TIDMGFIN

RNS Number : 8060I

Gfinity PLC

09 August 2023

THIS ANNOUNCEMENT (INCLUDING THE APPICES) AND THE INFORMATION

HEREIN IS RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE,

TRANSMISSION, DISTRIBUTION OR FORWARDING DIRECTLY OR INDIRECTLY, IN

WHOLE OR IN PART, IN OR INTO THE UNITED STATES, AUSTRALIA, CANADA,

THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY OTHER JURISDICTION IN

WHICH SUCH PUBLICATION, TRANSMISSION, RELEASE, DISTRIBUTION OR

FORWARDING WOULD BE UNLAWFUL.

For immediate release

9 August 2023

Gfinity PLC

("Gfinity" or the "Company")

Fundraising

Proposed Board changes

Proposed share capital reorganisation

Change of adviser

Summary

The Board of Gfinity plc (AIM:GFIN) is pleased to announce that

the Company has today conditionally raised GBP450,000 through a

Company arranged Subscription at a price of 0.06 pence per New

Ordinary Share (the "Issue Price"). The Subscription is conditional

on the passing of the resolutions to be proposed at a General

Meeting ("Resolutions").

As the Company's Existing Ordinary Shares have a nominal value

of 0.1 pence at present, to enable the Company to issue shares

pursuant to the Subscription at 0.06 pence per share, the Company

is proposing to undertake a Share Capital Reorganisation, pursuant

to which each Existing Ordinary Share of 0.1 pence currently in

issue will be subdivided into one New Ordinary Share of 0.01 pence

each and one Deferred Share of 0.09 pence each.

The recently announced restructuring has allowed the Company to

focus on its digital media business, Gfinity Digital Media, which

has a significant position in the Gamer website industry . To

support that strategy, the Company is proposing certain Board

changes:

-- David Halley will be joining the Company as Chief Executive

Officer on completion of the customary regulatory checks under the

AIM Rules.

-- Jonathan Hall ceases to be a director with immediate effect

and the Board would like to thank Jonathan for his significant

contribution to the Company since it was first admitted to AIM, and

to wish him well for the future. In the interim he will continue in

his role as Company Secretary until a new appointment is made.

The Company has today appointed Beaumont Cornish Limited ("BCL")

as the Company's Nominated Adviser and Broker with immediate

effect.

A circular, containing further details of the Subscription and

the Share Capital Reorganisation and notice of a General Meeting

to, inter alia, approve the Resolutions required to implement the

Subscription and the Share Capital Reorganisation, is expected to

be published and despatched to Shareholders shortly and a further

announcement will be made in due course.

Fundraising

The Company has today conditionally raised GBP450,000 (before

expenses) through the Company arranged Subscription at the Issue

Price. The Subscription is conditional on the passing of the

Resolutions. The Issue Price compares to the 10-day volume weighted

average price per share of 0.94 pence for the period ended on 8

August 2023 (being the Last Practicable Date prior to the

announcement of the Subscription). Subject to shareholder approval,

the Company will issue 750,000,000 New Ordinary Shares

("Subscription Shares") pursuant to the Subscription which will

rank pari passu with the New Ordinary Shares arising on the Share

Capital Reorganisation as described above. Application will be made

for admission of the Subscription Shares and the New Ordinary

Shares resulting from the Share Capital Reorganisation to trading

on AIM subject to the passing of the Resolutions.

Current trading and use of proceeds

On 31 March 2023, the Company announced its half year results

for the six-month period ended 31 December 2022. These results

reported revenue of GBP4.1 million, an adjusted operating loss of

GBP0.8 million and a period-end cash of GBP1.7m, supplemented by a

post period-end placing and subscription, raising GBP2.0 million

before expenses.

Following the divestment of 72.5% of Athlos, the closure of the

Esports Solutions Division and associated significant cost

reductions across the business, the Directors believe that the

business has now stabilised. As at 4 August 2023, the Company's

cash amounted to approximately GBP205,000.

Given the restructuring as described above, the Company will be

reviewing in accordance with normal year-end procedures, the

carrying cost of goodwill in its next audited Accounts to 30 June

2023 and it is likely that a substantial part of the goodwill

(which stood at GBP4.7m as per the last published balance sheet as

at 31 December 2022) will be written off, which would also be

reflected as a charge to the Income Statement.

The net proceeds from the Subscription are intended to fund the

immediate day-to-day working capital needs of the Company's media

business and the ongoing cost of its AIM listing. The Directors are

targeting cash break-even and attracting a monthly audience of 10m+

monthly active users over the next six months. Gfinity has invested

extensively in its tech content platform and, more recently in the

deployment of artificial intelligence ("AI"). Combined with more

effective use of "ad-tech" to boost CPM rates and direct

advertising, the Board believes it can create a market leader in

the gaming digital media space.

If the Resolutions are not passed at the General Meeting, the

Subscription will not proceed in the form currently envisaged, with

the result that the anticipated net proceeds of the Subscription

will not become available. The Directors would as a result need to

consider urgently alternative sources of funding to meet its

immediate working capital needs, including a trade sale of its

operating subsidiary. There is no assurance that any such

alternative funding arrangements could be put in place in the

timescale required, which would have a materially adverse effect on

the Company.

Share Capital Reorganisation

A company is not permitted under the Companies Act 2006 to issue

shares with an issue price which is below their nominal value. The

Company's Existing Ordinary Shares have a nominal value of 0.1

pence at present and to enable the Company to issue shares pursuant

to the Subscription at 0.06 pence per share, the Company is

proposing to undertake the Share Capital Reorganisation, pursuant

to which each Existing Ordinary Share currently in issue will be

subdivided into one New Ordinary Share of 0.01 pence each and one

Deferred Share of 0.09 pence each.

Immediately following the Share Capital Reorganisation, the

number of New Ordinary Shares in issue will be the same as the

number of Existing Ordinary Shares currently in issue, in each case

excluding the Subscription Shares, which as at the date of this

announcement is 2,649,029,913. Accordingly, immediately following

the Share Capital Reorganisation and before completion of the

Admission of the Subscription Shares, 2,649,029,913 New Ordinary

Shares and 2,649,029,913 Deferred Shares will be in issue.

Application will be made for Admission to trading on AIM for the

New Ordinary Shares arising on the Share Capital Reorganisation,

which on Admission will have the same rights as those currently

attaching to the Existing Ordinary Shares under the Articles,

including the rights relating to voting and entitlement to

dividends. New share certificates for New Ordinary Shares will not

be issued and the existing certificates are expected to remain

valid.

Holders of warrants over Existing Ordinary Shares will maintain

the same rights as currently accruing to them, subject to

adjustment of their subscription rights in respect of the New

Ordinary Shares, on the terms of the Existing Warrant Instrument,

to reflect the Share Capital Reorganisation. As such, upon

completion of the Share Capital Reorganisation, each Existing

Warrant will entitle its holder to subscribe for one New Ordinary

Share and one Deferred Share, subject to the terms and conditions

set out in the Existing Warrant Instrument.

The Deferred Shares will have no substantive rights attached to

them and, accordingly, will not carry the right to vote or to

participate in any distribution of surplus assets. They will not be

admitted to trading on AIM and will effectively carry no value.

The holders of the Deferred Shares will be deemed to have given

an irrevocable authority to the Company at any time to: (i) appoint

any person, for and on behalf of such holder, to, among other

things, transfer some or all of the Deferred Shares (at nil

consideration) to such person(s) as the Company may determine; and

(ii) purchase or cancel such Deferred Shares. In addition, the

Company may purchase all of the Deferred Shares, at a price not

exceeding GBP1 in aggregate.

As part of this process, the Articles will need to be amended to

set out the rights and restrictions attaching to the Deferred

Shares and the existing share authorities will need to be replaced.

A special resolution in the Notice of General Meeting will propose

the necessary amendments to the Articles and will set out the

rights attaching to the Deferred Shares, details of which will be

set out in the Notice of General Meeting.

General Meeting

A circular, containing further details of the Subscription and

the Share Capital Reorganisation and notice of the General Meeting

to, inter alia, approve the Resolutions required to implement the

Subscription and the Share Capital Reorganisation, is expected to

be published and despatched to Shareholders shortly and a further

announcement will be made in due course (the "Circular"). Following

its publication, the Circular will be available on the Group's

website.

Proposed Board changes

As previously announced on 6 June 2023, the Company announced

that it had sold 72.5% of Athlos to Tourbillon Group UK Limited and

the closure of its Esports division, as the market for esports

remained soft and the Directors saw limited profitable growth

opportunities. This restructuring has allowed the Company to focus

on its digital media business, Gfinity Digital Media, which has a

significant position in the Gamer website industry. Accordingly,

the Company is proposing certain Board changes to support its new

strategy.

David Halley will be joining the Company as Chief Executive

Officer on completion of the customary regulatory checks under the

AIM Rules. David has over 25 years' experience spanning banking,

hedge funds and insurance, incorporating risk management and

trading roles. He founded and served as the CIO of Capstone

Financial (HK) Ltd, founded a crypto related insurance broker and

has previously been a member of the investment management team for

Man-Vector Limited, a commodity trading advisor (CTA) hedge fund

that was part of the Man Group. David Halley served as the Risk

Manager for the fund. David is currently a director of Tourbillon

Group UK Limited which, as announced in June this year, acquired

72.5 per cent. of the Company's gaming subsidiary, Athlos. On

appointment to the Board, David Halley will not receive any direct

monetary remuneration in place of which the Company intends to make

a significant award of share options to him to subscribe for New

Ordinary Shares at the Issue Price.

Jonathan Hall ceases to be a director with immediate effect and

the Board would like to thank Jonathan for his significant

contribution to the Company since it was first admitted to AIM, and

to wish him well for the future. In the interim he will continue in

his role as Company Secretary until a new appointment is made .

Following the appointment of David Halley, Neville Upton will

revert to his previous role of non-executive Chairman.

Change of Adviser

The Company has today appointed Beaumont Cornish Limited ("BCL")

as the Company's Nominated Adviser and Broker with immediate

effect.

Directors' and Proposed Director's Participation and Related

Party Subscription

The directors are not participating in the Subscription. David

Halley, a proposed director, has participated in the Subscription

by subscribing for 66,666,667 New Ordinary Shares, representing

1.96% in the Company's Enlarged Share Capital on Admission.

Robert Keith is subscribing for 333,333,333 Subscription Shares

pursuant to the Subscription. Robert Keith is currently interested

in 12.02% of the Company's Ordinary Shares held by him directly and

indirectly.

The subscription by Robert Keith for the Subscription Shares is

therefore a related party transaction pursuant to rule 13 of the

AIM Rules for Companies. Accordingly, the Directors consider,

having consulted with the Company's nominated adviser, Beaumont

Cornish, that the subscription for the Subscription Shares by

Robert Keith which is on the same terms and conditions as for the

other subscribers, is fair and reasonable insofar as Gfinity's

Shareholders are concerned.

Other Information

Further information is available from the Company's website

which details the company's project portfolio as well as a copy of

this announcement: www.gfinityplc.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK Domestic Law by virtue of the European Union (Withdrawal) Act

2018 ("UK MAR").

The person who arranged for the release of this announcement on

behalf of the Company was Neville Upton, Executive Chairman and

Director.

Enquiries:

Gfinity Plc Neville Upton, ir@gfinity.net

Executive Chairman

Beaumont Cornish Limited Roland Cornish +44 (0)207 628 3369

Nominated Adviser Michael Cornish www.beaumontcornish.co.uk

and Broker

Important Notice

Beaumont Cornish Limited (" Beaumont Cornish "), which is

authorised and regulated in the United Kingdom by the Financial

Conduct Authority, is acting as nominated adviser to the Company in

connection with the proposed admission of the Subscription Shares

and the New Ordinary Shares arising from the Share Capital

Reorganisation to trading on AIM and the proposals described in

this document. It will not regard any other person as its client

and will not be responsible to anyone else for providing the

protections afforded to the clients of Beaumont Cornish or for

providing advice in relation to such proposals. Beaumont Cornish

has not authorised the contents of, or any part of, this document

and no liability whatsoever is accepted by Beaumont Cornish for the

accuracy of any information or opinions contained in this document

or for the omission of any information. Beaumont Cornish as

nominated adviser to the Company owes certain responsibilities to

the London Stock Exchange which are not owed to the Company, the

Directors, Shareholders or any other person.

The New Ordinary Shares referred to in this document have not

been and will not be registered under the US Securities Act of

1933, as amended (the "Securities Act") and may not be offered or

sold in the United States except pursuant to an exemption from, or

in a transaction not subject to, the requirements of the Securities

Act. There will be no public offer of the New Ordinary Shares in

the United States, the United Kingdom or elsewhere. The New

Ordinary Shares are being offered and sold outside the United

States in reliance on Regulation S under the Securities Act. The

New Ordinary Shares have not been approved or disapproved by the US

Securities and Exchange Commission, any state securities commission

or other regulatory authority, nor have the foregoing authorities

passed upon or endorsed the merits of this offering. Any

representation to the contrary is a criminal offence in the United

States and any re-offer or resale of any of the New Ordinary Shares

in the United States or to a US Person may constitute a violation

of US law or regulation.

The distribution of this document and the offering or sale of

the New Ordinary Shares in certain jurisdictions may be restricted

by law. No action has been taken by the Company or Beaumont Cornish

that would permit an offering of the New Ordinary Shares or

possession or distribution of this document or any other offering

or publicity material relating to the New Ordinary Shares in any

jurisdiction where action for that purpose is required. Persons

into whose possession this document comes are required by the

Company and Beaumont Cornish to inform themselves about and to

observe any such restrictions.

This document is directed only at members of the Company falling

within the meaning of Article 43(2)(a) of the Financial Services

and Markets Act 2000 (Financial Promotion) Order 2005, as amended

(all such persons together being referred to as "Relevant

Persons"). This document must not be acted on or relied on by

persons who are not Relevant Persons. This document does not

constitute an offer of securities and accordingly is not a

prospectus, neither does it constitute an admission document drawn

up in accordance with the AIM Rules.

FORWARD LOOKING STATEMENTS

This document includes "forward-looking statements" which

include all statements other than statements of historical facts,

including, without limitation, those regarding the Company's

financial position, business strategy, plans and objectives of

management for future operations, or any statements preceded by,

followed by or that include the words "targets", "believes",

"expects", "aims", "intends", "will", "may", "anticipates",

"would", "could" or "similar" expressions or negatives thereof.

Such forward-looking statements involve known and unknown risks,

uncertainties and other important factors beyond the Company's

control that could cause the actual results, performance or

achievements of the Company to be materially different from future

results, performance or achievements expressed or implied by such

forward-looking statements. Such forward-looking statements are

based on numerous assumptions regarding the Company's present and

future business strategies and the environment in which the Company

will operate in the future. These forward-looking statements speak

only as at the date of this document. The Company expressly

disclaims any obligation or undertaking to disseminate any updates

or revisions to any forward-looking statements contained herein to

reflect any change in the Company's expectations with regard

thereto or any change in events, conditions or circumstances on

which any such statements are based unless it is required to do so

by applicable law or the AIM Rules.

APPIX 1

SUBSCRIPTION STATISTICS

Issue Price 0.06 pence

Number of Existing Ordinary Shares prior to Admission

of any of the Subscription Shares 2,649,029,913

Total number of Subscription Shares issued by the

Company pursuant to the Subscription 750,000,000

Gross proceeds of the Subscription GBP450,000

Enlarged Share Capital following completion of

the Subscription and Admission 3,399,029,913

Percentage of the Enlarged Share Capital comprised 22.1 per cent.

by the Subscription Shares

Number of Existing Warrants 1,373,053,334

ISIN GB00BT9QD572

SEDOL BT9QD57

APPIX 2

DEFINITIONS

"Act " the Companies Act 2006 (as amended);

"Admission" the admission of the Subscription Shares

and the New Ordinary Shares arising from

the Share Capital Reorganisation to trading

on AIM becoming effective in accordance

with the AIM Rules;

"AIM Rules" the AIM Rules for Companies, as published

and amended from time to time by the London

Stock Exchange;

"Articles" the articles of association of the Company

at the date of this announcement;

"Board" or "Directors" the directors of the Company as at the date

of this announcement;

" Beaumont Cornish Beaumont Cornish Limited, the Company's

" nominated adviser and broker pursuant to

the AIM Rules;

"Business Day" any day (other than a Saturday or Sunday)

upon which commercial banks are open for

business in London, UK;

"Company ", "Group" Gfinity plc;

or "Gfinity"

"CREST" the relevant system for the paperless settlement

of trades and the holding of uncertificated

securities operated by Euroclear in accordance

with the CREST Regulations;

"CREST member" a person who has been admitted by Euroclear

as a system-member (as defined in the CREST

Regulations);

"Deferred Shares" the deferred shares of 0.09 pence each in

the capital of the Company to be created

as part of the Share Capital Reorganisation;

"Enlarged Share the New Ordinary Shares in issue on Admission,

Capital " including the Subscription Shares;

"Euroclear" Euroclear UK & International Limited, the

operator of CREST;

"Existing Ordinary the 2,649,029,913 existing ordinary shares

Shares" of 0.1p each in the capital of the Company

as at the date of this announcement;

"Existing Warrants" the warrants over 1,373,053,334 Ordinary

Shares pursuant to the Existing Warrant

Instrument, granting warrant holders the

right to subscribe for Ordinary Shares in

the Company;

"Existing Warrant the warrant instrument entered into by the

Instrument" Company, dated 6 March 2023;

"FCA" the Financial Conduct Authority;

"FSMA" the Financial Services and Markets Act 2000

(as amended);

"General Meeting the general meeting of Shareholders to be

" or "GM" held notice of which will be set out in

a circular;

"ISIN" International Securities Identification

Number;

"Issue Price" 0.06 pence per New Ordinary Share;

"Last Practicable 8 August 2023;

Date"

"Link" or "Link a trading name of Link Asset Services Limited,

Group" registrar to the Company;

"London Stock Exchange" London Stock Exchange plc;

"New Ordinary Shares" the ordinary shares of 0.01 pence each in

the capital of the Company in issue following

completion of the Share Capital Reorganisation;

"Notice of General the notice of General Meeting to set out

Meeting " in the Circular;

"Ordinary Shares" the ordinary shares of 0.1p each in the

capital of the Company, prior to the Share

Capital Reorganisation;

"Registrars" Link Group;

"Resolutions" the resolutions to be set out in the Notice

of General Meeting to be proposed at the

General Meeting;

"Restricted Jurisdiction" each and any of the United States of America,

Australia, Canada, Japan, New Zealand, Russia,

and the Republic of South Africa and any

other jurisdiction where extension or availability

of the Subscription would breach any applicable

law or regulations;

"Share Capital Reorganisation" the sub-division of each Existing Ordinary

Share into one New Ordinary Share and one

Deferred Share to be effected by the passing

of the Resolutions;

"Shareholder(s) holder(s) of Existing Ordinary Shares;

"

"sterling", "pounds the lawful currency of the United Kingdom

sterling", and "GBP",

"pence" or "p"

"Subscribers" the persons who have conditionally agreed

to subscribe for the Subscription Shares;

"Subscription" the subscription for the Subscription Shares

at the Issue Price as described in this

announcement;

"Subscription Shares" the 750,000,000 New Ordinary Shares to be

subscribed for by persons who have entered

or intend to enter into subscription letters

with the Company; and

"US Securities Act" the United States Securities Act of 1933

(as amended).

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGCGDILXGDGXC

(END) Dow Jones Newswires

August 09, 2023 05:54 ET (09:54 GMT)

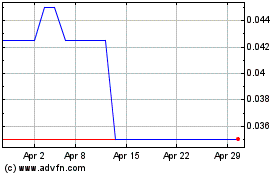

Gfinity (LSE:GFIN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Gfinity (LSE:GFIN)

Historical Stock Chart

From Dec 2023 to Dec 2024