Athelney Trust PLC Net Asset Value(s) (3830D)

02 March 2022 - 10:33PM

UK Regulatory

TIDMATY

RNS Number : 3830D

Athelney Trust PLC

02 March 2022

Athelney Trust PLC

Legal Entity Identifier:

213800ON67TJC7F4DL05

The unaudited net asset value of Athelney Trust was 270.1p at 28

February 2022.

Fund Manager's comment for February 2022

Russia's invasion of Ukraine this week rocked financial markets

and it is interesting to note that while Treasury yields plunged

across the entire curve, they recovered swiftly with the yields on

the two-year and 10-year US Treasury notes actually higher today

than they were before the conflict started. This would seem to

indicate that since the United States and Western allies are

unlikely to deploy troops into the Ukraine, resorting instead to

applying sanctions on state-owned financial institutions, high

net-worth Russian individuals as well as Russian sovereign debt,

the Federal Reserve's and other central banker's policy tightening

plans are unlikely to be changed by these geopolitical

developments. While Russian equity prices have collapsed by over

50%, the economic fallout on the global economy is likely to be

minimal. The nominal GDP of the Ukraine was approximately $154

billion and while the Russian economy is significantly larger at

$1.7 trillion, it accounts for less than 2% of global GDP. U.S.

exports to Ukraine and Russia total only $2 billion and $6 billion

respectively and EU exports to the two countries is less than 1% of

the total EU's GDP. The picture is very different in terms of its

inflationary impact since Russian production of crude oil amounts

to 10 million barrels per day or roughly 10% of global oil

production and it is the major supplier of natural gas to many

countries in Western Europe.

For the most part, CPI inflation across the major developed

economies remains elevated due to COVID as evidenced in recent

data. Here in the UK, the January CPI report surprised to the

upside with the Headline CPI edging up to 5.5% year-over-year and

with core CPI at 4.4%. Given this and the now elevated inflationary

expectations, we anticipate further, but gradual Bank of England

tightening with its concomitant impact on asset prices which is to

put pressure on the high PE valuations of the market and growth

stocks in particular. This is evidenced in the MSCI declining by

2.7% during the month, largely driven by similar declines in the

broader US market where the S&P500 index reported an overall

decline of 3.1% and the tech heavy NASDAQ declined by 3.4%. The UK

markets responded similarly with the broad indicator, the FTSE 250

Index closing down by 3.9% over the month as compared to the FTSE

100 which was down by 0.1%. As mentioned previously, the FTSE 100

is home to many larger, older and more traditional companies

including BP, Royal Dutch Shell and various utility companies. The

Fledgling Index was down by 3.8% during the month with the Small

Cap Index declining by 3.9%. Of the various indices, the AIM All

Share Index showed the biggest decline of 5.0%.

During the month we sold our holding in Forterra and increased

our exposure to Paypoint and Fevertree following recent

announcements by these companies. Our portfolio declined by 4.0%

during the month, in line with the overall market. This resulted in

a 4.2% decline in the NAV after providing for the expenses which

remain under strict control. Cash currently comprises 3.9% of the

portfolio at month end.

Fact Sheet

An accompanying fact sheet which includes the information above

as well as wider details on the portfolio can be found on the

Fund's website www.athelneytrust.co.uk under "About" then select

"Latest Monthly Fact Sheet".

Background Information

Dr. Emmanuel (Manny) Pohl AM

Manny is Chairman and Chief Investment Officer of E C Pohl &

Co ("ECP"), an investment management company and has been a major

shareholder in Athelney trust for many years.

E C Pohl & co is licensed by the Australian Financial

services (licence no.421704).

www.ecpohl.com

www.ecpam.com

Manny Pohl and the ECP group has AUD2.7bn (GBP1.5 billion) under

its management including four listed investment companies, three

listed in Australia and one in the UK:

-- Flagship Investments (ASX code:FSI)

AUD95m https://flagshipinvestments.com.au

-- Barrack St Investments (ASX code: BST)

AUD37m www.barrackst.com

-- Global Masters Fund Limited (ASX code: GFL)

AUD33m www.globalmastersfund.com.au

-- Athelney Trust plc (LSE code: ATY)

GBP6m www.athelneytrust.co.uk

Athelney Trust plc Investment Policy

The investment objective of the Trust is to provide shareholders

with prospects of long-term capital growth with the risks inherent

in small cap investment minimised through a spread of holdings in

quality small cap companies that operate in various industries and

sectors. The Fund Manager also considers that it is important to

maintain a progressive dividend record.

The assets of the Trust are allocated predominantly to companies

with either a full listing on the London Stock Exchange or a

trading facility on AIM or ISDX. The assets of the Trust have been

allocated in two main ways: first, to the shares of those companies

which have grown steadily over the years in terms of profits and

dividends but, despite this progress, the market rating is

favourable when compared to future earnings and dividends; second,

to those companies whose shares are standing at a favourable level

compared with the value of land, buildings or cash in the balance

sheet.

Athelney Trust was founded in 1994. In 1996 it was one of the

ten pioneer members of the Alternative Investment Market ("AIM").

In 2008 the shares became fully listed on the main market of the

London Stock Exchange. Athelney Trust has a successful progressive

dividend growth record and the dividend has grown every year since

2004. According to the Association of Investment Companies (AIC)

Athelney Trust is one of only "22 investment companies that have

increased their dividend every year between 10 and 20 years - the

next generation of dividend heroes" (as at 20/03/2018). See

link

https://www.theaic.co.uk/aic/news/press-releases/seven-investment-companies-join-the-next-generation-of-dividend-heroes

Website

www.athelneytrust.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVBBGDXXXGDGDD

(END) Dow Jones Newswires

March 02, 2022 06:33 ET (11:33 GMT)

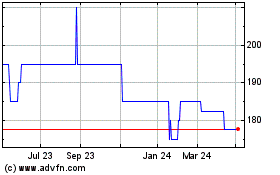

Athelney (LSE:ATY)

Historical Stock Chart

From Apr 2024 to May 2024

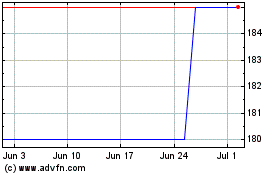

Athelney (LSE:ATY)

Historical Stock Chart

From May 2023 to May 2024