TIDMAFX

RNS Number : 7629P

Alpha FX Group PLC

22 June 2022

22 June 2022

Alpha FX Group plc

("Alpha FX" or the "Company")

Growth Share Schemes and PDMR Dealing

Alpha FX Group plc (AIM: AFX), a high-tech, high-touch provider

of FX risk management, accounts and payments solutions to

corporates and institutions internationally, today wishes to

provide an update with regard to changes to the Group's Employee

Share Schemes.

Following on from the issuance of the E Share Growth Scheme in

2020, in which a total of 882 E Shares were issued to employees of

the Group, the Group will be adopting three new Growth Share

Schemes as described below resulting in a total of 910 shares being

issued to employees of the Group.

F Share Growth Scheme

The Group will be adopting a growth share scheme, in addition to

and on similar terms to the existing C Share Growth Scheme and E

Share Growth Scheme under which 285 F ordinary shares ("F Shares")

in Alpha FX Limited will be issued to certain employees of the

Group ("F Share Growth Scheme").

The F Shares contain a put option, such that, when and to the

extent vested, they can be converted into ordinary shares in Alpha

FX Group plc ("Alpha"). The F Shares will vest in four equal

tranches, occurring annually, in respect of the Financial Years for

2023, 2024, 2025 and 2026. Vesting for each Financial Year will

require Group revenue growth of 20% in Financial Year 2023, 20% in

Financial Year 2024, 20% in Financial Year 2025 and 20% in

Financial Year 2026. The rate of conversion that the F Shares will

be regarded as worth, is a pro rata share of the market

capitalisation gain of Alpha above a hurdle price of GBP740

million. The gain that an F shareholder could receive is capped

through placing a ceiling on the maximum market capitalisation of

Alpha of GBP1,867 million. The result of doing so is that the F

Shares will be entitled to a pro rata share of the gain in market

capitalisation of Alpha between GBP740 million and the market

capitalisation ceiling of GBP1,867 million.

Upon conversion, the number of ordinary shares in Alpha that an

F Shareholder will receive is such number of ordinary shares whose

value is equivalent to Alpha's closing share price at the

conversion date. Conversion is only permitted to the extent that

the F Shares have vested.

G Share Growth Scheme

The Group will be adopting a new growth share scheme under which

360 G ordinary shares ("G Shares") in Alpha FX Limited will be

issued to certain employees ("G Shareholders") of the Group ("G

Share Growth Scheme").

The G Shares contain a put option, such that, when and to the

extent vested, they can be converted into ordinary shares in Alpha

FX Group plc. The G Shares will vest in five tranches, occurring

annually, in respect of the Financial Years for 2022, 2023, 2024,

2025 and 2026. The G Shareholders will be able to vest 12.5% of

their holding for Financial Year 2022, 12.5% for Financial Year

2023, 25% for Financial Year 2024, 25% for Financial Year 2025 and

25% for Financial Year 2026. Vesting for each Financial Year will

require revenue from the London Corporate division (and any future

corporate division in Spain) to grow by 5.5% in Financial Year

2022, 15% in Financial Year 2023, 15% in Financial Year 2024, 15%

in Financial Year 2025 and 15% in Financial Year 2026. The rate of

conversion that the G Shares will be regarded as worth, is a pro

rata share of the market capitalisation gain of Alpha above a

hurdle price of GBP740 million. The gain that a G shareholder could

receive is capped through placing a ceiling on the maximum market

capitalisation of Alpha of GBP1,867 million. The result of doing so

is that the G Shares will be entitled to a pro rata share of the

gain in market capitalisation of Alpha between GBP740 million and

the market capitalisation ceiling of GBP1,867 million.

Upon conversion, the number of ordinary shares in Alpha that a G

Shareholder will receive is such number of ordinary shares whose

value is equivalent to Alpha's closing share price at the

conversion date. Conversion is only permitted to the extent that

the G Shares have vested.

H Share Growth Scheme

The Group will be adopting a new growth share scheme under which

265 H ordinary shares ("H Shares") in Alpha FX Limited will be

issued to certain employees ("H Shareholders") of the Group ("H

Share Growth Scheme").

The H Shares contain a put option, such that, when and to the

extent vested, they can be converted into ordinary shares in Alpha

FX Group plc. The H Shares will vest in five tranches, occurring

annually, in respect of the Financial Years for 2022, 2023, 2024,

2025 and 2026. The H Shareholders will be able to vest 12.5% of

their holding for Financial Year 2022, 12.5% for Financial Year

2023, 25% for Financial Year 2024, 25% for Financial Year 2025 and

25% for Financial Year 2026. Vesting for each Financial Year is

subject to 2 revenue targets being met, with H Shareholders being

entitled to vest 50% of their holding for each Financial Year in

respect of each target being met. The first revenue target is for

the London Corporate division (and any future corporate division in

Spain) to grow by 5.5% in Financial Year 2022, 15% in Financial

Year 2023, 15% in Financial Year 2024, 15% in Financial Year 2025

and 15% in Financial Year 2026. The second target is for the

revenue from all the global corporate divisions to grow by 18.6% in

Financial Year 2022, 20% in Financial Year 2023, 20% in Financial

Year 2024, 20% in Financial Year 2025 and 20% in Financial Year

2026. The rate of conversion that the H Shares will be regarded as

worth, is a pro rata share of the market capitalisation gain of

Alpha above a hurdle price of GBP740 million. The gain that an H

shareholder could receive is capped through placing a ceiling on

the maximum market capitalisation of Alpha of GBP1,867 million. The

result of doing so is that the H Shares will be entitled to a pro

rata share of the gain in market capitalisation of Alpha between

GBP740 million and the market capitalisation ceiling of GBP1,867

million.

Upon conversion, the number of ordinary shares in Alpha an H

Shareholder will receive is such number of ordinary shares whose

value is equivalent to Alpha's closing share price at the

conversion date. Conversion is only permitted to the extent that

the H Shares have vested.

111 of the H Shares are being issued to Alex Howorth, who is a

PDMR of the Company, and therefore the relevant regulatory

disclosure has been made in the table below.

Enquiries:

Alpha FX Group plc via Alma PR

Morgan Tillbrook, Founder and CEO

Tim Kidd, CFO

Liberum Capital Limited (Nominated Adviser Tel: +44 (0) 20

and Sole Broker) 3100 2000

Neil Patel

Cameron Duncan

Kane Collings

Alma PR (Financial Public Relations) Tel: +44 (0) 20

3405 0205

Josh Royston

Andy Bryant

Kieran Breheny

Details of the person discharging managerial

1 responsibilities / person closely associated

a) Name Alex Howorth

----------------------- -------------------------------------

Reason for the notification

2

--------------------------------------------------------------

a) Position/status Group Managing Director

- FX Risk Management

----------------------- -------------------------------------

b) Initial notification Initial

/Amendment

----------------------- -------------------------------------

Details of the issuer, emission allowance

3 market participant, auction platform,

auctioneer or auction monitor

--------------------------------------------------------------

a) Name Alpha FX Group plc

----------------------- -------------------------------------

b) LEI 213800RESM1FPUXY6K31

----------------------- -------------------------------------

Details of the transaction(s): section

4 to be repeated for (i) each type of instrument;

(ii) each type of transaction; (iii) each

date; and (iv) each place where transactions

have been conducted

--------------------------------------------------------------

a) Description H ordinary shares in Alpha

of the financial FX Limited, which may be

instrument, convertible into ordinary

type of instrument shares in Alpha FX Group

plc

Identification ISIN: GB00BF1TM596

code

b) Nature of the Issue of H Shares

transaction

----------------------- -------------------------------------

c) Price(s) and

volume(s)

----------- -------------

Price(s) Volume(s)

----------- -------------

N/A 111 H Shares

----------- -------------

d) Aggregated information N/A

- Aggregated

volume

- Price

e) Date of the 22 June 2022

transaction

----------------------- -------------------------------------

f) Place of the Off market

transaction

----------------------- -------------------------------------

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHELLBLLQLZBBD

(END) Dow Jones Newswires

June 22, 2022 02:00 ET (06:00 GMT)

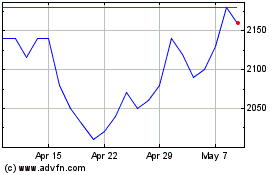

Alpha (LSE:ALPH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alpha (LSE:ALPH)

Historical Stock Chart

From Apr 2023 to Apr 2024