Gfinity PLC Disposal and Business Update (7273B)

06 June 2023 - 4:00PM

UK Regulatory

TIDMGFIN

RNS Number : 7273B

Gfinity PLC

06 June 2023

THIS ANNOUNCEMENT AND THE INFORMATION HEREIN IS RESTRICTED AND

IS NOT FOR PUBLICATION, RELEASE, TRANSMISSION, DISTRIBUTION OR

FORWARDING DIRECTLY OR INDIRECTLY, IN WHOLE OR IN PART, IN OR INTO

THE UNITED STATES, AUSTRALIA, CANADA, THE REPUBLIC OF SOUTH AFRICA,

JAPAN OR ANY OTHER JURISDICTION IN WHICH SUCH PUBLICATION,

TRANSMISSION, RELEASE, DISTRIBUTION OR FORWARDING WOULD BE

UNLAWFUL.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

06 June 2023

Gfinity PLC

("Gfinity", the "Company" or the "Group")

Disposal and Business Update

The Board of Gfinity plc (AIM:GFIN), a leading technology and

media company in the video gaming industry, today announces the

divestment of 72.5% of Athlos, a subsidiary of the Company, to

Tourbillon Group UK Limited. All future liabilities associated with

Athlos will be assumed by Tourbillon, with the buyer also providing

growth capital to support the business moving forward.

Alongside the funding, Tourbillon brings an experienced

management team who have the capability to take the business to the

next stage of its development. Gfinity will retain a 27.5%

shareholding in Athlos. The consideration payable to Gfinity by

Tourbillon is GBP1.

In the year to December 2022, Athlos generated revenue of

GBP0.4m, with a loss before tax o f GBP0.5m. If capitalised

development expenditure is added back, the loss before tax was

GBP1.2m. The net assets of Athlos as at December 2022 was GBP1.2m.

In the 12 months to the end of May 2023, Athlos has absorbed

GBP1.5m of Group cash. The divestment therefore significantly

reduces the cash burn of the Company.

The Company also today announces that it is closing down its

Esports division, as the market for esports remains soft and the

directors see limited profitable growth opportunities.

The above restructuring will allow the Company to focus on

digital media and its significant position in the Gamer website

industry. After a large dip in users in 2022 due to some adverse

market impacts including changes in the Google Search Engine, the

Company has performed a round of cost cuts and improvements in it

content as it streamlines the Editorial team and makes strategic

hires in SEO and tech, to increase user numbers. Part of this plan

includes the deployment of AI automation tools to reduce the cost

of specific items of content creation. This has already helped the

Company deliver an upturn in trading in May 2023.

After, a difficult period, the Stockinformer website has been

rebuilt, with an exciting future as its capabilities have increased

to scale across 1000's of products automatically and with an

increased accuracy of pricing.

The Company has also made extensive cost savings across the

business and the monthly cost base in July will be GBP185k

(annualised at GBP2.2m) compared to a monthly average of GBP600k in

H1 FY23. The Company currently has cash reserves of GBP0.4m. The

Directors believe that these cost savings provide the Directors

with an organisation that can achieve operating profitability on an

EBITDA basis in the near term.

Chairman, Neville Upton commented "This has been a difficult

year for Digital Media with the Company having losses across all

verticals, however after a significant re-structuring, we are

confident that Gfinity will flourish without the requirement to

raise further working capital. By focussing on our core web

offering for Gamers, we are able to remove the capital intensive

businesses of software development and esports events, and focus on

returning to a positive return on investment. We will update the

shareholders shortly on a more detailed strategy.

Enquiries :

Gfinity plc www.gfinityplc.com

Neville Upton, Executive Chairman ir@gfinity.net

Canaccord Genuity Limited (Nominated Adviser Tel: +44 (0)207 523

and Broker) 8150

Bobbie Hilliam / Patrick Dolaghan

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDEAAKSESLDEAA

(END) Dow Jones Newswires

June 06, 2023 02:00 ET (06:00 GMT)

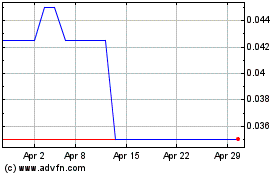

Gfinity (LSE:GFIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gfinity (LSE:GFIN)

Historical Stock Chart

From Dec 2023 to Dec 2024