TIDMCLI

RNS Number : 0301H

CLS Holdings PLC

14 May 2014

Release date: 14 May 2014

Embargoed until: 07:00

CLS Holdings plc

("CLS", the "Company" or the "Group")

Interim Management Statement for the period 1 January 2014 to 13

May 2014

The Group announces its Interim Management Statement for the

period 1 January 2014 to 13 May 2014.

HIGHLIGHTS

-- Disposal of Cambridge House, Hammersmith for GBP29.5 million,

32% above the 31 December 2013 external valuation and 65% above

that of 30 June 2013

-- Occupational demand remains firm:

o Overall Group vacancy level down to 3.5% (31 December 2013:

4.4%)

o Vacancy rate in France reduced to 7.3% (31 December 2013:

10.6%)

o Vacancy rate in Germany reduced to 1.6% (31 December 2013:

3.5%)

-- Annual contracted rent currently running at GBP84.2 million,

20% above the same time last year

-- New leases, lease renewals and extensions completed on 9,616 sqm

-- Weighted average cost of debt remains low at 3.80% (31 December 2013: 3.64%)

-- Spring Mews, Vauxhall SE11

o 20,800 sqm mixed-use development on schedule for completion Q3

2014

o Nominations Agreement signed letting 210 student rooms to the

University of Roehampton for 10 years

o Out of 378 student rooms, 69% pre-let for 2014/15, including

the University of Roehampton

-- Clifford's Inn, Fetter Lane, EC4

o Discussions to fully pre-let the 3,423 sqm of refurbished

offices ongoing

o Completion on schedule for Q3 2014

-- Vauxhall Square, London, SW8

o 143,000 sqm scheme with full planning consent in Vauxhall,

London

o Conditional exchange of contracts for a long lease to a

student operator to build and manage 30 storey, 359 student bedroom

development

OVERVIEW - Since 1 January 2014, the Group has made good

progress in a number of areas, including one opportunistic

disposal. Core investment operations have delivered in line with,

or above, expectations, financing costs have remained very low, and

developments have continued to progress well.

The occupational markets are firm, with the Group's vacancy

level remaining very low at 3.5% (31 December 2013: 4.4%) by rental

income. Demand from existing and potential occupiers is steady,

with good interest particularly in London and Germany. Of the

Group's income, 61% benefits from indexation and 73% is paid by

government occupiers (50% of the total) or major corporations

(23%).

On 14 April 2014, the Group sold Cambridge House, 100 Cambridge

Grove, London W6, for GBP29.5 million, a price 32% above its

external valuation at 31 December 2013, and 65% above its external

valuation at 30 June 2013. The net initial yield of 2.34% reflected

that the building, considered a development site, was 50%

vacant.

The Greater London investment market, outside the West End and

City, is more competitive than 12 months ago. We continue to

explore selective investment opportunities within and around the

M25, and in France and Germany, where financing conditions remain

at more attractive levels.

UK - London continues to benefit from its status as a global

safe haven, supported by continued improvement in the economy. The

UK's GDP growth is forecast to be 2.6% for 2014, unemployment has

fallen to 6.9% and inflation is low at 1.6%. Demand remains solid

from overseas investors searching for yield, with increasing

interest beyond the prime West End and City locations.

We continue to be successful in leasing space, due in part to

all of our management being performed in-house, and the vacancy

rate remains low at 2.9% (31 December 2013: 2.4%). New lettings,

lease renewals and extensions were completed on 882 sqm, and

occupiers vacated from 2,407 sqm since the beginning of the

year.

Our Spring Mews development, comprising an extended-stay hotel

and student accommodation, is well under way, and completion is

expected in the third quarter of 2014. In 2013, we signed an

agreement with InterContinental Hotels Group for the 93 bedroom

suite hotel to be operated under its Staybridge Suites brand, and

since 1 January 2014, we have signed a 10-year Nominations

Agreement with the University of Roehampton to let 210 student

rooms (55% of the total). The remaining student rooms, which are

being operated and marketed on a direct-let basis on our behalf by

Fresh Student Living, have already shown good take-up, and,

including the University of Roehampton space, 69% of the student

rooms have been pre-let for 2014/15.

At Clifford's Inn, Fetter Lane, EC4 the refurbishment of 3,433

sqm of new Grade A offices and the development of eight residential

apartments are on schedule to complete in the third quarter of

2014, and we remain in negotiations to pre-let the entire office

space.

The Vauxhall Nine Elms regeneration area, of which our 143,000

sqm mixed-use, residential-led Vauxhall Square scheme will be an

integral part, continues to progress. In January 2014, we entered

into a long lease agreement with a specialist student housing

operator to build and manage the 359 student room building adjacent

to the main site. The agreement is conditional on a number of

matters which we expect to satisfy within the next twelve months,

enabling a projected construction start of this first phase of

Vauxhall Square in 2015. We continue to hold positive discussions

with potential hoteliers and to explore financing options for the

scheme.

FRANCE - With 1% forecast GDP growth in 2014, unemployment at

10.2% and inflation at 0.6%, the French economy is virtually

stagnant. However, there are some signs of improvements in economic

conditions.

We believe the lack of new supply will restrict vacancy levels

and available space. In the overall market, lettings in the Paris

region in the first quarter of 2014 were 19% above the same period

last year. Our vacancy levels appear to have peaked at the end of

December; in the subsequent four and a half months they have fallen

to 7.3% (31 December 2013: 10.6%) and are expected to reduce

further this year. Since the end of December, we have let or

renewed 5,378 sqm of offices and taken back 1,261 sqm.

GERMANY - With 1.8% forecast GDP growth in 2014, unemployment

low at 6.7% and a projected budget surplus for the second

consecutive year, the German economy remains resilient. In the

first quarter of 2014, the German investment market saw a 47%

increase in transaction values over the same period last year, with

yields declining for prime and good secondary assets. Bank debt

availability and pricing remain the most attractive in all of our

regions.

We have seen an increase in activity and enquiries, and our

vacancy rate has fallen to 1.6% (31 December 2013: 3.5%). Since 1

January we have let 3,356 sqm and taken back 385 sqm.

SWEDEN - Swedish GDP is expected to rise by 2.7% in 2014, and

unemployment of 8.6% is forecast to fall to 7.7% by the end of the

year.

Occupancy of the Group's only directly held property in Sweden,

Vänerparken, to the north of Gothenburg, has remained unchanged

with a vacancy of 1.7% by rental value and negotiations remain

ongoing on certain lease renewals due in 2015.

FINANCE - The business generates more cash than a year ago. The

GBP165 million of acquisitions in 2013, which raised the Group's

annualised rental income by 25%, were acquired at a blended net

initial yield of 11.6% and financed at an average cost of debt of

4.0%, and this was evident in the growth in core profit in the

first quarter of 2014 compared to last year. Rent collection rates

have remained high and the weighted average cost of debt has

continued to be one of the lowest in the property sector at 3.80%

(31 December 2013: 3.64%), being 320 basis points below the

property portfolio's net initial yield.

The Group has 56 loans from 22 lenders, two unsecured corporate

bonds, a secured note and a debenture; none of the loan covenants

is in breach. The Group currently has liquid resources of over

GBP245 million, comprising GBP48 million of cash, GBP72 million of

corporate bonds, and available undrawn facilities in excess of

GBP125 million.

In the latest tender offer, all of the shares available were

cancelled by the Company on 2 May resulting in a distribution of

GBP10.0 million to shareholders and leaving 43,287,824 shares in

circulation.

Executive Chairman of CLS, Sten Mortstedt, commented:

"Continuing signs of improvement in the UK economy, both in

London and elsewhere, bode well for CLS, and I am particularly

pleased with the initiatives we are exploring within the Neo

portfolio which we acquired opportunistically last year.

"The Group's core activities are performing well, cash

generation is strong, debt costs remain low and good progress is

being made on pre-letting our development programme.

"With a strong balance sheet and our rental income predominantly

secured by high quality tenants, including governments and major

corporations, we are well positioned to meet future challenges with

confidence. Our financial resources, and our opportunistic

approach, will enable us to continue selectively to seek

possibilities to add value for our shareholders."

-ends-

For further information, please contact:

CLS Holdings plc +44 (0)20 7582 7766

www.clsholdings.com

Sten Mortstedt, Executive Chairman

Henry Klotz, Executive Vice Chairman and Acting Chief Executive

Officer

John Whiteley, Chief Financial Officer

Liberum Capital Limited +44 (0)20 3100 2222

Tom Fyson

Charles Stanley Securities

Mark Taylor +44 (0)20 7149 6000

Hugh Rich

Kinmont Limited +44 (0)20 7087 9100

Jonathan Gray

Smithfield Consultants (Financial PR) +44 (0)20 7903 0669

Alex Simmons

This information is provided by RNS

The company news service from the London Stock Exchange

END

IMSLLFEREDIVLIS

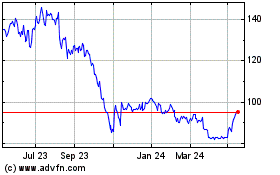

Cls (LSE:CLI)

Historical Stock Chart

From Jan 2025 to Feb 2025

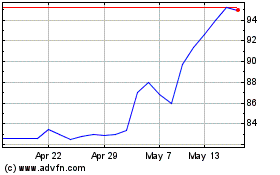

Cls (LSE:CLI)

Historical Stock Chart

From Feb 2024 to Feb 2025