TIDMACP

RNS Number : 0764B

Armadale Capital PLC

29 September 2022

Armadale Capital Plc / Index: AIM / Epic: ACP / Sector:

Investment Company

29 September 2022

Armadale Capital Plc

('Armadale' the 'Company' or the 'Group')

Interim Results

Armadale, the AIM quoted investment company focused on natural

resource projects in Africa, is pleased to announce its unaudited

interim results for the six months ended 30 June 2022.

Highlights

During the half year Armadale's primary focus was on securing

project development funding for the Mahenge Liandu Graphite project

while advancing the permitting and local community engagement. The

Company also expanded its presence following the grant of an

exploration license covering 19.99 square kilometers.

In March, the Company, pursuant to environmental compliance

requirements of the mining license, successfully completed the in

stallation of a weather station and has commenced the monthly

collection of data. The station records data at 5 second intervals

and covers all weather parameters including temperature, pressure,

wind, moon phase, humidity, solar radiation and rainfall.. All data

is automatically uploaded to the cloud. This will assist with the

planning of the mining operations on the Project.

In addition, the Company has also installed a total of 7 stream

gauges and one barotroll in the water streams located at the mine

site in March 2022 which will be used for hydrological studies. The

devices record 3 parameters which are temperature, pressure and

depth at 5 second intervals.. The data from all devices are being

manually downloaded at a frequency rate of once per month.

As Part of the ongoing FEED study, the Company cleared pads for

geotech drilling at the proposed plant Site and tailing dam

location.

The pad clearance activity was completed at site in the proposed

Plant site and Tailing Storage Facility areas. 10 pads were cleared

at the tailing storage facility area and 6 pads were cleared at the

plant site area as a part of geotechnical studies and the Company

is now preparing for Diamond Drilling in the proposed areas.

Furthermore, the test pitting program has been completed at the

proposed plant site, tailing storage facility and the access road

areas. A total of 41 test pits with 3 meters depth have been

excavated, DCP tested, strata logged, sampled and backfilled. 11

pits have been excavated at plant site, 25 pits excavated at

tailing storage facility and 5 pits excavated at the access road to

the mine site.

The Company has received an encouraging level of interest in

funding the Mahenge Liandu Graphite project and has advanced its

discussions with a number of potential finance partners with

respect to securing project development funding for the

project.

Grant of Prospecting License PL 119961/ 2022

The company was granted the prospecting license PL 119961/ 2022

by the ministry of minerals on 28(th) June 2022, for the

exploration of graphite minerals. The license area comprises of

19.99 square kilometers, located at Isongo and Liandu villages of

Ulanga District, in Morogoro Region.

The cash position at 30 June 2022 was GBP1,723,000 and the

average monthly cash burn is about GBP30,000, including annual

audit costs.

FINANCIAL STATEMENTS

FOR THE SIX MONTHSED 30 JUNE 2022

Condensed Consolidated Statement of Comprehensive Income

For the six months ended 30 June 2022

Unaudited

Six months ended

30 June 30 June

2022 2021

GBP'000 GBP'000

Administrative expenses (151) (157)

Change in fair value of investments (1) 139

Finance costs - (9)

Loss before taxation (152) (27)

Taxation -

-------------------- -------------------

Loss after taxation (152) (27)

Other comprehensive (loss)/income

Items that may be reclassified to

profit or loss:

Exchange differences on translating

foreign entities (57) 2

-------------------- -------------------

Total comprehensive loss attributable

to equity holders of the parent company (209) (25)

==================== ===================

Pence Pence

Loss per share attributable to equity

holders of the parent company (note

3)

Basic and fully diluted (0.03) (0.01)

==================== ===================

Consolidated Statement of Financial Position

At 30 June 2022

Unaudited Audited

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Assets

Non-Current assets

Exploration and evaluation assets 5,010 4,556 4,727

Investments 79 421 138

5,089 4,977 4,865

Current assets

Trade and other receivables 60 559 150

Cash and cash equivalents 1,723 562 886

------------- ------------- ----------------

1,783 1,121 1,036

------------- ------------- ----------------

Total assets 6,872 6,098 5,901

============= ============= ================

Equity and liabilities

Equity

Share capital (note 4) 3,321 3,237 3,275

Share premium 25,076 23,148 23,906

Shares to be issued 286 286 286

Share option and warrant reserve 610 972 925

Foreign exchange reserve 9 129 66

Retained earnings (22,473) (22,376) (22,636)

------------- ------------- ----------------

Total equity 6,829 5,396 5,822

============= ============= ================

Current liabilities

Trade and other payables 43 96 79

Loans - 606 -

Total liabilities 43 702 79

============= ============= ================

Total equity and liabilities 6,872 6,098 5,901

============= ============= ================

Unaudited Consolidated Statement of Changes in Equity

For the period ended 30 June 2022

Share Share Shares Share Foreign Retained Total

Capital Premium to be Option Exchange Earnings

GBP'000 GBP'000 Issued Reserve Reserve GBP'000 GBP'000

GBP'000 GBP'000 GBP'000

Balance 1

January

2021 3,208 22,348 286 762 127 (22,406) 4,325

Loss for the

year - - - - - (333) (333)

Other

comprehensive

loss - - - - (61) - (61)

------------ ------------ ------------ ------------ ------------- ------------- ------------

Total

comprehensive

loss for the

year - - - - (61) (333) (394)

------------ ------------ ------------ ------------ ------------- ------------- ------------

Issue of

shares and

warrants 67 1,558 - 266 - - 1,891

Transfer on

exercise

of warrants - - - (103) - 103 -

Total other

movements 67 1,558 - 163 - 103 1,891

------------ ------------ ------------ ------------ ------------- ------------- ------------

Balance 31

December

2021 3,275 23,906 286 925 66 (22,636) 5,822

Loss for the

period - - - - - (152) (152)

Other

comprehensive

loss - - - - (57) - (57)

------------ ------------ ------------ ------------ ------------- ------------- ------------

Total

comprehensive

loss for the

period - - - - (57) (152) (209)

------------ ------------ ------------ ------------ ------------- ------------- ------------

Issue of

shares 46 1,170 - - - - 1,216

Transfer on

exercise

of warrants - - - (315) - 315 -

Total other

movements 46 1,170 - (315) - 315 1,216

------------ ------------ ------------ ------------ ------------- ------------- ------------

Balance 30

June 2022 3,321 25,076 286 610 9 (22,473) 6,829

============ ============ ============ ============ ============= ============= ============

The following describes the nature and purpose of each reserve

within shareholders' equity:

Reserve Description and purpose

Share capital Amount subscribed for share capital at nominal

value

Share premium Amount subscribed for share capital in excess of

nominal value, net of allowable expenses

Shares to be issued Share capital to be issued in connection

with historical acquisition

Share option and warrant reserve Cumulative charge recognised

under IFRS2 in respect of share-based payment awards

Foreign exchange reserve Gains/losses arising on re-translating

the net assets of overseas operations into sterling

Retained earnings Cumulative net gains and losses recognised in

the statement of comprehensive income

Consolidated Statement of Cash Flows

For the period ended 30 June 2022

Unaudited Audited

Six Months ended Year ended

30 June 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Loss before taxation (152) (27) (333)

Change in fair value of investments 1 (139) (8)

Finance costs - 9 11

(151) (157) (330)

Changes in working capital

Receivables 30 9 1

Payables (31) (33) (39)

------------ ------------ ----------------

Net cash used in operating activities (152) (181) (368)

============ ============ ================

Cash flows from investing activities

Expenditure on exploration and

evaluation assets (345) (157) (399)

Sale of listed investments 58 - 152

Net cash used in investing activities (287) (157) (247)

============ ============ ================

Cash flows from financing activities

Proceeds from share issues 1,276 648 1,249

Net cash from financing activities 1,276 648 1,249

============ ============ ================

Net increase/(decrease) in cash

and cash equivalents 837 310 634

Cash and cash equivalents at

1 January 2022 886 252 252

Cash and cash equivalents at

30 June 2022 1,723 562 886

============ ============ ================

Notes to the unaudited condensed consolidated financial

statements

For the period ended 30 June 2022

1. Incorporation and principal activities

Country of incorporation

Armadale Capital Plc was incorporated in the United Kingdom as a

public limited company on 19 August 2005. Its registered office is

1 Arbrook Lane, Esher, Surrey, KT10 9EG.

Principal activities

The principal activity of the Group during the period was that

of an investment company.

2. Accounting policies

2.1. Statement of compliance

The financial information for the six months ended 30 June 2022

and 30 June 2021 is unreviewed and unaudited and does not

constitute the Group's statutory financial statements for those

periods within the meaning of Section 434 of the Companies Act

2006. The comparative financial information for the year ended 31

December 2021 has been derived from the Annual Report and Accounts,

which were approved by the Board of Directors on 20 May 2022 and

delivered to the Registrar of Companies. The report of the Auditors

on those accounts was unqualified and did not contain any statement

under Section 498 of the Companies Act 2006.

This condensed set of financial statements has been prepared in

accordance with IAS 34 'Interim Financial Reporting' as adopted by

the European Union. This condensed set of financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2021 which have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the United Kingdom.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 31 December 2021 as

described in those annual financial statements.

In respect of new financial reporting standards which came into

effect for reporting periods beginning on 1 January 2022, the

Directors consider that their implementation has no material effect

on the financial information presented in this statement.

2.2. Going Concern

The financial statements have been prepared on the going concern

basis as, in the opinion of the Directors, there is a reasonable

expectation that the Group will continue in operational existence

for the foreseeable future. The Company's ability to continue as a

going concern and to achieve its long term strategy of developing

its exploration projects is dependent on further fundraising.

During the period, a total of GBP1,276,000 was raised from warrant

exercises (see note 4). At 30 June 2022, the Group had cash of

GBP1,723,000.

2.3. Exploration and evaluation assets

These assets are recorded at cost and are amortised over their

expected useful life on a pro rata basis of actual production for

the period to expected total production.

2.4. Investments

Investments are stated at fair value.

3. Loss per share

The calculation of loss per share is based on a loss of

GBP152,000 (2021, GBP27,000) and on 560,588,302 (2021, 480,763,732)

Ordinary Shares, being the weighted average number of Ordinary

Shares in issue during the period.

There was no difference between basic loss per share and diluted

loss per share as the Group reported a loss for the period.

4. Share capital

During the period, 48,868,969 warrants were exercised providing

proceeds of GBP1,276,000.

**S**

For further information, please visit the Company's website

www.armadalecapitalplc.com , follow Armadale on Twitter

@ArmadaleCapital or contact:

Enquiries:

Armadale Capital Plc

Tim Jones, Company Secretary +44 (0)20 7236 1177

------------------------

Nomad and broker: finnCap Ltd

Christopher Raggett / Seamus Fricker /Edward

Whiley +44 (0)20 7220 0500

------------------------

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014) which is part of UK law by virtue of

the European Union (Withdrawal) Act 2018. Upon the publication of

this announcement, this inside information is now considered to be

in the public domain.

Notes

Armadale's wholly-owned Mahenge Liandu Graphite Project is

located in a highly prospective region, with a high-grade JORC

compliant indicated and inferred mineral resource estimate

announced February 2018 - 59.5Mt at 9.8% TGC. This includes 11.5Mt

@ 10.5% Measured 32.Mt Indicted at 9.6% and 15.9Mt at 9.8% TGC,

making it one of the largest high-grade resources in Tanzania.

The work to date has demonstrated the Project's potential as a

commercially viable deposit, with significant tonnage, high-grade

coarse flake and near surface mineralisation (implying a low strip

ratio) contained within one contiguous ore body.

The Company's updated Definitive Feasibility Study (June 2020)

confirmed Mahenge as a long-life low-cost graphite project with a

US$430m NPV and IRR of 91% based on a two-stage expansion strategy

comprising:

-- Stage One - processing plant and infrastructure at a nominal

design basis rate of 0.4-0.5 Mt/pa to produce a nominal 60,000t/pa

graphite concentrate in the first three years of production

-- Stage Two - a second 0.5 Mt/y plant and associated additional

infrastructure doubling throughput to 1 Mt/y from Year 5 of

operation

The DFS shows that Armadale can be a significant low-cost

supplier to the graphite industry with the potential to generate

pre-tax cashflows of US$985m over an initial 15 year mine-life and

scope for further improvement as this utilises just 25% of the

current resource, which remains open in multiple directions.

Projected timeline to first production is expected to be

approximately 10-12 months from the start of construction and the

capital cost estimate for Stage 1 is US$39.7m, which includes a

contingency of U$S4.1m or 15% of total direct capital cost, with a

1.6 year payback for Stage 1 (after tax) based on an average sales

price of US$1,112/t. Stage 2 expansion is expected to be funded

from cashflow.

More information can be found on the website

www.armadalecapitalplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCLGDDGDI

(END) Dow Jones Newswires

September 29, 2022 02:00 ET (06:00 GMT)

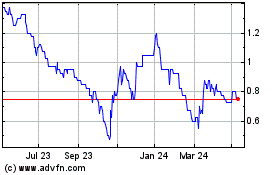

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Dec 2024 to Jan 2025

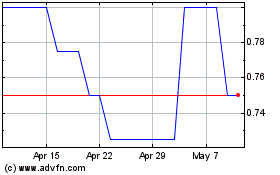

Armadale Capital (LSE:ACP)

Historical Stock Chart

From Jan 2024 to Jan 2025