- 2% revenue growth1 in Q3 2023-2024

- Continuing growth by Avanquest (+8%) and myDevices

(+18%)

- EBITDA margin2 target for FY 2023-2024 maintained at around

10%

This press release presents unaudited Group

consolidated revenue, prepared in accordance with IFRS.

Regulatory News:

Claranova (Paris:CLA):

Revenue trends by division for Q3 2023-2024:

In €m

Dec. 2023

Jan. to Mar. 2024 (3

months)

Dec. 2022

Jan. to Mar. 2023 (3

months)

Change

Change at constant exchange

rates

Change at constant consolidation

scope

Change at constant scope and

exchange rates

PlanetArt

61

60

2%

-2%

2%

-2%

Avanquest

31

29

7%

8%

7%

8%

myDevices

2

2

18%

18%

18%

18%

Revenue

94

91

4%

2%

4%

2%

Revenue trends by division for the first nine months of

FY 2023-2024:

In €m

Jul. 2023

to Mar. 2024

(9 months)

Jul. 2022

to Mar. 2023

(9 months)

Change

Change at constant exchange

rates

Change at constant consolidation

scope

Change at constant scope and

exchange rates

PlanetArt

296

314

-6%

-3%

-6%

-3%

Avanquest

92

86

7%

12%

7%

12%

myDevices

7

5

48%

54%

48%

54%

Revenue

395

405

-2%

1%

-2%

1%

Eric Gareau, CEO of Claranova commented: "Claranova's

recovery remains on track with growth in revenue of 2% in the third

quarter. This positive momentum reflected strong performances by

Avanquest and myDevices, while PlanetArt continued to improve the

effectiveness of its marketing investments. By continuing to focus

on profitability, we expect to achieve our target for the EBITDA

margin of around 10% for FY 2023-2024. Claranova is now entering a

new chapter in its development. After renewing its governance and

management, and rescheduling the maturity of its debt, Claranova is

now well positioned to seize profitable growth opportunities and

create value for its shareholders, priorities that will be the key

focus of the new strategic plan to be unveiled in the coming

months."

PlanetArt: a new path for virtuous and profitable

growth

PlanetArt, the Group's the personalized e-commerce division,

reported Q3 revenue of €61m, down -2% (up +2% at actual exchange

rates), bringing total revenue for the first 9 months to €296m (-3%

at constant exchange rates and -6% at actual exchange rates). In

line with the Group's strategy, its teams continued their efforts

to improve the return on marketing investments.

Avanquest: a mature business model delivering an excellent

performance

Continuing the trend of the first half, Avanquest's quarterly

sales rose 8% to €31m (+7% at actual exchange rates). For the first

nine months, the software publishing division reported revenue of

€92m, up from €86m year on year, representing growth of 12% (+7% at

actual exchange rates).

On that basis, core activities which now account for 90% of the

division's sales (vs. 82% one year earlier) and consist of sales of

proprietary SaaS software, all registered growth over the period3

and notably + 38% for Adaware, +6% for Soda PDF software and +4%

for InPixio. This means that non-core activities now account for

only 10% of sales, or €9m at the end of March, 2024, down 43% over

the period.

myDevices: on course for profitability with a continuing

expanded range of solutions

myDevices, the Group's IoT division, reported Q3 sales of €2m,

up 18% (+18% at actual exchange rates) year-on-year. This

performance has benefited from revenue generated by deployments

with partner companies. As a result, for the first nine months,

revenue rose 54% to €7m (+48% at actual exchange rates).

At the end of March, 2024, myDevices had 210 partners and €3.4m

in annual recurring revenue (ARR), an increase of 10% (+5% at

actual exchange rates) from the first nine months of FY

2022-2023.

Financial calendar: August 1, 2024: FY

2023-2024 revenue October 30, 2024: FY 2023-2024 results

About Claranova:

As a diversified global technology company, Claranova manages

and coordinates a portfolio of majority interests in digital

companies with strong growth potential. Supported by a team

combining several decades of experience in the world of technology,

Claranova has acquired a unique know-how in successfully turning

around, creating and developing innovative companies.

Claranova has proven its capacity to turn a simple idea into a

worldwide success in just a few short years. Present in 15

countries and leveraging the technology expertise of its 800+

employees across North America and Europe, Claranova is a truly

international group, with 95% of its revenue derived from

international markets.

Claranova’s portfolio of companies is organized into three

unique technology platforms operating in all major digital sectors.

As an e-commerce leader in personalized objects, Claranova also

stands out for its technological expertise in software publishing

and the Internet of Things, through its businesses PlanetArt,

Avanquest and myDevices. These three technology platforms share a

common vision: empowering people through innovation by providing

simple and intuitive digital solutions that facilitate everyday

access to the very best of technology.

For more information on Claranova Group:

https://www.claranova.com

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

1 Change at constant scope and exchange rates

2 EBITDA as a percentage of revenue.

3 At constant exchange rates

CODES Ticker: CLA ISIN: FR0013426004

www.claranova.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507741390/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 68

ir@claranova.com

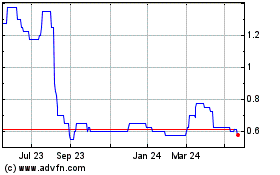

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Dec 2024 to Jan 2025

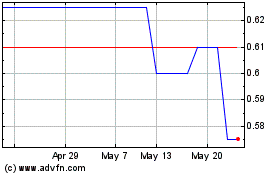

Celsius Resources (LSE:CLA)

Historical Stock Chart

From Jan 2024 to Jan 2025