Clariant delivered strong growth in Q4 2021 and record

profitability in FY 2021

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- Independent investigation concluded –

Full Year 2020 (restated) and 2021 audited

- Fourth Quarter

2021:

Sales

from continuing

operations grew by

23 % in local

currency to

CHF 1.242 billion

driven by strong pricing and volume expansion

- Fourth Quarter

2021: EBITDA margin

increased to

16.3 %

from

16.1 %

supported by operating leverage and

continued higher pricing,

which diminished

ongoing raw material,

energy, and

logistics cost

inflation

- Full Year 2021:

Sales from continuing

operations increased by 15 %

in local currency to

CHF 4.372 billion

- Full Year 2021:

EBITDA margin increased to

16.2 % from

15.5 % in a

supportive demand

environment – highest EBITDA margin since

1999

- Full Year 2021: Net result for total

Group at

CHF 373 million

- Full Year 2021: Strong operating cash

flow of CHF 363 million despite

higher growth-related net

working capital and restructuring

cash-out

- Distribution

of

CHF 0.40

per share proposed to AGM

on 24 June

2022

- Outlook 2022: Strong

local currency growth for the Group with

the aim to improve

year-on-year Group EBITDA margin

level in a challenging geopolitical

environment

“Clariant concluded the independent

investigation and today presented its audited full year 2021

financials. We are pleased to announce markedly higher organic

sales growth and a record profitability level in 2021 which is also

well above 2019 pre-COVID-19 pandemic levels. We were able to

successfully manage the challenges from unprecedented developments

in raw materials, as well as energy and logistics cost. These

results positively reflect the attractiveness of the Group’s

higher-value specialty portfolio and provide tangible proof of the

continued effective execution of cost discipline and our

performance improvement programs,” said Conrad Keijzer, CEO of

Clariant. “In 2022, we will continue to execute Clariant’s strategy

to deliver profitable growth, guided by our new purpose: Greater

Chemistry – between people and planet. I would like to take this

opportunity to thank all our people for their dedication and hard

work, which is reflected by these strong 2021 results, as well as

our customers and suppliers for placing their trust in

Clariant.”

Key Financial

Data1

| Continuing

operations |

Fourth Quarter |

|

Full Year |

| in CHF

million |

2021 |

2020 |

% CHF |

% LC |

|

2021 |

2020 |

% CHF |

% LC |

| Sales |

1 242 |

1 022 |

22 |

23 |

|

4 372 |

3 860 |

13 |

15 |

| EBITDA |

203 |

165 |

23 |

|

|

708 |

597 |

19 |

|

| - margin |

16.3 % |

16.1 % |

|

|

|

16.2 % |

15.5 % |

|

|

| EBITDA before

exceptional items |

230 |

179 |

28 |

|

|

760 |

623 |

22 |

|

| - margin |

18.5 % |

17.5 % |

|

|

|

17.4 % |

16.1 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

|

|

|

|

440 |

317 |

|

|

| Return on

invested capital (ROIC) |

|

|

|

|

|

9.9 % |

7.4 % |

|

|

| Net result from

continuing operations |

|

|

|

|

|

292 |

130 |

|

|

| Net result

(2) |

|

|

|

|

|

373 |

825 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating cash

flow (2) |

|

|

|

|

|

363 |

369 |

|

|

| Number of

employees as of 31 December (2) |

|

|

|

|

|

13 374 |

13 235 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Discontinued

operations (3) |

|

|

|

|

|

|

|

|

|

| Sales |

240 |

200 |

20 |

21 |

|

912 |

1 330 |

-31 |

-31 |

| Net result from

discontinued operations |

|

|

|

|

|

81 |

695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) FY 2020 restated, Q4 2020

corrected(2) Total Group including discontinued

operations(3) Masterbatches divested on

1 July 2020

Fourth Quarter 2021

– Strong growth with

higher profitability

MUTTENZ, MAY

19, 2022

Clariant, a focused, sustainable, and innovative

specialty chemical company, today announced its Fourth Quarter 2021

and audited Full Year 2021 results. Following the independent

investigation, the 2020 Full Year and quarterly results have been

restated and the quarters of 2021 have been corrected accordingly.

The restatements in the 2020 Annual Financial Statement resulted in

an EBITDA increase of CHF 19 million and

CHF 14 million in net result from continuing operations.

The fourth quarter continuing operations sales were

CHF 1.242 billion, compared to

CHF 1.022 billion in the fourth quarter of 2020. This

corresponds to an increase of 23 % in local currency and

22 % in Swiss francs. Both pricing, which addressed continued

cost inflation, and volume growth had a positive impact on the

Group of 14 % and 9 %, respectively. Care Chemicals and

Natural Resources grew sales strongly, which more than compensated

for the expected development in Catalysis.

All geographic regions contributed to the sales

expansion in the fourth quarter of 2021, reflecting both a demand

recovery as well as shortages in supply chains. In Europe, the

lofty 25 % local currency growth was underpinned by strong

expansion in Care Chemicals. The 12 % growth in Asia-Pacific

was driven by 17 % expansion in China while sales in North

America increased by 17 %. The 30 % sales growth in Latin

America and 76 % expansion in the Middle

East & Africa, the smallest region, were underpinned

by all Business Areas.

In the fourth quarter of 2021, Care Chemicals

increased sales by 39 % in local currency. This was supported

by organic double-digit expansion in Industrial Applications and

Consumer Care, Crop Solutions, and Aviation in particular, in

addition to the consolidation of the acquired majority share in

Clariant IGL Specialty Chemicals (CISC) and the result of acquiring

the remaining shares in Beraca, whose sales contributions exceeded

expectations. Catalysis sales remained unchanged in local currency,

primarily due to the expansion in Syngas, Specialty Catalysts, and

the emission-control businesses, which largely counterbalanced the

weakness in parts of Petrochemicals. Natural Resources sales

increased by a notable 25 % in local currency with growth

attributable to all three Business Units, Additives in

particular.

The continuing operations EBITDA increased to

CHF 203 million and a corresponding margin of

16.3 %, slightly exceeding the 16.1 % reported in the

fourth quarter of the previous year. The development was

underpinned by higher sales, operating leverage, pricing measures

largely offsetting raw material price increases, and the ongoing

execution of Clariant’s performance programs, which contributed

additional cost savings of CHF 13 million, including the

efficiency programs, in the fourth quarter of 2021. The absolute

profitability almost matched the high CHF 208 million

pre-pandemic level generated in the fourth quarter of 2019 despite

negative currency effects.

Full Year 2021 –

Specialty chemicals portfolio

delivered further sales and profitability

improvement

In the full year 2021, continuing operations

sales were CHF 4.372 billion, compared to

CHF 3.860 billion in full year 2020. This corresponds to

an increase of 15 % in local currency and 13 % in Swiss

francs. Both pricing and volume growth had a positive impact on the

Group of 8 % and 7 %, respectively.

In the full year 2021, sales rose in almost all

geographic regions. The developments in Europe, the Middle

East & Africa, Asia-Pacific, including China, and

Latin America were particularly robust with sales expansion in the

range of 16 % to 20 %. The sales gap in North America

continued to dwindle and the region ended the year unchanged versus

the previous year levels due to the ongoing recovery in

Oil and Mining Services.

Care Chemicals sales rose by 22 % in local

currency in the full year 2021 with a double-digit organic sales

increase in both Industrial Applications and Consumer Care. In

Catalysis, the top-line was up by 5 % in local currency,

supported by Syngas, Specialty Catalysts, and emission-control

catalyst demand. Oil and Mining Services, Functional

Minerals, and particularly Additives all contributed to the

14 % local currency sales growth reported in Natural

Resources.

The continuing operations EBITDA increased to

CHF 708 million as the Group improved profitability on

the back of notable sales expansion, operating leverage together

with the continued successful pricing measures largely offsetting

raw material price increases of approximately 21 %, and the

execution of the performance improvement programs, which resulted

in additional cost savings of CHF 41 million in the full

year 2021. Clariant recognized a CHF 33 million net

VAT-related credit over the full year 2021, which was offset by

exceptional cost, largely related to the performance improvement

programs. The EBITDA margin increased to 16.2 % from

15.5 % in the previous year due to the profitability

improvement in Care Chemicals and Natural Resources and the

continued cost discipline across the Group.In 2021, the total Group

net result was CHF 373 million versus

CHF 825 million in the previous year,

CHF 102 million excluding the gain on the Masterbatches

disposals. The 2021 net result was positively affected by the

strong business performance of the continuing operations and the

corresponding margin improvement. In 2020, the gain on the disposal

of the Masterbatches business of CHF 723 million and the

partial reversal of CHF 50 million of the EU fine

provision had an extraordinary positive impact on the result.

Operating cash flow for the total Group was

CHF 363 million, just slightly below the previous year

level of CHF 369 million, despite a growth-driven cash

outflow in net working capital of CHF 221 million, which

resulted from the marked sales increase as well as supply chain

uncertainties. The restructuring cash payments of

CHF 38 million also negatively impacted the cash flow

development.

Net debt for the total Group increased to

CHF 1.535 billion versus CHF 1.040 billion

recorded at the end of 2020. This development is attributable to a

growth-driven increase in working capital, higher investments into

property, plant, and equipment as well as acquisitions.

The Board of Directors recommends a regular

distribution of CHF 0.40 per share to the Annual General

Meeting (AGM) on 24 June 2022 based on the strong performance in

2021. This distribution represents an attractive pay-out ratio of

49 % of continuing operations earnings per share

(EPS: CHF 0.81) and is proposed to be made through

capital reduction by way of par value reduction.

The Board of Directors proposes the reelection

of Günter von Au as Chairman. The following Board of Directors

members will not stand for reelection at the 2022 AGM: Abdullah

Mohammed Alissa, Nader Ibrahim Alwehibi, and Calum MacLean. The

Board of Directors thanks them for their contribution to Clariant

and therefore proposes the election of the following individuals:

Ahmed Mohamed Alumar, Saudi Arabian Citizen; Roberto César

Gualdoni, German and Italian Citizen; Naveena Shastri, US

Citizen.

Discontinued Operations

In the fourth quarter of 2021, Pigments sales

increased by 21 % in local currency and by 20 % in Swiss

francs. In the full year 2021, on a like-for-like basis, excluding

Masterbatches sales from the first half of 2020, Pigments sales in

discontinued operations rose by 15 % in local currency and by

14 % in Swiss francs due to the improved economic

environment.

In the fourth quarter of 2021, the EBITDA margin

in discontinued operations increased to 8.8 % due to the

higher sales levels, the corresponding operating leverage

improvement in Pigments, the execution of the efficiency program,

as well as effects from other discontinued operations.

In the full year 2021, the EBITDA margin in

discontinued operations was 12.5 %.

Outlook – Full

Year 2022

Clariant aims to grow above the market to

achieve higher profitability through sustainability and innovation.

The Group has concluded its significant portfolio transformation

program by divesting Healthcare Packaging in 2019, Masterbatches in

2020, and Pigments in January of 2022. Clariant is now a truly

specialty chemical company and confirms its 2025 ambition to

deliver profitable growth (4 – 6 % CAGR), a Group EBITDA

margin between 19 – 21 % and a free cash flow conversion of

around 40 %.

In the first quarter of 2022, Clariant expects

to generate continued strong sales growth in local currency versus

the prior year, underpinned by expansion in Care Chemicals and

Natural Resources despite a normalizing growth environment.

Clariant is aiming to sustain its corrected year-on-year margin

levels in the first quarter of 2022 via volume growth, continuing

pricing actions, and cost discipline to diminish continued

inflation in raw materials, logistics, labor, and energy cost.

For the full year 2022, Clariant expects strong

growth in local currency for the Group driven by a particularly

strong first half of 2022. The current high level of uncertainty as

a result of the geopolitical conflicts, suspension of business in

Russia and the resurgence of COVID-19 in China are expected to

impact global economic growth and consumer demand in the second

half of the year. Clariant expects the high inflationary

environment with regard to raw material, energy and logistic cost

as well as supply chain challenges to persist in the second half of

2022. Clariant aims to improve its year-on-year Group EBITDA margin

levels via solid volume growth, continued cost discipline, and

pricing in an overall increasingly challenging economic

environment.

Clariant intends to publish its Integrated

Report 2021 on 2 June 2022 and the First Quarter 2022 results on 15

June 2022. The virtual Annual General Meeting 2022 is scheduled for

24 June 2022.

Please note that all information provided in this document

references the FY 2020 restated and Q4 2020 corrected results. For

details regarding the restatements please refer to the

Fourth Quarter / Full Year 2021 Analyst Presentation

and the Financial Review – Full Year 2021,

available on the Clariant website: Latest Results

(clariant.com)

FY 2021 Financial Review ENQ4 2021 Media Release EN

| CORPORATE

MEDIA RELATIONS Jochen DubielPhone

+41 61 469 63

63jochen.dubiel@clariant.com Anne

MaierPhone +41 61 469 63

63anne.maier@clariant.com Ellese GolderPhone

+41 61 469 63 63ellese.golder@clariant.com |

INVESTOR

RELATIONS Andreas Schwarzwälder

Phone +41 61 469 63

73andreas.schwarzwaelder@clariant.com Maria

IvekPhone +41 61 469 63

73maria.ivek@clariant.com Alexander

KambPhone +41 61 469 63 73alexander.kamb@clariant.com |

|

Follow us on Twitter, Facebook, LinkedIn, Instagram. This

media release contains certain statements that are neither reported

financial results nor other historical information. This document

also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the Company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these

materials. www.clariant.com Clariant is a focused,

sustainable and innovative specialty chemical company based in

Muttenz, near Basel/Switzerland. On 31 December 2021, the company

employed a total workforce of 13 374. In the financial year

2021, Clariant recorded sales of CHF 4.372 billion for

its continuing businesses. The company reports in three Business

Areas: Care Chemicals, Catalysis, and Natural Resources. Clariant’s

corporate strategy is led by the overarching purpose of ”Greater

chemistry – between people and planet,” and reflects the importance

of connecting customer focus, innovation, sustainability, and

people. |

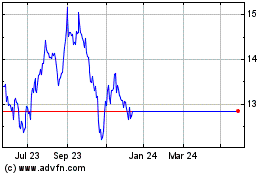

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025