TIDMCLDN

RNS Number : 1678S

Caledonia Investments PLC

19 December 2016

CALEDONIA INVESTMENTS PLC

SALE OF INVESTMENT IN PARK HOLIDAYS UK

Caledonia Investments plc ("Caledonia") is pleased to announce

that it has agreed terms for the sale of Park Holidays UK ("Park

Holidays"), the UK's third largest holiday park operator, to Tiger

Bidco Limited, a special purpose vehicle incorporated by

Intermediate Capital Group plc ("ICG"), for a headline enterprise

value of GBP362m. Caledonia will receive GBP197m in cash, net of

fees, for the sale of its 81.5% fully diluted equity stake. The net

proceeds will be held on deposit for future investment.

The net proceeds represent a premium of 47% to Caledonia's

carrying value of Park Holidays at 30 September 2016 of GBP134m and

are in addition to GBP41m of cumulative distributions that the

Caledonia group has received from Park Holidays since it acquired

the business in 2013. Overall, Caledonia will have realised a net

IRR of 44% and a money multiple of 2.9x from its investment in Park

Holidays.

Park Holidays was originally acquired by Caledonia in November

2013 for a headline valuation of GBP172m. At that time, Caledonia

backed Park Holidays' incumbent senior management team of Jeff

Sills (Chief Executive), Al Loch (Chief Financial Officer), Tony

Clish (Commercial Director) and Adrian Fawcett (non-executive

Chairman), all of whom will remain in place following the sale to

ICG.

Under Caledonia's ownership, Park Holidays accelerated capital

investment across the estate driving further revenue growth in

addition to increasing the number of parks it operates from 23 to

26. These actions supported strong growth in profitability with

EBITDA expected to be up 79% from GBP20.4m (for the year ended 31

December 2012) to an estimated GBP36.5m (for the year ending 31

December 2016).

Completion of the transaction is conditional on the approval of

the Financial Conduct Authority which could take up to three

months.

Commenting on the sale, Duncan Johnson, Caledonia's Head of

Unquoted Investments, said:

"Caledonia's unquoted strategy is to invest in leading

businesses which combine an ability to grow profits whilst also

paying a healthy annual cash return to shareholders. Park Holidays

has delivered in every respect and we congratulate Jeff Sills and

his team, as well as the company's Chairman, Adrian Fawcett, for

their stewardship of the business over the past three years. We

wish them and the business every success in the future."

Jeff Sills, Chief Executive Officer of Park Holidays,

commented:

"We were attracted to Caledonia because of its unique investment

model. Caledonia has proved to have been a very supportive

financial partner over the past three years, which has enabled us

both to acquire new sites and improve the quality of our existing

estate. We look forward to continuing to deliver good returns for

our new investor."

Will Wyatt, Chief Executive of Caledonia, stated:

"Park Holidays has been an outstanding investment for Caledonia

and we are delighted with the progress it has made since we became

involved in 2013. It exemplifies our ability to find and attract

capable management teams and I am delighted that the outcome has

been so successful for both us and Jeff Sills and his

colleagues."

19 December 2016

For further information contact:

Caledonia Investments

plc

Will Wyatt,

Chief Executive +44 20 7802 8080

Duncan Johnson,

Head of Unquoted

Investments

Media contact:

Tulchan Communications

Peter Hewer +44 20 7353 4200

This announcement contains inside information relating to

Caledonia.

END

Notes for editors:

Caledonia Investments plc

Caledonia is a self-managed investment trust company listed on

the London Stock Exchange with net assets of approximately GBP1.7bn

as at 30 November 2016. The company maintains a concentrated

portfolio of international quoted, unquoted and fund investments

and has paid an increasing annual dividend for 49 years.

In the unquoted arena, Caledonia seeks to invest GBP25m to

GBP100m in private companies either on a majority or minority

basis, providing a meaningful presence and growth capital

supporting double-digit operating margins. In addition to Park

Holidays, its current unquoted portfolio includes Cobehold (a

European unquoted investment house), Gala Bingo (the UK market

leading retail bingo operator), Seven Investment Management (a

provider of discretionary fund management, asset management and

self-invest platform services), The Liberation Group (the market

leading Channel Islands pub, restaurants and drinks business), The

Sloane Club (a London residential club) and Choice Care Group (a UK

learning disability care homes provider).

For additional information on Caledonia, please visit

www.caledonia.com.

Park Holidays

Park Holidays was originally established in 1985 under the name

Cinque Ports Leisure Limited by Peter Bull and Jim Watson and

subsequently sold in 2006 to a management buy-in led by Jeff Sills,

Al Loch and Tony Clish. The business was rebranded Park Holidays UK

in 2007.

Park Holidays' portfolio currently has a total of c. 10,000

developed caravan pitches, 76% of which are owner occupied and 14%

of which are hired out to holiday makers on a short term basis.

For additional information on Park Holidays, please visit

www.parkholidays.com.

Transaction

The sale of Park Holidays was led by Andy Powell and Tim Lewis

for Caledonia.

PricewaterhouseCoopers (Rick Jones) provided corporate finance

advice to Caledonia, with legal advice provided by Macfarlanes

(Stephen Drewitt), vendor financial due diligence by KPMG (Barry

Carter) and vendor commercial due diligence by CIL (Alex Marshall).

Management was advised by Wyvern Partners (Martin Kitkatt) and DWF

(Mark Gibson).

Neither the contents of Caledonia's or Park Holidays' websites,

nor the contents of any website accessible from hyperlinks on such

websites (or any other website) is incorporated into, or forms part

of, this announcement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISLVLFFQLFEFBF

(END) Dow Jones Newswires

December 19, 2016 02:00 ET (07:00 GMT)

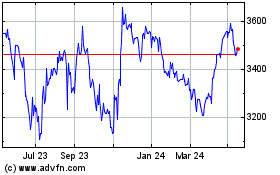

Caledonia Investments (LSE:CLDN)

Historical Stock Chart

From Dec 2024 to Jan 2025

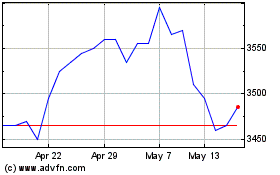

Caledonia Investments (LSE:CLDN)

Historical Stock Chart

From Jan 2024 to Jan 2025