TIDMAEWU

RNS Number : 2051U

AEW UK REIT PLC

22 November 2023

22 November 2023

AEW UK REIT PLC

Interim Report and Financial Statements

for the six months ended 30 September 2023

AEW UK REIT PLC ("AEW UK REIT" or the "Company"), which holds a

diversified portfolio of 35 commercial investment properties

throughout the UK, is pleased to publish its Interim Report and

Financial Statements for the six months ended 30 September

2023.

Mark Burton, Chairman of AEW UK REIT, commented : "We have been

encouraged by the Company's performance this period with NAV total

return of 4.30%. All sectors of the Company's portfolio

outperformed the MSCI index, demonstrating the benefits of our

active asset management style in delivering performance throughout

market cycles. I am pleased to report significant progress towards

the Company's strategic objective of reinvesting surplus capital

into higher yielding assets which are expected to deliver NAV

growth over time. The purchases of NCP, York, and Cambridge House,

Bath, have returned the portfolio to being materially fully

invested, with EPRA earnings growing accordingly. NAV grew by

0.49%, driven by two successive quarters of positive valuation

movement and accretive asset sales, where values were felt to have

been maximised over the medium term. This momentum in activity has

helped to create a healthy near-term outlook and we are pleased to

have confirmed continued payment of the Company's market-leading 2p

quarterly dividend, which has now been paid for 32 consecutive

quarters."

Financial Highlights

-- Net Asset Value ('NAV') of GBP167.93 million and of 106.00

pence per share ('pps') as at 30 September 2023 (31 March

2023: GBP167.10 million and 105.48 pps).

-- NAV Total Return for the period of 4.30% (six months ended

30 September 2022: 4.35%).

-- Operating profit before fair value changes of GBP6.63

million for the period (six months ended 30 September

2022: GBP5.25 million).

-- Profit Before Tax ('PBT')* of GBP7.16 million and earnings

per share ('EPS') of 4.52 pps for the period (six months

ended 30 September 2022: GBP8.32 million and 5.25 pps).

PBT includes a GBP0.16 million loss arising from changes

to the fair values of investment properties in the period

(six months ended 30 September 2022: GBP6.51 million loss)

and GBP1.65 million realised gains on disposal of investment

properties (six months ended 30 September 2022: GBP10.83

million gains).

-- EPRA Earnings Per Share ('EPRA EPS') for the period of

3.58 pps (six months ended 30 September 2022: 2.58 pps).

See the full Half Year Report for the calculation of EPRA

EPS.

-- Total dividends* of 4.00 pps declared in relation to the

period (six months ended 30 September 2022: 4.00 pps).

-- Shareholder Total Return* for the period of 11.00% (six

months ended 30 September 2022: -18.53%).

-- The price of the Company's Ordinary Shares on the London

Stock Exchange was 98.43 pps as at 30 September 2023 (31

March 2023: 92.10 pps).

-- As at 30 September 2023, the Company had drawn GBP60.00

million (31 March 2023: GBP60.00 million) of its GBP60.00

million (31 March 2023: GBP60.00 million) loan facility

with AgFe and was geared to 27.35% of GAV (31 March 2023:

28.06%). See note 15 in the full Half Year Report for

further detail.

-- The Company held cash balances totalling GBP6.44 million

as at 30 September 2023 (31 March 2023: GBP14.32 million).

Property Highlights

-- As at 30 September 2023, the Company's property portfolio

had a valuation of GBP219.36 million across 35 properties

(31 March 2023: GBP213.83 million across 36 properties)

as assessed by the valuer(1) and a historical cost of

GBP231.38 million (31 March 2023: GBP224.03 million).

-- The Company acquired two properties during the period

for a total purchase price of GBP21.52 million, excluding

acquisition costs (year ended 31 March 2023: five properties

for GBP32.05 million).

-- The Company made three disposals during the period for

gross sale proceeds of GBP20.85 million (year ended 31

March 2023: five properties for gross sale proceeds of

GBP44.41 million).

-- The portfolio had an EPRA vacancy rate** of 6.98% as at

30 September 2023 (31 March 2023: 7.83%).

-- Rental income generated during the period was GBP9.43

million (six months ended 30 September 2022: GBP8.41 million).

-- EPRA Net Initial Yield ('EPRA NIY')** of 7.85% as at 30

September 2023 (31 March 2023: 7.65%).

-- Weighted Average Unexpired Lease Term ('WAULT')* of 4.45

years to break and 5.72 years to expiry (31 March 2023:

3.05 years to break and 4.33 years to expiry).

(*) See KPIs in the full Half Year Report for definition of

alternative performance measures. (**) See glossary in the full

Half Year Report for definition of alternative performance

measures. (1) The valuation figure is reconciled to the fair value

under IFRS in note 12.

Enquiries

AEW UK

L aura Elkin Laura.Elkin@eu.aew.com

Nicki Gladstone Nicki.Gladstone-ext@eu.aew.com

+44(0) 771 140 1021

Liberum Capital Darren.Vickers@liberum.com

Darren Vickers +44 (0)20 3100 2218

TB Cardew AEW@tbcardew.com

Ed Orlebar +44(0) 7738 724 630

Tania Wild +44(0) 7425 536 903

Chairman's Statement

Overview

Despite the lacklustre economic headlines, we were encouraged to

see the portfolio's performance return to positive territory in the

first half of the year, following a tumultuous period for UK

property valuations. During the period, the Company achieved NAV

growth of 0.49%, with two successive quarters of positive valuation

movements and numerous NAV accretive sales having been completed.

Positive like-for-like valuation movement was seen in all sectors

of the Company's portfolio, with the exception of offices, which

are still stabilising. All sectors of the Company's portfolio

outperformed the MSCI index during the period, demonstrating the

benefits of an actively managed portfolio. Quarterly EPRA earnings

per share ('EPS') grew by 4% during the period, with EPS reaching

1.84pps for the quarter ending 30 September 2023. Further growth in

earnings and NAV are expected in the near term.

The commercial property investment market remained subdued

during the period, with transaction volumes in all sectors well

below historic averages. Despite the depressed transactional

activity, the Company has identified plentiful pipeline

opportunities. Less direct competition and a greater prevalence of

mispricing have resulted in value investment opportunities being

more numerous.

To exploit these opportunities, the Company has undertaken a

strategy of selective capital recycling, in order to benefit from

the attractive locations and advantageous pricing in its pipeline.

Assets have been sold where their values have been maximised over

the medium term and their earnings are below those seen in the

Company's pipeline. During the period, the Company undertook three

sales where offers had been received at levels that maximised asset

value over the short to medium term. These sales included two

industrial assets in Leeds and Bradford, sold as a package for a

blended net initial yield of 6.2%, far below the Company's achieved

average purchase yield during the period of 8.6%, demonstrating the

Company's ability to crystallise asset management gains by selling

out of lower yielding assets and recycling them into higher

yielding assets, thereby enhancing earnings. The sale prices

exceeded the assets' valuations prior to disposal by an average of

14%. The third sale was of an industrial property in Deeside, which

was sold vacant for an 8% premium to the prior valuation. The asset

was sold in order to avoid a costly refurbishment programme. These

sales added to the Company's existing strong track record of

crystallising net gains on disposal. The resulting capital profit

will be utilised, where needed, to supplement earnings in the

payment of the Company's market leading dividend, which has now

been paid for 32 consecutive quarters.

I am pleased to report significant progress towards the

Company's strategic objective of reinvesting capital generated from

sales into higher yielding assets in core urban locations. The

purchases of NCP, York, and Cambridge House, Bath, utilised most of

the capital available for deployment and have strengthened earnings

with a combined initial yield of 8.6%. Both assets have robust

reversionary potential, each offering yields in excess of 10%, thus

furthering their potential accretion to earnings over time. Despite

the short-term negative impact on NAV of acquisition costs, these

purchases are expected to deliver NAV growth over the medium term.

Critical to these acquisitions were the strong locations of the

assets, both of which occupy attractive central pitches in cities

with a tight supply of land.

This has been a fruitful period for the Company's active asset

management capabilities, with high numbers of leasing transactions

completing that have fuelled earnings growth and bolstered NAV. The

Company's portfolio has seen robust occupational activity across

all major market sectors, with a particular concentration of

activity in retail sectors, where the Company has focused much of

its recent purchases. This activity is testament to the Investment

Manager's expertise in stock selection and proactive asset

management, both of which have driven the strong total return

performance achieved by the portfolio's assets.

Further benefits to earnings and values from asset management

transactions are expected to be realised over coming periods, with

a number of key negotiations ongoing. As at the period end, the

Company had a reversionary yield of 8.72%, as independently

assessed by the valuer, Knight Frank, versus an initial yield of

7.31%. This is a measure of the inherent potential for future

income growth that the current portfolio provides. Given the

portfolio retains a low average passing rent of GBP6.29 per sq ft,

this represents a conservative starting point for value protection

and income growth.

Financial Results

Six months Six months Year ended

ended 30 September ended 30 September 31 March

2023 2022 2023

Operating profit before fair value

changes (GBP'000) 6,627 5,253 11,096

Operating profit/(loss) (GBP'000) 8,110 9,576 (9,164)

Profit/(loss) before tax (GBP'000) 7,162 8,322 (11,325)

Earnings/(loss) per share (basic

and diluted) (pence)* 4.52 5.25 (7.15)

EPRA Earnings per share (basic

and diluted) (pence)* 3.58 2.58 5.70

Ongoing Charges (%) 1.50 1.33 1.37

Net Asset Value per share (pence)* 106.00 121.88 105.48

EPRA Net Tangible Assets per share

(pence)* 106.00 121.88 105.48

* see note 10 of the Financial Statements for the corresponding

calculations. See the Investment Manager's Report for further

explanation of performance in the period.

Awards

I am delighted that the Company's performance and practices have

been recognised in four awards received during the period. The

Company has once again been awarded a gold medal by EPRA, the

European Public Real Estate Association, for its high standard of

financial reporting and a silver medal for standards of

sustainability reporting. These awards are testament to the

Company's robust governance and transparency.

The Company also won the Citywire investment trust award in the

'UK Property' category for the fourth successive year, as well as

winning the 'Property' category at the Investment Week Investment

Company of the Year awards.

Board Changes

As announced previously, I am very pleased to confirm the

appointments of Mr Robin Archibald and Mrs Liz Peace as independent

Non-Executive Directors to the Board of the Company, effective 1

October 2023. As part of orderly succession planning, Robin has

been appointed as Chairman-elect and will succeed as Chairman of

the Board upon my retirement at the Company's 2024 AGM. I am

delighted that Robin and Liz are joining the Board and I am

confident that their experience and range of skills will complement

and further strengthen the existing Board for many years to come.

Their collective extensive knowledge and experience in property and

investment companies will be of great benefit. I look forward to

working closely with Robin to ensure a smooth handover until

September 2024.

On 30 September 2023, Mr Bim Sandhu retired from the Board as

Chairman of the Audit Committee, having reached the end of his

nine-year tenure as a Director of the Company. As first announced

on 10 November 2022, Mr Mark Kirkland was appointed as

Chairman-designate of the Audit Committee and has now succeeded Mr

Sandhu as Audit Committee Chairman. On behalf of the Board, I thank

Bim for his invaluable contribution since the IPO of the Company,

and wish him well for his future endeavours.

Outlook

We are pleased by the Company's progress in continuing to invest

capital into attractive pipeline assets, where market conditions

have enabled attractive pricing levels. These purchases have

returned the Company's portfolio to being materially fully invested

and as a result, income levels have grown accordingly. We are

reassured by the occupational resilience that the portfolio has

shown during a period of ongoing uncertainty. The quantum of asset

management activity completed during the period is testament to the

Investment Manager's proactive approach and to the quality of

assets held in the portfolio. This activity has also boosted

earnings and creates a healthy near-term outlook for further

growth.

The Board believes that the ongoing relevance of the Company's

strategy is highlighted by its consistent outperformance of the

MSCI benchmark, with a five-year annualised outperformance of

6.66%. The Company has identified a plentiful pipeline, which has

presented excellent opportunities for a diversified, value-focused

investment strategy that is nimble in making cross-sector and

often, counter-cyclical moves, thereby delivering optimal value to

Shareholders. We believe that the relevance of this strategy is

highlighted by the robustness of the Company's share rating, whose

discount to NAV has consistently been the narrowest of its peers in

the UK diversified peer group.

The Board and Investment Manager will continue to take a prudent

approach to the ongoing management of the Company, alongside

considering opportunities for investment, growth and capital

recycling, as they arise.

Mark Burton

Chairman

21 November 2023

Investment Manager's Report

Property Market Outlook

Despite uncertainty remaining in the wider economy, values in UK

commercial property largely stabilised during the six months to 30

September 2023. UK property is expected to offer healthy return

prospects over the coming periods, with consensus forecasts showing

an expected return to positive rental growth across all major

market sectors by 2025, and all UK property total returns to

average 5.6% per annum over the next five years (2023-2027).

Industrial

During the period, the industrials sector remained robust having

been the sector which saw the steepest value declines at the end of

2023. Supported by resilient levels of occupational demand, the

sector has continued to see the highest levels of rental growth and

although this is expected to slow in coming years, it is expected

to remain in positive territory, showing expected average annual

growth of 3.3% between 2023 and 2027. We believe that the Company's

industrial portfolio, with a low average passing rent of GBP3.60

per sq ft, will be well placed to benefit. The Company has

completed several sales from the sector during the period, where

sales yields have compressed significantly compared to pipeline

assets, due to vendors' positive expectations on rental growth.

Retail

Values in the retail sector also faired robustly during the

period, buoyed by positive sector indicators. Retail sales volumes

increased 0.3% over the three months to August 2023 and the

proportion of online retail sales fell marginally in the month to

August. These figures, however, mask a divergence in performance of

the underlying retail sectors, with retail warehousing remaining

more robust on a total return basis than its high street

equivalent. Vacancy levels across retail warehousing have fallen to

4.7%, the lowest level seen since 2018. Performance on the high

street remains significantly polarised from town to town, with the

top tiers remaining robust and those now deemed to be lower quality

struggling, both for occupational and investor demand.

The period saw the failure of Wilko, which affected both high

street and retail warehousing locations. Tenant failures and CVAs

have not been as common as compared to the more regular occurrence

seen during the Covid pandemic, however we remain cautious of

further distress in the sector.

Office

The Office sector saw a stronger post-Covid recovery in 2022

than some may have expected, with office-based employment growing

in 2022. This trend started to reverse during 2023, resulting in

negative capital growth seen across most locations. Occupational

uncertainty remains across the sector, as businesses continue to

transition to new working patterns. Tenants have also become more

discerning in recent years, with occupiers now wishing to benefit

from strong sustainability credentials as well as surrounding

amenities and top-quality space. This is particularly the case for

large corporate tenants, but it is increasingly becoming a key

factor for smaller businesses too. As a result of all these

factors, we have seen investor demand for the sector remain light,

with investors further deterred by the high costs associated with

delivery.

Alternatives

Across alternative sectors, visibility of performance in trading

updates is key to investor demand and where these have remained

robust, despite the squeeze on consumer discretionary spend,

investment volumes have held up. Generally, leisure has

historically fared relatively defensively during periods of

economic uncertainty. Operators carrying unsustainably high levels

of debt are seen as a concern, however. We find the sector

attractive on a selective basis, particularly for assets that offer

a superior income return and occupy larger land holdings, or sites

in urban areas that can often be underpinned by alternative use

values, most likely residential.

Financial Results

The Company's NAV as at 30 September 2023 was GBP167.93 million

or 106.00 pps (31 March 2023: GBP167.10 million or 105.48 pps).

This represents an increase of 0.52 pps or 0.49% over the six-month

period, with the underlying movement in NAV set out in the table

below:

NAV Reconciliation

NAV as at 1 April 2023 105.48

Change in fair value of investment

property 1.82

Portfolio acquisition costs (1.06)

Capital expenditure (0.87)

Gain on disposal of investment

property 1.04

Income earned for the period 6.19

Expenses and net finance costs

for the period (2.60)

Dividends paid (4.00)

NAV as at 30 September 2023 106.00

EPRA EPS for the period was 3.58 pence which, based on dividends

paid of 4.00 pps, reflects a dividend cover of 89.50%. The increase

in dividend cover compared to the prior six-month period has

largely arisen due to the completion of key asset management

transactions. Our portfolio has gradually been reducing its

industrial exposure over the past 18 months, and although this may

not continue at the same rate going forward, it has allowed us to

crystallise profits made in the sector and concurrently recycle the

resulting capital into high yielding assets in our pipeline, mostly

within other market sectors. We believe that this ability to move

nimbly between property sectors in order to extract maximum value

from our portfolio is a key strength of our strategy.

Further gains in EPS are expected in the coming quarters as the

ongoing programme of new lettings should provide a boost to income

streams and a reduction in void costs. The Company's focus for the

deployment of capital continues to be further accretive investment

opportunities, alongside re-investment into the existing portfolio

where capex is needed in order to drive future performance

gains.

Rent collection rates have reached 99% for both the March 2023

and June 2023 quarters respectively, with further payments expected

to be received under longer-term payment plans. Of the outstanding

arrears, the Company has made a GBP1.27 million expected credit

loss provision, given the challenging economic outlook. The Company

will continue to pursue all outstanding arrears.

The ongoing charges ratio has increased during the period as a

result of the decline in the valuation of the portfolio rather than

an increase in the Company's underlying cost base.

Financing

The Company holds a GBP60.00 million five-year term loan

facility, maturing in May 2027. The loan is held with AgFe, a

leading independent asset manager specialising in debt-based

investments. It is priced as a fixed rate loan with a total

interest cost of 2.959%. In the current inflationary environment,

the Company considered it prudent to fix the loan and interest,

rather than run the risk of further interest rate rises during the

loan term.

The details of the loan facility are as follows:

30 September 2023 31 March 2023

------------------ -----------------

Facility GBP60.00 million GBP60.00 million

Drawn GBP60.00 million GBP60.00 million

Gearing (Loan to GAV) 27.35% 28.06%

Interest rate 2.959% fixed 2.959% fixed

Property Portfolio

In the year to 30 September 2023, the Company outperformed the

benchmark in total return terms across all property sectors,

demonstrating the benefits of an actively managed portfolio. This

was driven by capital growth outperformance in all sectors aside

from retail, and income return outperformance in all sectors aside

from offices.

The following tables illustrate the composition of the portfolio

in relation to its properties, tenants and income streams:

Summary by Sector as at 30 September 2023

Gross Gross Like- Like-

passing passing for-like for-like

Number Vacancy WAULT rental rental Rental rental rental

of Valuation Area by ERV to income income ERV ERV income growth* growth*

Sector assets (GBPm) (sq ft) (%) break (GBPm) (GBPpsf) (GBPm) (GBPpsf) (GBPm) (GBPm) %

(years)

Industrial 14 78.33 1,880,794 4.35 3.80 6.78 3.60 7.71 4.10 3.51 (0.08) (2.31)

Retail

warehouses 5 46.25 484,033 18.14 5.25 3.40 7.03 4.32 8.93 2.07 (0.19) (9.67)

Standard

retail 8 38.16 357,227 3.16 4.89 3.89 10.90 3.98 11.13 2.03 0.03 1.98

Alternatives 5 30.37 197,491 0.00 7.54 2.98 15.08 2.75 13.95 1.16 (0.04) (3.91)

Office 3 26.25 125,318 9.34 2.96 2.10 16.74 2.73 21.75 0.66 0.05 8.14

-------- ----------- ---------- --------- --------- -------- --------- -------- ---------- -------- --------- ---------

Portfolio 35 219.36 3,044,863 6.98 4.45 19.15 6.29 21.49 7.06 9.43 (0.23) (2.89)

-------- ----------- ---------- --------- --------- -------- --------- -------- ---------- -------- --------- ---------

Summary by Geographical Area as at 30 September 2023

Gross Gross Like- Like-

passing passing for-like for-like

Number Vacancy WAULT rental rental Rental rental rental

Geographical of Valuation Area by ERV to income income ERV ERV income growth* growth*

Area assets (GBPm) (sq ft) (%) break (GBPm) (GBPpsf) (GBPm) (GBPpsf) (GBPm) (GBPm) %

(years)

South West 7 57.35 635,587 9.65 3.96 4.58 7.20 6.15 9.68 2.33 0.10 6.51

West Midlands 5 43.00 597,860 10.24 4.22 3.60 6.03 3.86 6.46 1.81 (0.09) (4.62)

Yorkshire and

Humberside 7 32.43 616,838 13.81 4.85 2.92 4.74 3.57 5.79 1.48 (0.02) (1.57)

Eastern 4 22.08 326,419 0.80 3.29 1.92 5.87 2.10 6.44 0.83 (0.15) (15.61)

North West 4 21.60 336,043 0.00 6.05 1.90 5.67 2.00 5.95 0.98 (0.07) (9.75)

Wales 2 14.90 319,010 0.00 9.48 1.28 4.00 1.38 4.34 0.61 (0.03) (5.37)

South East 3 12.15 86,826 0.00 2.67 1.39 16.06 1.05 12.07 0.62 0.07 17.96

Rest of London 1 10.00 71,720 0.00 8.01 0.94 13.04 0.79 10.94 0.49 (0.02) (4.62)

East Midlands 1 3.70 28,219 0.00 3.62 0.41 14.56 0.38 13.38 0.18 (0.02) (10.37)

Scotland 1 2.15 26,341 0.00 4.54 0.21 7.97 0.21 7.97 0.10 - 1.89

-------- ----------- ---------- --------- --------- -------- --------- -------- ---------- -------- --------- ---------

Portfolio 35 219.36 3,044,863 6.98 4.45 19.15 6.29 21.49 7.06 9.43 (0.23) (2.89)

-------- ----------- ---------- --------- --------- -------- --------- -------- ---------- -------- --------- ---------

*like-for-like rental growth is for the six months ended 30

September 2023.

Source: Knight Frank/AEW, 30 September 2023.

Individual Property Classifications

Market Value

Property - Top 10 Sector Region Range (GBPm)

---------------------- ------------------ ------------------------- -------------

1 Central Six Retail Retail warehouses West Midlands 20.0-25.0

Park, Coventry

2 Northgate House, Standard retail South West 10.0-15.0

Bath

3 Gresford Industrial Industrial Wales 10.0-15.0

Estate, Wrexham

4 Cambridge House, Offices South West 10.0-15.0

Bath

5 40 Queen Square, Offices South West 10.0-15.0

Bristol

6 Tanner Row, York Other Yorkshire and Humberside 10.0-15.0

7 London East Leisure Other Rest of London 10.0-15.0

Park, Dagenham

8 Arrow Point Retail Retail warehouses West Midlands 7.5-10.0

Park, Shrewsbury

9 Units 1001-1004, Industrial North West 5.0-7.5

Sarus Court, Runcorn

10 Apollo Business Park, Industrial Eastern 5.0-7.5

Basildon

The Company's top ten properties listed above comprise 51.1% of

the total value of the portfolio.

Market Value

Property Sector Region Range (GBPm)

11 Cuerden Way, Preston Retail warehouses North West 5.0 - 7.5

12 Storey's Bar Road, Industrial Eastern 5.0 - 7.5

Peterborough

13 Barnstaple Retail Retail warehouses South West 5.0 - 7.5

Park, Barnstaple

14 15-33 Union Street, Standard retail South West 5.0 - 7.5

Bristol

15 Mangham Road, Rotherham Industrial Yorkshire and Humberside 5.0 - 7.5

16 Westlands Distribution Industrial South West 5.0 - 7.5

Park, Weston Super

Mare

17 Brockhurst Crescent, Industrial West Midlands 5.0 - 7.5

Walsall

18 Walkers Lane, St Industrial North West 5.0 - 7.5

Helens

19 Diamond Business Industrial Yorkshire and Humberside 5.0 - 7.5

Park, Wakefield

20 Odeon Cinema, Southend Other Eastern 5.0 - 7.5

21 Next, Bromley Standard retail South East 5.0 - 7.5

22 710 Brightside Lane, Industrial Yorkshire and Humberside < 5.0

Sheffield

23 Oak Park, Droitwich Industrial West Midlands < 5.0

24 Commercial Road, Standard retail South East < 5.0

Portsmouth

25 Pearl House, Nottingham Standard retail East Midlands < 5.0

26 The Railway Centre, Retail warehouses Yorkshire and Humberside < 5.0

Dewsbury

27 Cedar House, Gloucester Offices South West < 5.0

28 Pipps Hall Industrial Industrial Eastern < 5.0

Estate, Basildon

29 69-75 Above Bar Standard retail South East < 5.0

Street, Southampton

30 Eagle Road, Redditch Industrial West Midlands < 5.0

31 Circuit, Cardiff Other Wales < 5.0

32 Bridge House, Bradford Industrial Yorkshire and Humberside < 5.0

33 Pricebusters Building, Standard retail North West < 5.0

Blackpool

34 JD Gyms, Glasgow Other Scotland < 5.0

35 11/15 Fargate, Sheffield Standard retail Yorkshire and Humberside < 5.0

Sector and Geographical Allocation by Market Value as at 30

September 2023

Sector Allocation

Sector %

------------------- ---

Industrial 36

Retail warehouses 21

Standard retail 17

Alternative 14

Offices 12

Geographical Allocation

Location %

-------------------------- ---

South West 26

West Midlands 20

Yorkshire and Humberside 15

Eastern 10

North West 10

Wales 7

South East 5

Rest of London 4

East Midlands 2

Scotland 1

Source: Knight Frank valuation report as at 30 September

2023.

Top Ten Tenants

% of

Portfolio

Passing Total

Rental Contracted

Income Rental

Tenant Sector Property (GBP'000) Income

------------------ ----------------- ------------------------------ ----------- ------------

Plastipak UK Gresford Industrial

1 Limited Industrial Estate, Wrexham 975 5.1

2 NCP Other Tanner Row, York 733 3.8

3 Matalan Retail warehouse Matalan, Preston 651 3.4

4 Wyndeham Group Industrial Wyndeham, Peterborough 644 3.4

5 Poundland Limited Retail Various 631 3.3

6 Next Retail Next, Bromley 630 3.3

7 TJX UK Ltd Retail Various 608 3.2

London East Leisure

8 Mecca Bingo Ltd Other Park, Dagenham 584 3.1

9 Odeon Cinemas Other Odeon Cinema, Southend-on-Sea 535 2.8

Bath Northgate

House Centre Northgate House,

10 Ltd Retail Bath 491 2.5

The Company's top ten tenants, listed above, represent 33.9% of

the total passing rental income of the portfolio.

Source: Knight Frank valuation report as at 30 September

2023.

Investment Update

The Company completed the following material asset management

transactions during the period:

Acquisitions - In July 2023, the Company completed the

acquisition of Tanner Row, York, a mixed-use asset within York city

centre for GBP10.02 million, reflecting an attractive net initial

yield of 9.3%.

In September 2023, the Company acquired Cambridge House, Bath, a

mixed-use asset in Bath city centre for GBP11.50 million,

reflecting an attractive net initial yield of 8.0% and a capital

value of GBP223 per sq ft.

Disposals - In May 2023, the Company completed the sale of its

industrial holding in Deeside for GBP4.75 million, reflecting a

capital value of circa GBP49 per sq ft. The vacant asset was sold

to an owner-occupier, with the price reflecting an 8.0% premium to

the 31 March 2023 valuation. By disposing of the asset, the Company

also avoided a speculative refurbishment project costing

approximately GBP1.00 million.

In June 2023, the Company completed the sale of two industrial

assets, being Euroway Trading Estate, Bradford and Lockwood Court,

Leeds, for combined proceeds of GBP16.10 million. This reflected a

blended net initial yield (NIY) of 6.2% and a weighted average

premium to acquisition price of 31.2%. Both sales realised

significant profit for AEWU's shareholders. For Euroway Trading

Estate and Lockwood Court respectively, their sales prices exceeded

their 31 March 2023 valuations by 26.5% and 3.8%, as well as their

acquisition prices by 30.3% and 31.8%.

Asset Management Update

Central Six Retail Park, Coventry (retail warehousing) - in

April 2023, the Company completed a lease renewal with existing

tenant, Grahams Baked Potatoes Limited. The tenant has entered into

a new four-year lease with rolling mutual break options at a rent

of GBP24,500 per annum, equating to GBP45 per sq ft.

In May 2023, the Company completed a lease renewal with existing

tenant, Oak Furnitureland Group Limited, for Unit 12. The tenant

has entered into a new two-year lease with rolling mutual break

options at a rent of GBP25,000 per annum, equating to GBP2.50 per

sq ft.

In May 2023, the Company also completed a reversionary lease

with existing tenant, Boots UK Limited, for Unit 7. The tenant has

entered into a new five-year lease with effect from 28 February

2024 at a rent of GBP259,293 per annum, equating to GBP14.25 per sq

ft. The letting also includes seven and a half months' rent free

taken under the existing lease.

In June 2023, the Company completed the acquisition of the

freehold interest in units 1-11, which had previously been held by

way of long leasehold from Friargate JV Projects Limited. The

acquisition of the freehold interest is expected to increase the

liquidity of the asset in case of its future sale and also removes

user restrictions within the long lease which are constrictive to

lettings. In exchange for the freehold interest, the Company has

granted to Friargate JV Projects an option to acquire the Company's

long leasehold interest in units 12 A & B over a five-year

period, commencing in two years' time.

The Company completed a new 20-year lease to Aldi Stores

Limited, following the completion of the agreement for lease in

October 2022. The lease provides an annual rent of GBP270,166 per

annum, reflecting GBP13 per sq ft, to be reviewed every five years

based on compounded annual RPI, collared and capped at 1% and 3%

respectively. The lease provides Aldi with a 12-month rent-free

incentive and a tenant break option at year 15.

In September 2023, the Company received formal confirmation of

the planning permission for the amalgamation of Unit 6a and Unit 6b

and extended delivery hours in order to facilitate the letting to

The Food Warehouse. The letting is expected to complete in February

2024.

Barnstaple Retail Park, Barnstaple (retail warehousing) - the

Company has completed an eight-year reversionary lease with B&Q

from 29 September 2024 at the current passing rent of GBP348,000

per annum (GBP9.75 per sq ft). In return, the tenant has been

granted a six-month rent-free period.

40 Queens Square, Bristol (office) - after protracted

negotiations, the Company has settled three outstanding rent

reviews at the building dating back to 2021 and 2022 with the

following tenants: Leonard Curtis Recovery Limited, Chapman Taylor

LLP and Turley Associates. The outcome of the reviews will see the

annual rent from the three tenant's increase from GBP213,812 per

annum to GBP281,550, reflecting a 32% uplift.

The Company has also recently completed a new five-year ex-Act

lease to Environmental Resources Limited with a tenant break option

at the end of the third year at a rent of GBP69,230 per annum

(GBP35 per sq ft). The tenant has the benefit of an initial

six-month rent-free period, with a further four months incentive if

they do not serve their break option.

Arrow Point Retail Park, Shrewsbury (retail warehousing) - the

Company has completed a three-year lease to Universal Consumer

Products Limited at a rent of GBP110,000 per annum (GBP8 per sq

ft). The previous passing rent was GBP95,844 (GBP7 per sq ft). No

lease incentive was given.

Oak Park, Droitwich (industrial) - the Company has completed a

new three-year ex-Act lease on units 266-270 to Roger Dyson at a

stepped rent starting at GBP123,000 per annum in year one,

GBP135,000 per annum in year two and GBP148,000 per annum in year

three. There is a mutual break option on the expiry of the second

year. The tenant was granted a one-month rent free period.

The Company has also completed a new three-year ex-Act lease to

Adam Hewitt Ltd at units 263 and 265 at a rent of GBP70,000 per

annum. There is a tenant break option after the first year. No rent

incentive was given.

Lastly, the Company has completed a letting at units 272 and 273

to J Warwick Holdings Ltd for a new 15-year term, with rolling

tenant break options every three years at a rent of GBP79,000 per

annum. The tenant has the benefit of a six-month rent-free period.

The property is now fully let.

Diamond Business Park, Wakefield (industrial) - in April 2023,

the Company completed the settlement of an open market rent review

with Tasca Tankers, dating back to June 2022. The review will see

the rent received increase from GBP209,000 to GBP229,900 per annum,

reflecting an uplift of 9.6%.

The Company has settled Compac UK's July 2023 RPI rent review at

GBP53,517 per annum, representing an GBP11,517 per annum (circa

27%) increase. The unit is still considered under-rented, with an

ERV of GBP4.00 per sq ft, compared to the new passing rent of

GBP3.90 per sq ft.

The Company has also settled Economy Packaging Ltd's August 2023

open market rent review at GBP79,065 per annum, representing a

GBP26,565 per annum (circa 50%) increase. This letting equates to

GBP3.75 per sq ft and will provide good evidence for further asset

management activity.

Northgate House, Bath (retail) - in June 2023, the Manager

completed a new five-year ex-Act lease to Dimension Vintage limited

at a rent of GBP40,000 per annum. Four months' rent-free has been

granted.

Commercial Road, Portsmouth (retail) - in June 2023, a new

10-year lease was completed to Specsavers at a rent of GBP60,000

per annum in vacant accommodation previously let to River Island.

An incentive of nine months' rent free was granted to the tenant,

along with a GBP40,000 capital contribution to improvement works.

There will be a tenant only break option after six years on six

months' notice.

Sarus Court, Runcorn (industrial) - The Manager has completed

three lease renewals with existing tenant, CJ Services, for their

leases at units 1001, 1002 and 1003. The total rent is GBP276,283

per annum reflecting GBP6.50 per sq ft, an increase from the

previous average passing rent of GBP5.25 per sq ft. Five-year

ex-Act leases were granted, with incentives equal to six months'

rent-free.

The Railway Centre, Dewsbury (leisure) - Mecca Bingo, whose

lease expires on 24 December 2023, have surrendered their lease

early on 29 September 2023, paying all their rent, service charge

and insurance to lease expiry. In doing so, the Company has also

settled Mecca's dilapidations at GBP285,000. The full and final

combined settlement totals GBP365,126. The Manager is in the

process of agreeing terms with an incoming tenant where landlord

enabling works will be required. An early surrender of Mecca's

lease will facilitate the new letting completing a quarter earlier

than otherwise possible.

Westlands Distribution Park, Weston-Super-Mare (industrial) -

the Company has completed a lease renewal with JN Baker who have

extended their occupation of Unit 2A for a further two years from

April 2023, with a mutual break option exercisable after nine

months. The agreed rent is GBP159,000 per annum, inclusive of

insurance.

The Company has settled three outstanding April 2022 rent

reviews with North Somerset Council at units 2, 5 and 6. The

combined rental increase is GBP35,864 per annum (circa 20%).

Carr Coatings, Redditch (industrial) - the Company has settled

Carrs Coatings Ltd's August 2023 annual uncapped RPI rent review at

GBP294,348 per annum (GBP7.75 per sq ft), representing a GBP24,385

per annum (circa 9%) increase. The unit is single-let to Carrs

Coatings Ltd until August 2028. The lease was entered into as a

sale and leaseback in 2008 at an initial starting rent of

GBP170,300 per annum (GBP4.50 psf).

Vacancy - The portfolio's overall vacancy level is 6.98%.

ESG Update

The Company has maintained its two stars Global Real Estate

Sustainability Benchmark ('GRESB') rating for 2023, as well as

maintaining its score of 67 (GRESB Peer Group Average-65). A large

portion of the GRESB score relates to performance data coverage

where, due to the high percentage of single-let assets with tenant

procured utilities, the Company does not score as well as Funds

with a smaller holding of single-let assets and a higher proportion

of multi-let assets where the owner is responsible for the

utilities and can therefore gather the relevant data.

We continue to implement our plan to improve overall data

coverage and data collection for all utilities through increased

tenant engagement at our single-let assets and by installing

automated meter readers ('AMR') across the portfolio. We currently

have thirteen AMR installation projects ongoing, including at

single lets and multi-lets such as Central Six Retail Park. Several

other AMR installations will be executed during 2024.

We endeavour, where the opportunity presents itself through a

lease event, to include green clauses in leases, covenanting

landlord and tenant to collaborate over the environmental

performance of the property. Green clauses seek to improve data

coverage by ensuring tenants provide regular and appropriate

utility consumption data.

We continue to assess and strengthen our reporting and alignment

against the framework set out by the TCFD with further disclosure

provided in the 2023 annual report and accounts. We are pleased to

report that the Company has maintained its EPRA Silver rating for

EPRA Sustainability Best Practices Recommendations ('sBPR') for ESG

disclosure and transparency.

We have an Asset Sustainability Action Plan ('ASAP') initiative,

tracking ESG initiatives across the portfolio on an asset-by-asset

basis for targeted implementation of ESG improvements. In doing so,

we ensure all possible sustainability initiatives are considered

and implemented where physically and economically viable.

Following a significant emissions reduction from assets within

the portfolio during 2022 (-33.8% vs. the 2018 baseline), we took

the decision to increase the reduction target from 15% to 40% by

2030, equating to a planned saving of roughly 76 extra tonnes of

carbon. All managed assets and units have been contracted to High

Quality Green Tariffs, ensuring that electricity supply is from

renewable sources and contributing to the continued reduction in

emissions. All void/vacant unit supplies have also been transferred

to High Quality Green Tariffs, while gas capping exercises have

been undertaken where possible, including several units at Diamond

Business Park.

We are currently implementing several biodiversity initiatives

across our portfolio, including significant biodiversity

improvements to the Railway Centre, Dewsbury. This includes the

installation of 20 bird boxes, 10 insect towers & hotels, a

hedgehog house, a wildflower meadow and replanting of bushes across

the site. Other notable projects include the installation of EV

chargers at Central Six and a solar PV feasibility study at London

East Leisure Park.

Lease Expiry Profile

Approximately GBP2.40 million of the Company's current

contracted income stream is subject to an expiry or break within

the 12-month period commencing 1 October 2023. We will proactively

manage these leases nearing expiry, looking to unlock capital

upside, whether that be through lease regears/renewals, or through

refurbishment/capex projects and new lettings.

Source: Knight Frank valuation report as at 30 September

2023.

AEW UK Investment Management LLP

21 November 2023

AEW UK REIT PLC's interim report and financial statements for

the period ended 30 September 2023 will be

available today on www .aewukreit.com.

It will also be submitted shortly in full unedited text to the

Financial Conduct Authority's National Storage Mechanism and will

be available for inspection at

data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance with

DTR 6.3.5(1A) of the Financial Conduct Authority's Disclosure

Guidance and Transparency Rules.

LEI: 21380073LDXHV2LP5K50

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFFVILDLLFIV

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

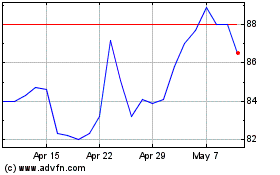

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Aew Uk Reit (LSE:AEWU)

Historical Stock Chart

From Jan 2024 to Jan 2025