TIDMFAB

RNS Number : 4785V

Fusion Antibodies PLC

04 December 2023

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Article 7 under the Market Abuse

Regulations (EU) No. 596/2014 ("MAR"). With the publication of this

announcement, this information is now considered to be in the

public domain.

4 December 2023

Fusion Antibodies plc

("Fusion" or the "Company")

Half year Report

Fusion Antibodies plc (AIM: FAB), an Early Discovery Contract

Research Organisation ("CRO") specialising in pre-clinical antibody

discovery, engineering and supply for both therapeutic drug and

diagnostic applications, announces its unaudited interim results

for the six months ended 30 September 2023 ("H1 FY2024") and

provides an update on recent commercial progress.

Operational highlights

-- Increased numbers of commercial opportunities identified and improving pipeline valuation

-- A number of projects delayed by clients as they seek further investment

-- Progress in development of the OptiMAL(R) library, with

demonstration of whole IgG antibodies expressed on the cell

surface

-- GBP1.67 million fundraise alongside GBP1.6 million cost rationalisation exercise

-- Appointment of Stephen Smyth as interim CFO

Financial highlights

-- Revenue of GBP541k (H1 FY2023: GBP1.9 million)

-- Expenditure on R&D decreased by 60% to GBP0.18 million (H1 FY2023: GBP0.45 million)

-- Loss of GBP1.4 million (H1 FY2023: GBP1.1 million loss)

-- Cash position at 30 September 2023 was GBP0.5 million (31 March 2023: GBP0.2 million)

Post-period highlights

-- Collaboration Agreement with the National Cancer Institute,

USA ("NCI") to validate OptiMAL(R)

-- First AI/ML-Ab(TM) project successfully completed

-- Further pipeline progression and increased rate of deal closures

-- FY2024 results expected to be significantly weighted towards the second half of the year

Commenting on the interim results, Adrian Kinkaid, CEO of Fusion

Antibodies plc, said: "During this calendar year, the industry has

been experiencing significant headwinds especially in the venture

capital ("VC") funded biotech sector. A number of clients have

consequently delayed initiating their projects with us.

Nonetheless, we have generated a significantly stronger pipeline

which includes a wider diversity of clients that are less dependent

on VC funding. Consequently, whilst overall revenues for the period

are low as previously announced, through our efforts we have

benefitted from a trend of increasing month-on-month revenues

throughout the H1 FY2024 period, which we hope will continue to

strengthen in the remainder H2 and beyond.

" It is particularly encouraging to see our newer offerings also

being well received with our first AI/ML-Ab(TM) contract being

successfully completed and, post-period end, securing the agreement

with the NCI to help validate OptiMAL(R). Both of these

developments are having a positive impact on market awareness and

engagement."

Investor presentation via Investor Meet Company

Fusion will host a presentation on the results open to all

investors via the Investor Meet Company platform at 11.00 a.m. on

Thursday, 7(th) December 2023, delivered by Dr Adrian Kinkaid, CEO

and Mr Stephen Smyth, CFO. The Company is committed to providing an

opportunity for all existing and potential investors to hear

directly from management on its results whilst additionally

providing an update on the business and current trading.

I nvestors can sign up to Investor Meet Company for free and add

to meet Fusion Antibodies plc via the following link:

https://www.investormeetcompany.com/fusion-antibodies-plc/register-investor

Enquiries:

Fusion Antibodies plc www.fusionantibodies.com

Adrian Kinkaid PhD, Chief Executive Via Walbrook PR

Officer

S tephen Smyth , Chief Financial Officer

Allenby Capital Limited Tel: +44 (0)20 3328 5656

James Reeve / Vivek Bhardwaj (Corporate

Finance)

Tony Quirke/Joscelin Pinnington (Sales

and Corporate Broking)

Walbrook PR Tel: +44 (0)20 7933 8780 or fusion@walbrookpr.com

Anna Dunphy Mob: +44 (0)7876 741 001

About Fusion Antibodies plc

Fusion is a Belfast-based Collaborative Research Organisation

("CRO") company, listed on AIM, providing an integrated end-to-end

range of antibody engineering services for the development of

antibodies for both therapeutic drug and diagnostic

applications.

Fusion provides a broad range of services in antibody

generation, development, characterisation, optimisation, and

small-scale production. These services include antigen expression,

purification and sequencing, antibody humanisation using Fusion's

proprietary CDRx(TM) platform and cell line development, producing

antibody generating stable cell lines optimised for use downstream

by the customer to produce material for clinical trials. Since

2012, the Company has successfully sequenced and expressed over 250

antibodies and successfully completed over 200 humanisation

projects for its international customer base, which has included

eight of the top 10 global pharmaceutical companies by revenue.

At every stage, our client's vision is central to how we work in

combining the latest technological advances with cutting edge

science. In this work our world-class humanization and antibody

optimization platforms harness the power of natural somatic

hypermutation (SHM) to ensure the best molecule goes to the clinic.

Fusion Antibodies' growth strategy is based on enabling Pharma and

Biotech companies get to the clinic more effectively, using

molecules with optimized therapeutic profile and enhanced potential

for successful development and approval and, ultimately, on

speeding up the drug discovery and development process. The

announced Integrated Therapeutic Antibody Services ("ITA") offering

will enhance the efficiency of this process by providing a

continuous service offering from target nomination to stable cell

line. Fusion's use of SHM to create a fully human antibody library

to capture the human antibody repertoire will address a continuing

market need in antibody discovery.

Fusion Antibodies' emphasis on antibody therapeutics is based on

the size and growth rate in the sector, with the market valued at

$186 billion in 2021 and forecast to surpass $400 billion by 2028.

As of June 2022, there were 150 approved antibody therapies on the

market and nearly 600 antibody drugs in clinical trials.

Operational Review

As announced on 29 September 2023, at the time of publication of

its annual report for the year ended 31 March 2023 ("FY2023"), the

Company has been experiencing a commercially challenging period,

primarily due to weak market conditions for investment in new drug

discovery and development programmes and the subsequent delays to a

number of anticipated contracts, both large and small. The Company

had anticipated an easing of these constraints during H1 FY2024,

however, this has not materialised as quickly as expected.

Consequently, trading conditions remain very challenging and

revenue for H1 FY2024 is GBP541k. Towards the end of the period,

several projects were subject to certain technical challenges which

required additional work to be undertaken, thereby pushing some of

the expected H1 recognised revenue into H2. The remainder of the

shortfall was due to a delayed project initiation.

Revenues for FY2024 are expected to be significantly weighted

towards the second half of the year, and the Board remain

optimistic that our new services, such as AI/ML-Ab(TM) , will have

an impact, and contribute positively to revenue growth in the

second half. The Company has achieved a marked growth in its

pipeline of sales opportunities with overall values now standing at

approximately four times that of six months ago. Part of the

pipeline growth is attributable to enhanced penetration of adjacent

markets (including Veterinary Medicine, Diagnostics and Research

Antibodies) in line with our previously stated strategy. These

factors bode well for the Company's future provided opportunities

can be progressed and converted into work in progress.

In June 2023, the Company successfully completed a GBP1.5m

fundraise (net of expenses) to provide additional working capital

and we have now implemented circa. GBP1.6m in restructuring

savings, including a reduction in headcount from 48 at 31 March

2023 to 29 at 30 September 2023. We are seeking to identify

additional cost savings that can be implemented without further

impacting on the operating capacity of the Company. A significant

program of cross training of staff from different laboratories has

been completed which maintains the capability to deliver all of our

services.

In August 2023, we announced that the negotiations with a

leading AI/ML (artificial intelligence/machine learning) company

based in the USA had been finalised and that we received our first

order from this new collaboration to generate de-novo antibody

sequences. This AI/ML platform, known as the AI/ML-Ab (TM) service

(pronounced "AIM Lab"), provides a method of designing panels of

antibodies in-silico, with the AI/ML algorithms typically producing

small libraries of sequences which are an excellent match with our

Mammalian Display platform, which emanated from the OptiMAL(R)

library development program. These designs are transformed into

real protein molecules for screening and final selection and is a

potentially powerful combination to speed up the discovery

process.

Our Integrated Therapeutic Antibody Service (ITAS) that

integrates our current Discovery, Engineering and Supply services

into one proposition, continues to gain attention and our R&D

program to develop a cell-based mammalian display technology

screening library, OptiMAL(R), is progressing, with key stages of

the process now developed. As announced in our annual report for

the year ended 31 March 2023 ("FY2023"), w e now have clear

evidence that our highly diverse library of DNA sequences are

expressed as fully intact antibodies on the surface of mammalian

cells. With the antibody on the cell surface, a cell can be

individually selected and manipulated to produce larger quantities

of the antibody of interest, although further optimisation work is

still required to deliver the full operational screening

parameters. The goal of this cell-based process is to directly

identify intact fully human antibodies against biomarkers and other

targets of interest and is in line with the antibody drug discovery

industry's aim to gradually moving away from the use of

animals.

We will continue to build a body of data with a view to

establishing commercial relationships for further validation and we

recently announced our first validation partner. The Company has

signed a Collaboration Agreement (the "Agreement") with the

National Cancer Institute, USA (NCI) to validate OptiMAL (R) .

Under the terms of the Agreement, Fusion will provide access to the

OptiMAL(R) technology to NCI for the discovery of novel antibodies

against an agreed number of primarily cancer targets selected by

NCI over a period of up to two years in order to develop potential

therapeutic antibodies. The parties will work together to ensure

successful validation of the OptiMAL (R) technology and jointly

publish any results from the collaboration at various times over

the two-year period, although as with any R&D project the

timing of any results from the collaboration cannot be

predicted.

We have seen the first of the results in our strategy to grow

sales through penetration of adjacent markets. We recently

announced t he signing of a commercial contract with a US-based

diagnostic company to develop production quality cell lines using

our new Mammalian Display technology, for the expressions of a

range of proteins, other than antibodies, showing the flexibility

of the technology. An initial feasibility study will be performed

on a fee-for-service basis for two difficult to produce reagents.

The study, if successful, can be expanded to a much larger

portfolio of reagents.

Board changes

Changes in the board composition during the period to September

2023 was the appointment of Stephen Smyth as the interim CFO /

Company secretary following the resignation of James Fair (CFO). In

addition, post period end, Sonya Ferguson stepped down as a

non-Executive Director of the Company.

Financial Review

Revenues for the six-month period ending 30 September 2023 were

GBP0.54 million (H1 FY2023: GBP1.86 million). All revenues were

derived from services and they contained no milestone or royalty

payments.

The (15)% gross profit percentage for H1 FY2024 (H1 FY2023: 33%)

was lower than in the same period last year due to a service based

labour fixed cost in place in readiness for an increased

revenue.

R&D expenditure in H1 FY2024 was GBP182k (H1 FY2023:

GBP452k), a decrease of 60% over the comparable period. SG&A

expenditure of GBP1,153k was GBP266k lower than in H1 FY2023

(GBP1,419k) and, despite significantly lower revenue than H1

FY2023, the operating loss for H1 FY2024 was GBP1.36 million (H1

FY2023: GBP1.26 million loss). The reduction in R&D

expenditure, S&G expenditure and small increase in operating

loss relative to the reduction in revenues are all primarily due to

the restructuring and cost saving measures that were in the process

of being implemented during H1 FY2024.

Cash used in operations was GBP1,213k compared with GBP754k used

in H1 FY2023. The H1 FY2024 operational outflow includes the

GBP182k investment in R&D. The total inflow was GBP291k and the

closing cash balance at 30 September 2023 was GBP487,000.

Key Performance Indicators

The key performance indicators (KPIs) regularly reviewed by the

Board are:

KPI H1 FY2024 H1 FY2023

--------------------------- ------------ ------------

Underlying revenue growth (71)% (19)%

EBITDA* (GBP1.231m) (GBP1.008m)

Cash used in operations (GBP1.351m) (GBP0.754m)

--------------------------- ------------ ------------

* Earnings before interest, tax, depreciation and

amortisation

The investment in R&D and the impact on EBITDA is set out in

Note 12 to these statements. EBITDA for the period was a loss of

GBP1.231 million (H1 FY2023: GBP1.008 million loss) and adjusting

for research and development expenditure shows an EBITDA loss

excluding R&D of GBP1.049 million for the period (H1 FY2023:

GBP0.5560 million loss).

Outlook

The Board is confident that Fusion's prospects for growth are

increasingly positive and the new novel technologies available to

the Company, especially AI/ML-Ab(TM) and OptiMAL(R), will play an

important role in differentiating the business and creating fresh

value for our shareholders.

Revenues for FY2024 are expected to be significantly weighted

towards the second half of the financial year. This is supported by

the revenue growth trend observed through H1 FY2024 and the marked

growth in its sales opportunities pipeline over the last six

months. Additionally, the recent news regarding OptiMAL(R) has

raised the Company's profile with new connections being made with

significant prospective clients, further enhancing our strategy of

penetration into adjacent markets including Veterinary Medicine,

Diagnostics and Research Antibodies.

It remains a key strategic focus for the Company to achieve cash

neutrality. The Company continues to maintain stringent cost

controls, closely monitor the cash runway, and will seek to

identify additional cost savings that can be implemented without

further impacting the operating capacity of the Company.

Statement of Directors' Responsibilities

The Directors confirm, to the best of their knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS34 'Interim Financial Reporting';

-- The interim management report includes a fair review of the

information required by DTR 4.2.7R of the Disclosure and

Transparency Rules of the of the United Kingdom's Financial Conduct

Authority, being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the year, and gives a true and fair view of

the assets, liabilities, financial positions and profit for the

period of the Company; and

-- The interim management report includes a fair review of the

information required by DTR 4.2.8R of the Disclosure and

Transparency Rules of the United Kingdom's Financial Conduct

Authority, being a disclosure of related party transactions and

changes therein since the previous annual report.

On behalf of the Board

Dr Simon Douglas

Non-executive Chairman

04 December 2023

Condensed Statement of Comprehensive Income

For the six months ended 30 September 2023

6 months 6 months Year to

to 30.09.23 to 30.09.22 31.03.23

Unaudited Unaudited Audited

Notes GBP'000 GBP'000 GBP'000

Revenue 541 1,863 2,901

Cost of sales (625) (1,256) (2,327)

------------------------------- -------- ------------- ------------- ----------

Gross profit (84) 607 574

Other operating income 10 - 8 11

Administrative expenses 3 (1,335) (1,871) (3,443)

------------------------------- -------- ------------- ------------- ----------

Operating loss (1,419) (1,256) (2,858)

------------------------------- -------- ------------- ------------- ----------

Finance income 4 2 1 3

Finance costs 4 (3) (7) (4)

------------------------------- -------- ------------- ------------- ----------

Loss before tax (1,420) (1,262) (2,859)

Income tax credit 5 63 146 263

------------------------------- -------- ------------- ------------- ----------

Loss for the period (1,357) (1,116) (2,596)

Total comprehensive expense

for the period (1,357) (1,116) (2,596)

------------------------------- -------- ------------- ------------- ----------

Pence Pence Pence

Basic loss per share 6 (2.3) (4.3) (10.0)

Condensed Statement of Financial Position

As at 30 September 2023

As at As at 30.09.22 As at

30.09.23 Unaudited 31.03.23

Unaudited GBP'000 Audited

Notes GBP'000 GBP'000

---------------------------------- -------- ----------- --------------- ----------

Assets

Non-current assets

Intangible assets - - -

Property, plant and equipment 7 250 743 375

250 743 375

---------------------------------- -------- ----------- --------------- ----------

Current assets

Inventories 524 552 539

Trade and other receivables 471 1,212 690

Current tax receivable 326 277 263

Cash and cash equivalents 487 1,198 195

---------------------------------- -------- ----------- --------------- ----------

1,808 3,329 1,687

---------------------------------- -------- ----------- --------------- ----------

Total assets 2,058 3,982 2,062

---------------------------------- -------- ----------- --------------- ----------

Liabilities

Current liabilities

Trade and other payables 537 1,057 844

Borrowings 8 17 83 35

---------------------------------- -------- ----------- --------------- ----------

554 1,140 879

---------------------------------- -------- ----------- --------------- ----------

Net current assets 1,254 2,100 808

Non-current liabilities

Borrowings 8 30 250 40

Provisions for other liabilities

and charges 20 20 20

---------------------------------- -------- ----------- --------------- ----------

Total liabilities 604 1,410 60

---------------------------------- -------- ----------- --------------- ----------

Net assets 1,454 2,572 1,123

---------------------------------- -------- ----------- --------------- ----------

Equity

Called up share capital 12 2,378 1,040 1,040

Share premium reserve 7,981 7,647 7,647

(Accumulated losses)/retained

earnings (8,905) (6,115) (7,564)

---------------------------------- -------- ----------- --------------- ----------

Equity 1,454 2,572 1,123

---------------------------------- -------- ----------- --------------- ----------

Condensed Statement of Changes in Equity

For the six months ended 30 September 2023

6 months ended 30 September Called Share Accumulated Total

2023 up share premium losses Equity

Unaudited capital reserve GBP'000 GBP'000

GBP'000 GBP'000

------------------------------ ---------- -------------- ------------ ---------

At 1 April 2023 1,040 7,647 (7,564) 1,123

Loss for the period - - (1,357) (1,357)

------------------------------ ---------- -------------- ------------ ---------

Issue of share capital 1,338 334 - 1,672

Share options - value

of employee services - - 16 16

------------------------------ ---------- -------------- ------------ ---------

Total transactions with

owners, recognised directly

in equity - - 16 16

------------------------------ ---------- -------------- ------------ ---------

At 30 September 2023 2,378 7,981 (8,905) 1,454

------------------------------ ---------- -------------- ------------ ---------

6 months ended 30 September Called Share premium Retained Total

2022 up share reserve earnings Equity

Unaudited capital GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ ---------- -------------- ------------ ---------

At 1 April 2022 1,040 7,647 (5,003) 3,684

Loss for the period - - (1,116) (1,116)

------------------------------ ---------- -------------- ------------ ---------

Issue of share capital - - - -

Share options - value of

employee services - - 4 4

Total transactions with

owners, recognised directly

in equity - - 4 4

------------------------------ ---------- -------------- ------------ ---------

At 30 September 2022 1,040 7,647 (6,115) 2,572

------------------------------ ---------- -------------- ------------ ---------

Year ended 30 March 2023 Called Share premium Accumulated Total

Audited up share reserve losses Equity

capital GBP'000 GBP'000 GBP'000

GBP'000

------------------------------ ---------- -------------- ------------ ---------

At 1 April 2022 1,040 7,647 (5,003) 3,684

Loss for the year - - (2,596) (2,596)

------------------------------ ---------- -------------- ------------ ---------

Share options - value of

employee services - - 35 35

Total transactions with

owners, recognised directly

in equity - - 35 35

------------------------------ ---------- -------------- ------------ ---------

At 31 March 2023 1,040 7,647 (7,564) 1,123

------------------------------ ---------- -------------- ------------ ---------

Statement of Cash Flows

For the six months ended 30 September 2023

6 months Year to

6 months to 30.09.22 31.03.23

to Unaudited Audited

30.09.23 GBP'000 GBP'000

Unaudited

GBP'000

--------------------------------------- ----------- ------------- ----------

Cash flows from operating activities

Loss for the period (1,357) (1,116) (2,596)

Adjustments for:

Share based payment expense 16 4 35

Depreciation 125 248 372

Amortisation of intangible assets - - -

Finance income (2) (1) (3)

Finance costs 3 7 4

Income tax credit (63) (146) (263)

Decrease/(increase) in inventories 15 32 46

Decrease/(increase) in trade and

other receivables 219 304 819

(Decrease)/increase in trade and

other payables (307) (86) (299)

--------------------------------------- ----------- ------------- ----------

Cash used in operations (1,351) (754) (1,885)

Income tax received - - 131

--------------------------------------- ----------- ------------- ----------

Net cash used in operating activities (1,351) (754) (1,754)

Cash flows from investing activities

Purchase of property, plant and

equipment - (358) (114)

Finance income - interest received 2 1 3

--------------------------------------- ----------- ------------- ----------

Net cash generated by/(used in)

investing activities 2 (357) (111)

Cash flows from financing activities

Proceeds from issue of share capital 1,672 - -

Proceeds from new borrowings - 323 69

Repayments of borrowings (28) (56) (62)

Finance costs - interest paid (3) (7) (4)

--------------------------------------- ----------- ------------- ----------

Net cash generated from financing

activities 1,641 260 3

Net increase/(decrease) in cash

and cash equivalents 292 (851) 1,862

Cash and cash equivalents at the

beginning of the period 195 2,049 2,049

--------------------------------------- ----------- ------------- ----------

Effects of exchange rate changes

on cash and cash equivalents 8

--------------------------------------- ----------- ------------- ----------

Cash and cash equivalents at the

end of the period 487 1,198 195

--------------------------------------- ----------- ------------- ----------

Notes to the Interim Results

For the six months ended 30 September 2023

1 Basis of Preparation

The condensed financial statements comprise the unaudited

results for the six months to 30 September 2023 and 30 September

2022 and the audited results for the year ended 31 March 2023. The

financial information for the year ended 31 March 2023 does not

constitute the full statutory accounts for that period. The Annual

Report and Financial Statements for the year ended 31 March 2023

have been filed with the Registrar of Companies. The Independent

Auditor's Report on the Annual Report and Financial Statements for

the year ended 31 March 2023 was unmodified and did not contain a

statement under s498(2) or s498(3) of the Companies Act 2006. The

Auditor's report contained a material uncertainty related to going

concern.

The condensed financial statements for the period ended 30

September 2023 have been prepared in accordance with the Disclosure

and Transparency Rules of the Financial Conduct Authority and with

IAS 34 'Interim Financial Reporting' as adopted by the UK. The

information in these condensed financial statements does not

include all the information and disclosures made in the annual

financial statements.

Going concern

At 30 September 2023 the Company had a cash balance of GBP0.5

million. The Directors have reviewed detailed projections for the

Company. These projections are based on estimates of future

performance and have been adjusted to reflect various scenarios and

outcomes that could potentially impact the forecast outturn. Based

on these estimates, the Directors have a reasonable expectation

that the Company has adequate resources to continue in operational

existence for 12 months from the reporting date. Accordingly, they

have prepared these condensed financial statements on the going

concern basis.

The Directors note that there is inherent uncertainty in any

cash flow forecast, however this is further exacerbated given the

nature of the Company's trade and the industry in which it

operates. Due to the risk that revenues and the related conversion

of revenue to cash inflows may not be achieved as forecast over the

going concern period, the Directors believe that there exists a

material uncertainty that may cast significant doubt on the

Company's ability to continue as a going concern and it may be

unable to realise its assets and discharge its liabilities in the

normal course of business.

These financial statements do not include the adjustments that

would result if the Company were unable to continue as a going

concern.

Accounting policies

The condensed financial statements have been prepared in a

manner consistent with the accounting policies set out in the

financial statements for the year ended 31 March 2023 and on the

basis of the International Financial Reporting Standards (IFRS) as

adopted for use in the UK that the Company expects to be applicable

at 31 March 2023. IFRS are subject to amendment and interpretation

by the International Accounting Standards Board (IASB).

2 Segmental information

For all the financial periods included in these condensed

financial statements, all the revenues and costs relate to the

single operating segment of research, development and manufacture

of recombinant proteins and antibodies.

3 Administrative expenses

6 months 6 months Year to

to 30.09.23 to 30.09.22 31.03.23

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------- ------------- ------------- ----------

Research & development 182 452 807

Selling, general and administration 1,153 1,419 2,636

------------------------------------- ------------- ------------- ----------

1,335 1,871 3,443

------------------------------------- ------------- ------------- ----------

4 Finance income and costs

6 months 6 months Year to

to 30.09.23 to 30.09.22 31.03.23

Unaudited Unaudited Audited

Income GBP'000 GBP'000 GBP'000

--------------------------- ------------- ------------- ----------

Bank interest receivable 2 1 3

--------------------------- ------------- ------------- ----------

6 months 6 months Year to

to 30.09.23 to 30.09.22 31.03.23

Unaudited Unaudited Audited

Expense GBP'000 GBP'000 GBP'000

--------------------------- ------------- ------------- ----------

Interest expense on other

borrowings 3 7 4

--------------------------- ------------- ------------- ----------

5 Income tax credit

6 months 6 months Year to

to 30.09.23 to 30.09.22 31.03.23

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------- ------------- ------------- ----------

Current tax (63) (146) (263)

------------- ------------- ------------- ----------

6 Loss per share

6 months 6 months to Year to

to 30.09.22 31.03.23

30.09.23 Unaudited Audited

Unaudited Number Number

Number

------------------------ ----------- ------------ ----------

Loss for the financial

year (1,357) (1,116) (2,596)

------------------------ ----------- ------------ ----------

Loss per share pence pence pence

Basic (2.3) (4.3) (10.0)

Diluted (2.9) (4.3) (10.0)

------------------------ ----------- ------------ ----------

6 Loss per share (continued)

The weighted average number of shares used in the calculation of

the basic earnings per share are as follows:

6 months 6 months to Year to

to 30.09.22 31.03.23

30.09.23 Unaudited Audited

Unaudited Number Number

Number

---------------------------- ------------- ------------- -------------

Issued ordinary shares

at the end of the period 59,453,714 26,014,946 26,014,946

Weighted average number

of shares in issue during

the period 46,496,775 26,014,946 26,014,946

---------------------------- ------------- ------------- -------------

Basic earnings per share is calculated by dividing the basic

earnings for the period by the weighted average number of shares in

issue during the period. Diluted earnings per share is calculated

by dividing the basic earnings for the year by the diluted weighted

average number of shares in issue inclusive of share options

outstanding at year end.

7 Property, plant and equipment

Right Leasehold Plant Fixtures, Total

of use property & fittings GBP'000

assets GBP'000 machinery & equipment

GBP'000 GBP'000 GBP'000

-------------------------- --------- ---------- ----------- ------------- ---------

Cost

At 1 April 2023 14 844 2,396 277 3,531

Additions - - - - -

Disposals - - - - -

-------------------------- --------- ---------- ----------- ------------- ---------

At 30 September 2023 14 844 2,396 275 3,531

-------------------------- --------- ---------- ----------- ------------- ---------

Accumulated depreciation

At 1 April 2023 9 812 2,112 223 3,156

Disposals - - - - -

Depreciation charged

in the period 2 17 93 13 125

-------------------------- --------- ---------- ----------- ------------- ---------

At 30 September 2023 11 829 2,205 236 3,281

-------------------------- --------- ---------- ----------- ------------- ---------

Net book value

At 30 September

2023 3 15 191 41 250

-------------------------- --------- ---------- ----------- ------------- ---------

At 31 March 2023 5 32 284 54 375

-------------------------- --------- ---------- ----------- ------------- ---------

8 Borrowings

At 30 September At 30 September At 31 March

2023 2022 2023

GBP'000 GBP'000 GBP'000

-------------------------- ---------------- ---------------- ------------

At 1 April 75 69 69

Additions in period - 323 69

Interest 3 7 4

Repayments (31) (66) (67)

-------------------------- ---------------- ---------------- ------------

At period end 47 333 75

-------------------------- ---------------- ---------------- ------------

Amounts due in less than

1 year 17 83 35

Amounts due after more

than 1 year 30 250 40

-------------------------- ---------------- ---------------- ------------

47 333 75

-------------------------- ---------------- ---------------- ------------

Borrowings are secured by a fixed and floating charge over the

whole undertaking of the Company, its property, assets and rights

in favour of Northern Bank Ltd trading as Danske Bank.

9 Retirement benefits obligations

The Company operates a defined contribution scheme, the assets

of which are managed separately from the Company.

10 Transactions with related parties

The Company had the following transactions with related parties

during the period:

Invest Northern Ireland is a shareholder in the Company. The

Company received invoices for rent and estate services amounting to

GBP38,000 (6 months ended 30 September 2022: GBP42,000, year ended

31 March 2023: GBP79,000). There was no balance due and payable to

Invest NI at the reporting dates presented.

11 Events after the reporting date

The Company was pleased to announce on 28(th) November 2023 that

an agreement had been established with the National Cancer

Institute to help validate the OptiMAL (R) platform.

12 Reconciliation of loss to EBITDA and EBITDA excluding R&D expenditure

6 months 6 months Year to

to 30.09.23 to 30.09.22 31.03.23

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------- ------------- ------------- ----------

Loss before tax (1,357) (1,262) (2,859)

Finance income/ expense 1 6 1

Depreciation and amortisation 125 248 372

------------------------------- ------------- ------------- ----------

EBITDA (1,231) (1,008) (2,486)

Expenditure on research and

development 182 452 807

------------------------------- ------------- ------------- ----------

EBITDA excluding research and

development (1,049) (556) 1,679

------------------------------- ------------- ------------- ----------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FSDFEEEDSEEE

(END) Dow Jones Newswires

December 04, 2023 02:00 ET (07:00 GMT)

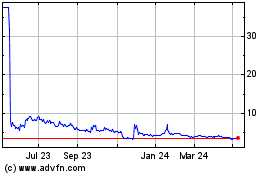

Fusion Antibodies (LSE:FAB)

Historical Stock Chart

From Apr 2024 to May 2024

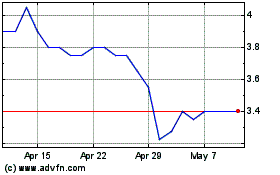

Fusion Antibodies (LSE:FAB)

Historical Stock Chart

From May 2023 to May 2024