TIDMCWK

RNS Number : 3490G

Cranswick PLC

26 July 2021

26 July 2021

Cranswick plc

("Cranswick" or "the Company" or "the Group")

First quarter trading statement

Cranswick, a leading UK food producer, today provides an update

on trading for the 13 weeks to 26 June 2021.

Current trading

Revenue in the 13 weeks to 26 June 2021 was 9.6 per cent ahead

of the same period last year, with corresponding volumes up 7.7 per

cent reflecting strong retail demand and increased sales from the

Eye poultry facility. Revenue growth also reflected the gradual but

sustained recovery of the food to go and food service channel.

Far East export sales were well ahead of the same quarter last

year, reflecting strong market prices. The China export licence at

our Norfolk primary processing facility remains suspended; as

previously noted, whilst the technical audits were passed at the

site in January 2021, we still await final approval.

The UK pig price increased by 12 per cent during the period; the

average price across the quarter to June 2021 was 9 per cent below

that in the equivalent period a year earlier.

Investment

We continue to invest at pace across our asset base to support

future growth and further operating efficiencies. The capacity

uplift from 1.1m to 1.4m birds per week at the Eye poultry facility

was delivered successfully and, as anticipated, the new GBP20m

cooked bacon facility in Hull started commercial production during

the quarter. A further GBP5m will be spent at the facility over the

coming months to add additional capacity and capability. Work on

the new premium breaded poultry facility in Hull is progressing

well, with incremental investment of GBP5m, which includes a third

production line, added to what is now an overall GBP30m build

plan.

'Second Nature' Sustainability

We continue to make meaningful progress in delivering our

Group-wide 'Second Nature' sustainability strategy. During the

period six more of our sites were awarded the carbon neutral (IPAS

2060) certification. Nine of our sites have now gained the

accreditation, with all remaining production facilities on track to

achieve this status by the end of 2021.

We set exacting standards in animal welfare and our leadership

in this field was again recognised with confirmation on 30 March

2021 that we had retained our Tier 1 status in the Business

Benchmark on Farm Animal Welfare (BBFAW) for the fifth consecutive

year. The BBFAW is the globally recognised investor framework for

assessing the quality of companies' practices, processes and

performance on farm animal welfare. W e are one of only four

companies globally, and the only meat processor, to be ranked in

'Tier One'.

On 22 July 2021 we received confirmation that our Science Based

Target (SBT) has now been validated. Our challenging but achievable

SBT is set in line with efforts to limit global warming to 1.5 C

under the Paris agreement and includes halving our Scope 1, 2 and 3

emissions by 2030 and achieving Net Zero status by 2040.

Financial position

As a result of strong cash generation and tight working capital

management, net debt was only modestly higher than the March 2021

year end position. The Group remains in a robust financial position

with committed, unsecured facilities of GBP200 million providing

comfortable headroom.

Outlook

The outlook for the current financial year remains in line with

the Board's expectations.

The Board is confident that continued focus on the strengths of

the Company, which include its long-standing customer

relationships, breadth and quality of products, robust financial

position and industry leading asset infrastructure, will support

the further successful development of the Group during the current

year and over the longer term.

Adam Couch, CEO of Cranswick, commented:

"We have made a positive start to the year. Our capital

investment programme remains firmly on track as we build the

platform to deliver our long-term growth strategy and we continue

to make meaningful progress in delivering our Group-wide 'Second

Nature' sustainability strategy. We also continue to support our

customers by delivering excellent service levels to ensure full

availability of our products.

"The professionalism and commitment of our colleagues across the

business is the foundation on which our successful performance is

based and as always I would like to thank them for their continued

dedication and support.

"As announced on 18 May 2021, Martin Davey will stand down as

Chairman at the conclusion of this morning's AGM. He will though

stay with the business in an advisory capacity till May 2022.

Martin joined Cranswick 36 years ago and has been Chairman since

2004. Much of what Cranswick is today in terms of its culture and

ethos reflects Martin's character and personality. He has been an

inspiration, mentor, wise counsel and friend and on behalf of all

at Cranswick I would like to thank Martin for his invaluable

contribution over the last 36 years and to wish him, his wife Linda

and their family all the very best for the future."

Interim results

The Company's next scheduled comment on trading will be the

interim results announcement for the 26 weeks ending 25 September

2021, on Tuesday 23 November 2021.

Enquiries:

Cranswick plc 01482 275 000

Mark Bottomley, Finance Director

--------------------------------

Powerscourt 020 7250 1446

--------------------------------

Nick Dibden / Nick Hayns cranswick@powerscourt-group.com

--------------------------------

Notes:

1. Cranswick is a leading and innovative supplier of premium,

fresh and added value food products. The business employs over

12,900 people and operates from sixteen well invested, highly

efficient production facilities in the UK. Cranswick was formed in

the early 1970s by farmers in East Yorkshire to produce animal feed

and has since evolved into a business which produces a range of

high quality, predominantly fresh food, including fresh pork,

poultry, convenience and gourmet products. Through the Group's four

primary processing and twelve added value processing facilities the

business develops innovative, great tasting food products to the

highest standards of food safety and traceability. The Group

supplies the major grocery multiples as well as the growing premium

and discounter retail channels. Cranswick also has a strong

presence in the 'food-to-go' sector and a rapidly growing export

business. Results for the 52 weeks to 27 March 2021 showed revenue

of GBP1,898m and profit before tax of GBP114.8m. For more

information go to: www.cranswick.plc.uk

2. Cranswick is committed to ensuring that its business

activities are sustainable from farm-to-fork. Our ambitious

sustainability strategy 'Second Nature' has been developed to

deliver our vision to become the world's most sustainable meat

business. Find out more at: www.thisissecondnature.co.uk

3. This announcement is based on information sourced from unaudited management accounts.

4. This announcement contains certain forward-looking statements

with respect to the financial conditions, results of operations and

businesses of Cranswick. These statements involve risk and

uncertainty because they relate to events and depend upon

circumstances that will occur in the future. There are a number of

factors that could cause actual results or developments to differ

materially from those expressed or implied by these forward-looking

statements. Nothing in this announcement should be construed as a

profit forecast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFIEDTIVFIL

(END) Dow Jones Newswires

July 26, 2021 02:00 ET (06:00 GMT)

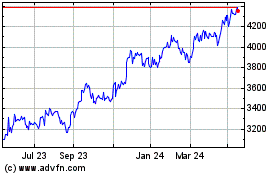

Cranswick (LSE:CWK)

Historical Stock Chart

From Jan 2025 to Feb 2025

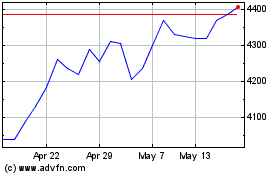

Cranswick (LSE:CWK)

Historical Stock Chart

From Feb 2024 to Feb 2025