Current Report Filing (8-k)

16 May 2020 - 7:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 15, 2020

(Exact name of registrant as specified in its charter)

Delaware 1-2257 13-1394750

(State or other jurisdiction (Commission (IRS Employer

of incorporation) File Number) Identification No.)

135 East 57th Street, 14th Floor, New York, NY 10022

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (800) 243-5544

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 8.01 Other Events.

Trans-Lux Corporation (the “Company”) is relying on the U.S. Securities and Exchange Commission’s Order under Section 36 of the Securities Exchange Act of 1934, as amended, Granting Exemptions From Specified Provisions of the Exchange Act and Certain Rules Thereunder dated March 25, 2020 (Release No. 34-88465) (the “Order”) to delay the filing of its Form 10-Q (the “Form 10-Q”) for the quarter ended March 31, 2020 due to the circumstances related to the COVID-19 pandemic. In particular, COVID-19 has caused the Company’s office in New York, New York to close and the Company issued a work from home policy to protect its employees and their families from potential virus transmission among co-workers. The office closures and work from home policy have in turn caused a delay in the completion of our Form 10-Q process. As a result, the Company will not be able to timely review and prepare the Company’s Form 10-Q for the three months ended March 31, 2020.

The Company is supplementing the risk factors previously disclosed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 with the following risk factor:

Our results of operations may be negatively impacted by the coronavirus outbreak.

We are closely monitoring the impact of the 2019 novel coronavirus, or COVID-19, on all aspects of our business. In March 2020, the World Health Organization characterized COVID-19 as a pandemic and the President of the United States declared the COVID-19 outbreak a national emergency. Since then, the COVID-19 pandemic has rapidly spread across the globe and has already resulted in significant volatility, uncertainty and economic disruption. The outbreak of COVID-19 has caused and may continue to cause travel bans or disruptions, and in some cases, prohibitions of non-essential activities, disruption and shutdown of businesses and greater uncertainty in global financial markets. The impact of COVID-19 is fluid and uncertain, but it has caused and may continue to cause various negative effects, including an inability to meet with actual or potential customers, our end customers deciding to delay or abandon their planned purchases or failing to make payments, and delays or disruptions in our or our partners’ supply chains. As a result, we may experience extended sales cycles, our ability to close transactions with new and existing customers and partners may be negatively impacted, and the efficiency and effect of those activities, may be negatively affected, and it has been and, until the COVID-19 outbreak is contained, will continue to be more difficult for us to forecast our operating results. These uncertainties have, and may continue to, put pressure on global economic conditions and overall LED display spending and may cause our end customers to modify spending priorities or delay or abandon purchasing decisions, thereby lengthening sales cycles and potentially lowering prices for our solutions, and may make it difficult for us to forecast our sales and operating results and to make decisions about future investments, any of which could materially harm our business, operating results and financial condition.

Further, our management team is focused on addressing the impacts of COVID-19 on our business, which has required and will continue to require, a large investment of their time and resources and may distract our management team or disrupt our 2020 operating plans. The extent to which COVID-19 ultimately impacts our results of operations, cash flow and financial position will depend on future developments, which are uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the actions taken by governments and authorities to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even after the COVID-19 pandemic has subsided, we may continue to experience materially adverse impacts to our business as a result of its global economic impact, including as a result of any recession that may occur.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: May 15, 2020

|

TRANS-LUX CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

|

|

|

|

Name:

|

Todd Dupee

|

|

|

|

Title:

|

Senior Vice President and

Chief Accounting Officer

|

3

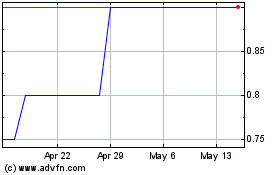

Trans Lux (PK) (USOTC:TNLX)

Historical Stock Chart

From Oct 2024 to Nov 2024

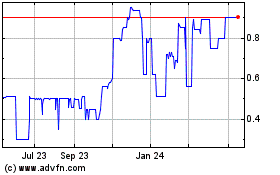

Trans Lux (PK) (USOTC:TNLX)

Historical Stock Chart

From Nov 2023 to Nov 2024