Standard Life Equity Income Tst PLC Edison review: Standard Life Equity Income Trust

08 August 2017 - 4:01PM

RNS Non-Regulatory

TIDMSLET

Standard Life Equity Income Tst PLC

07 August 2017

London, UK, 7 August 2017

Edison issues review on Standard Life Equity Income Trust

(SLET)

Standard Life Equity Income Trust (SLET) aims to generate

above-average income and real capital and income growth from a

relatively concentrated portfolio of c 50-70 UK equities. Since

2011, SLET has been managed by Thomas Moore, who says that the

trust's strong revenue growth is leading to higher dividend growth.

The board has indicated that the FY17 annual dividend will be at

least 9.1% higher than in FY16. Following a tough period of

relative performance surrounding the Brexit vote, as companies with

domestic businesses underperformed those with overseas operations,

the manager is now more positive on the outlook. SLET's performance

is improving versus both the FTSE All-Share benchmark and its peer

group. Moore is placing greater emphasis on higher-growth smaller

companies that are reasonably valued and have faster-than-average

dividend growth.

In recent months, SLET's share price discount to cum-income NAV

has narrowed meaningfully from abnormally wide levels, which

occurred during a period of heightened investor risk aversion ahead

of the US presidential election. Its current 5.4% discount to

cum-income NAV is narrower than the 6.4% average of the last 12

months (range of 2.8% to 11.3%), but modestly wider than its

average discounts of 3.4%, 2.9% and 4.1% for the last three, five

and 10 years respectively.

Click here to view the full report.

All reports published by Edison are available to download free

of charge from its website

www.edisoninvestmentresearch.com

About Edison: Edison is an investment research and advisory

company, with offices in North America, Europe, the Middle East and

AsiaPac. The heart of Edison is our world-renowned equity research

platform and deep multi-sector expertise. At Edison Investment

Research, our research is widely read by international investors,

advisers and stakeholders. Edison Advisors leverages our core

research platform to provide differentiated services including

investor relations and strategic consulting.

Edison is authorised and regulated by the Financial Conduct

Authority.

Edison is not an adviser or broker-dealer and does not provide

investment advice. Edison's reports are not solicitations to buy or

sell any securities.

For more information please contact Edison:

Mel Jenner, +44 (0)20 3077 5720

Sarah Godfrey, +44 (0)20 3681 2519

Investmenttrusts@edisongroup.com

Learn more at www.edisongroup.com and connect with Edison

on:

LinkedIn https://www.linkedin.com/company/edison-investment-research

Twitter www.twitter.com/Edison_Inv_Res

YouTube www.youtube.com/edisonitv

This information is provided by RNS

The company news service from the London Stock Exchange

END

NRAUGUUURUPMPUM

(END) Dow Jones Newswires

August 08, 2017 02:01 ET (06:01 GMT)

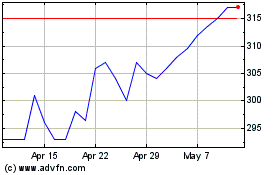

Abrdn Equity Income (LSE:AEI)

Historical Stock Chart

From Apr 2024 to May 2024

Abrdn Equity Income (LSE:AEI)

Historical Stock Chart

From May 2023 to May 2024