TIDMBBB

RNS Number : 9055W

Bigblu Broadband PLC

16 December 2019

Bigblu Broadband plc

("BBB" or the "Company" or the "Group")

Refinancing of Existing Debt Facilities

Significant Reduction in Cost of Debt and Net Interest

Payments

Increased Value for Shareholders by Enhancing Free Cash Flow and

Increasing EPS

Bigblu Broadband plc (AIM: BBB.L), a leading provider of

alternative fast broadband services, has agreed a new GBP30m

revolving credit facility with Santander Bank UK plc. This will be

used to replace the two tranches of loan notes totalling GBP12m

issued in 2016 by Business Growth Fund ("BGF") (the "Loan Notes")

and the Group's GBP10m revolving credit facility with HSBC plc (the

"HSBC Facility") and to provide additional working capital to

support the Group.

The Company also announces that HSBC will continue to provide a

GBP4m revolving credit facility and operational banking support to

the Group's UK fixed wireless subsidiary QCL Holdings Limited

("QCL").

This provides the Group with combined facilities of GBP34m with

Santander and HSBC.

The facility with Santander is a 3-year loan agreement with an

option to extend for up to a further 2 years. Interest terms are on

a ratchet to LIBOR according to the Group's net leverage ratio.

This replaces, in its entirety, the BGF Loan Notes which bore

interest at a fixed coupon, and the HSBC Facility which had an

interest charge at a margin related to LIBOR. As a result, there

will be a significant reduction in the Group's annual cost of debt

and net interest payments. Further details on the BGF Loan Notes

and HSBC Facility are included at the end of the announcement.

BGF continues to own 4.5m shares in BBB. As part of BGF's

initial subscription for the Loan Notes in 2016, BGF had options

over 4.9m ordinary shares at an exercise price of 112.5p, expiring

August 2021, and a GBP2.4m convertible Loan Note convertible at an

exercise price of 135p per share. As part of the refinancing, BBB

has agreed to extend the 4.9m options to May 2024 and granted BGF

an additional 1.8m options at an exercise price of 135p expiring

May 2024 to replace the conversion rights within the GBP2.4m

convertible Loan Note which is being redeemed in full. This is

beneficial to the Company as the redemption premium would otherwise

have been payable immediately on early redemption.

BGF has also agreed to defer the repayment of the GBP5.5m

redemption premium on the Loan Notes from May 2021 to May 2024 to

align with the options above.

Impact of Refinance

The Board is pleased to announce a number of key benefits as a

result of the agreement with Santander, which effectively enables

it to re-finance debt with a coupon of 10% with a more flexible

revolving credit facility with a margin of only 3-4%.

As such, the refinancing of existing debt facilities will

support the Group for the next stage of its growth strategy and

will:

-- reduce the Group's cost of debt;

-- provide additional funding headroom to support accelerated growth;

-- provide a simplified capital and covenant structure;

-- defer amortising principal repayments under the BGF Loan

Notes and HSBC Facility which will enhance cash flow; and

-- improve our free cash flow and increase our EPS via reduced

finance charges, which the Directors believe will increase value

for shareholders.

Andrew Walwyn, CEO of BBB plc, said: "I am delighted an

institution such as Santander has recognised the progress BBB has

made and the strong position the Company is in. Being able to

secure such attractive funding to supplement our increasingly cash

generative business immediately following a successful FY19

financial year positions us well to continue our ambitious growth

plans in FY20 and shows how robust the business model we are

building has already become.

"We are delighted that the increasing maturity of our organic

growth model has enabled us to attract such good terms, which puts

us on an even stronger footing to execute our strategy while

increasing value for shareholders. We wish to thank BGF and HSBC

for their ongoing support of the Group and look forward to

continuing our strong relationship going forward."

Sean Longsdale, Managing Director, Structured Finance Group,

Santander Corporate & Commercial, said: "BBB plc has an

excellent track record and is well-placed to benefit from continued

improvements in satellite and fixed wireless technology. We are

delighted that Santander was chosen as a banking partner and to be

supporting such a high growth international business, to realise

their continued ambitions."

Bigblu Broadband plc www.bbb-plc.com

Andrew Walwyn, Chief Executive Via Walbrook PR

Officer

Frank Waters, Chief Financial Officer

Simon Clifton, Chief Technology

Officer

Dominic Del Mar, Corporate Development

Numis Securities (Nomad and broker) Tel: +44 (0)20 7260 1000

Oliver Hardy (Corporate Advisory)

James Black (Corporate Broking)

Walbrook (Media and Investor Relations) Tel: +44 (0)20 7933 8780

Nick Rome/Tom Cooper or bigblubroadband@walbrookpr.com

Previous debt facilities

BGF

BBB entered into funding agreement with BGF in July 2016

pursuant to which BGF provided a total investment of GBP12.0

million by way of a subscription for unsecured loan notes,

comprising GBP9.6 million ordinary notes and GBP2.4 million

convertible notes (convertible at 135p per ordinary share).

The ordinary notes and convertible notes carry a fixed coupon of

10% per annum, with interest payable quarterly in arrears, and are

repayable from May 2021 with bi-annual principal repayments which

end on maturity at 31 May 2024.

A redemption premium of GBP5.5m is also payable on 31 May

2021.

BBB also agreed to grant BGF an option to subscribe for

4,934,661 new ordinary shares exercisable at 112.5p per share at

any time, with proceeds of GBP5.5m to offset the redemption premium

payable. The option lapses on whichever is the earlier of 31 August

2021, redemption of the loan note, or completion of a change of

control.

BBB has the ability to repay both sets of Loan Notes early with

the prior consent of BGF, but subject to an early redemption

payment equivalent to 12 months' interest.

BBB has given various covenants to BGF regarding the conduct of

its business, typical of those required by lenders to growth

companies.

Upon completion of the refinancing, the BGF Loan Notes are to be

repaid in full.

HSBC - BBB facility

In March 2017, BBB secured a GBP5.0m HSBC revolving credit

facility. This was subsequently extended to GBP8.25m in April 2018

and again to GBP10.0m in August 2019, in order to support continued

growth.

As at November 2019 the total utilisation on the facility was

GBP8.25m, which has been drawn for both acquisitions and working

capital.

Upon refinancing this facility is to be repaid in full, and

security over Group subsidiaries will be discharged.

New facility - Santander RCF

A new GBP30m revolving credit facility (RCF) for an initial

3-year term, extendable by 1 year on up to two occasions (at the

option of BBB).

There are no annual clean down payments required.

Interest margin on LIBOR ratchets according to prior quarter's

net leverage ratio (Net Debt / LTM EBITDA), and the cost of debt is

therefore expected to reduce as net debt decreases over the term of

the loan.

The facility includes customary covenants, including:

-- Net Leverage (Net Debt / 12m EBITDA)

-- Interest cover

-- Capex control linked to budgets

The Security on the facility will entail cross-guarantees from

material Group companies, although QCL and its subsidiaries are

carved out and not regarded as a Borrower or part of the Group for

the loan purposes.

Santander will also acquire first ranking security (share

pledge) over BBB's shares in QCL.

Refinancing highlights

BGF have granted consent to the refinancing of the GBP12m in

principal Loan Notes on the following terms:

-- Deferral of the GBP5.5m redemption premium previously due at

the earlier of redemption of the notes or May-21, but now deferred

until May-24.

-- Preservation and extension of the existing share options over

4.9m shares at 112.5p from current expiry date of Aug-21 to May-24,

therefore keeping them aligned to the redemption premium with the

expectation of a cashless settlement of the redemption premium in

shares.

-- Issuance of new options as replacement for the convertible

loan note of GBP2.4m to be redeemed, on the same terms as the

original loan conversion of 1.8m shares at 135p.

The initial refinancing drawdown of c. GBP22.9m includes

repayment of the BGF and HSBC principal, the BGF early redemption

charge, fees and working capital.

When compared against the previous BGF Loan Notes and HSBC

Facility, over the five-year period to 2024 the refinancing is

expected to result in estimated total net cash benefit of c. GBP14m

to the Group arising from:

o c. GBP2.0m cash savings due to the lower interest margin;

and

o GBP12m arising from deferral of the scheduled BGF principle

repayments to May-24.

The current P&L interest charge includes BGF interest rate

of 10% on the GBP12m Loan Notes, the effective interest charge for

the of the GBP5.5m redemption premium over the life of the

instrument (July 2016 to May 2024) and the HSBC facility finance

charges. The Santander RCF reflects a lower and simpler variable

interest margin over LIBOR (which depends on the Group's net

leverage ratio). This is expected to result in finance savings of

c. GBP2.0m over the five-year period to FY24.

Group headroom immediately post-refinancing equals c. GBP13.1m,

being c. GBP7.1m unused Santander RCF and c. GBP6m cash. This

reflects an immediate headroom increase of GBP5.35m against the

current headroom of GBP1.75m on the HSBC Facility.

Quickline is carved out and will maintain its existing GBP4m RCF

facility with HSBC, which has a separate and distinct security

package.

About Bigblu Broadband plc

Bigblu Broadband plc (AIM: BBB), is a leading provider of

alternative super-fast satellite and xed wireless broadband

solutions for consumers and businesses unserved or underserved by

bre broadband throughout Europe and Australia.

BBB has a signi cant target market with 27m customers in Europe

with speeds of under 4 Mbps, and a further 1m in Australia who have

been identi ed as only suitable for either satellite or xed

wireless broadband. Acquisitive and organic growth have enabled BBB

to grow rapidly since inception in 2008 during which me BBB has

completed 20 acquisitions across nine di erent countries. It is

well positioned to continue growing as it targets customers that

are trapped in the 'digital divide' with limited or no bre

broadband options.

BBB's range of solutions includes satellite, next generation xed

wireless and 4G/5G, delivering between 30 Mbps and 300 Mbps for

consumers, and up to 1 Gbps for businesses. It provides customers

with ongoing services from hardware installation and billing to

post-sale customer support, whilst o ering various tari s depending

on end user requirements.

Importantly, as core technologies evolve and cheaper capacity is

made available, BBB will continue to o er ever increasing speeds

and higher data throughputs to satisfy market demands including

'video-on-demand'. BBB's alternative broadband o erings present a

customer experience that is similar to that o ered by wired

broadband and the connection can be shared in the normal way with

PCs, tablets and smart-phones via a normal wired or wireless

router. High levels of recurring revenue, increasing economies of

scale and Government support for the alternative broadband market

in many countries provides a solid foundation for BBB as demand for

alternative super-fast broadband services increases around the

world.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCEAFASFENNFAF

(END) Dow Jones Newswires

December 16, 2019 02:00 ET (07:00 GMT)

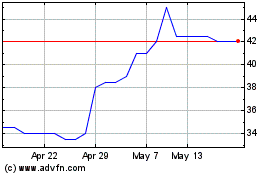

Bigblu Broadband (LSE:BBB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Bigblu Broadband (LSE:BBB)

Historical Stock Chart

From Apr 2023 to Apr 2024