Animalcare Group PLC Equity Raise Post-Transaction Report

05 December 2024 - 8:13PM

RNS Regulatory News

RNS Number : 9618O

Animalcare Group PLC

05 December 2024

Animalcare Group

plc

("Animalcare", the "Company" or the "Group")

Equity Raise Post-Transaction

Report

5

December 2024. In accordance with

the Statement of Principles (November 2022) published by the

Pre-Emption Group, Animalcare Group Plc (AIM: ANCR), the

international animal health business, announces the following post

transaction report in connection with the Company's non-pre-emptive

issue of equity securities, as announced on 3 December

2024.

Terms defined in the fundraise

announcement issued on 3 December 2024 (the 'Fundraise Announcement') have the same

meanings in this announcement unless the context provides

otherwise.

|

Name of Issuer

|

Animalcare Group plc

|

|

Transaction Details

|

The Company issued 8,602,150 new

ordinary shares in total pursuant to the Fundraise, representing

approximately 14.2% of the Company's existing issued ordinary

shares prior to the Fundraise.

Settlement and admission of the

Placing Shares took place at 8.00 am on 5 December 2024.

|

|

Use of Proceeds

|

As set out in the Fundraise

Announcement the proceeds of the Fundraise (net of transaction

costs) will be used to part fund the cash

consideration payable by the Company for the conditional

acquisition of the entire issued share capital of Randlab Pty Ltd,

Randlab Australia Pty Ltd (and its wholly-owned subsidiary, Randlab

(New Zealand) Limited) and Randlab Middle East Veterinary Medicine

Trading Single Owner L.L.C. , a privately-owned Australian-based

equine veterinary business (the "Acquisition"). The Fundraise

will also enable the Company to maintain an appropriate leverage

position that enables Animalcare to continue to invest in its

growth strategy, including future inorganic investment

opportunities.

|

|

Quantum of Proceeds

|

The aggregate gross proceeds from

the Fundraise amounted to approximately £20

million.

|

|

Discount

|

The Issue Price of 232.5 pence

per Placing Share represented a 5.1%

discount to the closing price on 2 December

2024.

|

|

Allocations

|

Soft pre-emption has been adhered to

in the allocations process, where possible. The Company was

involved in the allocations process, which has been carried out in

compliance with the MIFID II Allocation requirements.

|

|

Consultation

|

Stifel and the Company undertook a

pre-launch wall-crossing process, including consultation with

certain major shareholders, to the extent reasonably practicable

and permitted by law.

|

|

Retail

|

Following discussions between Stifel

and the Company, it was decided that a retail offer would not be

included in the Placing. The Placing structure was chosen to

minimise time to completion and complexity.

|

|

For

further enquiries, please contact:

|

|

|

|

|

|

Animalcare Group Plc

|

+44 (0)1904 487 687

|

|

Jenny Winter, Chief Executive

Officer

|

|

|

Chris Brewster, Chief Financial

Officer

Media/investor relations

|

communications@animalcaregroup.com

|

|

Stifel Nicolaus Europe Limited

(Sole and Exclusive M&A Adviser, Sole Bookrunner and

Nominated Adviser)

|

+44 (0) 20 7710 7600

|

|

Ben Maddison

Charles Hoare

Nicholas Harland

Francis North

|

|

Forward Looking Statements

Statements that are not historical

facts, including statements about Animalcare or its management's

beliefs and expectations, are forward-looking statements.

Forward-looking statements, by their nature, involve substantial

risks and uncertainties as they relate to events and depend on

circumstances which will occur in the future and actual results and

developments may differ materially from those expressly stated or

otherwise implied by these statements.

These forward-looking statements are

statements regarding Animalcare's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies and

the industry and markets within which it operates.

These forward-looking statements

relate to the date of this announcement and Animalcare does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

such date.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

ROIGCBDDGBGDGSU

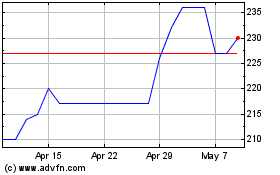

Animalcare (LSE:ANCR)

Historical Stock Chart

From Nov 2024 to Dec 2024

Animalcare (LSE:ANCR)

Historical Stock Chart

From Dec 2023 to Dec 2024