TIDMBATS

RNS Number : 6725R

British American Tobacco PLC

09 March 2021

BRITISH AMERICAN TOBACCO p.l.c.

Annual Report for the Year Ended 31 December 2020

In compliance with Listing Rule 9.6.1, British American Tobacco

p.l.c. (the "Company") reports that its Annual Report 2020

(including the Strategic Report 2020) and Performance Summary 2020

will be shortly submitted to the National Storage Mechanism and

will be available for inspection via the following link:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

The Company's Annual Report 2020 and Performance Summary 2020

have been published to be viewed or downloaded on the British

American Tobacco website at www.bat.com/annualreport .

In addition, in accordance with Section 203.01 of the New York

Stock Exchange Listed Company Manual, the Company announces that

today it filed with the Securities and Exchange Commission an

Annual Report on Form 20-F that included audited financial

statements for the year ended 31 December 2020. The Annual Report

on Form 20-F will be available online at the British American

Tobacco website at www.bat.com/annualreport and also online at

www.sec.gov .

The Annual Report 2020 and other ancillary shareholder documents

will be mailed and made available to shareholders on 17 March 2021.

Investors have the ability to receive a hard copy of BAT's complete

audited financial statements, free of charge, upon request, by

contacting the below:

United Kingdom

British American Tobacco Telephone: +44 20 7511 7797

Publications Email: bat@team365.co.uk

-----------------------------------------

South Africa

The Company's Representative Telephone: +27 21 003 6712

Office

-----------------------------------------

United States

Citibank Shareholder Services Telephone: +1 888 985 2055

(toll-free)

Email: citibank@shareholders-online.com

-----------------------------------------

The Company's Sustainability Report 2020 will be available

online at the British American Tobacco website at www.bat.com.

The Company made its preliminary announcement of its audited

results (which included a condensed set of the Company's financial

statements, extracts of the management report and a Directors'

responsibility statement) in respect of the year ended 31 December

2020 (the "Preliminary Announcement") on 17 February 2021. Further

to the Preliminary Announcement and with reference to the

requirements of Rule 6.3.5 of the Disclosure Guidance and

Transparency Rules, the following disclosures are made in the

Appendices below.

Appendix A to this announcement contains a description of the

Group Principal Risks (page 84 of the Annual Report 2020), Appendix

B is a statement of related party disclosures (page 222 of the

Annual Report 2020) and Appendix C contains the Directors'

responsibility statement (page 140 of the Annual Report 2020).

Together these constitute the material required by Rule 6.3.5 of

the Disclosure Guidance and Transparency Rules to be communicated

to the media in unedited full text through a Regulatory Information

Service. This material is not a substitute for reading the full

Annual Report 2020. Any page numbers and cross-references in the

extracted information below refer to page numbers in the Annual

Report 2020.

P McCrory

Company Secretary

9 March 2021

Enquiries:

Investor Relations

British American Tobacco Investor Relations

Mike Nightingale / Victoria Buxton / William Houston / John

Harney

+44 (0) 20 7845 1180 / 2012 / 1138 / 1263

British American Tobacco Press Office

+44 (0) 20 7845 2888 (24 hours) | @BATplc

APPIX A

GROUP PRINCIPAL RISKS

Overview

The principal risks that may affect the Group are set out on the

following pages.

Each risk is considered in the context of the Group's strategy,

as set out in this Strategic Report on pages 18 and 19. Following a

description of each risk, its potential impact and management by

the Group is summarised. Clear accountability is attached to each

risk through the risk owner.

The Group has identified risks and is actively monitoring and

taking action to manage the risks. This section focuses on those

risks that the Directors believe to be the most important after

assessment of the likelihood and potential impact on the business.

Not all of these risks are within the control of the Group and

other risks besides those listed may affect the Group's

performance. Some risks may be unknown at present. Other risks,

currently regarded as less material, could become material in the

future.

The risks listed in this section and the activities being

undertaken to manage them should

be considered in the context of the Group's internal control

framework. This is described in the section on risk management and

internal control in the corporate governance statement on pages 114

to 115. This section should also be read in the context of the

cautionary statement on page 318.

A summary of all the risk factors (including the principal

risks) which are monitored by the Board through the Group's risk

register is set out in the Additional disclosures section on pages

288 to 306.

Assessment of Group Risk

During the year, the Directors have carried out a robust

assessment of the principal risks and uncertainties facing the

Group, including those that could impact delivery of its strategic

objectives, business model, future performance, solvency or

liquidity.

During the first half of 2020, the Board assessed that it was

appropriate to include COVID-19 as a Group principal risk as

reported in the Half-year Report, however as new working practices

are implemented to reflect the current operating environment and

associated risks are incorporated into existing Group risks, the

Group no longer maintains COVID-19 as a principal risk (please see

Group risk factors, page 294 for further information). The Group's

current principal risks remain broadly unchanged compared to 2019

with regards to marketplace, excise and tax, operations, regulation

and litigation risks, and continue to reflect the challenging

external environment.

The viability statement below provides a broader assessment of

long-term solvency and liquidity. The Directors considered a number

of factors that may affect the resilience of the Group. Except for

the risk 'injury, illness or death in the work place' the Directors

have also assessed the potential impact of the principal risks that

may impact the Group's viability.

Viability Statement

The Board has assessed the viability of the Group taking into

account the current position and principal risks, in accordance

with provision 31 of the 2018 UK Corporate Governance Code. Whilst

the Directors have no reason to believe the Group will not be

viable over a longer period, owing to the inherent uncertainty

arising due to ongoing litigation and regulation, the period over

which the Board considers it possible to form a reasonable

expectation as to the Group's longer-term viability (that it will

be able to continue in operation and meet its liabilities as they

fall due) is three years.

In making this assessment of the Group's prospects, the Board

considered the Group's strong cash generation from operating

activities, access to external sources of financing (and ability to

manage the impact of COVID-19). In doing so, the Directors

recognised the Group's ability to utilise is geographic footprint

and integrated operating model to minimise the impact of the

pandemic on the Group's performance.

This assessment included a robust review of the Group's

operational and financial processes and the principal risks (as

indicated on pages 85 to 88) that may impact the Group's viability.

These are considered, with the mitigating actions, at least once a

year. The assessment included reverse stress test of the core

drivers of the Group's performance to determine the impact of the

risks (individually and in aggregate) whilst recognising that, from

2020, no external financial covenant exists with regards to the

Group's financing facilities. The reverse stress testing did not

identify any individual risk, based upon a prudent annual forecast,

that would, if arising in isolation and without mitigation, impact

the Group's viability within the 3 year confirmation period.

Furthermore, the Board recognised that even if all the principal

risks arose simultaneously, given the underlying strong free cash

flow generation before the payment of dividends (2020: GBP7.3

billion), the Group would be able to undertake mitigating actions

to meet the liabilities as they fall due.

The Board noted that the Group has access to a GBP6 billion

credit facility (2020 undrawn), US (US$4 billion) and Euro (GBP3

billion) commercial paper programmes (2020: GBPnil outstanding) and

GBP3.4 billion of bilateral agreements (2020: undrawn) which may be

utilised to support the Group's ability to operate.

However, the Group is subject to uncertainties with regards to

regulatory change and litigation, which may have a bearing on the

Group's viability. The Group maintains, as referred to in note 27

in the Notes on the Accounts 'Contingent Liabilities and Financial

Commitments,' that the defences of the Group's companies to all the

various claims are meritorious on both law and the facts. If an

adverse judgment is entered against any of the Group's companies in

any case, an appeal may be made, the duration of which can be

reasonably expected to last for a number of years.

Risks

Competition from illicit trade

Increased competition from illicit trade and illegal products -

either local duty evaded, smuggled, counterfeits or non-regulatory

compliant.

Time frame

Short/Long term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Society

Considered in viability statement

Yes

Impact

Erosion of goodwill, with lower volumes and reduced profits.

Reduced ability to take price increases.

Investment in trade marketing and distribution is

undermined.

Counterfeit New Categories products and other illicit products

could harm consumers, damaging goodwill, and/or the category (with

lower volumes and reduced profits), potentially leading to

misplaced claims against BAT and further regulation.

Mitigation activities across all categories

Dedicated Anti-Illicit Trade (AIT) teams operating at global and

country levels; internal cross-functional levels; compliance

procedures, toolkit and best practice shared.

Active engagement with key external stakeholders.

Cross-industry and multi-sector cooperation on a range of AIT

issues.

Global AIT strategy supported by a research programme to further

the understanding of the size and scope of the problem.

AIT Engagement Team (including a dedicated analytical laboratory

and a forensic compliance team) work with enforcement agencies in

pursuit of priority targets.

Tobacco, New Categories and other regulation interrupts growth

strategy

The enactment of regulation that significantly impairs the

Group's ability to communicate, differentiate, market or launch its

products.

Time frame

Medium term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Society

Considered in viability statement

Yes

Impact

Erosion of brand value through commoditisation, the inability to

launch innovations, differentiate products, maintain or build brand

equity and leverage price.

Regulation in respect of menthol, Nicotine levels and New

Categories may adversely impact individual brand portfolios.

Adverse impact on ability to compete within the legitimate

tobacco, nicotine or New Categories industry and with illicit

traders.

Reduced consumer acceptability of new product specifications,

leading to consumers seeking alternatives in illicit markets.

Shocks to share price on the announcement or enactment of

restrictive regulation.

Reduced ability to compete in future product categories and make

new market entries.

Increased scope and severity of compliance regimes in new

regulation leading to higher costs, greater complexity and

potential reputational damage or fines for inadvertent breach.

EU Directive on single-use plastics could result in increased

operational costs and/or adverse impact on sales volume and

profit.

Please refer to pages 307 to 310 for details of tobacco and

nicotine regulatory regimes under which the Group's businesses

operate.

Mitigation activities

Engagement and litigation strategy coordinated and aligned

across the Group to drive a balanced global policy framework for

combustibles and New Categories.

Stakeholder mapping and prioritisation, developing robust

compelling advocacy materials (with supporting evidence and data)

and regulatory engagement programmes.

Regulatory risk assessment of marketing plans to ensure

decisions are informed by an understanding of the potential

regulatory environments.

Advocating the application of integrated regulatory proposals to

governments and public health practitioners based on the harm

reduction principles of New Categories.

Development of an integrated regulatory strategy that spans

conventional combustibles and New Categories.

Training and capability programmes for End Markets to upskill

Legal and External Affairs managers on combustible and New

Categories product knowledge.

Direct access to online portal providing latest position and

advocacy material for End Market engagement on combustibles and New

Categories.

Inability to develop, commercialise and deliver the New

Categories strategy

Risk of not capitalising on the opportunities in developing and

commercialising successful, safe and consumer-appealing

innovations.

Time frame

Long term

Strategic impact

New Categories

Combustibles

Simplification

Key Stakeholders

Consumers

Considered in viability statement

Yes

Impact

Failure to deliver Group strategic imperative, 2025 growth

ambition (previously 2024) and 2030 consumer targets.

Potentially missed opportunities, unrecoverable costs and/or

erosion of brand, with lower volumes and reduced profits.

Reputational damage and recall costs may arise in the event of

defective product design or manufacture.

Loss of market share due to non-compliance of product portfolio

with regulatory requirements.

Mitigation activities

Focus on product stewardship to ensure high-quality standards

across portfolio.

Brand Expression, which sets out how our brand expresses itself

(including through its logo, name, product, packaging etc.)

deployed to lead End Markets via activation workshops and best

practices shared.

Generating sufficient IP to develop competitive and sustainable

products.

Accelerating digital and consumer analytics along with data

management platforms for enhanced methodologies, insight generation

and line of sight across the Group.

R&D is accredited to ISO9001 standard and laboratories are

accredited to ISO17025 for key methods.

Market size reduction and consumer down-trading

The Group is faced with steep excise-led price increases and,

due in part to the continuing difficult economic and regulatory

environment in many countries, market contraction and consumer

down-trading is a risk.

Time frame

Short/Medium term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Consumers

Shareholders

Considered in viability statement

Yes

Impact

Volume decline and portfolio mix erosion leading to lower

profitability.

Funds to invest in growth opportunities are reduced.

Mitigation activities

Geographic spread mitigates impact at Group level.

Close monitoring of portfolio and pricing strategies across

combustibles and New Categories, ensuring balanced portfolio of

strong brands across key segments.

Overlap with many mitigation activities undertaken for other

principal risks facing the Group, such as competition from illicit

trade and significant excise increases or structure changes.

New Category growth and multi category approach.

Litigation

Product liability, regulatory or other significant cases

(including investigations) may be lost or settled resulting in a

material loss or other consequence.

Time frame

Long term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Shareholders

Considered in viability statement

Yes

Impact

Damages and fines, negative impact on reputation, disruption and

loss of focus on the business.

Consolidated results of operations, cash flows and financial

position could be materially affected, in a particular fiscal

quarter or fiscal year, by region or country, by an unfavourable

outcome or settlement of pending or future litigation, criminal

prosecution or other contentious action.

Inability to sell products as a result of patent infringement

action may restrict growth plans and competitiveness.

Mitigation activities

Consistent litigation and patent management strategy across the

Group.

Expertise and legal talent maintained both within the Group and

external partners.

Ongoing monitoring of key legislative and case law developments

related to our business.

Delivery with Integrity compliance programme.

Please refer to note 27 in the Notes on the Accounts for details

of contingent liabilities applicable to the Group.

Significant increases or structural changes in tobacco, nicotine

and New Categories related taxes

The Group is exposed to unexpected and/or significant increases

or structural changes in tobacco, nicotine and New Categories

related taxes in key markets.

Time frame

Long term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Consumers

Society

Considered in viability statement

Yes

Impact

Consumers reject the Group's legitimate tax-paid products for

products from illicit sources or cheaper alternatives.

Reduced legal industry volumes.

Reduced sales volume and/or portfolio erosion.

Partial absorption of excise increases leading to lower

profitability.

Mitigation activities

Formal pricing and excise strategies, including Revenue Growth

Management using a data science-led approach, with annual risk

assessments and contingency plans across all products.

Pricing, excise and trade margin committees in markets, with

global support.

Engagement with relevant local and international authorities

where appropriate, in particular in relation to the increased risk

to excise revenues from higher illicit trade.

Portfolio reviews to ensure appropriate balance and coverage

across price segments.

Monitoring of economic indicators, government revenues and the

political situation.

Foreign exchange rate exposures

The Group faces translational and transactional foreign exchange

(FX) rate exposure for earnings/cash flows from its global

business.

Time frame

Short/Medium term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Shareholders

Considered in viability statement

Yes

Impact

Fluctuations in FX rates of key currencies against sterling

introduce volatility in reported earnings per share (EPS), cash

flow and the balance sheet driven by translation into sterling of

our financial results and these exposures are not normally

hedged.

The dividend may be impacted if the payout ratio is not

adjusted.

Differences in translation between earnings and net debt may

affect key ratios used by credit rating agencies.

Volatility and/or increased costs in our business, due to

transactional FX, may adversely impact financial performance.

Mitigation activities

While translational FX exposure is not hedged, its impact is

identified in results presentations and financial disclosures;

earnings are restated at constant rates for comparability.

Debt and interest are matched to assets and cash flows to

mitigate volatility where possible and economic to do so.

Hedging strategy for transactional FX and framework is defined

in the treasury policy, a global policy approved by the Board.

Illiquid currencies of many markets where hedging is either not

possible or uneconomic are reviewed on a regular basis.

Geopolitical tensions

Geopolitical tensions, civil unrest, economic policy changes,

global health crises, terrorism and organised crime have the

potential to disrupt the Group's business in multiple markets.

Time frame

Medium term

Strategic impact

New Categories

Combustibles

Simplification

Considered in viability statement

Yes

Impact

Potential loss of life, loss of assets and disruption to supply

chains and normal business processes.

Increased costs due to more complex supply chain arrangements

and/or the cost of building new facilities or maintaining

inefficient facilities.

Lower volumes as a result of not being able to trade in a

country.

Higher taxes or other costs of doing business as a foreign

company or the loss of assets as a result of nationalisation.

Mitigation activities

Physical and procedural security controls are in place, and

constantly reviewed in accordance with our Security Risk Management

process, for all field force and supply chain operations, with an

emphasis on the protection of Group employees.

Globally integrated sourcing strategy and contingency sourcing

arrangements.

Security risk modelling, including external risk assessments and

the monitoring of geopolitical and economic policy developments

worldwide.

Insurance cover and business continuity planning, including

scenario planning and testing, and risk awareness training.

Solvency and liquidity

Liquidity (access to cash and sources of finance) is essential

to maintaining the Group as a going concern in the short term

(liquidity) and medium term (solvency).

Time frame

Short/Medium term

Strategic impact

New Categories

Combustibles

Key Stakeholders

Shareholders

Considered in viability statement

Yes

Impact

Inability to fund the business under the current capital

structure resulting in missed strategic opportunities or inability

to respond to threats.

Decline in our creditworthiness and increased funding costs for

the Group.

Requirement to issue equity or seek new sources of capital.

Reputational risk of failure to manage the financial risk

profile of the business, resulting in an erosion of shareholder

value reflected in an underperforming share price.

Mitigation activities

Group policies include a set of financing principles and key

performance indicators including the monitoring of credit ratings,

interest cover, solvency and liquidity with regular reporting

to

Corporate Finance Committee and the Board.

The Group targets an average centrally managed debt maturity of

at least five years with no more than 20% of centrally managed debt

maturing in a single rolling year.

The Group holds a two-tranche revolving credit facility of GBP6

bn syndicated across a wide banking group, consisting of a 364-day

tranche (with two one-year extension options and a one-year

term-out option) and a GBP3 bn five-year tranche (with two one-year

extension options).

Liquidity pooling structures are in place to ensure that there

is maximum mobilisation of cash liquidity within the Group.

Going concern and viability support papers are presented to the

Board on a regular basis.

Injury, illness or death in the workplace

The risk of injury, death or ill health to employees and those

who work with the business is a fundamental concern of the Group

and can have a significant effect on its operations.

Time frame

Short term

Strategic impact

New Categories

Combustibles

Simplification

Key Stakeholders

Employees

Considered in viability statement

No

Impact

Serious injuries, ill health, disability or loss of life

suffered by employees and the people who work with the Group.

Exposure to civil and criminal liability and the risk of

prosecution from enforcement bodies and the cost of associated

legal costs, fines and/or penalties.

Interruption of Group operations if issues are not addressed

immediately.

High staff turnover or difficulty recruiting employees if

perceived to have a poor Environment, Health and Safety (EHS)

record.

Reputational damage to the Group.

Mitigation activities

Risk control systems in place to ensure equipment and

infrastructure are provided and maintained.

EHS strategy aims to ensure that employees at all levels receive

appropriate EHS training and information.

Behavioural-based safety programme to drive operations' safety

performance, culture and closer to zero accidents.

Analysis of incidents undertaken regionally and globally by a

dedicated team to identify increasing incident trends or high

potential risks that require coordinated action.

Disputed taxes, interest and penalties

The Group may face significant financial penalties, including

the payment of interest, in the event of an unfavourable ruling by

a tax authority in a disputed area.

Time frame

Short/Medium term

Strategic impact

New Categories

Combustibles

Simplification

Key Stakeholders

Shareholders

Considered in viability statement

Yes

Impact

Significant fines and potential legal penalties.

Disruption and loss of focus on the business due to diversion of

management time.

Impact on profit and dividend.

Mitigation activities

End market tax committees.

Internal tax function provides dedicated advice and guidance,

and external advice sought where needed.

Engagement with tax authorities at Group, regional and

individual market level.

Please refer to note 27 in the Notes on the Accounts for details

of contingent liabilities applicable to the Group.

APPIX B

RELATED PARTY DISCLOSURES

The Group has a number of transactions and relationships with

related parties, as defined in IAS 24 Related Party Disclosures,

all of which are undertaken in the normal course of business.

Transactions with CTBAT International Limited (a joint operation)

are not included in these disclosures as the results are immaterial

to the Group.

Transactions and balances with associates relate mainly to the

sale and purchase of cigarettes and tobacco leaf. The Group's share

of dividends from associates, included in other net income in the

table below, was GBP394 million (2019: GBP239 million; 2018: GBP211

million).

2020 2019 2018

GBPm GBP m GBPm

==================================== ================ =========================

T ransactions

511 473 (79)

- revenue 495 (101)

- pu r chases (80) 248 216

- other net income 388 42 26 (2) (1)

Amount s receivable at 31 December 33

Amount s payable at 31 December (5)

==================================== ================ =========================

During 2020, the Group made a capital contribution in Brascuba

Cigarrillos S.A. at a cost of GBP17 million (2019: GBP20 million)

and increased its ownership of FE "Samfruit" JSC to 38.63% for GBP5

million.

During 2020, there was a capital reduction in CTBAT

International Limited of approximately US$171 million with funds

due to be remitted prorate to investors in 2021.

During 2019, the Group acquired 60% of VapeWild Holdings LLC and

a minority stake in AYR Limited.

During 2018, the Group acquired a further 44% interest in

British American Tobacco Myanmar Limited and a further 11% interest

in British American Tobacco Vranje.

The key management personnel of British American Tobacco consist

of the members of the Board of Directors of British American

Tobacco p.l.c. and the members of the Management Board. No such

person had any material interest during the year in a contract of

significance (other than a service contract) with the Company or

any subsidiary company. The term key management personnel in this

context includes their close family members.

2020 201 9 2018

GBPm GBP m GBPm

=================================================== ===== =====================

Th e total compensation for key management

personnel, including Directors, was:

- salaries and other short-term employee benefits 17 2 6 21

- post-employment benefits 2 4 4

- share-based payments 13 23 18

=================================================== ===== =====================

32 53 43

=================================================== ===== =====================

The following table, which is not part of IAS24 disclosures,

shows the aggregate emoluments of the Directors of the Company.

Executive Directors Chairman Non-Executive Directors Total

2020 201 9 2018 2020 201 9 2018 2020 201 9 2018 2020 201 9 2018

GBP'000 GBP'00 0 GBP'000 GBP'00 0 GBP'000 GBP'00 0 GBP'000 GBP'000 GBP'00 0

GBP'000 GBP'000 GBP'000

==================== ============ ================= =========== ================= ============ ===================== ============ ================

Sala r y ;

fees; benefits;

incentives

- sala ry 2,026 2,356 2,211 - - - - - 2,026 2,356 2,211

- fees - - 714 6 95 680 1,028 969 1,092 1,742 1, 664 1,772

- taxable benefits 744 608 427 77 1 37 116 72 310 303 893 1,055 846

- short-term

incentives 3,274 4,791 5,031 - - - - - - - 3,274 4, 791 5,031

- long-term

incentives 1,294 4,4 20 5,300 - - - - 1,294 4,420 5,300

==================== ============ ================= =========== ================= ============ ===================== ============ ================

Sub-total 7,338 12, 175 12,969 791 832 796 1,100 1,2 79 1,395 9,229 14,286 15,160

==================== ============ ================= =========== ================= ============ ===================== ============ ================

Pension ; other

emoluments

- pension

- other emoluments 304 6 86 921 - - - - - - 304 6 86 921

20 47 50 - - - - - - 20 47 50

==================== ============ ================= =========== ================= ============ ===================== ============ ================

Sub-total 324 733 971 - - - - - - 324 733 971

==================== ============ ================= =========== ================= ============ ===================== ============ ================

T ota l emoluments 7,662 1 2,908 13,940 791 832 796 1,100 1,2 79 1,395 9,553 15,019 16,131

==================== ============ ================= =========== ================= ============ ===================== ============ ================

Aggregat e gains on L TIP shares

exe r cised in the year

================================= ============================================================================

Pric Aggregate

Exe r e per gain

cised share

A war d date L TI P Exe r cis (GBP) (GBP)

shares e date

================================= ======================= =========== ============ ========== ============

Jack Bowles 2 7 Mar 2017 18,497 06 Apr 2020 29.62 547,881

08 June

Tadeu Marroco 2 7 Mar 2017 14,755 2020 31.23 460,799

================================= ======================= =========== ============ ========== ============

LTIP - Value of awards 2017

============================ =====================================

Pric Face

e per Value

share

Shares (GBP)(1) (GBP)

============================ =========== ========== ==========

Jack Bowles 26,463 52.11 1,378,987

Tadeu Marroco 21,109 52.11 1,099,990

============================== =========== ========== ==========

1. For information only as awards are made as nil cost options.

Sharesave- Aggregate Gains

2020

============================== ======================================================================================

Price Aggregate

per share gain

A war d date Shares Exercise (GBP) (GBP)

date

============================== ======================== ====== ===================== ========== =================

Tadeu Marroco 2 3 March 2015 495 09 June 2020 30.26 0

Sharesave- Value of award 2015

============================== ======================================================================================

Price Face

per share Value

Shares (GBP) (GBP)

============================== ======================== ====== ===================== ========== =================

Tadeu Marroco 495 30.26 14.979

APPIX C

DIRECTORS' RESPONSIBILITY STATEMENT

The responsibility statement set out below is solely for the

purpose of complying with Disclosure Guidance and Transparency Rule

6.3.5R. This statement relates to and is extracted from the 2020

Annual Report. Responsibility is for the full 2020 Annual Report

and not the extracted information presented in this announcement

and the Preliminary Announcement. We confirm that to the best of

our knowledge:

-- the financial statements, prepared in accordance with the

applicable set of accounting standards, give a true and fair view

of the assets, liabilities, financial position and profit or loss

of the Company and the undertakings included in the consolidation

taken as a whole; and

-- the Strategic Report and the Directors' Report include a fair

review of the development and performance of the business and the

position of the Company and the undertakings included in the

consolidation taken as a whole, together with a description of the

principal risks and uncertainties that they face.

Forward looking statements

This announcement contains certain forward-looking statements,

including "forward-looking" statements made within the meaning of

U.S. Private Securities Litigation Reform Act 1995. These

statements are often, but not always, made through the use of words

or phrases such as "believe," "anticipate," "could," "may,"

"would," "should," "intend," "plan," "potential," "predict,"

"will," "expect," "estimate," "project," "positioned," "strategy,"

"outlook", "target" and similar expressions. These include

statements regarding our intentions, beliefs or current

expectations concerning, amongst other things, our results of

operations, financial condition, liquidity, prospects, growth,

strategies and the economic and business circumstances occurring

from time to time in the countries and markets in which the Group

operates, including the projected future financial and operating

impacts of the COVID-19 pandemic.

All such forward-looking statements involve estimates and

assumptions that are subject to risks, uncertainties and other

factors. It is believed that the expectations reflected in this

announcement are reasonable but they may be affected by a wide

range of variables that could cause actual results to differ

materially from those currently anticipated. Among the key factors

that could cause actual results to differ materially from those

projected in the forward-looking statements are uncertainties

related to the following: the impact of competition from illicit

trade; the impact of adverse domestic or international legislation

and regulation; the inability to develop, commercialise and deliver

the Group's New Categories strategy; the impact of market size

reduction and consumer down-trading; adverse litigation and dispute

outcomes and the effect of such outcomes on the Group's financial

condition; the impact of significant increases or structural

changes in tobacco, nicotine and New Categories related taxes;

translational and transactional foreign exchange rate exposure;

changes or differences in domestic or international economic or

political conditions; the ability to maintain credit ratings and to

fund the business under the current capital structure; the impact

of serious injury, illness or death in the

workplace; adverse decisions by domestic or international

regulatory bodies; and changes in the market position, businesses,

financial condition, results of operations or prospects of the

Group.

It is believed that the expectations reflected in this

announcement are reasonable but they may be

affected by a wide range of variables that could cause actual

results to differ materially from those

currently anticipated. Past performance is no guide to future

performance and persons needing advice should consult an

independent financial adviser. The forward-looking statements

reflect knowledge and information available at the date of

preparation of this announcement and the Group undertakes no

obligation to update or revise these forward-looking statements,

whether as a result of new information, future events or otherwise.

Readers are cautioned not to place undue reliance on such

forward-looking statements.

No statement in this communication is intended to be a profit

forecast and no statement in this communication should be

interpreted to mean that earnings per share of BAT for the current

or future financial years would necessarily match or exceed the

historical published earnings per share of BAT.

Additional information concerning these and other factors can be

found in the Company's filings with the U.S. Securities and

Exchange Commission ("SEC"), including the Annual Report on Form

20-F filed on 9 March 2021 and Current Reports on Form 6-K, which

may be obtained free of charge at the SEC's website,

http://www.sec.gov, and the Company's Annual Reports, which may be

obtained free of charge from the British American Tobacco website

www.bat.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSDKCBBNBKDDNK

(END) Dow Jones Newswires

March 09, 2021 09:00 ET (14:00 GMT)

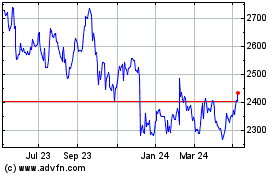

British American Tobacco (LSE:BATS)

Historical Stock Chart

From Mar 2024 to May 2024

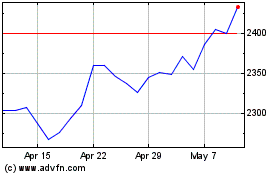

British American Tobacco (LSE:BATS)

Historical Stock Chart

From May 2023 to May 2024