Re Tender Offer

31 July 2000 - 11:35PM

UK Regulatory

RNS Number:4620O

Compagnie de Saint-Gobain

26 July 2000

Saint-Gobain to launch a friendly tender offer for Chemfab

The Boards of Directors of Chemfab Corporation (NYSE: CFA) and Norton Company, a

U.S.-based subsidiary of Compagnie de Saint-Gobain, jointly announced the

signing of a definitive agreement under which a subsidiary of Norton Company

will begin a tender offer on August 2, 2000 to purchase all of the outstanding

shares of Chemfab at $18.25 per share, net to the seller in cash (excluding any

tax effect). This price represents a 42% premium over the last six months'

average trading price. The value of the transaction is approximately $136

million to purchase Chemfab's shares and approximately $5 million to extinguish

outstanding options, plus the assumption of approximately #30 million in net

financial debt. Each of the Directors of Chemfab, including Mr. John Verbicky,

President and Chief Executive Officer, has agreed to tender all of his shares of

Chemfab common stock to Saint-Gobain in the tender offer.

The Board of Directors of Chemfab has unanimously agreed to recommend that its

shareholders accept the offer and tender their shares. The tender offer is

scheduled to close on August 30, 2000, but may be extended by Saint-Gobain

subject to certain conditions. The transaction is subject to approval by the

relevant anti-trust authorities.

Chemfab has a worldwide presence with locations in nine countries (USA, Europe,

Asia, South America) and sales of $125 million for the fiscal year ended June

30, 2000.

Chemfab is a leader in the design, manufacture and marketing of polymer-based

engineered products for use in specialized and severe service environments. The

company's products are films, coated glass fabrics and adhesive tapes, which are

based on glass fiber-reinforced and non-reinforced fluoropolymers,

fluoroelastomers and silicone elastomers. These are sold into food processing,

architectural, electrical, environmental, aerospace and other industrial

businesses.

Chemfab will be integrated into Saint-Gobain Performance Plastics, which was

formed last year following the acquisition of Furon Company and its integration

with Norton Performance Plastics Corp. Saint-Gobain Performance Plastics, a

leader in the high performance plastics business, serves a broad range of

industries including transportation, electronics, food processing, electrical,

medical device, and pharmaceutical. it processes high-performance polymers and

elastomers into flexible foams, bearings, flexible tubing and fluid handling

systems, films and pressure sensitive tapes.

Both companies have a great fit from a technical, industrial and commercial

point of view. On a pro forma basis for calendar year 2000, Saint-Gobain

Performance Plastics' and Chemfab's combined businesses should have sales of

more than $850 million and 5,400 employees in 15 countries.

Chemfab's acquisition will allow immediate industrial synergies that will

strengthen the combined companies. It will be earnings enhancing for

Saint-Gobain Group as early as 2001.

July 26th, 2000

Investor Relations Department

Tel.: Florence TRIOU-TEIXEIRA +33 1 47 62 45 19 - mailto:

florence.triou@saint-gobain.com

Tel.: Lounis BEKKAT +33 1 47 62 32 36 - mailto:

lounis.bekkat@saint-gobain.com

Fax: +33 1 47 62 50 62

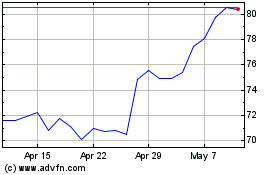

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Oct 2024 to Nov 2024

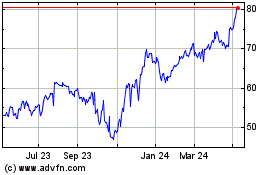

Compagnie De Saint-gobain (LSE:COD)

Historical Stock Chart

From Nov 2023 to Nov 2024