UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

DATE OF EARLIEST EVENT REPORTED: March 10,

2015

VG LIFE SCIENCES, INC.

(Exact name of Registrant as specified in

its charter)

|

DELAWARE

(State or other jurisdiction of incorporation) |

000-26875

(Commission File Number) |

33-0814123

(IRS Employer Identification Number) |

121 Gray Avenue, Suite 200

Santa Barbara, CA 93101

(Address of Principal Executive offices)

(805) 879-9000

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[_] Written communications pursuant to Rule 425 under the Securities

Act

[_] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act

[_] Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act

[_] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act

Item 1.02 Termination

of a Material Definitive Agreement.

Effective July 2013 and amended in September 2014, we entered into

a Patent License Agreement with Scott & White Healthcare (“S&W”) with respect to certain intellectual property

and patents developed or co-developed by Dr. M. Karen Newell for her employer, Texas A &M University Hospital Science Center

(“HSC”). HSC has previously granted S&W the exclusive right to market and license these rights. Under the Patent

License Agreement, S&W granted us an exclusive license under the patent rights and intellectual property to make, have made,

use and sell the licensed products worldwide and in all applications, to the end of the patent term. The U.S. and International

provisional patent rights include MHC Engagement and CLIP Modulation for the Treatment of Disease, CLIP Modulation for the Treatment

of Mucosal Diseases, Cancer Biomarkers, Therapeutics and Methods and Products For Treating Preeclampsia and Modulating Blood Pressure,

and Treating Neurological Diseases.

We were required to make an initial $50,000 payment to S&W,

and were obligated to make royalty payments to S&W of 3% of net sales in developed countries and 0.5% of net sales in underdeveloped

countries, of licensed products or services requiring their use, subject to adjustment as defined in the agreement. In consideration

for Amendment 1 dated September 9, 2014, we were required to make an additional payment of $25,000 to S&W. Additionally, in

order to maintain the license, we were required to pay S&W minimum annual consideration, in combination with the aforementioned

royalties, as follows:

| (a) |

Calendar Year 2013, payable January 1, 2014 |

$ |

20,000 |

| (b) |

Calendar Year 2014, payable January 1, 2015 |

$ |

20,000 |

| (c) |

Calendar Year 2015, payable January 1, 2016 |

$ |

87,500 |

| (d) |

Calendar Year 2016, payable January 1, 2017 |

$ |

125,000 |

| (e) |

Calendar Year 2017, payable January 1, 2018 |

$ |

187,000 |

| (f) |

Calendar Year 2018, payable January 1, 2019 and each January 1

year thereafter through the expiration of the Agreement |

$ |

250,000 |

In addition, we were obligated for certain

milestone payments –

| |

· |

For each Phase I clinical trial - $100,000 |

| |

· |

Upon successful conclusion of each Phase III clinical trial or any other clinical trial following a Phase II clinical trial for each licensed product - $500,000 |

| |

· |

Upon each regulatory/market approval on each licensed product/indication - $2,000,000. |

We were responsible for prosecution and maintenance of

the patent rights after the effective date and would have been directly responsible for such future expenses of filing

and protection of patent claims, including counsel fees. The Patent License Agreement contained other obligations for timely

periodic reporting of its activities and other matters that are material to maintenance of the patent rights.

We were in compliance with these payment terms, except

that the payment due January 1, 2015 was not made. As a result, we received notice of termination on March 10, 2015,

which resulted in termination under the original Patent License Agreement on May 9, 2015. S&W has the right under the

Patent License Agreement to charge daily interest on overdue payments commencing on the 31st day after the payment

is due at the lower of either one and a half percent per month or the highest legal interest rate. This right does not

terminate upon the termination of the Patent License Agreement.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

| Exhibit No. |

Description |

| |

|

| 10.1* |

Amendment No. 1 to the Exclusive License Agreement between Scott & White Healthcare and VG Life Sciences, Inc., dated September 9, 2014. |

*filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VG LIFE SCIENCES, INC. |

| |

|

| Date: May 18, 2015 |

By: /s/ John Tynan |

| |

Name: John Tynan |

| |

Title: Chief Executive Officer |

Exhibit 10.1

AMENDMENT NO. 1 TO LICENSE AGREEMENT BETWEEN VG LIFE

SCIENCES, INC.,

AND SCOTT & WHITE HEALTHCARE.

This is Amendment No. 1 (the “Amendment No. 1) to the license agreement between VG Life Sciences,

Inc. (“LICENSEE”) and Scott & White Healthcare (“S&W) dated July 18, 2013

(the “Agreement”). LICENSEE and S&W are individually a “Party” and collectively “the

Parties.” The effective date of this Amendment No. 1 is September 9, 2014 (the “Amendment No. 1 Effective Date”).

WHEREAS the Parties desire to amend the Agreement to include an additional technology, and to include

certain additional terms in the Agreement.

NOW, THEREFORE, in consideration of the premises, the mutual covenants contained herein and other

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties hereby agree as follows:

| A. | | Terms. Except to the extent specifically provided for in this Amendment No. 1, all

capitalized terms used in this Amendment No. 1 shall have the meanings given thereto in the Agreement. |

| B. | | The Parties desire to amend and modify certain terms of the Agreement as set forth

in this Amendment No. 1 as follows: |

| 1. | | Paragraph 1.2. The Parties desire to amend Paragraph 1.2 to include in Table 1 the

following. |

Table 1

| No. 5. “Treating Neurological Diseases “(SW14-001) in the FIELD OF USE |

| Country |

Type |

Serial No. |

Filing Date |

Inventor(s) |

| US |

Provisional |

61/875,670 |

9/9/2013 |

M. Karen Newell-Rogers (HSC/S&W) |

| US |

Provisional |

62/033,088 |

8/4/2014 |

Richard Tobin (HSC)

Lee Shapiro (HSC) |

References to the PATENT RIGHTS for Technology No. 5 shall be limited to only the FIELD OF USE for

Technology No. 5 as defined below.

| 2. | | Paragraph 1.8. The Parties desire to amend Paragraph 1.8 to limit the FIELD OF USE

for Technology No. 5 solely to the claims for methods for treating brain trauma and epilepsy and for no other subject matter including,

but not limited, methods for treating cancer. |

| 3. | | Paragraph 3.1. Paragraph 3.1 is amended to include the following after the last sentence: |

“LICENSEE must make an additional payment in the amount of twenty-five thousand dollars

($25,000) to S&W. This payment is due no later than January 1, 2015, Failure to make this additional payment within the

specified time period will cause this Agreement to immediately terminate notwithstanding anything herein to the contrary.”

| 3. | | Paragraph 3.5 is amended as follows: |

| c) Calendar Year 2014, payable January 1, 2015 |

$20,000 |

| d) Calendar Year 2015, payable January 1, 2016 |

$87,500 |

| e) Calendar Year 2016, payable January 1, 2017 |

$125,000 |

| f) Calendar Year 2017, payable January 1, 2018 |

$187,500 |

| g) Calendar year 2018 (payable January 1, 2019) and each year thereafter (payable January 1st) through the expiration of this Agreement |

$250,000 |

In the event that LICENSEE’s payment of royalties for the

Calendar Year due under paragraph 3.2 do not meet or exceed the required minimum annual consideration,

LICENSEE’s royalty payment for the last quarter of the Calendar Year must include payment of the balance needed to

achieve the required minimum. If this Agreement expires or is terminated before the end of a Calendar Year, or Technology is

abandoned by LICENSEE pursuant to paragraph 6.11, then the corresponding minimum annual consideration paragraph 3.5(d) - must

be prorated for that year.,”

| 4. | | For purposes of determining SUBLICENSEE Consideration in Paragraph 4.2, the Parties

acknowledge and agree that the “Effective Date of this Agreement” in Schedule 1 and Schedule 2 of paragraph 4.2 shall

refer to the Amendment No. 1 Effective Date only with respect to the following in Table 1: No. 5 - “Treating Neurological

Diseases” (SW14-001) hereinafter “Technology NO. 5”) in revised Table 1. |

| 5. | | Regarding Paragraph 5.1, Licensee is responsible for its documented expenses incurred

prior to or on the Amendment No. 1 Effective Date in relation to the prosecution and maintenance of patent applications, whether

or not included as PATENT RIGHTS, with respect to; (a) Technology No. 5 and will be directly responsible for such future expenses

beyond the Amendment No. 1 Effective Date in accordance with Article VI; and (b) Technology No. 6 entitled, “Methods and

Products for Treating Type II Diabetes” (SW14-002), including U.S. patent application filing 61/878,495 filed by Licensee

on September 16, 2013 (“Technology No. 6”). For purposes of clarity and notwithstanding Licensee’s payment and

confidentiality obligations, Licensee has not license or other rights in or to Technology No. 5 outside its FIELD OF USE, or Technology

No. 6. |

| 6. | | Paragraph 8.4 of the Agreement is amended to include this sentence, “Obligations

under Paragraph 9.1 shall survive the expiration or termination of this Agreement.” |

| 7. | | The following is inserted into the Agreement as new Paragraph 6.14. |

6.14 The Parties agree that the provisions of Article VI, as

amended by this Paragraph 6.14, shall apply for the PATENT RIGHTS jointly-owned by them. In addition, upon request

by S&W, Counsel shall provide a reasoned opinion to S&W regarding Counsel’s inventorship determination

including, without limitation, the names of those considered as potential investors, those selected as inventors, and the

basis for their inventive contribution to the claims. If the parties disagree on Counsel’s determination, either Party

may seek a mutually agreeable independent third party patent attorney to render an opinion. The Parties agree to be bound

by that attorney’s opinion regarding inventorship (“ Ultimate Determination”). If the Ultimate Determination

is different than Counsel’s determination, then LICENSEE shall reimburse S&W’s costs, if any, in obtaining

the Ultimate Determination.

Paragraphs 6.11 and 6.13 of the Agreement are amended with

respect to jointly-owned PATENT RIGHTS by adding to the end of the sentence, “and assigned to S&W.”

The parties shall cooperate in selecting a patent within

the jointly-owned PATENT RIGHTS to seek a term extension for, and Licensed Product to seek a supplementary protection

certificate on in accordance with the applicable laws of each country where there are such PATENT RIGHTS. Each Party agrees

to execute any documents and to take any additional actions as the other Party may reasonably request in connection therewith.

For all jointly-owned PATENT RIGHTS, LICENSEE shall

promptly inform S&W of any alleged infringement along with providing available evidence thereof. LICENSEE shall have the

first right to abate the infringement and enforce the jointly-owned PATENT RIGHTS upon consent of S&W and its assumption

of all costs and expenses. S&W shall be kept fully informed and given the right and opportunity to advise and comment

thereon, including to be represented by counsel of its choosing. All amounts received in connection with the abatement

and/or enforcement of the jointly-owned PATENT RIGHTS shall be shared in equally between the owners after deducting

LICENSEE’s reasonable and documented costs and expenses therefor and submitting copies thereof to S&W. If LICENSEE

elects not to abate an alleged infringement or to enforce the PATENT RIGHTS following S&W’s consent, then S&W

may, in its sole judgment and at its own expense, take steps to enforce any patent and control, settlement and defend such

suit, and recover, for its own account, any damages, awards or settlements. LICENSEE shall reasonably cooperate with S&W

in any such actions at S&W’s expense, including being joined as a party.

As joint owners of certain PATENT RIGHTS and except as

provided in this Agreement, neither Party has any obligation to the other Party regarding these jointly-owned PATENT RIGHTS.

For clarity, LICENSEE is not an agent of or given the right to obligate or bind S&W on its behalf in any manner.

Notwithstanding the last sentence of Paragraph 8.4 of

the Agreement, or anything inconsistent in Article VI, and provided LICENSEE has not entered liquidation, had a receiver

or administrator appointed over any assets related to this Agreement, made any voluntary arrangement with any of its

creditors, or ceased to conduct its business, or any similar event under the law of any of any foreign jurisdiction, this

Paragraph 6.14 shall survive the expiration or termination of the Agreement, unless such termination is pursuant to Paragraph

8.3, for so long as the jointly-owned PATENT RIGHTS are in effect anywhere in the world (“Post-Agreement

Cooperation”). All references to SYSTEM shall be disregarded during Post-Agreement Cooperation.

| C. | | Terms. Except as modified by this Agreement No. 1, the Agreement shall remain

in full force and effect between the Parties. |

| D. | | Counterparts. This Amendment No. 1 may be executed in one or more counterparts,

each of which shall be deemed an original but all of which shall constitute one and the same instrument. |

IN WITNESS WHEREOF, LICENSEE and S&W have entered into

this Amendment No. 1 effective as of the Amendment No. 1 Effective Date.

| SCOTT & WHITE HEALTHCARE: |

|

VG LIFE SCIENCES, INC.: |

|

|

|

| /s/ Robert W. Pryor |

|

/s/ Haig Keledjian |

| Robert W. Pryor, M.D. |

|

Haig Keledjian |

| President & CEO |

|

Chairman and VP of IP |

| |

|

|

| |

|

|

| Date: 9/11/2014 |

|

Date: 9/9/2014 |

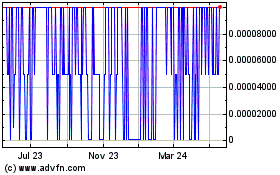

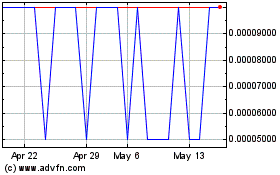

VG Life Sciences (PK) (USOTC:VGLS)

Historical Stock Chart

From Dec 2024 to Dec 2024

VG Life Sciences (PK) (USOTC:VGLS)

Historical Stock Chart

From Dec 2023 to Dec 2024