TIDMAET

RNS Number : 7007A

Afentra PLC

27 September 2022

27 September 2022

AFENTRA P L C

2022 HALF YEAR RESULTS

Afentra plc ('Afentra' or the 'Company'), the upstream oil and

gas company focused on acquiring mature production and development

assets in Africa, announces its half year results for the six

months ended 30 June 2022 (the 'Period').

Financial S ummary

-- Cash resources as at 30 June 2022 of $27.1 million (30 June 2021 of $40.8 million)

-- Additional restricted funds of $8.0 million(1)

-- Adjusted EBITDAX loss of $1.2 million (1H 2021: loss $1.5 million)

-- Loss after tax of $2.9 million (1H 2021: loss $2.4 million)

-- The Group remains debt free and fully carried for Odewayne operations

Angolan Acquisitions

The Company announced two strategically consistent and

complementary transactions in Angola, signing sale and purchase

agreements ('SPAs') with completion expected in Q4 2022 (together

the 'Acquisitions'):

-- Sonangol Acquisition : acquisition of interests in Block 3/05

(20%) and Block 23 (40%) offshore Angola for a firm consideration

of $80.5 million and contingent payments of up to $50 million;

-- INA Acquisition : acquisition of interests in Block 3/05 (4%)

and Block 3/05A (5.33%)(2) offshore Angola for a firm consideration

of $12 million and contingent payments of up to $21 million;(3)

-- Financing Agreements : Sonangol and INA Acquisitions will be

financed through cash on the balance sheet and agreed RBL and

revolving working capital facilities with Trafigura:

o 5-year RBL facility with up to $75 million available to

finance the Acquisitions (8% margin over 3-month secured overnight

financing rate (the 'SOFR')) (the 'Acquisition Facility');

o Revolving working capital facility for up to $30 million to

finance asset funding requirements between crude offtakes (4.75%

over 1-month SOFR) (the 'Working Capital Facility').

-- Offtake Agreement : The Company has also entered into an

offtake agreement with Trafigura for Afentra's crude oil

entitlement lifted from the Acquisitions.(4)

AIM Re-admission Process

-- AIM Admission Document was published on 10 August 2022.

Suspension of the trading in the Company's shares was lifted and

trading in the Company's ordinary shares recommenced

-- General Meeting: Resolution to approve the Sonangol

Acquisition was passed at the General Meeting held on 30 August

2022

-- Completion of the Acquisitions and re- admission of the

enlarged group to trading on AIM is anticipated in Q4 2022

Operations Summary

Operations pursuant to the ongoing Acquisitions

-- Block 3/05 : Congo basin, Angola (24% interest)(5) - net 2P

reserves of 27.7 mmbo, net 1H 2022 production of c. 4,700 bbl/day,

net 2C resources of 10 mmbo with significant potential for future

upgrades

-- Block 3/05A : Congo basin, Angola (5.33% interest)(2,5) -

three appraised discoveries in adjacent licence to Block 3/05,

providing tie-back opportunities using existing infrastructure; net

2C resource of 1.8 mmbo

-- Block 23 : Kwanza basin, Angola (40% interest)(5) - highly

prospective deepwater exploration and appraisal opportunity that is

largely under-explored containing a small pre-salt oil

discovery

Existing operations

-- Odewayne exploration block : offshore Somaliland (34%

interest fully carried by operator, Genel Energy) - the team

continues its technical assessment and outlook on block

prospectivity in discussion with the operator

Paul McDade, Chief Executive Officer, Afentra plc commented:

"The first half of 2022 marked a transformational period for the

Company, including the foundational asset transaction with Sonangol

enabling entry into Block 3/05 in Angola. Following Period end,

Afentra announced an incremental transaction with INA gaining

additional exposure to the high quality 3/05 block and the adjacent

3/05A block. Combined, these complementary acquisitions provide a

strong growth platform, underpinned by robust cash flow and

significant potential to deliver upside value. The financing and

offtake agreements announced with Trafigura demonstrate our ability

to efficiently fund our focussed buy and build strategy. In August,

we were pleased to recommence trading in Afentra's shares on AIM

and, subsequently, shareholder approval of the Sonangol

transaction. We take confidence that the completion of a smooth

election process and the re-instatement of the government will

allow the Company to re-engage with the Government to achieve

completion of the transactions in Q4 2022. Meanwhile, the Company

continues to remain highly active and disciplined in its assessment

of the opportunity landscape in line with its stated growth

strategy."

For further information contact:

Afentra plc +44 (0)20 7405 4133

Paul McDade, CEO

Anastasia Deulina, CFO

Buchanan (Financial PR) +44 (0)20 7466 5000

Ben Romney

Jon Krinks

Peel Hunt LLP (Nominated Advisor and Joint Broker) +44 (0)20

7418 8900

Richard Crichton

David McKeown

Tennyson Securities (Joint Broker) +44 (0)20 7186 9033

Peter Krens

(1) Please refer to Note 4 (notes to the accounts) for further

detail on restricted funds.

(2) Subject to final approval of the distribution of the China

Sonangol International ('CSI') interest to the remaining joint

venture partners.

(3) $12 million upfront consideration is split $9 million for 4%

interest in Block 3/05 and $3 million for 5.33% interest in Block

3/05A. $21 million in contingent payments broken down as $10

million upon licence extension of Block 3/05 (from 2025 to 2040),

up to $6 million for Block 3/05 subject to certain oil price

hurdles, and $5 million linked to successful future development of

certain discoveries in Block 3/05A.

(4) Subject to the terms of the Trafigura Offtake Agreement.

(5) Subject to completion of the Acquisitions.

CEO Statement

I am pleased to provide an update on Afentra's progress in the

first half of 2022, a period in which we have announced a

transformative inaugural acquisition, enabling the Company to enter

Angola, a major oil and gas jurisdiction with significant

opportunities ahead to build a material business and positively

impact the energy transition in Africa.

The Sonangol Acquisition aligns with the management team's

clearly defined strategic vision set out at launch in May 2021: to

capitalise on opportunities presented by the accelerating energy

transition in Africa and in doing so support a responsible transfer

of asset ownership that provides beneficial outcomes for all

stakeholders involved. The industry trends and market drivers that

formed the basis of Afentra's strategy at the time of launch have

only strengthened this year in terms of a greater emphasis on

energy security and a more pragmatic understanding of the timeline

required for an effective and responsible energy transition.

Following P eriod end , we have been pleased to announce an

incremental and accretive transaction with INA, increasing

Afentra's exposure to this high-quality asset, underpinned by

strong cash flow from stable and long-life production and 28

million barrels of net 2P Reserves, as per the published CPR. With

Trafigura, Afentra have also secured an RBL facility, flexible

working capital facility, and offtake agreement ; combined, these

provi de the financial headroom for the business while limiting the

Company's exposure to offtake risk with the sale and purchase

secured for 100% of Afentra's entitlement to crude oil lifted from

the acquired assets.

In August, we were delighted to recommence trading in Afentra's

shares on the AIM market after the lengthy suspension period

associated with the RTO process, as well as shareholder approval of

the Sonangol Acquisition . We take confidence that a smooth

reinstatement of government in Angola (following the general

election) will help the Company to re-engage with the Angolan

government to achieve completion of the transactions in Q4

2022.

The market landscape in terms of the industry transition that

supports Afentra's long-term growth strategy remains compelling,

despite the current impact of a volatile commodity price

environment, and we remain highly active and disciplined in our

assessment of the opportunity landscape. The initial transactions

in Angola represent the first steps towards our more ambitious

growth targets and demonstrate the value accretion that can be

achieved through the team's disciplined approach to M&A.

To support our business development activities, we continue to

engage with both debt and equity capital markets to ensure we have

supportive investors and access to capital for any deals we bring

to market. We look forward to demonstrating the true value

accretive nature of these initial transactions as we complete them

both in the coming months and begin working with the Operator and

JV partners to optimise production, enhance environmental

performance and realise the material upside value from th e se

licences.

Overall, it has been a transformational first half of the year

for Afentra and we have since made further headway with our stated

growth ambitions. We thank our shareholders for their support and

look forward to delivering positive outcomes for all our

stakeholders through the second half of the year and beyond .

Angolan Acquisitions and Financing Agreements

The Company has announced two strategically consistent and

complementary transactions in Angola, signing sale and purchase

agreements ('SPAs') with completion expected in Q4 2022. The SPA

for the Sonangol Acquisition was signed with Sonangol Pesquisa e

Produção S.A. ('Sonangol') on 28 April 2022. This was to acquire a

20% interest in Block 3/05 offshore Angola for a firm consideration

of $80 million and contingent payments of up to $50 million (in

aggregate) and Block 23 (40%) for a $0.5 million consideration. The

SPA for the INA Acquisition was signed with Industrija Nafte, d.d

('INA') on 19 July 2022. This was to acquire (i) a 4% interest in

Block 3/05 offshore Angola for an initial consideration of $9

million, additional considerations of $10 million and up to $6

million payable upon licence extension and certain oil price

hurdles, respectively; (ii) a 5.33% interest in Block 3/05A

offshore Angola for an initial consideration of $3 million and

contingent consideration of up to $5 million linked to successful

future development of certain discoveries and oil price hurdles.

The Acquisitions will be financed through cash on the balance sheet

and agreed RBL acquisition facility and a revolving working capital

facility agreed with Trafigura. The Company has also entered into

an offtake agreement with Trafigura (the 'Trafigura Offtake

Agreement') to secure the sale and purchase of 100% of Afentra's

entitlement to the crude oil lifted from the acquired assets in

Angola (subject to the terms of the Trafigura Offtake

Agreement).

The Acquisition Facility and Working Capital Facility were

signed with Trafigura on 10 August 2022 with Afentra Angola as

original borrower and the Company as original guarantor. The

Acquisition Facility is a senior secured 5-year RBL facility

agreement for up to $110 million, with up to $75 million available

to finance the Acquisitions ($60 million and $15 million to fund

the Sonangol and INA Transactions, respectively). The terms include

an 8% margin over 3-month SOFR, semi-annual linear amortisations

and conventional RBL covenants. The revolving working capital

facility agreement is for up to $30 million to finance asset

funding requirements between crude offtakes, repayable with the

proceeds from each crude lifting and maturing on the date on which

the Trafigura Offtake Agreement terminates. Interest is payable at

4.75% over 1-month SOFR. Further detail on the Acquisitions,

Acquisition Facility, Working Capital Facility and Trafigura

Offtake Agreement can be found on the Company's website at

www.afentraplc.com and in the admission document .

Operations Review

Angola

Angola is one of the largest oil producers in Africa with

current production of 1.2 million bopd from deepwater, shallow

water & onshore dating back to 1956. The economy is dependent

on responsible management of hydrocarbon resources. Investment has

historically been dominated by IOCs, however assets are starting to

change hands. Afentra believes that the situation is similar to the

status to the UKCS where a more mature industry transition has

already played out. Global research and consultancy business Wood

Mackenzie has identified 15 billion barrels of oil and gas reserves

in Angola, highlighting the scale of opportunity in Angola.

According to IHS Markit Consulting, close to 300 fields have been

discovered with less than half developed (IHS 2022). Over the last

5 years, the Angolan government led by President Joao Louranco has

actively sought new oil and gas investors alongside improving

fiscal terms and extending licenses. There are large opportunities

for growth and limited competition in the independent space.

Block 3/05 (24%)

Block 3/05 is located in the Lower Congo Basin and consists of

eight mature producing fields. The discoveries were made by Elf

Petroleum (now part of TotalEnergies) in the early 1980s.

Development was by shallow-water (40-100m) platforms that included

successful waterflood activities with first oil in 1985. Sonangol

assumed operatorship from 2005 and has focused on sustaining

production through workovers and maintaining asset integrity. No

infill drilling campaigns have taken place in the last 15 years.

The asset has a diverse portfolio of over 100 wells and currently

produces from around 40 production wells and has nine active water

injectors. The facilities include 17 well-head and support

platforms and four processing platforms, with oil exported via the

Palanca FSO.

In the 1H of 2022 average daily gross production was 19,500

bopd. Gross 2P reserves are 115 mmbo as of 1 April 2022 and 2C

resources are 42 mmbo. Block 3/05's existing Production Sharing

Agreement ('PSA') expires in 2025 and this is expected to be

extended to 2040. This extension is a condition to completing the

Acquisition. To date, the asset decommissioning costs have been

pre-funded to the amount of $554 million.

Post completion of the Acquisition, the JV will be comprised as

follows: Sonangol (Operator, 30%), Afentra (24%), M&P (20%),

ENI (12%), Somoil (10%) and NIS-Naftagas (4%).

Block 3/05A (5.33%)

Block 3/05A, which is located adjacent to Block 3/05, contains

the undeveloped discoveries Punja, Caco and Gazela with an

estimated in place resource of 0.3 billion barrels. The 2C

resources estimated by Afentra is 33 mmbo. From 2015 circa two

years of production from the Gazela field via a single well and

fields supported by Block 3/05 infrastructure was undertaken.

Approximately 2 million barrels were recovered prior to a wellbore

driven shut down. There is currently no production from the Block

3/05A fields. Assessments to define an optimal development

framework of these fields benefitting from the use of the nearby

Block 3/05 facilities and infrastructure is ongoing.

Post completion of the Acquisition and subject to final approval

of the distribution of the CSI interest, the JV will be comprised

as follows: Sonangol (Operator, 33.33%), M&P (26.67%), ENI

(16%), Somoil (13.33%), Afentra (5.33%) and NIS-Naftagas

(5.33%).

Block 23 (40%)

Block 23 is a 5,000 km(2) exploration and appraisal block

located in the Kwanza basin in water depths from 600 to 1,600

meters and has a working petroleum system. Whilst the large block

is covered by modern 3D and 2D seismic data sets, with no

outstanding work commitments remaining, the majority of the block

remains under-explored.

The block contains the Azul oil discovery, the first deepwater

pre-salt discovery in the Kwanza basin. This discovery made in

carbonate reservoirs has oil in place of around 150 mmbo and tested

at flow rates of around 3,000 - 4,000 bopd of light oil.

Post completion of the Acquisition, the JV is expected to be

comprised of: Namcor, Sequa and Petrolog (40% and operator);

Afentra (40%) and Sonangol (20%).

Somaliland

Somaliland offers one of the last great opportunities to target

an undrilled onshore rift basin in Africa. The Odewayne block, with

access to Berbera deepwater port less than a 100km to the north, is

ideally located to commercialise any discovered hydrocarbons.

Odewayne Block (34%)

This large, unexplored, frontier acreage position covers

22,840km.(2) The Odewayne PSA is in the Third Period (further

extended through the 8th deed of amendment) with a 1,000km, 10km by

10km 2D seismic grid acquired in 2017 by BGP (this data was

reprocessed in 2019 and is currently being reviewed).

In 2H 2022 the Company will work alongside the Operator in

developing an appropriate forward work program to further evaluate

the prospectivity of the licence. The Company's 34% working

interest in the PSA is fully carried by Genel Energy Somaliland

Limited for its share of the costs of all exploration activities

during the Third and Fourth Periods of the PSA.

Outlook on buy and build strategy

Afentra is leveraging its extensive regional experience and

network to deliver significant value. The initial transactions have

established a foothold in Angola with our acquisition of Block 3/05

and 3/05A and provide a strong foundation for future growth and

consolidation in Angola. Blocks 3/05 and 3/05A are long-life

production and development assets with low decline rate, material

upside and future short-cycle developments, alongside reducing

emission profiles. Screening assets continues across West Africa

and we see similar scale and larger operated and non-operated

opportunities onshore and offshore and an opportunity for new

credible and responsible operators.

Financial Rev iew

Selected financial data

1H 2022 1H 2021 FY 2021

Cash and cash equivalents net to Group ($m) 27.1 40.8 37.7

--------------------------------------------- -------- -------- --------

Restricted Funds 8.0 - -

--------------------------------------------- -------- -------- --------

Adjusted EBITDAX(1) ($m) (1.2) (1.5) (2.0)

--------------------------------------------- -------- -------- --------

Loss after tax ($m) (2.9) (2.4) (5.0)

--------------------------------------------- -------- -------- --------

Debt ($m) - - -

--------------------------------------------- -------- -------- --------

Share price (at period end) (GBP pence) 14.6 15.0 14.6

--------------------------------------------- -------- -------- --------

(1) Adju s t ed EBITDAX is cal c u lat ed as earnings be f ore

int ere s t, taxat i on, depreciation, amor t i sat i on, impa i r

m ent, pr e - l i cence expend i tur e, pr ov isio ns and shar e

-ba s ed pa y m ents.

Loss from operations

T he loss from operations for 1H 2022 was $2.9 million (1H 2021:

loss $2.5 million).

During the period, net administrative expenditure increased to

$2.9 million (1H 2021: $2.5 million) predominantly as a result of

costs relating to the Angolan Acquisitions and its associated

workstreams ($611k). Pre-licence costs for 1H 2022 was $1.6m (1H

2021: $862k).

Adjusted EBITDAX and loss after tax

A d j usted EBI T DAX totalled a loss of $1.2 million (1H 2021:

loss 1.5 million).

Finance inco me of $2k r epre sents inter est r e c eived on

cash h eld by the Group (1H 2021: $46k).

Finance costs totalled $73k (1H 2021: $23k).

The loss after tax totalled $2.9 million (1H 2021: loss $2.4

million). Basic loss per share was 1.34 USc per share (1H 2021:

1.11 USc loss per share). No dividend is proposed to be paid for

the six months to 30 June 2022 (30 June 2021: nil).

Cash flow

Net cash outflow from operating activities (pre-working capital

movements) totalled $2.8 million (1H 2021: outflow $2.3 million).

After working capital, net cash outflow from operating activities

totalled $2.5 million (1H 2021: outflow $1.8 million). During the

period the Company provided a bank guarantee (issued by Nedbank

Limited) to Sonangol, in respect of the Sonangol Acquisitions,

detailed in Note 4.

Statement of financial position

At 30 June 2022, Afentra held $27.1 million cash and cash

equivalents (30 June 2021: $40.8 million) and restricted funds of

$8.0 million.

Group net assets at 30 June 2022 were $55.9 million (30 June

2021 were $61.4 million). Non-current assets totalled $21.8 million

(30 June 2021: $22.0 million) with net current assets reducing to

$34.4 million (30 June 2021: $40.1 million).

Going Concern

T he Group's business activitie s, togeth er with the factors

likely to af f ect its future de v elop ment, performance and

position is s et out above (page 1) and within the CEO State ment

and in the Op erations Re vie w. The financial position of the

Group is de scribed in the Financial R e vie w.

The Group has paid deposits in relation to the disclosed

transactions detailed in Note 5, which may not be refundable under

certain circumstances but otherwise currently has no unconditional,

legally binding commitments in relation to such transactions. In

the event that these deposits are not refunded the Group has

sufficient cash resources for its working capital needs for at

least the next 12 months.

The Directors remain confident the Group has sufficient cash

resources to meet its liabilities as they fall due for a period of

at least 12 months from the date of signing these financial

statements, and notwithstanding the impact from the current

situation in Ukraine and the impact to commodity prices and foreign

exchange rates. As a consequence, the Directors believe that the

Group is in a strong position and thus, they continue to adopt the

going concern basis of in preparing the results for the six months

ended 30 June 2022.

Disclaimer

T his document contains ce r tain forward-looking statements

that are subj ect to the usual risk factors and uncertainties

associated with the oil and gas e xploration and production busines

s. Whilst the Group beli e v es the e xpectation re flected he r

ein to be reasonable in light of the information available to it at

this time, the actual outcome may be materially diff erent owing to

factors eith er beyond the Group's control or oth erwise within the

Group's control but where, for e xample, the Group decides on a

change of plan or strategy. Accordingly, no reliance may be plac ed

on the figures contained in such for ward -looking statements.

Glossary

$ US Dollars

2D two dimensional

------------------------------------------------------

3D three dimensional

------------------------------------------------------

Adjusted EBITDAX earnings before interest, taxation, depreciation,

amortisation, impairment, pre-

licence expenditure, provisions and share based

payments

------------------------------------------------------

AIM Alternative Investment Market of the London Stock

Exchange

------------------------------------------------------

bopd Barrels of Oil per day

------------------------------------------------------

CPR Competent Persons Report

------------------------------------------------------

CSI China Sonangol International

------------------------------------------------------

ERCE Independent and qualified Reserves and Resources

evaluator (CPR)

------------------------------------------------------

Group Afentra plc, together with its subsidiary undertakings

(the 'Group')

------------------------------------------------------

INA Industrija Nafte, d.d

------------------------------------------------------

km kilometre

------------------------------------------------------

mmbo million Barrels of Oil

------------------------------------------------------

Petrosoma Petrosoma Limited (JV partner in Somaliland)

------------------------------------------------------

PSA production sharing agreement

------------------------------------------------------

Seismic Geophysical investigation method that uses seismic

energy to interpret the geometry of rocks in the

subsurface

------------------------------------------------------

Sonangol Sonangol Pesquisa e Produção S.A.

------------------------------------------------------

km(2) square kilometre

------------------------------------------------------

WI working interest

------------------------------------------------------

Condensed consolidated income statement for the six m onths to

30 June 2022

Six months Six months

to to Year ended

30th June 30th June 31st December

2022 2021 2021

$000 $000 $000

(unaudited) (unaudited) (audited)

------------ ------------ --------------

Other administrative

expenses (1,301) (1,605) (2,249)

Pre-licence costs (1,574) (862) (2,734)

-------------------------- ------------ ------------ --------------

Total administrative

expenses (2,875) (2,467) (4,983)

Loss from operations (2,875) (2,467) (4,983)

Finance income 2 46 36

Finance expense (73) (23) (45)

Loss before tax (2,946) (2,444) (4,992)

Tax - - -

Loss for the period

attributable to the

owners of the parent (2,946) (2,444) (4,992)

------------ ------------ --------------

Other comprehensive

expense - items to

be

reclassified to the

income statement in

subsequent periods

Currency translation

adjustments (21) (5) (5)

Total comprehensive

expense for the period (21) (5) (5)

------------ ------------ --------------

Total comprehensive

expense for the period

attributable to the

owners of the parent (2,967) (2,449) (4,997)

============ ============ ==============

Basic and diluted

loss per share (US

cents) (1.3) (1.1) (2.3)

Condensed consolidated statement of financial position as at 30

June 2022

As at As at As at

30th June 30th June 31st December

Note 2022 2021 2021

$000 $000 $000

(unaudited) (unaudited) (audited)

------------ ---------------------------------------- -----------------------------------

Non-current

assets

Intangible

exploration

and

evaluation

assets 3 21,305 21,252 21,289

Property,

plant and

equipment 542 746 725

21,847 21,998 22,014

------------ ---------------------------------------- -----------------------------------

Current

assets

Trade and

other

receivables 290 228 288

Cash and cash

equivalents 27,096 40,772 37,727

Restricted

Funds 4 8,000 - -

35,386 41,000 38,015

------------ ---------------------------------------- -----------------------------------

Total assets 57,233 62,998 60,029

============ ======================================== ===================================

Equity

Share capital 28,143 28,143 28,143

Currency

translation

reserve (223) (202) (202)

Retained

earnings 28,007 33,501 30,953

Total equity 55,927 61,442 58,894

------------ ---------------------------------------- -----------------------------------

Current

liabilities

Trade and

other

payables 836 825 518

Lease

liability 111 120 234

947 945 752

------------ ---------------------------------------- -----------------------------------

Non-current

liabilities

Lease

liability 327 576 347

Long-term

provision 32 35 36

359 611 383

------------ ---------------------------------------- -----------------------------------

Total

liabilities 1,306 1,556 1,135

------------ ---------------------------------------- -----------------------------------

Total equity

and

liabilities 57,233 62,998 60,029

============ ======================================== ===================================

Condensed consolidated statement of changes in equity for the

six months ended 30 June 2022

Currency

Share translation Retained

capital reserve earnings Total

$000 $000 $000 $000

--------------------- ---------------------------- --------- --------

At 1 January 2021 28,143 (197) 35,945 63,891

---------------------------------- --------------------- ---------------------------- --------- --------

Total comprehensive expense for

the period attributable to the

owners of the parent - (5) (2,444) (2,449)

---------

At 30 June 2021 28,143 (202) 33,501 61,442

---------------------------------- --------------------- ---------------------------- --------- --------

Total comprehensive expense for

the period attributable to the

owners of the parent - - (2,548) (2,548)

At 31 December 2021 28,143 (202) 30,953 58,894

---------------------------------- --------------------- ---------------------------- --------- --------

Total comprehensive expense for

the period attributable to the

owners of the parent - (21) (2,946) (2,967)

At 30 June 2022 28,143 (223) 28,007 55,927

---------------------------------- --------------------- ---------------------------- --------- --------

Condensed consolidated statement of cash flows for the six

months ended 30 June 2022

Six months Six months

to to Year ended

30th June 30th June 31st December

Note 2022 2021 2021

$000 $000 $000

(unaudited) (unaudited) (audited)

------------ ------------- --------------

Operating activities:

Loss before tax (2,946) (2,444) (4,992)

Depreciation, depletion

& amortisation 119 119 241

Finance income and

gains (2) (46) (13)

Finance expense and

losses 15 23 45

------------ ------------- --------------

Operating cash outflow

prior to working capital

movements (2,814) (2,348) (4,719)

Increase in trade

and other receivables (2) (35) (95)

Increase in trade

and other payables 318 616 309

(Decrease)/increase

in provision (4) 1 2

Net cash outflow

from operating activities (2,502) (1,766) (4,503)

Investing activities

Interest received 2 11 13

Purchase of property,

plant and equipment (1) (9) (127)

Exploration and evaluation

costs 3 (16) (43) (80)

Net cash used in

investing activities (15) (41) (194)

Financing activities

Principal paid on

lease liability (99) (121) (234)

Interest paid on lease

liability (14) (20) (39)

Increase in restricted

funds 4 (8,000) - -

Net cash used in

financing activities (8,113) (141) (273)

Net decrease in cash

and cash equivalents (10,630) (1,948) (4,970)

Cash and cash equivalents

at beginning of period 37,727 42,674 42,674

Effect of foreign

exchange rate changes (1) 46 23

Cash and cash equivalents

at end of period 27,096 40,772 37,727

============ ============= ==============

Notes to the consolidated results for the six months ended 30

June 2022

1. Basis of preparation

T he financial information contained in this announcement does

not constitute statutory financial statements within the meaning of

S ection 435 of the Co mpanies Act 2006.

T he financial information for the six months ended 30 June 2022

is unaudited. In the opinion of the Directors, the financial

information for this period fairly repre s ents the f inancial

position of the Group. R e sults of operations and cash flo ws for

the period are in compliance with International Financial Reporting

Standards (IFRSs). The accounting policie s, e stimat es and judg e

ments applied are consistent with those disclos ed in the annual

financial statements for the year ended 31 De c e mber 2021. The se

financial statem ents should be read in con junction with the

annual financial statem ents for the year ended 31 De c em b er

2021. All financial information is pres ented in USD, unle ss oth

erwise disclos ed.

An unqualified audit opinion was expressed for the year ended 31

December 2021, as delivered to the Registrar.

The Directors of the Company approved the financial information

included in the results on 27 September 2022.

2. Results & dividends

T he Group has r etained earnings at the end of the p eriod of

$28.0 million (30 June 2021: $33.5 million r etained earnings) to

be carried forward. The Directors do not recom mend the paym ent of

a dividend (1H 2021: nil ).

3. Intangible exploration and evaluation (E&E) assets

Group intangible assets:

Total

$000

(unaudited)

------------

Net book value at 31 December

2020 21,209

------------

Additions during the period 43

Net book value at 30 June

2021 21,252

------------

Additions during the period 38

Net book value at 31 December

2021 21,289

------------

Additions during the period 16

Net book value at 30 June

2022 21,305

------------

Odewayne PSA, Somaliland: A(EA)L 34%, Genel Energy Somaliland

Limited 50%, Petrosoma 16%.

4. Restricted Funds

The Company has provided a bank guarantee issued by Nedbank

Limited to Sonangol in respect of a $8.0 million cash deposit in

respect of the Sonangol Acquisitions that would otherwise have been

required to be paid shortly after the signing of the Sonangol

Acquisition Agreement. This guarantee has been fully cash

collateralised by the Company.

5. Subsequent Events

During the Period (28th April 2022) Afentra plc announced that

its wholly-owned subsidiary, Afentra (Angola) Ltd, had signed a

Sale and Purchase Agreement with Sonangol to purchase interests in

Block 3/05 and Block 23, offshore Angola.

On the 19th July 2022 Afentra plc announced that its

wholly-owned subsidiary, Afentra (Angola) Ltd, had signed a Sale

and Purchase Agreement with INA to acquire a 4% interest in Block

3/05 and a 5.33% interest in Block 3/05A, offshore Angola.

On the 10th August 2022 Afentra plc published its Admission

Document in relation to the acquisitions and Notice of General

Meeting. The resolution to approve the Acquisitions was passed as

an ordinary resolution by the requisite majority at the general

meeting, held on the 30th August 2022.

The Group has paid deposits in relation to the transactions,

which may not be refundable under certain circumstances but

otherwise currently has no unconditional, legally binding

commitments in relation to such transactions.

The next steps in the process contain a number of conditions

precedent that will need to be satisfied or waived before the

Acquisition can be completed. There is, however, no guarantee at

this stage that the Acquisition will be completed.

The measurement of expected credit losses in accordance with

IFRS 9 (Financial Instruments), are not impacted by subsequent

global developments related to the situation in Ukraine and the

impact to commodity prices and foreign exchange rates and are

therefore non-adjusting.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKNKADLAEFA

(END) Dow Jones Newswires

September 27, 2022 02:00 ET (06:00 GMT)

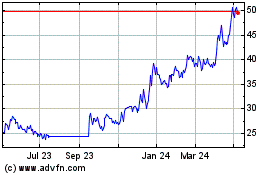

Afentra (LSE:AET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Afentra (LSE:AET)

Historical Stock Chart

From Apr 2023 to Apr 2024