Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

07 July 2023 - 8:32PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of July, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Share Subscription Agreement Pangea | 2 |

TELEFÓNICA, S.A. (“Telefónica” or the “Company”) in compliance with the Securities Market legislation, hereby communicates the following:

OTHER RELEVANT INFORMATION

Telefónica informs that its subsidiary Telefónica Hispanoamérica, S.A. (“Telefónica Hispam”) has entered into share subscription agreements with an affiliate of Kohlberg Kravis Roberts – KKR & Co, Inc. (“KKR”) and Entel Perú S.A. (“Entel Perú”), for the entry of both companies, with 54% and 10%, respectively, into the share capital of Pangeaco, S.A.C. (“Pangea”), the wholesale fiber-to-the-home (“FTTH”) company in Peru, maintaining Telefónica Hispam 36% of the shares of said company.

As part of the transaction Telefónica del Perú S.A.A. (“TDP”) and Entel will sell to Pangea certain assets of their FTTH infrastructure. Likewise, as part of the transaction, certain agreements will be signed, among them, agreements for the provision of wholesale connectivity services with TDP and Entel Perú.

The transaction represents for Telefónica a multiple of approximately 20x OIBDA proforma. At closing of the transaction, Telefónica Group's net financial debt will be reduced by approximately 0.2 billion dollars (approximately 0.2 billion euros at the current exchange rate). Additionally, certain variable payments will be received in the next 4 years following the closing of the transaction.

The transaction is subject to obtaining the regulatory approvals.

This operation is part of the Telefónica Group's strategy, which includes, among other objectives, an active portfolio management policy of its businesses and assets, based on value creation.

Madrid, July 7, 2023

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | July 07, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

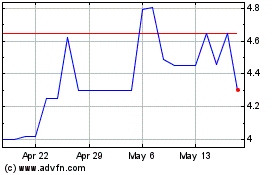

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From Apr 2024 to May 2024

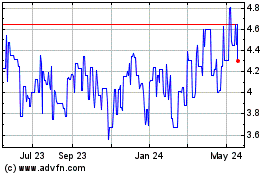

Telefonica (PK) (USOTC:TEFOF)

Historical Stock Chart

From May 2023 to May 2024