false

0001463208

0001463208

2023-11-01

2023-11-01

0001463208

dei:FormerAddressMember

2023-11-01

2023-11-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or Section 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of Earliest Event Reported): November 1, 2023

Transportation

and Logistics Systems, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-34970 |

|

26-3106763 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5500

Military Trail, Suite 22-357

Jupiter,

Florida 33458

(Address

of Principal Executive Offices)

(833)

764-1443

(Issuer’s

telephone number)

Not

Applicable

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation to the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None.

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Forward

Looking Statements

Statements

in this report regarding Transportation and Logistics Systems, Inc. (the “Company”) that are not historical facts

are forward-looking statements and are subject to risks and uncertainties that could cause actual future events or results to differ

materially from such statements. Any such forward-looking statements, including, but not limited to, financial guidance, are made pursuant

to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include all statements

that do not directly or exclusively relate to historical facts. In some cases, you can identify forward-looking statements by terms such

as “may,” “will,” “should,” “could,” “would,” “expects,” “plans,”

“anticipates,” “intend,” “plan,” “goal,” “seek,” “strategy,”

“future,” “likely,” “believes,” “estimates,” “projects,” “forecasts,”

“predicts,” “potential,” or the negative of those terms, and similar expressions and comparable terminology.

These include, but are not limited to, statements relating to future events or our future financial and operating results, plans, objectives,

expectations, and intentions. Although we believe that the expectations reflected in these forward-looking statements are reasonable,

these expectations may not be achieved. Forward-looking statements are neither historical facts nor assurances of future performance.

Instead, they represent our intentions, plans, expectations, assumptions, and beliefs about future events and are subject to known and

unknown risks, uncertainties and other factors outside of our control that could cause our actual results, performance or achievement

to differ materially from those expressed or implied by these forward-looking statements. In addition to the risks described above, these

risks and uncertainties include: our ability to successfully execute our business strategies, including integration of acquisitions and

the future acquisition of other businesses to grow our company; customers’ cancellation on short notice of master service agreements

from which we derive a significant portion of our revenue or our failure to renew such master service agreements on favorable terms or

at all; our ability to attract and retain key personnel and skilled labor to meet the requirements of our labor-intensive business or

labor difficulties which could have an effect on our ability to bid for and successfully complete contracts; the ultimate geographic

spread, duration and severity of the coronavirus outbreak and the effectiveness of actions taken, or actions that may be taken, by governmental

authorities to contain the outbreak or ameliorate its effects; our failure to compete effectively in our highly competitive industry

could reduce the number of new contracts awarded to us or adversely affect our market share and harm our financial performance; our ability

to adopt and master new technologies and adjust certain fixed costs and expenses to adapt to our industry’s and customers’

evolving demands; our history of losses, deficiency in working capital and stockholders’ equity and our ability to achieve sustained

profitability; remaining weaknesses in our internal control over financial reporting and our ability to maintain effective controls over

financial reporting in the future; our remaining liabilities and indebtedness could adversely affect our business, financial condition

and results of operations and our ability to meet our payment obligations; unanticipated and materially adverse developments in our few

remaining litigations; the impact of new or changed laws, regulations or other industry standards that could adversely affect our ability

to conduct our business; and changes in general market, economic and political conditions in the United States and global economies or

financial markets, including those resulting from natural or man-made disasters.

These

forward-looking statements represent our estimates and assumptions only as of the date of this report and, except as required by law,

we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future

events or otherwise after the date of this report. Given these uncertainties, you should not place undue reliance on these forward-looking

statements and should consider various factors, including the risks described, among other places, in our most recent Annual Report on

Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any amendments thereto, filed with the Securities and Exchange Commission.

Item

1.01 Entry into a Material Definitive Agreement.

Transportation

and Logistics Systems, Inc. (OTC PINK: TLSS) (“TLSS” or the “Company”), a publicly-traded holding company in

which its wholly-owned operating subsidiaries, Cougar Express, Inc., Freight Connections, Inc., JFK Cartage, Inc., and Severance Trucking

Co., together provide a full suite of logistics and transportation services, on November 1, 2023, executed a promissory note for

a loan of $500,000 from John Mercadante. Mr. Mercadante is a Director of the Company. The funds

had been advanced previously. The terms of the note provide for interest at 12% per annum. The maturity date of the

note is June 30, 2024, provided, however, that loan is prepayable by the Company at any time without premium or penalty.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| Dated:

November 3, 2023 |

TRANSPORTATION

AND LOGISTICS SYSTEMS, INC. |

| |

|

|

| |

By: |

/s/

Sebastian Giordano |

| |

Name: |

Sebastian

Giordano |

| |

Title: |

Chief

Executive Officer |

Exhibit

10.1

PROMISSORY

NOTE

| $500,000.00

|

Date:

November 1, 2023 |

FOR

VALUE RECEIVED, Transportation and Logistics Systems, Inc., a Nevada corporation (“Maker”), hereby promises to pay to

the order of John Mercadante (“Payee”) at [REDACTED] or at such other place as the holder hereof

may designate in writing, the principal sum of $500,000.00, together with interest, from the date hereof, on the unpaid principal

amount hereof outstanding from time to time at the rate per annum equal to 12% (the “Base Rate”), on the terms set forth

herein. Payee may transfer this Note to any person, who shall then be deemed to be Payee hereunder.

Principal

outstanding and interest accrued and unpaid hereunder and any other amounts due hereunder shall be due and payable on June 30, 2024.

All amounts paid hereunder shall be credited first to the payment of accrued and unpaid interest, and then to the payment of outstanding

principal. Payment of principal, interest and any other sum due hereunder shall be made in lawful money of the United States of America.

This Note may be prepaid in whole or in part at any time without premium or penalty.

All

amounts paid hereunder shall be credited first to the payment of accrued and unpaid interest, and then to the payment of outstanding

principal. Payment of principal, interest and any other sum due hereunder shall be made in lawful money of the United States of America.

This Note may be prepaid in whole or in part at any time without premium or penalty provided that such prepayment is accompanied by a

notice of the amount being prepaid.

Maker

covenants not to issue any instrument of indebtedness senior to this Note or secured by any assets of Maker, or, other than the Loans,

pari passu with this Note.

If

any one or more of the following events (herein termed “Events of Default”) shall happen:

| |

(a) |

any

payment of principal or interest hereunder is not paid when due; |

| |

|

|

| |

(b) |

Maker

shall: |

(i)

become insolvent or admit its inability, or become unable, to pay its debts generally as they become due,

(ii)

file a petition for relief or for reorganization or for the adoption of an arrangement under the federal bankruptcy laws or any other

similar law or statute for the relief or aid of debtors of the United States of America or any State thereof, as now or hereinafter in

effect (the “Bankruptcy Laws”), or an admission seeking the relief therein provided, or

(iii)

have an order for relief entered against it under the Bankruptcy Laws or otherwise be adjudicated a bankrupt or insolvent; or

(c)

if Maker defaults in the due observance of any material provision of this Note, and the same shall not be cured within 30 days of written

notice from Payee; or

(d)

if Maker takes any action to terminate, liquidate or dissolve Maker,

then

and in any such event, at any time thereafter, if any Event of Default shall then be continuing, Payee may by written notice to Maker

declare the principal, accrued interest and any other amounts owing under this Note to be immediately due and payable, and in such case

the same shall be paid immediately in full. Interest shall accrue on all amounts past due, whether or not an Event of Default has occurred,

at the rate per annum of the lesser of the Base Rate plus 5% or the highest rate permitted by law until paid.

In

case any one or more default hereunder or under any related document shall happen and be continuing, Payee may proceed to protect and

enforce Payee’s rights either by suit in equity or by action at law, or both, whether for the specific performance of any covenant,

condition, or agreement contained in this Note or in aid of the exercise of any power granted in this Note or to enforce any other legal

or equitable right of Payee. After an Event of Default, Maker shall pay to Payee immediately upon written demand therefor any amounts

reasonably expended or incurred by Payee in collecting any amount due hereunder, including, without limitation, reasonable attorneys’

fees and costs, whether or not any legal action is instituted in connection therewith, including interest on all such amounts from the

date demanded until the date paid at the rate per annum of the lesser of the Base Rate plus 5% or the highest rate permitted by law until

paid. Each and every remedy hereunder or at law or equity shall be cumulative, and Payee may exercise any such remedy or remedies together,

separately or in any combination at any time.

This

Note (a) may not be changed, waived, discharged or terminated, nor may any provision(s) of it be waived, except by an instrument in writing

signed by the Payee and (b) shall be binding upon Maker and each of Maker’s successors and assigns, and shall inure to the benefit

of and be enforceable by Payee and Payee’s heirs and personal representatives. No promises or representations have been made by

Payee in connection herewith except as expressly set forth herein. Maker hereby waives presentment, demand, protest, notice of dishonor

and all other notices and demands, except as expressly set forth herein.

This

Note shall be paid in full without any offset or deduction for any claim, counterclaim or defense of any kind whatsoever, the right to

raise any of which is waived by Maker. Because Maker has already received fair value in assets with a readily ascertainable value for

this Note (i.e., a cash advance), such waiver by Maker shall include any and all claims that Maker may have, whether known or not known

to Maker, for fraud or any related cause of action. Maker also hereby waives the right to trial by jury in any litigation related

to this Note.

This

Note shall be construed and governed in all respects by the laws of the State of Florida applicable to contracts made and to be performed

therein.

If

any provision of this Note is deemed to be invalid, illegal, or unenforceable, the balance of this Note shall remain in full force and

effect.

Maker

and Payee intend this Note to conform strictly to the usury and similar laws relating to interest and the collection of other charges

from time to time in force, and this Note is hereby expressly limited so that in no contingency or event whatsoever, whether by acceleration

of maturity hereof or otherwise, shall the amount paid or agreed to be paid in the aggregate to Payee as interest or other charges hereunder

or under any other security agreement given to secure this Note, or in any other document evidencing, securing or pertaining to this

Note, exceed the maximum amount permissible under applicable usury or such other laws (the “Maximum Amount”). If under any

circumstances whatsoever fulfillment of any provision hereof, or any of such other related documents, at the time performance of such

provision shall be due, shall involve transcending the Maximum Amount, then ipso facto, the obligation to be fulfilled shall be

reduced to the Maximum Amount. For the purposes of calculating the actual amount of interest or other charges paid and/or payable hereunder,

in respect of laws pertaining to usury or such other laws, all charges and other sums paid or agreed to be paid hereunder to the holder

hereof for the use, forbearance or detention of the amount advanced, outstanding from time to time shall, to the extent permitted by

applicable law, be amortized, prorated, allocated and spread from the date of disbursement of the proceeds reflected by this Note until

payment in full of all amounts under this Note, so that the actual rate of interest on account of the principal hereof is uniform through

the term hereof. The terms and provisions of this paragraph shall control and supersede every other provision of this Note.

If

under any circumstances Payee shall ever receive an amount which would exceed the Maximum Amount, such amount shall be deemed a payment

in reduction of amounts owing hereunder and any other obligation of Maker in favor of Payee, and shall be so applied, or if such excessive

interest exceeds the unpaid balance owing hereunder and any other obligation of Maker in favor of Payee, then the excess shall be deemed

to have been a payment made by mistake and shall be refunded to Maker.

Any

notice or communication required or sent in connection with this Note shall be sent by first class mail, postage prepaid, addressed as

set forth above. Any such address may be changed by sending notice of such change at least 10 days prior to the effective date of the

change.

As

a further inducement to the Payee to accept this Note, Maker, acknowledging that Payee is relying on the covenants in this paragraph,

covenants and agrees that: in any action or proceeding brought on, under or in connection with or relating to this Note, any legal suit

arising out of or in connection with this Note may be instituted in any Federal or State Court in the State of Florida; Maker waives

any objection Maker may now or hereafter have to such venue in any legal suit; Maker irrevocably submits to the jurisdiction of any such

Court in any such suit; Maker agrees not to bring any such suit, action or other proceeding in any other jurisdiction; and Maker agrees

that service of process upon Maker may be made at Maker’s address above by mailing to such address by certified mail, return receipt

requested, with an additional copy to such address by first class mail, and such service shall be deemed in every respect effective service

of process upon Maker in any such suit, action or proceeding in the State of Florida.

IN

WITNESS WHEREOF, Maker has caused this Note to be executed by its duly authorized officer on the day and year first above written.

| Transportation

and Logistics Systems, Inc. |

|

| |

|

|

| By: |

/Sebastian

Giordano/ |

|

| Name: |

Sebastian

Giordano |

|

| Title: |

CEO |

|

| State

of New York |

) |

| County

of Rockland |

)ss.: |

On

the 1st day of November in the year 2023 before me, the undersigned, personally appeared Sebastian Giordano, personally

known to me or proved to me on the basis of satisfactory evidence to be the individual whose name is subscribed to the within instrument

and acknowledged to me that he executed the same in his capacity, and that by his signature on the instrument, the individual executed

the instrument, and that such individual made such appearance before the undersigned in the County of Rockland, City/Town of .

| /Neil

F. Agyiri/ |

|

(Signature

and Office of individual

taking

acknowledgment.) |

|

| |

|

|

NEIL F. AGYIRI

Notary Public – State of New York

NO. 01AG6324731

Qualified in Rockland County

My Commission Expires May 11, 2027

|

|

v3.23.3

Cover

|

Nov. 01, 2023 |

| Entity Addresses [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 01, 2023

|

| Entity File Number |

001-34970

|

| Entity Registrant Name |

Transportation

and Logistics Systems, Inc.

|

| Entity Central Index Key |

0001463208

|

| Entity Tax Identification Number |

26-3106763

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

5500

Military Trail

|

| Entity Address, Address Line Two |

Suite 22-357

|

| Entity Address, City or Town |

Jupiter

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33458

|

| City Area Code |

(833)

|

| Local Phone Number |

764-1443

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Former Address [Member] |

|

| Entity Addresses [Line Items] |

|

| Entity Address, Address Line One |

Jupiter

|

| Entity Address, Address Line Two |

Florida 33458

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLine items represent financial concepts included in a table. These concepts are used to disclose reportable information associated with domain members defined in one or many axes to the table.

| Name: |

dei_EntityAddressesLineItems |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

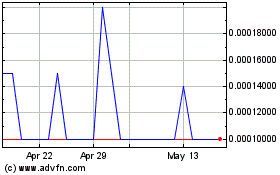

Transportation and Logis... (CE) (USOTC:TLSS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Transportation and Logis... (CE) (USOTC:TLSS)

Historical Stock Chart

From Dec 2023 to Dec 2024