TIDMAGL

RNS Number : 5604S

Angle PLC

14 July 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF

AMERICA, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH RELEASE,

PUBLICATION OR DISTRIBUTION WOULD BE UNLAWFUL.

FURTHER, THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND

IS NOT AN OFFER OF SECURITIES IN ANY JURISDICTION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.THIS ANNOUNCEMENT

AMOUNTS TO A FINANCIAL PROMOTION FOR THE PURPOSES OF SECTION 21 OF

THE FINANCIAL SERVICES AND MARKETS ACT 2000 AND HAS BEEN APPROVED

BY PRIMARYBID LIMITED WHICH IS AUTHORISED AND REGULATED BY THE

FINANCIAL CONDUCT AUTHORITY (FRN 779021).

14 July 2022

ANGLE plc

(" ANGLE ", the " Company " or the "Group" )

Retail Offer via PrimaryBid

-- ANGLE plc announces a retail offer via PrimaryBid;

-- The price will be determined at the close of the bookbuilding

process in connection with the Placing;

-- Investors can access the PrimaryBid Offer by visiting

www.primarybid.com and downloading the PrimaryBid mobile app;

-- The issue price for the Retail Offer Shares will be the Placing Price;

-- There is a minimum subscription of GBP250 per investor in the Retail Offer;

-- No commission is charged by PrimaryBid on applications to the Retail Offer.

Retail Offer

ANGLE plc ( AIM : AGL ), a world-leading liquid biopsy company,

is pleased to announce, a conditional offer for subscription via

PrimaryBid (the "Retail Offer") of new ordinary shares of 10 pence

each in the Company ("Retail Offer Shares"). The Company is also

conducting a placing of new ordinary shares (the "Placing Shares")

by way of an accelerated bookbuilding process (the "Placing") as

announced earlier today. The price at which the Placing Shares are

to be placed (the "Placing Price") will be determined at the close

of the bookbuilding process. The Company has further announced a

subscription by certain directors of the Group (the "Management

Subscription") of new ordinary shares (the "Management Subscription

Shares")(together, the "Capital Raise").

The issue price for the Retail Offer Shares, as well as for the

Management Subscription Shares, will be the Placing Price.

The Retail Offer is conditional on completion of the Placing and

the new ordinary shares to be issued pursuant to the Capital Raise

being admitted to trading on AIM ("Admission"). Admission is

expected to take place at 8.00 a.m. on 19 July 2022. The Retail

Offer will not be completed without the Placing also being

completed.

The net proceeds of the Capital Raise will be used to support

the Company's commercialisation plan and capitalise on the momentum

gained from obtaining a world first US Food and Drug Administration

("FDA") product clearance for its Parsortix system.

Reason for the Retail Offer

The Company values its retail investor base, which has supported

the Company alongside institutional investors over several years,

and is therefore pleased to provide private and other investors the

opportunity to participate in the Retail Offer by applying through

the PrimaryBid mobile app available on the Apple App Store and

Google Play. PrimaryBid does not charge investors any commission

for these services.

Details of the Retail Offer

The Retail Offer, via the PrimaryBid mobile app, will be open to

individual investors following the release of this announcement.

The Retail Offer is expected to close no later than 7.00 a.m. on 15

July 2022. The Retail Offer may close early if it is

oversubscribed.

There is a minimum subscription of GBP250 per investor under the

terms of the Retail Offer which is open to existing shareholders

and other investors subscribing via the PrimaryBid mobile app.

The Company reserves the right to scale back any order at its

discretion. The Company and PrimaryBid reserve the right to reject

any application for subscription under the Offer without giving any

reason for such rejection.

No commission is charged to investors on applications to

participate in the Retail Offer made through PrimaryBid. It is

vital to note that once an application for new Retail Offer Shares

has been made and accepted via PrimaryBid, an application cannot be

withdrawn.

For further information on PrimaryBid or the procedure for

applications under the Retail Offer , please visit

www.PrimaryBid.com or email PrimaryBid at enquiries@primarybid.com.

T he terms and conditions on which the Retail Offer is made,

including the procedure for application and payment for Retail

Offer Shares, is available to all persons who register with

PrimaryBid.

The Retail Offer Shares will be issued free of all liens,

charges and encumbrances and will, when issued and fully paid, rank

pari passu in all respects with the Company's existing ordinary

shares, as well as the new ordinary shares to be issued pursuant to

the Placing and the Management Subscription.

ANGLE plc

Andrew Newland, Chief Executive

Ian Griffiths, Finance Director

Andrew Holder, Head of Investor Relations +44 (0) 1483 343434

enquiries@primarybid.com

PrimaryBid Limited

Charles Spencer / James Deal

Joh. Berenberg, Gossler & Co. KG,

London Branch (NOMAD)

Toby Flaux, Ciaran Walsh, Milo Bonser,

Thomas Graham +44 (0) 20 3207 7800

FTI Consulting

Simon Conway, Ciara Martin +44 (0) 203 727 1000

Matthew Ventimiglia (US) +1 (212) 850 5624

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the UK Market Abuse Regulation . Upon the publication of this

announcement via a regulatory information service, this information

is considered to be in the public domain.

Investors should make their own investigations into the merits

of an investment in the Company. Nothing in this announcement

amounts to a recommendation to invest in the Company or amounts to

investment, taxation or legal advice.

It should be noted that a subscription for Retail Offer Shares

and investment in the Company carries a number of risks. Investors

should consider the risk factors set out on www.PrimaryBid.com and

the PrimaryBid mobile app before making a decision to subscribe for

Retail Offer Shares. Investors should take independent advice from

a person experienced in advising on investment in securities such

as the Retail Offer Shares if they are in any doubt.

IMPORTANT NOTICES

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT, IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE, TRANSMISSION,

FORWARDING OR DISTRIBUTION, DIRECTLY OR INDIRECTLY, IN WHOLE OR IN

PART, IN OR INTO THE UNITED STATES OF AMERICA, ITS TERRITORIES AND

POSSESSIONS, ANY STATE OF THE UNITED STATES OF AMERICA OR THE

DISTRICT OF COLUMBIA (COLLECTIVELY, THE "UNITED STATES"),

AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF SOUTH

AFRICA OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION, RELEASE

OR DISTRIBUTION WOULD BE UNLAWFUL. FURTHER, THIS ANNOUNCEMENT IS

FOR INFORMATION PURPOSES ONLY AND IS NOT AN OFFER OF SECURITIES IN

ANY JURISDICTION.

This Announcement or any part of it does not constitute or form

part of any offer to issue or sell, or the solicitation of an offer

to acquire, purchase or subscribe for, any securities in the United

States, Canada, Australia, Japan, New Zealand or the Republic of

South Africa or any other jurisdiction in which the same would be

unlawful. No public offering of the Retail Offer Shares is being

made in any such jurisdiction.

No action has been taken by the Company or any person acting on

its behalf that would permit an offer of the Retail Offer Shares or

possession or distribution of this Announcement or any other

offering or publicity material relating to such Retail Offer Shares

in any jurisdiction where action for that purpose is required.

Persons into whose possession this Announcement comes are required

by the Company to inform themselves about, and to observe, such

restrictions.

No prospectus, offering memorandum, offering document or

admission document has been or will be made available in connection

with the matters contained in this Announcement and no such

prospectus is required (in accordance with the Regulation (EU) No

2017/1129 (as amended) or Regulation (EU) No 2017/1129 (as amended)

as it forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018) to be published. Persons needing advice

should consult a qualified independent legal adviser, business

adviser, financial adviser or tax adviser for legal, financial,

business or tax advice.

The Retail Offer Shares have not been and will not be registered

under the US Securities Act of 1933, as amended (the "Securities

Act"), or with any securities regulatory authority of any State or

other jurisdiction of the United States, and may not be offered,

sold or transferred, directly or indirectly, in or into the United

States except pursuant to an exemption from, or in a transaction

not subject to, the registration requirements of the Securities Act

and in compliance with the securities laws of any State or any

other jurisdiction of the United States. The Retail Offer Shares

will be offered and sold only outside of the United States to

persons who are not U.S. persons (as defined in Regulation S under

the Securities Act ("Regulation S") in "offshore transactions" (as

such term is defined in Regulation S) pursuant to Regulation S and

otherwise in accordance with applicable laws. No public offering of

the Retail Offer Shares will be made in the United States or

elsewhere.

The Retail Offer has not been approved or disapproved by the US

Securities and Exchange Commission, any State securities commission

in the United States or any US regulatory authority, nor have any

of the foregoing authorities passed upon or endorsed the merits of

the Retail Offer, or the accuracy or adequacy of this Announcement.

Any representation to the contrary is a criminal offence in the

United States.

This Announcement has not been approved by the London Stock

Exchange, nor is it intended that it will be so approved.

Certain statements contained in this Announcement constitute

"forward-looking statements" with respect to the financial

condition, results of operations and businesses and plans of the

Group. Words such as "believes", "anticipates", "estimates",

"expects", "intends", "plans", "aims", "potential", "will",

"would", "could", "considered", "likely", "estimate" and variations

of these words and similar future or conditional expressions, are

intended to identify forward-looking statements but are not the

exclusive means of identifying such statements. These statements

and forecasts involve risk and uncertainty because they relate to

events and depend upon future circumstances that have not occurred.

There are a number of factors that could cause actual results or

developments to differ materially from those expressed or implied

by these forward-looking statements and forecasts. As a result, the

Group's actual financial condition, results of operations and

business and plans may differ materially from the plans, goals and

expectations expressed or implied by these forward-looking

statements. No representation or warranty is made as to the

achievement or reasonableness of, and no reliance should be placed

on, such forward-looking statements. The forward-looking statements

contained in this Announcement speak only as of the date of this

Announcement. The Company and its directors and any person acting

on its or their behalf each expressly disclaim any obligation or

undertaking to update or revise publicly any forward-looking

statements, whether as a result of new information, future events

or otherwise, unless required to do so by applicable law or

regulation or the London Stock Exchange.

This Announcement does not constitute a recommendation

concerning any investor's investment decision with respect to the

Retail Offer. Any indication in this Announcement of the price at

which ordinary shares have been bought or sold in the past cannot

be relied upon as a guide to future performance. The price of

shares and any income expected from them may go down as well as up

and investors may not get back the full amount invested upon

disposal of the shares. Past performance is no guide to future

performance. This Announcement does not identify or suggest, or

purport to identify or suggest, the risks (direct or indirect) that

may be associated with an investment in the Retail Offer Shares.

The contents of this Announcement are not to be construed as legal,

business, financial or tax advice. Each investor or prospective

investor should consult their or its own legal adviser, business

adviser, financial adviser or tax adviser for legal, financial,

business or tax advice.

No statement in this Announcement is intended to be a profit

forecast or profit estimate for any period, and no statement in

this Announcement should be interpreted to mean that earnings,

earnings per share or income, cash flow from operations or free

cash flow for the Company for the current or future financial years

would necessarily match or exceed the historical published

earnings, earnings per share or income, cash flow from operations

or free cash flow for the Company.

The Retail Offer Shares will not be admitted to trading on any

stock exchange other than the London Stock Exchange.

Neither the content of the Company's website (or any other

website) nor the content of any website accessible from hyperlinks

on the Company's website (or any other website) is incorporated

into or forms part of this Announcement.

This Announcement has been prepared for the purposes of

complying with applicable law and regulation in the United Kingdom

and the information disclosed may not be the same as that which

would have been disclosed if this Announcement had been prepared in

accordance with the laws and regulations of any jurisdiction

outside the United Kingdom.

Joh. Berenberg, Gossler & Co. KG, London Branch

("Berenberg") is authorised and regulated by the German Federal

Financial Supervisory Authority subject to limited regulation by

the Financial Conduct Authority (the "FCA") in the United Kingdom.

Berenberg is acting exclusively for the Company and no one else in

connection with the contents of this Announcement or any other

matters described in this Announcement. Berenberg will not regard

any other person as its client in relation to the content of this

Announcement or any other matters described in this Announcement

and will not be responsible to anyone other than the Company for

providing the protections afforded to its clients or for providing

advice to any other person in relation to the content of this

Announcement or any other matters referred to in this

Announcement.

END

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEMZGMNVDLGZZM

(END) Dow Jones Newswires

July 14, 2022 12:24 ET (16:24 GMT)

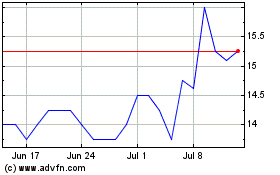

Angle (LSE:AGL)

Historical Stock Chart

From Mar 2024 to May 2024

Angle (LSE:AGL)

Historical Stock Chart

From May 2023 to May 2024