per share data) | |

2024 | |

2023 | |

2024 | |

2023 |

| Revenue and profit | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

$ | 2,786 | | |

$ | 1,843 | | |

$ | 9,065 | | |

$ | 6,476 | |

| Gross profit | |

$ | 542 | | |

$ | 152 | | |

$ | 1,607 | | |

$ | 1,112 | |

| Gross profit before depreciation and amortization1 | |

$ | 1,052 | | |

$ | 432 | | |

$ | 3,272 | | |

$ | 1,973 | |

| Profit (loss) from continuing operations before taxes | |

$ | 256 | | |

$ | (324 | ) | |

$ | (718 | ) | |

$ | (75 | ) |

| Adjusted EBITDA1 | |

$ | 835 | | |

$ | 321 | | |

$ | 2,933 | | |

$ | 1,436 | |

| Profit (loss) from continuing operations attributable to shareholders | |

$ | 385 | | |

$ | (167 | ) | |

$ | (467 | ) | |

$ | (118 | ) |

| Profit attributable to shareholders | |

$ | 399 | | |

$ | 483 | | |

$ | 406 | | |

$ | 2,409 | |

| Cash flow | |

| | | |

| | | |

| | | |

| | |

| Cash flow from operations | |

$ | 1,288 | | |

$ | 1,126 | | |

$ | 2,790 | | |

$ | 4,084 | |

| Expenditures on property, plant and equipment | |

$ | 422 | | |

$ | 771 | | |

$ | 2,262 | | |

$ | 3,885 | |

| Capitalized production stripping costs | |

$ | 82 | | |

$ | 100 | | |

$ | 373 | | |

$ | 455 | |

| Balance Sheet | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| | | |

| | | |

$ | 7,587 | | |

$ | 744 | |

| Total assets | |

| | | |

| | | |

$ | 47,037 | | |

$ | 56,193 | |

| Debt and lease liabilities, including current portion | |

| | | |

| | | |

$ | 5,482 | | |

$ | 7,595 | |

| Per share amounts | |

| | | |

| | | |

| | | |

| | |

| Basic earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) | |

$ | (0.90 | ) | |

$ | (0.23 | ) |

| Diluted earnings (loss) per share from continuing operations | |

$ | 0.75 | | |

$ | (0.32 | ) | |

$ | (0.90 | ) | |

$ | (0.23 | ) |

| Basic earnings per share | |

$ | 0.78 | | |

$ | 0.93 | | |

$ | 0.79 | | |

$ | 4.65 | |

| Diluted earnings per share | |

$ | 0.78 | | |

$ | 0.92 | | |

$ | 0.78 | | |

$ | 4.59 | |

| Dividends declared per share | |

$ | 0.125 | | |

$ | 0.125 | | |

$ | 1.00 | | |

$ | 1.00 | |

| PRODUCTION, SALES AND PRICES | |

| | | |

| | | |

| | | |

| | |

| Production (000’s tonnes) | |

| | | |

| | | |

| | | |

| | |

| Copper2 | |

| 122 | | |

| 103 | | |

| 446 | | |

| 296 | |

| Zinc in concentrate | |

| 146 | | |

| 182 | | |

| 616 | | |

| 644 | |

| Zinc – refined | |

| 62 | | |

| 70 | | |

| 256 | | |

| 267 | |

| Sales (000’s tonnes) | |

| | | |

| | | |

| | | |

| | |

| Copper2 | |

| 125 | | |

| 101 | | |

| 435 | | |

| 291 | |

| Zinc in concentrate | |

| 204 | | |

| 165 | | |

| 635 | | |

| 660 | |

| Zinc – refined | |

| 61 | | |

| 68 | | |

| 260 | | |

| 258 | |

| Average prices and exchange rates | |

| | | |

| | | |

| | | |

| | |

| Copper (LME cash – US$/pound) | |

$ | 4.17 | | |

$ | 3.70 | | |

$ | 4.15 | | |

$ | 3.85 | |

| Zinc (LME cash – US$/pound) | |

$ | 1.38 | | |

$ | 1.13 | | |

$ | 1.26 | | |

$ | 1.20 | |

| Average exchange rate (CAD$ per US$1.00) | |

$ | 1.40 | | |

$ | 1.36 | | |

$ | 1.37 | | |

$ | 1.35 | |

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

| 2. | We include 100% of production and sales from our Quebrada Blanca and Carmen

de Andacollo mines in our production and sales volumes, even though we do not own 100% of these operations, because we fully consolidate

their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate ownership

interest in this operation. |

| 7 | Teck Resources Limited 2024 Fourth Quarter News Release |

SEGMENTED RESULTS

Our revenue, gross profit, and gross profit before depreciation and amortization1

by reportable segments are summarized in the table below.

| | |

Three months ended

December 31, | |

Year ended

December 31, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Revenue | |

| | | |

| | | |

| | | |

| | |

| Copper | |

$ | 1,674 | | |

$ | 1,142 | | |

$ | 5,542 | | |

$ | 3,425 | |

| Zinc | |

| 1,112 | | |

| 701 | | |

| 3,523 | | |

| 3,051 | |

| Total | |

$ | 2,786 | | |

$ | 1,843 | | |

$ | 9,065 | | |

$ | 6,476 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| | | |

| | | |

| | | |

| | |

| Copper | |

$ | 299 | | |

$ | 81 | | |

$ | 1,045 | | |

$ | 712 | |

| Zinc | |

| 243 | | |

| 71 | | |

| 562 | | |

| 400 | |

| Total | |

$ | 542 | | |

$ | 152 | | |

$ | 1,607 | | |

$ | 1,112 | |

| | |

| | | |

| | | |

| | | |

| | |

| Gross profit before depreciation and amortization1 | |

| | | |

| | | |

| | | |

| | |

| Copper | |

$ | 732 | | |

$ | 281 | | |

$ | 2,401 | | |

$ | 1,265 | |

| Zinc | |

| 320 | | |

| 151 | | |

| 871 | | |

| 708 | |

| Total | |

$ | 1,052 | | |

$ | 432 | | |

$ | 3,272 | | |

$ | 1,973 | |

| Gross profit margins before depreciation and amortization1 | |

| |

| |

| |

|

| Copper | |

| 44 | % | |

| 25 | % | |

| 43 | % | |

| 37 | % |

| Zinc | |

| 29 | % | |

| 22 | % | |

| 25 | % | |

| 23 | % |

| 1. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

| 8 | Teck Resources Limited 2024 Fourth Quarter News Release |

COPPER SEGMENT

| | |

Three months ended

December 31, | |

Year ended

December 31, |

| (CAD$ in millions) | |

2024 | |

2023 | |

2024 | |

2023 |

| | |

| |

| |

| |

|

| Copper price (realized – US$/pound) | |

$ | 4.17 | | |

$ | 3.75 | | |

$ | 4.18 | | |

$ | 3.84 | |

| Production (000’s tonnes)1 | |

| 122 | | |

| 103 | | |

| 446 | | |

| 296 | |

| Sales (000’s tonnes)1 | |

| 125 | | |

| 101 | | |

| 435 | | |

| 291 | |

| Gross profit | |

$ | 299 | | |

$ | 81 | | |

$ | 1,045 | | |

$ | 712 | |

| Gross profit before depreciation and amortization2 | |

$ | 732 | | |

$ | 281 | | |

$ | 2,401 | | |

$ | 1,265 | |

| Property, plant and equipment expenditures | |

$ | 370 | | |

$ | 705 | | |

$ | 1,977 | | |

$ | 3,639 | |

| 1. | We include 100% of production and sales from our Quebrada Blanca and Carmen

de Andacollo mines in our production and sales volumes, even though we do not own 100% of these operations, because we fully consolidate

their results in our financial statements. We include 22.5% of production and sales from Antamina, representing our proportionate ownership

interest in this operation. |

| 2. | This is a non-GAAP financial measure or ratio. See “Use of Non-GAAP

Financial Measures and Ratios” for further information. |

Gross profit from our copper segment increased to $299 million in the fourth

quarter compared with $81 million a year ago (see table below). The increase in gross profit was due to higher copper prices and substantially

higher sales volumes, partly offset by the depreciation of QB assets, which commenced at the start of 2024. In addition, in the same period

last year, gross profit was impacted by elevated operating costs at QB during the early stages of production ramp-up in fourth quarter

of 2023.

Record quarterly copper production of 122,100 tonnes was achieved in the

fourth quarter, an increase of 18% from the same period last year, driven by continued quarter over quarter ramp-up in QB's production

through 2024. QB produced 60,700 tonnes of copper production in the fourth quarter compared with 52,500 tonnes in the third quarter of

2024 and 34,300 tonnes in the fourth quarter last year. The increase in QB production was partially offset by lower production from Antamina

as a result of lower grades, as well as reduced mill throughput due to lower tonnes mined, as expected, and unplanned maintenance.

The table below summarizes the change in gross profit in our copper segment

for the quarter.

| Gross Profit (CAD$ in millions) | |

Three months ended

December 31, |

| | |

|

| As reported in the fourth quarter of 2023 | |

$ | 81 | |

| Increase (decrease): | |

| | |

| Copper price realized | |

| 166 | |

| Sales volumes | |

| 52 | |

| Unit operating costs | |

| 146 | |

| Inventory write-down (2023) | |

| 20 | |

| Labour settlement | |

| (38 | ) |

| Co-product and by-product contribution | |

| 90 | |

| Foreign exchange (CAD$/US$) | |

| 15 | |

| Depreciation | |

| (233 | ) |

| Net increase | |

$ | 218 | |

| As reported in current quarter | |

$ | 299 | |

| 9 | Teck Resources Limited 2024 Fourth Quarter News Release |

Property, plant and equipment expenditures in the fourth quarter totalled

$370 million, including $218 million for sustaining capital. Capitalized production stripping costs were $61 million in the fourth quarter

compared with $78 million a year ago.

Markets

In the fourth quarter, LME copper prices were relatively similar to the

previous quarter at US$4.17 per pound, and remain well above the long-term historic price trend. Prices in the fourth quarter rose by

13% compared with the same period a year ago. Global demand for copper remains well supported with demand increasing in North America

and China, while falling in Europe. Increased demand in China, Southeast Asia, India and North America is being primarily driven by government

and corporate spending on renewable energy and infrastructure construction.

The tightness in the copper concentrate market increased during the fourth

quarter and has accelerated into the first quarter of 2025. Spot treatment terms for concentrate started to fall in the third quarter

and continued through the fourth quarter with annual terms for 2024 settling below 2023 annual contract terms. New smelter capacity continues

to come online with both new smelters and expansion of existing smelters in 2024 and expected in 2025.

Mine production globally was relatively flat in 2024 growing only 1% to

22.6 million tonnes. This is lower than the projected 3.9% growth forecast at this time last year. Production losses from Chile, Panama,

the Democratic Republic of the Congo, Zambia, and China all combined to reduce mine production by approximately 0.7 million tonnes. Global

stocks of copper cathode on exchanges at the end of the fourth quarter were approximately 5.6 days of global consumption compared to the

long-term average of 10.3 days. Stocks on exchanges and in bonded warehouses in China decreased by 102,000 tonnes in the fourth quarter

but were still up 207,500 tonnes in 2024. Total visible stocks, including bonded stocks, fell and continue to remain at low levels at

5.9 days of consumption, compared to a long-term average of 13.8 days.

Operations

Quebrada Blanca

The following are the key updates relating to operational performance at

QB in the fourth quarter:

| • | QB copper production of 60,700 tonnes in the fourth quarter

increased compared to 52,500 tonnes in the third quarter of 2024. 2024 annual production from QB was 207,800 tonnes, within our previously

disclosed guidance range of 200,000 to 210,000 tonnes. |

| • | We achieved design mill throughput rates at QB by the end

of 2024, as expected, with record daily production achieved throughout the fourth quarter. We also saw an improvement in grades, as expected,

and recoveries in the fourth quarter as compared with the third quarter of 2024, driving increased production in the fourth quarter. The

improved grades were in line with the mine plan and the improved recoveries were the result of the successful improvement work on the

grinding and flotation circuits performed in the third quarter. |

| • | We had scheduled planned maintenance in January 2025 at QB

for minor modifications; however, we extended the scheduled shutdown to 18 days to conduct maintenance and reliability work, and complete

additional tailings lifts as part of the operational ramp-up. Since production recommenced, we have been processing transition ores which

was planned for in the first quarter of 2025 within our mine plan. We continue to expect to see an overall increase in ore grades in 2025

over 2024 as we carry out the scheduled mine plan. Consistent with our operating plan, we expect to continue to have quarterly maintenance

shutdowns. |

| • | QB molybdenum production for the year was 0.6 thousand tonnes,

lower than our previously disclosed annual QB molybdenum production guidance to 0.8 to 1.2 thousand tonnes due to continued ramp-up of

the molybdenum plant. |

| 10 | Teck Resources Limited 2024 Fourth Quarter News Release |

| • | New three-year collective bargaining agreements with 2 of

our 3 labour unions at QB, representing 78% of the workforce, were ratified. |

| • | Operating costs were US$299 million in the fourth quarter

resulting in lower net cash unit costs1 compared to the third quarter of 2024 primarily due to a reduction in contractor costs.

|

| • | Optimization of the existing QB asset is progressing, with

a focus on identifying near-term growth opportunities for the debottlenecking within the current asset base. |

Highland Valley Copper

Copper production of 27,100 tonnes in the fourth quarter was 2,700 tonnes

lower than a year ago. The decrease was primarily due to lower ore grades and recoveries. Copper sales volumes of 24,200 tonnes in the

fourth quarter were 2,000 tonnes lower than a year ago, reflecting lower production levels.

Copper production in the fourth quarter increased from the third quarter

of 2024 due to improved haul truck performance and increased mining in the higher-grade Lornex pit, as expected. Annual copper production

in 2024 was 102,400 tonnes and within our previously disclosed guidance of 97,000 to 105,000 tonnes.

Operating costs in the fourth quarter of $213 million, before changes in

inventory and capitalized production stripping costs, were $19 million lower than a year ago, driven by reduced contractor and diesel

costs.

Capitalized production stripping costs in the fourth quarter decreased to

$12 million compared with $29 million in the fourth quarter last year, reflecting near completion of the current phase of waste stripping

in the Lornex pit.

Antamina

Copper production (100% basis) of 93,600 tonnes in the fourth quarter was

26,700 tonnes lower than a year ago primarily due to lower grades as well as lower mill throughput due to unplanned maintenance. The mix

of mill feed in the quarter was 55% copper-only ore and 45% copper-zinc ore, similar with 54% copper-only ore and 46% copper-zinc ore

a year ago. Zinc production (100% basis) was 79,800 tonnes in the fourth quarter compared with 117,700 tonnes a year ago due to lower

grades.

During the fourth quarter, a three-year collective bargaining agreement

was ratified for all unionized labour.

Operating costs in the fourth quarter, before changes in inventory, were

US$105 million (22.5% share), US$3 million higher than a year ago. The increase in costs was primarily driven by costs associated with

the new collective bargaining agreement signed in the fourth quarter, partially offset by lower diesel prices and lower contractor and

maintenance costs.

Carmen de Andacollo

Copper production of 13,200 tonnes in the fourth quarter was 3,000 tonnes

higher than a year ago. The increase was driven by higher grades, recoveries and mill throughput. Improved mill throughput was driven

by increased water availability in the fourth quarter.