UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 14C

Information Statement Pursuant

to Section 14(c) of the Securities

Exchange Act of 1934

Check the appropriate box:

| þ |

|

Preliminary Information Statement |

| o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-5(d)(2)) |

| o |

|

Definitive Information Statement |

VIROPRO, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| þ |

|

No fee required. |

| o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

|

Title of each class of securities to which transaction applies: |

| |

|

|

|

| |

|

|

|

| |

(2) |

|

Aggregate number of securities to which transaction applies: |

| |

|

|

|

| |

|

|

|

| |

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

|

| |

|

|

|

| |

(4) |

|

Proposed maximum aggregate value of transaction: |

| |

|

|

|

| |

|

|

|

| |

(5) |

|

Total fee paid: |

| |

|

|

|

| |

|

|

|

| o |

|

Fee paid previously with preliminary materials. |

| |

|

|

| o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

|

Amount Previously Paid: |

| |

|

|

|

| |

|

|

|

| |

(2) |

|

Form, Schedule or Registration Statement No.: |

| |

|

|

|

| |

|

|

|

| |

(3) |

|

Filing Party: |

| |

|

|

|

| |

|

|

|

| |

(4) |

|

Date Filed: |

| |

|

|

|

| |

|

|

|

VIROPRO, INC.

49 West 38th Street

11th Floor

New York, NY 10018

(718) 845-7374

Notice of Action by Written Consent of Shareholders to be Effective March __, 2016

Dear Stockholder:

Viropro, Inc., a Nevada

corporation. (the "Company"), hereby notifies our stockholders of record on March __, 2016 that stockholders holding

approximately 59% of the voting power have approved by written consent in lieu of a special meeting on January 8, 2016 the following

proposals:

| Proposal |

1 |

To amend our Articles of Incorporation

to effect a reverse stock split of the common stock, $.001 par value, of the Company by a ratio of one-for-1,000.

|

| |

|

|

| Proposal |

2 |

To change the name of the Company to Axxiom,

Inc. |

This Information Statement

is first being mailed to our stockholders of record as of the close of business on March __, 2016. The action contemplated herein

will not be effective until April __, 2016, a date which is at least 20 days after the date on which this Information Statement

is first mailed to our stockholders of record. You are urged to read the Information Statement in its entirety for a description

of the action taken by the majority stockholders of the Company.

WE ARE NOT ASKING YOU FOR

A PROXY AND

YOU ARE REQUESTED

NOT TO SEND US A PROXY.

The corporate action

is taken by consent of the holders of a majority of the shares outstanding, and pursuant to Nevada law and the Company’s

bylaws permit holders of a majority of the voting power to take a stockholder action by written consent. Proxies are not being

solicited because stockholders holding approximately 59% of the issued and outstanding voting capital stock of the Company hold

more than enough shares to effect the proposed action and have voted in favor of the proposals contained herein.

Exhibit A Amendment to the

Company's Articles of Incorporation

/s/ Kenneth A. Sorensen

Chairman of the Board

March __, 2016

VIROPRO, INC.

49 West 38th Street

11th Floor

New York, NY 10018

(718) 845-7374

INFORMATION STATEMENT

WE ARE NOT ASKING

YOU FOR A PROXY AND YOU ARE REQUESTED NOT TO SEND US A PROXY.

General Information

This

Information Statement is being furnished to the stockholders of Viropro, Inc., a Nevada corporation (the “Company”),

in connection with the adoption of an Amendment to our Articles of Incorporation by written consent of our Board of Directors and

the holders of a majority of our issued and outstanding voting securities in lieu of a special meeting. On December 9, 2015 our

Board of Directors approved and, on January 8, 2016 the holders of a majority of our voting capital stock approved an amendment

to our Articles of Incorporation to provide for a 1:1,000 reverse split of the Company’s common stock, par value $.001 per

share (“Common Stock”) and to change our name to Axxiom, Inc. (the “Amendment”). We will, when permissible

following the expiration of the 20 day period mandated by Rule 14C of the Exchange Act and the provisions of the Nevada Revised

Statutes, file the Amendment with the Nevada Secretary of State’s Office. The Amendment will become effective upon such filing

and we anticipate that such filing will occur approximately 20 days after this Information Statement is first mailed to our stockholders.

Voting Securities

As of the date of

this Information Statement, our voting securities consist of our common stock, par value $0.001 per share, of which 1,270,196,700

shares are outstanding. Approval of the Amendment requires the affirmative consent of a majority of the shares of our

Common Stock issued and outstanding at March __, 2016 (the “Record Date”). The quorum necessary to conduct business

of the stockholders consists of a majority of the Common Stock issued and outstanding as of the Record Date.

Stockholders who beneficially

own an aggregate of 730,708,001 shares of our Common Stock, or approximately 59% of the total 1,270,196,700 issued and outstanding

shares of Common Stock are the “Consenting Stockholders.” The Consenting Stockholders have the power to vote all of

their shares of our Common Stock, which number exceeds the majority of the issued and outstanding shares of our Common Stock on

the date of this Information Statement. The Consenting Stockholders have consented to the proposed action set forth herein

and had and have the power to pass the proposed corporate action without the concurrence of any of our other stockholders.

The approval of this

action by written consent is made possible by Section 78.320 of the Nevada Revised Statutes, which provides that the written consent

of the holders of outstanding shares of voting stock, having not less than the minimum number of votes that would be necessary

to authorize or take such action at a meeting at which all shares entitled to vote thereon were present and voted, may be substituted

for such a meeting. In order to eliminate the costs involved in holding a special meeting, our Board of Directors elected to utilize

the written consent of the holders of more than a majority of our voting securities.

This Information Statement

will be mailed on or about March __, 2016 to stockholders of record as of the Record Date, and is being delivered to inform you

of the corporate action described herein before such action takes effect in accordance with Rule 14c-2 of the Securities Exchange

Act of 1934.

The entire cost of

furnishing this Information Statement will be borne by the Company. We will request brokerage houses, nominees, custodians, fiduciaries

and other like parties to forward this Information Statement to the beneficial owners of our voting securities held of record by

them, and we will reimburse such persons for out-of-pocket expenses incurred in forwarding such material.

Dissenters'

Right of Appraisal

The Nevada Revised

Statutes does not provide for dissenter's rights of appraisal in connection with the proposed actions nor have we provided for

appraisal rights in our Articles of Incorporation or Bylaws.

PROPOSAL 1 - AMENDMENT TO OUR ARTICLES

OF INCORPORATION

TO EFFECT A REVERSE STOCK SPLIT OF THE COMMON STOCK OF THE COMPANY

Our Board

of Directors has unanimously approved and adopted, subject to stockholder approval, an amendment to the Company’s Articles

of Incorporation to effect a reverse stock split of the Company’s Common Stock. Pursuant to the proposed Reverse Split, 1,000

outstanding shares of Common Stock will be combined and become one share of Common Stock. (the “Reverse Split”).

As of March 10, 2016,

the Company had 1,270,196,700 shares of Common Stock issued and outstanding. Based on the number of shares currently issued and

outstanding, immediately following the Reverse Split the Company would have approximately 1,270,196,700 shares of Common Stock

issued and outstanding (without giving effect to the rounding of fractional shares). The par value of the Common Stock will not

be changed in connection with the Reverse Split. such shares, for general corporate purposes.

When implemented, the

Reverse Split will be realized simultaneously and in the same ratio for all shares of the Common Stock. All holders of Common Stock

will be affected uniformly by the Reverse Split, which will have no effect on the proportionate holdings of any of our stockholders,

except for possible changes due to the treatment of fractional shares resulting from the Reverse Split. In lieu of issuing fractional

shares, the Company will round up in the event a stockholder would be entitled to receive less than one share of Common Stock as

a result of the Reverse Split. In addition, the split will not affect any holder of Common Stock’s proportionate voting power

(subject to the treatment of fractional shares), and all shares of Common Stock will remain fully paid and non-assessable. The

number of authorized and issued shares of the Company’s various series of preferred stock will not be affected in any way

by the Reverse Split.

When implemented by

the Board, the Reverse Split will be effective upon the filing of an Amendment to our Articles of Incorporation with the Secretary

of State of the State of Nevada. The Board of Directors will determine the actual time of filing of the Restated Certificate.

The following chart

reflects the changes in our capital structure following the reverse split, the top row reflecting the pre-split capital structure

and the bottom row reflecting the post-split capital structure:

| Authorized Shares of Common Stock | | |

Issued and Outstanding Shares | | |

Reserved but Unissued | | |

Available for Issuance | |

| | 1,600,000,000 | | |

| 1,270,196,700 | | |

| 141,000,000 | | |

| 280,853,300 | |

| | 1,600,000,000 | | |

| 1,270,196 | | |

| 141,000 | | |

| 1,598,680,854 | |

Reasons for the Reverse Split

The primary purpose

for effecting the Reverse Split is to increase the number of our available shares for future financings, acquisitions and general

corporate purposes.

In determining to authorize

the Reverse Split, and in light of the foregoing, our Board of Directors considered, among other things, that in the event that

the Company engages in acquisitions or is spun out eventually fewer shares should result in a higher per share price of our Common

Stock, which might heighten the interest of the financial community in the Company and potentially broaden the pool of investors

that may consider investing in the Company. In theory, the Reverse Split should cause the trading price of a share of our Common

Stock after the Reverse Split to be ten times what it would have been if the Reverse Split had not taken place. However, this will

not necessarily be the case.

In addition, our Board

of Directors considered that as a matter of policy, many institutional investors are prohibited from purchasing stocks below certain

minimum price levels. For the same reason, brokers may be reluctant to recommend lower-priced stocks to their clients, or may discourage

their clients from purchasing such stocks. Other investors may be dissuaded from purchasing lower-priced stocks because the commissions,

as a percentage of the total transaction, tend to be higher for such stocks. Our Board of Directors believes that, to the extent

that the price per share of our Common Stock remains at a higher per share price as a result of the Reverse Split, some of these

concerns may be ameliorated. The combination of lower transaction costs and increased interest from investors could also have the

effect of increasing the liquidity of the Common Stock.

In evaluating whether

or not to authorize the Reverse Split, in addition to the considerations described above, our Board of Directors also took into

account various negative factors associated with reverse stock splits. These factors include:

| |

• |

the negative perception of reverse stock splits held by some investors, analysts and other stock market participants; |

| |

|

|

| |

• |

the fact that the stock price of some companies that have implemented reverse stock splits has subsequently declined back to pre-reverse stock split levels; and |

| |

|

|

| |

• |

the adverse effect on liquidity that might be caused by a reduced number of shares outstanding, and the potential concomitant downward pressure decreased liquidity could have on the trading price. |

Also, other factors

such as our financial results, market conditions and the market perception of our business may adversely affect the market price

of our Common Stock. As a result, there can be no assurance that the price of our Common Stock would be maintained at the per share

price in effect immediately following the effective time of the Reverse Split. There also can be no assurance that the total market

capitalization of the Company following the Reverse Split will be higher than the market capitalization preceding the split or

that an increase in our trading price, if any, would be sufficient to generate investor interest.

Stockholders should

recognize that if the Reverse Split is effected, they will own a fewer number of shares than they currently own (a number equal

to the number of shares owned immediately prior to the Reverse Split divided by 1,000). While we expect that the Reverse Split

will result in an increase in the per share price of our Common Stock, the Reverse Split may not increase the per share price of

our Common Stock in proportion to the reduction in the number of shares of our Common Stock outstanding. It also may not result

in a permanent increase in the per share price, which depends on many factors, including our performance, prospects and other factors

that may be unrelated to the number of shares outstanding. The history of similar reverse splits for companies in similar circumstances

is varied.

If the Reverse Split

is effected and the per share price of our Common Stock declines, the percentage decline as an absolute number and as a percentage

of our overall market capitalization may be greater than would occur in the absence of the Reverse Split. Furthermore, the liquidity

of our Common Stock could be adversely affected by the reduced number of shares that would be outstanding after the Reverse Split.

Finally, following

the Reverse Split the number of authorized but unissued shares of our Common Stock relative to the number of issued shares of our

Common Stock will be increased. This increased number of authorized but unissued shares of our Common Stock could be issued by

the Board without further stockholder approval, which could result in dilution to the holders of our Common Stock. The increased

proportion of unissued authorized shares to issued shares could also, under certain circumstances, have an anti-takeover effect.

For example, the issuance of a large block of Common Stock could dilute the ownership of a person seeking to effect a change in

the composition of our Board of Directors or contemplating a tender offer or other transaction. The Reverse Split is not being

proposed in response to any effort of which the Company is aware to accumulate shares of Common Stock or obtain control of the

Company.

Principal Effects of the Reverse Split

General

The Reverse Split will

affect all of holders of our Common Stock uniformly and will not change the proportionate equity interests of such stockholders,

nor will the respective voting rights and other rights of holders of our Common Stock be altered, except for possible changes due

to the treatment of fractional shares resulting from the Reverse Split, as described below.

Exchange Act Matters

Our Common Stock is

currently registered under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and we are subject

to the periodic reporting and other requirements of the Exchange Act. The Reverse Split, if implemented, will not affect the registration

of our Common Stock under the Exchange Act or our reporting or other requirements thereunder. Trading in our Common Stock on OTC

Pink under the symbol "VPRO" has been suspended by OTC Markets for lack of current public information. We intend to provide

the missing periodic reports and meet the trading requirements of OTC Markets and have engaged Ciro E. Adams, CPA, LLC as our independent

registered public accounting firm for that purpose. Note, however, that the CUSIP number for our Common Stock will change

in connection with the Reverse Split and will be reflected on new certificates issued by the Company and in electronic entry systems.

Number of Shares of Common Stock and

Number of Stockholders

The Reverse Split would

have the following effects on the number of shares of Common Stock:

1. Each 1,000 shares

of our Common Stock owned by a stockholder immediately prior to the Reverse Split would become one share of Common Stock after

the Reverse Split;

2. All outstanding

but unexercised options and warrants entitling the holders thereof to purchase shares of our Common Stock will enable such holders

to purchase, upon exercise of their options or warrants, one-tenth of the number of shares of our Common Stock that such holders

would have been able to purchase upon exercise of their options or warrants immediately preceding the Reverse Split, at an exercise

price equal to 1,000 times the exercise price specified before the Reverse Split, resulting in approximately the same aggregate

exercise price being required to be paid upon exercise thereof immediately preceding the Reverse Split; and

3. The number of shares

of our Common Stock reserved for issuance (including the maximum number of shares that may be subject to options) under our stock

option plan will be reduced to one-thousandth of the number of shares currently included in such plan.

Rounding in Lieu of Issuing Fractional

Shares

The Company will not

issue fractional shares in connection with the Reverse Split. Instead, the Company will round up to the nearest whole share any

stockholder’s share ownership to the extent such stockholder would be entitled to receive less than one share of Common Stock

or greater as a result of the Reverse Split.

Accounting Matters

The Reverse Split will

not affect total stockholders’ equity on our balance sheet. However, because the par value of our Common Stock will remain

unchanged, the components that make up total stockholders’ equity will change by offsetting amounts. As a result of the Reverse

Split, the stated capital component attributable to our Common Stock will be reduced to an amount equal to one-one thousandth of

its present amount, and the additional paid-in capital component will be increased by the amount by which the stated capital is

reduced. The per share net loss and net book value per share of our Common Stock will be increased as a result of the Reverse Split

because there will be fewer shares of our Common Stock outstanding.

Procedure for Effecting the Reverse

Split and Filing the Certificate of Amendment

Generally

The Reverse Split and

related amendment to the Articles of Incorporation, our Board of Directors will file the Amendment effecting the Reverse Split

with the Secretary of State of the State of Nevada. The Reverse Split will become effective as of 5:00 p.m. eastern standard time

on the date of filing, which time on such date will be referred to as the “effective time.” At the effective time,

each 1,000 shares of Common Stock issued and outstanding immediately prior to the effective time will, automatically and without

any further action on the part of our stockholders, be combined into and become one share of Common Stock, subject to the treatment

for fractional shares described above, and each certificate which, immediately prior to the effective time represented pre-Reverse

Split shares, will be deemed cancelled and, for all corporate purposes, will be deemed to evidence ownership of post-Reverse Split

shares. However, a stockholder will not be entitled to receive any dividends or distributions payable after the Certificate of

Amendment is effective until that stockholder surrenders and exchanges his or her certificates.

Jersey Stock Transfer

LLC, the Company’s transfer agent (the “Transfer Agent”), will act as exchange agent for purposes of implementing

the exchange of stock certificates, and is sometimes referred to as the “exchange agent.” As soon as practicable after

the effective time, a letter of transmittal will be sent to stockholders of record as of the effective time for purposes of surrendering

to the exchange agent certificates representing pre-Reverse Split shares in exchange for certificates representing post-Reverse

Split shares in accordance with the procedures set forth in the letter of transmittal. No new certificates will be issued to a

stockholder until such stockholder has surrendered such stockholder’s outstanding certificate(s), together with the properly

completed and executed letter of transmittal, to the exchange agent. From and after the effective time, any certificates formerly

representing pre-Reverse Split shares which are submitted for transfer, whether pursuant to a sale, other disposition or otherwise,

will be exchanged for certificates representing post-Reverse Split shares. STOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S)

AND SHOULD NOT SUBMIT ANY CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

In connection with

the Reverse Split, our Common Stock will change its current CUSIP number. This new CUSIP number will appear on any new certificates

representing post-Reverse Split shares of our Common Stock.

Street Name and

Book-Entry Holders

Upon the Reverse Split,

the Company intends to treat shares held by stockholders in “street name”, through a bank, broker or other nominee,

in the same manner as stockholders whose shares are registered in their own names. Banks, brokers and other nominees will be instructed

to effect the Reverse Split for their beneficial holders. These brokers, banks and other nominees may have other procedures for

processing the transaction, however, and stockholders holding in street name are encouraged to ask their brokers, banks or other

nominees any questions they may have regarding such procedures.

Stockholders who hold

some or all of their shares in electronic book-entry form with the Transfer Agent do not have certificates evidencing their ownership

and need not take any action to receive their post-Reverse Split shares. Rather, a statement will be sent automatically to any

such stockholder’s address of record indicating the effects of the transaction, including the number of shares of Common

Stock held following the Reverse Split.

Certain U.S. Federal Income Tax Consequences

The discussion below

is only a summary of certain U.S. federal income tax consequences of the Reverse Split generally applicable to beneficial holders

of shares of our Common Stock and does not purport to be a complete discussion of all possible tax consequences. This summary addresses

only those stockholders who hold their pre-Reverse Split shares as “capital assets” as defined in the Internal Revenue

Code of 1986, as amended (the “Code”), and will hold the post-Reverse Split shares as capital assets. This discussion

does not address all U.S. federal income tax considerations that may be relevant to particular stockholders in light of

their individual circumstances or to stockholders that are subject to special rules, such as financial institutions, tax-exempt

organizations, insurance companies, dealers in securities, and foreign stockholders. The following summary is based upon the provisions

of the Code, applicable Treasury Regulations thereunder, judicial decisions and current administrative rulings, as of the date

hereof, all of which are subject to change, possibly on a retroactive basis. Tax consequences under state, local, foreign, and

other laws are not addressed herein. Each stockholder should consult his, her or its own tax advisor as to the particular

facts and circumstances that may be unique to such stockholder and also as to any estate, gift, state, local or foreign tax considerations

arising out of the Reverse Split.

The Reverse Split will

qualify as a recapitalization for U.S. federal income tax purposes. As a result,

| |

• |

Stockholders should not recognize any gain or loss as a result of the Reverse Split. |

| |

|

|

| |

• |

The aggregate basis of a stockholder’s pre-Reverse Split shares will become the aggregate basis of the shares held by such stockholder immediately after the Reverse Split. |

| |

|

|

| |

• |

The holding period of the shares owned immediately after the Reverse Split will include the stockholder’s holding period before the Reverse Split. |

The above discussion

is not intended or written to be used, and cannot be used by any person, for the purpose of avoiding U.S. Federal tax penalties.

It was written solely in connection with the solicitation of stockholder votes with regard to a proposed reverse split of our Common

Stock

PROPOSAL 2

AMENDMENT

TO OUR ARTICLES OF INCORPORATION

TO EFFECT A CHANGE OF NAME OF THE COMPANY

The Company will change

its name in its new Articles of Incorporation from "Viropro, Inc." to "Axxiom, Inc." since the Company will

now be engaged in the acquisition of a number of biopharmaceutical companies engaged in the development and commercialization of

several biopharma products and not concentrating on design, scale up and manufacture of biologics which the Company operated primarily

through its Malaysian-based subsidiary, Alpha. Alpha had a state-of-the-art production facility of approximately 50,000 square

foot production facility suitable for the development and manufacturing of biopharmaceuticals until September 2014 when one of

Alpha's creditors, Bank Pembangunan Malaysia Berhad ("BPMB"), without court order, appointed PricewaterhouseCoopers as

Alpha's receiver and manager pursuant to the terms of the loan agreements BPMB had with Alpha, purportedly to recover the value

of its loans.. The Board of the Company has concluded that the name of Axxiom, Inc. more clearly reflects its new focus and future

prospects and will help build a brand identity. Accordingly, the Board has concluded that is in the best interests of the Company

and its shareholders to amend its charter to change its name to "Axxiom, Inc."

VOTING SECURITIES AND PRINCIPAL

STOCKHOLDERS

Our voting securities

consist of our Common Stock, par value $0.001 per share, of which 1,270,196,700 shares are outstanding. The following tables contain

information regarding record ownership of our Common Stock as of March 10, 2016 held by:

| |

• |

persons who own beneficially more than 5% of our outstanding voting securities; |

| |

|

|

| |

• |

our directors; |

| |

|

|

| |

• |

our executive officers; and |

| |

|

|

| |

• |

all of our directors and executive officers as a group. |

All addresses below are 49 West 38th Street, 11th

Floor, New York, NY 10018 unless otherwise stated.

| Stockholders, Management and Directors | |

Shares Beneficially Owned | | |

Percentage of

Outstanding

Shares Owned | |

| Officers and Directors | |

| | |

| |

| | |

| | |

| |

| Bruce A. Cohen | |

| 25,000,000 | (1) | |

| 1.97 | % |

| | |

| | | |

| | |

| Michelle L.E. Peake | |

| 22,500,000 | (2) | |

| 1.77 | % |

| | |

| | | |

| | |

| Kenneth A. Sorensen | |

| 32,500,000 | (3) | |

| 2.56 | % |

| | |

| | | |

| | |

| Dr. Joseph J. Vallner | |

| 10,000,000 | (1) | |

| .79 | % |

| | |

| | | |

| | |

| Dr. Ivor Royston | |

| n/a | (4) | |

| - | |

| | |

| | | |

| | |

| John Doll | |

| n/a | (5) | |

| - | |

| | |

| | | |

| | |

All directors and executive

officers as a group (5 persons) | |

| 90,000,000 | | |

| 7.09 | % |

| | |

| | | |

| | |

| 5% Shareholders | |

| | | |

| | |

| | |

| | | |

| | |

Spring Hill Bioventures SDN BHD

Level 18

The Gardens North Tower

Mid Valley, Lingkaran Syed Putra

59200 Kuala Lumpur, Malaysia | |

| 340,097,124 | | |

| 26.78 | % |

| | |

| | | |

| | |

THG Capital SDN BHD

50-07-02, 7th Floor,

Wisma UOA Damansara,

No 50 Jalan Dungun,

Damansara Heights,

50490 Kuala Lumpur Malaysia | |

| 183,844,211 | | |

| 14.47 | % |

| | |

| | | |

| | |

Intas Pharnaceuticals Ltd.

Chinubhai Centre, Off. Nehru Bridge, Ashram Road,

Ahmedabad - 380009. Gujarat. India. | |

| 181,766,666 | | |

| 14.31 | % |

| (1) |

Issued in the form of warrants priced at the three day average closing price of Viropro's common stock as of February 2, 2015

or $.0027 per share and exercisable for ten years. |

| (2) |

10,000,000 shares are in the form of warrants at the three day average closing price of Viropro common stock as of February 2,

2015 or $.0027 per share and exercisable for ten years. |

| (3) |

7,500,000 000 shares are in the form of warrants at the three day average closing price of Viropro common stock as of February

2, 2015 or $.0027 per share and exercisable for ten years. |

| (4) |

The Board is negotiating the compensation package for Dr. Royston who joined the Board on December 8, 2015. |

| (5) |

The Board is negotiating the compensation package for John Doll who joined the Board on February 2, 2015. |

DELIVERY OF DOCUMENTS TO SECURITY

HOLDERS SHARING AN ADDRESS

Only one Information

Statement is being delivered to multiple security holders sharing an address unless the Company has received contrary instructions

from one or more of its security holders. The Company undertakes to deliver promptly upon written or oral request a separate copy

of the Information Statement to a security holder at a shared address to which a single copy of the documents was delivered and

provide instructions as to how a security holder can notify the Company that the security holder wishes to receive a separate copy

of the Information Statement.

Security holders sharing

an address and receiving a single copy may request to receive a separate Information Statement at Viropro, Inc., 49 West 38th Street,

11th Floor, New York, NY 10018. Security holders sharing an address can request delivery of a single copy of the Information

Statement if they are receiving multiple copies may also request to receive a separate Information Statement at Viropro, Inc.,

49 West 38th Street, 11th Floor, New York, NY 10018, telephone: (718) 845-7374.

COMPLIANCE WITH SECTION 16(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Section 16(a) of the

Securities Exchange Act of 1934, as amended, requires that our directors and executive officers, and persons who own more than

ten percent (10%) of our outstanding Common Stock, file with the Securities and Exchange Commission (the “SEC”) initial

reports of ownership and reports of changes in ownership of Common Stock. Such persons are required by the SEC to furnish us with

copies of all such reports they file. Specific due dates for such reports have been established by the SEC and we are

required to disclose any failure to file reports by such dates. We believe that during the fiscal year ended January

31, 2014, all reports required to be filed pursuant to Section 16(a) were filed on a timely basis.

WHERE YOU CAN OBTAIN

ADDITIONAL INFORMATION

We are required to

file annual, quarterly and special reports, proxy statements and other information with the SEC. You may read and copy any document

we file at the SEC’s public reference rooms at 100 F Street, N.E, Washington, D.C. 20549. You may also obtain copies of the

documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Room 1580, Washington,

D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information on the operation of the public reference rooms. Copies of

our SEC filings are also available to the public from the SEC’s web site at www.sec.gov.

We will provide, upon

request and without charge, to each shareholder receiving this Information Statement a copy of our filings with the SEC and other

publicly available information. A copy of any public filing is also available, at no charge, by contacting Viropro, Inc., 49 West

38th Street, 11th Floor, New York, NY 10018, telephone: (718) 845-7374.

| Date: March __, 2016 |

Viropro, Inc. |

| |

|

| |

|

By Order of the Board of Directors |

| |

|

|

| |

By: |

/s/ Kenneth A. Sorensen |

| |

|

Kenneth A. Sorensen |

| |

|

Chairman of the Board |

Exhibit A

AMENDMENT TO VIROPRO'S ARTICLES OF

INCORPORATION

Article I is amended as follows:

The name of the Corporation is Axxiom, Inc.

Article V is amended as follows: The Corporation

effects a reverse split pursuant to which every 1,000 shares of the Corporation's outstanding common stock, par value $.001 per

share (the "Common Stock"), shall automatically be reclassified and continued, without any action on the part of the

holder thereof, as one (1) new share of Common Stock. In the event that the total number of outstanding shares of Common

Stock held by any holder shall give rise to a fractional interest of Common Stock upon conversion, then in lieu of issuing fractional

shares, the Corporation shall round such fractional share up to the next highest whole number.

Viropro (CE) (USOTC:VPRO)

Historical Stock Chart

From Nov 2024 to Dec 2024

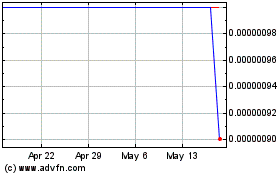

Viropro (CE) (USOTC:VPRO)

Historical Stock Chart

From Dec 2023 to Dec 2024