TIDMATM

RNS Number : 9385V

AfriTin Mining Ltd

15 August 2022

15 August 2022

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014 (MAR) as in force in

the United Kingdom and pursuant to the European Union (Withdrawal)

Act 2018. Upon the publication of this announcement via Regulatory

Information Service (RIS), this inside information is now

considered to be in the public domain.

AfriTin Mining Limited

("AfriTin" or the "Company")

Uis Phase 1 Expansion: Construction Completed

AfriTin Mining Limited (AIM: ATM), an African technology-metals

mining company with a portfolio of mining and exploration assets in

Namibia, announces a project update on the expansion of the

processing plant at the Company's flagship polymetallic asset, the

Uis Mine ("Uis").

Highlights:

-- Construction for the Phase 1 Expansion completed;

-- Commissioning scheduled to be complete by the end of September 2022;

-- Production to increase by 67% (up to 1,200 tonnes of tin concentrate per annum);

-- Lithium and tantalum by-product pilot facilities progress to

detailed engineering phase; and

-- REMINDER: Webinar: Unlocking AfriTin's Lithium Opportunity - 18 August 2022 10:00am BST.

Anthony Viljoen (CEO) commented:

"The AfriTin team has demonstrated remarkable resilience in

completing the construction milestone for the Uis Phase 1 Expansion

Project despite challenging market conditions and a difficult

construction environment. We are extremely pleased with the

progress and look forward to completing the production ramp-up.

We aim to achieve a significant increase in revenue and

reduction in unit cost through this expansion. In addition, the

expanded operation will provide an excellent platform for

implementing our lithium and tantalum by-product strategies.

Through our aggressive development programme, we plan to

demonstrate the superior quality and scale of the Uis polymetallic

deposit."

Project Overview

The Uis Phase 1 Expansion Project ("the Project") is targeting

an increase tin concentrate production of up to 67%, (from 720

tonnes per annum to up to 1,200 tonnes per annum). The Project

scope consists of a modular expansion of the current processing

plant, leveraging existing bulk infrastructure services.

Specifically, it involves the expansion of the crushing and

screening circuits ("the dry plant") and construction of a fines

ore stockpile prior to the concentrator. In addition, the Project

addresses potential throughput constraints in the concentrator

("the wet plant") that could have resulted from the increased feed

rate, as well as upgrades to the concentrate cleaning circuit to

enhance tin recovery.

Construction and Commissioning Progress

Construction of the plant expansion circuits is now complete,

allowing the Project to advance to the commissioning stage.

Commissioning of the new circuits is being implemented in two

stages: firstly, the commissioning of the dry plant which has

commenced and will be completed by end of August 2022, and secondly

the commissioning of the wet plant, which is scheduled for the

month of September 2022.

The commissioning process has been designed to minimise

production disruption. There is a requirement to shutdown certain

plant circuits to facilitate tie-ins with the existing plant but

due to stockpiling and flexibility built into the current circuit,

this is not expected to have a material impact on the production

performance of the Company.

Figure 1 : Plant circuit additions (foreground) and the existing

processing plant (background, right)

Production Ramp-up

The plant expansion is projected to increase the nameplate

capacity from 60 tonnes of tin concentrate per month (720 tonnes

per annum) to up to 100 tonnes per month (up to 1,200 tonnes per

annum). Current output is expected to expand progressively over

four months.

Lithium By-product Development

The Company is planning to produce a lithium and tantalum

by-products integrated with existing tin production facilities and

the development of these potential revenue streams is being

fast-tracked.

As such, an infill drilling programme is underway at the main

V1/V2 pegmatite at Uis, to increase the confidence of the existing

lithium and tantalum resource estimates for the deposit. In

addition, projects to construct lithium and tantalum pilot plants

have progressed to the detailed engineering phase. The Company will

provide an update on this development programme in Q4 2022.

Lithium Webinar

The Company will host a webinar host a webinar presentation

titled "Unlocking AfriTin's Lithium Opportunity" on Thursday, 18th

August 2022 at 10:00am BST. Investors can sign up to Investor Meet

Company for free and add to meet AFRITIN MINING LIMITED via:

https://www.investormeetcompany.com/afritin-mining-limited/register-investor

AfriTin Mining Limited +27 (11) 268 6555

Anthony Viljoen, CEO

Nominated Adviser +44 (0) 207 220 1666

WH Ireland Limited

Katy Mitchell/Andrew de Andrade

Corporate Advisor and Joint Broker

H&P Advisory Limited

Andrew Chubb

Jay Ashfield

Nilesh Patel +44 (0) 20 7907 8500

Stifel Nicolaus Europe Limited

Ashton Clanfield

Callum Stewart +44 (0) 20 7710 7600

Tavistock Financial PR (United

Kingdom) +44 (0) 207 920 3150

Jos Simson

Emily Moss

Cath Drummond

About AfriTin Mining Limited

Notes to Editors

AfriTin Mining Limited is a London-listed tech-metals mining

company with a vision to create a portfolio of globally

significant, conflict-free, producing assets. The Company's

flagship asset is the Uis Tin Mine in Namibia, formerly the world's

largest hard-rock open cast tin mine.

AfriTin is managed by an experienced board of directors and

management team with a current strategy to ramp-up production at

the Uis Tin Mine in Namibia to more than 10,000 tonnes of tin

concentrate and 350,000 tonnes of lithium concentrate in a Phase 2

expansion, having reached Phase 1 commercial production in 2020.

The Company strives to capitalise on the solid supply/demand

fundamentals of tin and lithium by developing a critical mass of

resource inventory, achieving production in the near term and

further scaling production by consolidating assets in Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFVATVISLIF

(END) Dow Jones Newswires

August 15, 2022 02:00 ET (06:00 GMT)

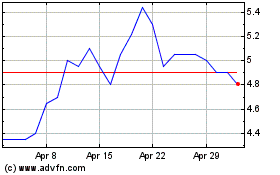

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Andrada Mining (LSE:ATM)

Historical Stock Chart

From Apr 2023 to Apr 2024