Clariant reports markedly stronger sales growth and EBITDA expansion in Q1 2022

15 June 2022 - 3:00PM

Clariant reports markedly stronger sales growth and EBITDA

expansion in Q1 2022

AD HOC ANNOUNCEMENT PURSUANT TO ART. 53 LR

- First quarter 2022 sales from

continuing operations increased

by 30 % in local currency and

26 % in Swiss

francs to

CHF 1.262 billion

– pricing

contributed 16 % to

the strong

top-line

growth

- Continuing operations EBITDA

was up

27 % to

CHF 220 million

- EBITDA margin increased to

17.4 % from

17.3 %

in the first quarter of 2021

- First quarter performance

underlines

the ability to achieve

mid-term targets

- Outlook 2022: Strong

local currency growth for the Group with

the aim to improveyear-on-year Group

EBITDA margin level in a challenging

geopolitical

environment

“I’m proud to announce that Clariant had a

strong start to 2022 despite the turbulent environment. In the

first quarter, we successfully generated compelling revenue growth

and clearly increased absolute EBITDA. The Group’s higher-value

specialty portfolio once again enabled us to successfully manage

continued variable cost inflation arising from raw materials,

energy, and logistics services,” said Conrad Keijzer, CEO of

Clariant. “Although the short-term macroeconomic uncertainty

remains high, we are well on track to deliver on our mid-term

targets.”

Key Financial Data

| Continuing

operations |

|

|

First Quarter |

| in CHF

million |

|

|

|

|

|

2022 |

2021 |

% CHF |

% LC |

| Sales |

|

|

|

|

|

1 262 |

1 002 |

26 |

30 |

| EBITDA |

|

|

|

|

|

220 |

1731 |

27 |

|

| - margin |

|

|

|

|

|

17.4 % |

17.3 % |

|

|

| EBITDA before

exceptional items |

|

|

|

|

|

238 |

1781 |

34 |

|

| - margin |

|

|

|

|

|

18.9 % |

17.8 % |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 restated

First Quarter 2022

– Very strong

sales growth

MUTTENZ, JUNE 15, 2022

Clariant, a focused, sustainable, and innovative

specialty chemicals company, today announced first quarter 2022

continuing operations sales of CHF 1.262 billion,

compared to CHF 1.002 billion in the first quarter of

2021. This corresponds to a particularly strong increase of

30 % in local currency and 26 % in Swiss francs. The

positive pricing impact of 16 % in part addressed continued

cost inflation and also slightly outpaced the volume growth of

14 %. Care Chemicals and Natural Resources grew sales at an

accelerated pace, which more than compensated for the expected

slightly weaker development in Catalysis.

All geographic regions contributed meaningfully

to the sales expansion in the first quarter of 2022, reflecting

both continued strong demand as well as supply chain shortages. In

Europe, the high 27 % local currency growth was underpinned by

strong expansion in Care Chemicals as well as Natural Resources.

Sales in Asia-Pacific rose by 31 %, underpinned by expansion

in all Business Areas and clearly driven by 34 % higher sales

in China. The Americas reported compelling growth as North American

sales increased by a resounding 37 %, followed closely by

Latin America at 31 %. In the Middle

East & Africa, sales rose by 26 %.

In the first quarter of 2022, Care Chemicals

increased sales by 44 % in local currency. This progress was

supported by double-digit expansion in both Consumer Care and

Industrial Applications, in particular Personal Care, Crop

Solutions, Aviation, and Coatings. The consolidation of the

acquired majority share in Clariant IGL Specialty Chemicals (CISC)

and the acquisition of the remaining shares in Beraca further

supported this positive development with an addition of 4 %

local currency volume growth for the Group. Catalysis sales

decreased by a slight 1 % in local currency, despite

significantly higher Specialty Catalysts sales, which could not

entirely counterbalance the weakness in parts of Petrochemicals and

Syngas. Natural Resources sales increased by a resounding 31 %

in local currency with growth attributable to all three Business

Units, especially Additives.

The continuing operations EBITDA increased to

CHF 220 million with a corresponding margin of

17.4 %, slightly exceeding the 17.3 % reported in the

first quarter of the previous year. The increase was underpinned by

operating leverage from higher sales, cost savings (CHF

4 million savings from efficiency programs), and pricing

measures, which largely offset raw material price increases, supply

chain constraints, and higher energy and logistics cost. The

absolute EBITDA increased by a notable 27 %.

Discontinued Operations

Clariant’s Pigments business was divested to a

consortium comprising Heubach Group and SK Capital Partners on 3

January 2022, which resulted in a provisional pretax disposal gain

of CHF 168 million and an EBITDA of

CHF 160 million for discontinued operations. Total Group

(continuing operations and discontinued operations) EBITDA was

CHF 380 million in the first quarter of 2022.

Outlook – Full Year 2022

Clariant aims to grow above the market to

achieve higher profitability through sustainability and innovation.

The Group concluded the final step in its significant portfolio

transformation in January of 2022. Clariant is now a truly

specialty chemicals company and confirms its 2025 ambition to

deliver profitable growth (4 – 6 % CAGR), a Group EBITDA

margin between 19 – 21 %, and a free cash flow conversion of

around 40 %.

In the second quarter of 2022, Clariant expects

to generate continued strong sales growth in local currency versus

the prior year, underpinned by expansion in all Business Areas

despite a normalizing growth environment. Sequential sales are

expected to decline moderately as a result of seasonal impacts

(aviation, refinery) and demand normalization in Care Chemicals and

Natural Resources. Clariant expects to improve on its restated

year-on-year margin levels in the second quarter of 2022.

Sequentially, the Group expects to be broadly in line with its

first quarter 2022 margin level, especially via operating leverage

from growth, continuing pricing actions, and cost discipline to

counter continued inflation in raw materials, logistics, labor, and

energy cost.

For the full year 2022, Clariant expects strong

growth in local currency for the Group, driven by a particularly

strong first half of 2022. The current high level of uncertainty

resulting from the geopolitical conflicts, suspension of business

with Russia, and the resurgence of COVID-19 in China are expected

to continue to impact global economic growth and consumer demand in

the second half of the year. Clariant expects the high inflationary

environment with regard to raw material, energy, and logistics cost

as well as supply chain challenges to persist in the second half of

2022. Clariant aims to improve its year-on-year Group EBITDA margin

levels via solid revenue growth driven by pricing and continued

cost discipline, despite the increasingly challenging economic

environment.

Q1 2022 Media Release EN

| CORPORATE

MEDIA RELATIONS Jochen DubielPhone

+41 61 469 63 63jochen.dubiel@clariant.com Anne

MaierPhone +41 61 469 63 63anne.maier@clariant.com

Ellese CaruanaPhone +41 61 469 63

63ellese.caruana@clariant.com |

INVESTOR

RELATIONS Andreas Schwarzwälder

Phone +41 61 469 63 73andreas.schwarzwaelder@clariant.com

Maria IvekPhone +41 61 469 63

73maria.ivek@clariant.com Alexander

KambPhone +41 61 469 63 73alexander.kamb@clariant.com |

|

Follow us on Twitter, Facebook, LinkedIn, Instagram. This

media release contains certain statements that are neither reported

financial results nor other historical information. This document

also includes forward-looking statements. Because these

forward-looking statements are subject to risks and uncertainties,

actual future results may differ materially from those expressed in

or implied by the statements. Many of these risks and uncertainties

relate to factors that are beyond Clariant’s ability to control or

estimate precisely, such as future market conditions, currency

fluctuations, the behavior of other market participants, the

actions of governmental regulators and other risk factors such as:

the timing and strength of new product offerings; pricing

strategies of competitors; the Company’s ability to continue to

receive adequate products from its vendors on acceptable terms, or

at all, and to continue to obtain sufficient financing to meet its

liquidity needs; and changes in the political, social and

regulatory framework in which the Company operates or in economic

or technological trends or conditions, including currency

fluctuations, inflation and consumer confidence, on a global,

regional or national basis. Readers are cautioned not to place

undue reliance on these forward-looking statements, which speak

only as of the date of this document. Clariant does not undertake

any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of these materials. www.clariant.com

Clariant is a focused, sustainable, and innovative specialty

chemical company based in Muttenz, near Basel/Switzerland. On 31

December 2021, Clariant totaled a staff number of 11 537 and

recorded sales of CHF 4.372 in the fiscal year for its continuing

businesses. The company reports in three business areas: Care

Chemicals, Catalysis and Natural Resources. Clariant’s corporate

strategy is led by the overarching purpose of ‘Greater chemistry –

between people and planet,’ and reflects the importance of

connecting customer focus, innovation, sustainability, and

people. |

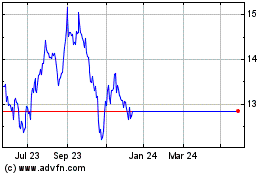

Clariant (LSE:0QJS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Clariant (LSE:0QJS)

Historical Stock Chart

From Mar 2024 to Mar 2025