TIDMGRG

RNS Number : 8038H

Greggs PLC

01 August 2023

1 August 2023

GREGGS PLC

("Greggs" or the "Company")

INTERIM RESULTS FOR THE 26 WEEKSED 1 JULY 2023

Strategic growth plans delivering strong performance

First half financial highlights

H1 2023 H1 2022

Total sales GBP844.0m GBP694.5m

---------- ----------

Underlying pre-tax profit excluding exceptional GBP63.7m GBP55.8m

items *

---------- ----------

Pre-tax profit GBP80.0m GBP55.8m

---------- ----------

Underlying diluted earnings per share excluding

exceptional items* 46.8p 44.8p

---------- ----------

Diluted earnings per share 59.0p 44.8p

---------- ----------

Ordinary interim dividend per share 16.0p 15.0p

---------- ----------

* Excludes impact of GBP16.3 million exceptional net income

related to settlement of a Covid business interruption insurance

claim

-- Total first-half sales up 21.5%, with company-managed shop LFL** sales up 16.0%

-- Underlying profit before tax excluding exceptional items up 14.2% to GBP63.7 million.

-- Reported pre-tax profit includes an additional GBP16.3

million of exceptional net income recognised in respect of the

settlement of a Covid business interruption insurance claim

-- Strong cash position of GBP139 million supporting plans for future investment in growth

-- Underlying earnings growth of 4.5% reflects increase in Corporation Tax rate

-- Interim dividend of 16 pence per share declared, an increase of 6.7%

** Like-for-like (LFL) company-managed shop sales performance

against comparable period in 2022

Strategic progress

-- Growing and developing the Greggs estate : 94 new shops

opened in the first half, 44 closures; 2,378 shops trading as at 1

July 2023. Strong pipeline of good opportunities and continue to

anticipate circa 150 net new shop openings in 2023.

-- Expanding our evening trade : continued extension of early

evening trading progressing in line with plan. Evening remains the

fastest growing daypart and, in the first half, represented 8.3% of

company-managed shop sales (H1 2022: 6.5%).

-- Developing our digital channels : good progress in improving

operational service levels for delivery customers. Trial with

second delivery aggregator progressing well.

-- Broadening customer appeal and driving loyalty : continued

growth in brand health and market share. Further increase in Greggs

App participation: 10.6% of company-managed shop transactions

scanned in first half (H1 2022: 5.2%).

-- Supply chain investment : commenced redevelopment of

Birmingham distribution centre, extension of Amesbury distribution

centre due to start in the second half. Fourth savoury production

line at Balliol Park in Newcastle upon Tyne due to be commissioned

in the fourth quarter.

Outlook

The strong trading momentum of the first half has continued into

the second half of the year, with good sales reflecting the

exceptional value that Greggs offers to customers who need food and

drink on-the-go. The rate of cost inflation has started to ease and

we expect this trend to continue through the second half.

Whilst uncertainties in the economic outlook remain, we continue

to trade in line with our plan and are making good progress against

our strategic objective to grow the frequency of customer visits

through new channels. As such, the Board's expectations for the

full year outcome are unchanged .

" Greggs strong performance continued in the first half of 2023

as we deliver on our strategic growth plan. With consumers

remaining under pressure, we continue to offer exceptional value,

which is reflected in our performance and growing market share

.

"In the period we continued to open further new shops, extended

trading hours into the evening and saw increased participation in

the Greggs App.

"Our ambitious plans for growth are o n track and our amazing

teams are committed to realising the opportunity to become a

significantly larger, multi-channel business ."

- Roisin Currie, Chief Executive

ENQUIRIES:

Greggs plc Hudson Sandler

Roisin Currie, Chief Executive Wendy Baker / Nick Moore

Richard Hutton, Chief Financial /

Officer Sophie Miles / Emily Brooker

David Watson, Head of IR Email: greggs@hudsonsandler.com

Tel: 0191 281 7721 Tel: 020 7796 4133

An audio webcast of the analysts' presentation will be available

to download later today at http://corporate.greggs.co.uk/

CHIEF EXECUTIVE'S REPORT

Greggs has continued to trade well in 2023 with like-for-like

sales in company-managed shops growing by 16.0% when compared with

the equivalent period of 2022 . Total sales for the 26 weeks to 1

July 2023 were GBP844.0 million, an increase of 21.5% (H1 2022:

GBP694.5 million).

We continue to make good progress with our strategic growth

plan, which is centred around 1) growing and developing our estate;

2) expanding our evening trade; 3) developing our digital services;

4) broadening customer appeal and driving loyalty. These objectives

are underpinned by investment in our supply chain and systems which

will enable us to drive progress and growth across our business

.

Operational review

The first half of 2023 saw Greggs deliver a strong sales

performance. At a time when consumers are under pressure, our

long-standing focus on providing outstanding value on-the-go food

and drink is as relevant as ever. The LFL performance for the first

two months of the year was flattered by comparison with the

Omicron-affected period in 2022 and the actions we have taken to

make Greggs available in more channels and at more times of day

continue to result in additional customer visits.

Our new Flatbread Range, including Mexican Chicken and Vegan

Tandoori Chicken-Free has performed well and, alongside the new

Sweet Chilli Chicken Noodle Salad, extends our range of healthier

options for customers. Plant-based foods are contributing more

significantly to our range over time and the introduction of new

options such as the Vegan Mexican Chicken-Free Bake are testament

to this trend. Pizza continues to be in high demand, particularly

in the evening and our Late Trade Pizza Deal is proving to be very

popular.

In the first half of 2023 we opened 94 new shops (including 33

franchised units) and closed 44 shops, giving a total of 2,378

shops (of which 466 are franchised) trading as at 1 July 2023. We

have increased the pace of both openings and closures as we expand

the reach of our shops into new locations and relocate existing

shops to larger sites in better locations to facilitate further

growth. The phasing of shop closures was unusual in its weighting

towards the first half of the year. However, we have a strong new

shop pipeline and we remain confident that we will open around 150

net new shops in the year as a whole.

Greggs has a growing presence in travel hubs and in the first

half we opened shops at Glasgow and Cardiff Airports as well as

Shepherds Bush and Canary Wharf Underground stations. Last week we

opened our latest airport unit at London Gatwick Airport's South

Terminal.

In the first half of 2023 we refurbished 71 shops, modernising

them to our latest look and enhancing their capability for food

preparation and digital collection. We anticipate completing around

140 shop refurbishments, 125 company-managed and 15 franchised, in

2023 (2022: 86 refurbishments).

Strategic development

Growing and developing the Greggs estate

Our assessment of catchments across the UK continues to support

our ambition to have significantly more than 3,000 shops in the

Greggs estate. Our confidence in this opportunity is underpinned by

recent success in catchments where Greggs is underrepresented such

as retail parks, railway stations, airports, roadsides and

supermarkets. We now have shops trading in Tesco, Asda and

Sainsburys supermarkets, with plans for further development.

Greggs is a trusted brand offering a strong covenant to

landlords and franchise partners and this continues to support the

strength of our shop pipeline. We are on track to deliver 150 net

new shop openings in 2023 with around a third of these expected to

be with franchise partners, in line with the trend in recent years.

We now work with 16 franchise partners who recognise the value that

the Greggs brand brings to the catchments in which they

operate.

Evening trade

We have continued to grow sales in the evening daypart. This

remains a significant opportunity for Greggs as it is the largest

segment of the food-to-go market by value, yet the one where Greggs

currently has the lowest level of penetration. In the first half of

2023, post-4pm sales grew more strongly than any other daypart, and

represented 8.3% of company-managed shop sales, up from 6.5% in the

first half of 2022. The extension of trading hours supported

evening growth and we also saw increased levels of trade post-4pm

in existing opening hours as customers recognise the convenience

and value of our offer later in the day.

Analysis of customer missions in the evening food-to-go market

suggests that 'Grab & Go' and 'Delivery' occasions represented

more than three quarters of the market in 2022 ( source: Circana) .

Our shop estate and existing menu are well positioned to serve Grab

& Go customers with key locations being transport hubs, city

centres, shopping centres and retail parks. In addition, suburban

shops offer a significant opportunity to grow our share of the

evening delivery market. Over time our new shops, relocation and

refurbishment programmes are all adding further seating capacity

for customers who choose to dine in.

Digital channels

Our multi-channel development strategy has progressed well in

the period, with a new and improved Click + Collect website ready

to launch, improving the customer experience through the order

process. Improved operational service levels, combined with

adaptation of shop pick-up points, are making for a better

collection experience for our customers. With the expansion of

personalisation options and the convenience that this channel

offers we expect to continue to see growing participation from our

customers.

Delivery sales remain an important opportunity and we made good

progress in the first half improving operational service levels

through our existing partnership with Just Eat. Our 30-shop trial

with a second delivery aggregator is progressing well.

Broadening customer appeal and driving loyalty

Greggs brand health and market share metrics continue to improve

further from the record levels reported in 2022. In particular, our

reputation for value remains sector-leading, reflecting our focus

on delivering exceptional prices relative to the market. The

evolution of our range to include more plant-based and hot food and

drink options is important in broadening our appeal to more

consumers at more times of day.

We have continued to invest in enhancing our customer

relationship management capabilities in the first half of the year,

focusing on customer journeys such as onboarding, retention and

reactivation. Our growing digital data and analytics capability is

enabling us to understand better the needs of our customers and

provide them with more tailored, relevant communication. G rowth in

use of the Greggs App has continued, with 10.6% of company-managed

customer transactions scanned in the first half of 2023 (H1 2022:

5.2%). Analysis of customer behaviour continues to indicate that

the additional rewards offered to App users are more than

compensated by increased frequency of purchase.

Investing in our supply chain and technology for a bigger

business

To facilitate our strategic growth plan, we are investing in our

supply chain and in technology. We are on track to add a dditional

manufacturing capacity for our iconic savoury rolls and bakes at

Balliol Park in Newcastle upon Tyne, with a fourth production line

due to be commissioned in the fourth quarter.

We have commenced the redevelopment of our Birmingham

distribution centre, and work to extend our distribution centre in

Amesbury is due to start in the second half of 2023. This will add

additional logistics capacity to our network by the end of 2024.

Good progress is being made on the identification of sites for the

development of a national distribution centre and further

manufacturing and frozen storage facilities.

Our investment in technology continues to drive improved

processes and provide greater insight from our data. We have also

rolled out new EPOS tills across our shop estate, which will enable

improved management of pricing and promotions.

The Greggs Pledge

Our separate sustainability report details the progress made in

2022 on the objectives of the Greggs Pledge, our commitment to

continue to improve our ESG credentials in ten key areas by the end

of 2025. In the first half of 2023 we continued to make good

progress across the broad range of commitments, including opening a

further three "Outlet" shops to provide affordable food in areas of

social deprivation, with a share of profits also given to local

community organisations . As we continue to make good progress

against our Pledge objectives for 2025 we are also ensuring that we

have in place ambitious targets for the period beyond 2025. In

doing so we are assessing the next stage of our Pledge journey for

the period 2025 to 2030 and look forward to providing further

details on this in due course.

Financial performance

Total sales for the 26 weeks to 1 July 2023 were GBP844.0

million (H1 2022: GBP694.5 million). Like-for-like sales in

company-managed shops grew by 16.0%.

Underlying pre-tax profit (excluding a GBP16.3 million

exceptional gain, discussed below) was GBP63.7 million in the first

half of 2023 (H1 2022: GBP55.8 million). The year-on-year

progression was supported by a strong start to the year in January

and February where the sales comparatives in 2022 reflected the

impact of Omicron. Sales and profit progression normalised through

the remainder of the first half in line with our plan. The level of

interest income also grew by GBP2.5 million as a result of improved

deposit rates on the cash we have earmarked for our supply chain

capital investment.

Cost inflation, particularly in food and packaging commodities,

continued to be a feature of the first half of 2023 but is expected

to ease somewhat as we annualise on the significant mid-year

increases seen in 2022. Overall like-for-like cost inflation was

11% in the first half of 2023 and we expect this to reduce to

around 7% in the second half, averaging around 9% for the year as a

whole, in line with our previously communicated expectations.

Looking forward we have around four months' forward purchasing

cover on requirements for food, packaging and energy input costs.

The underlying net profit margin before taxation in the first half

of 2023 was 7.5% (H1 2022: 8.0%).

Our investments to grow the frequency of customer visits through

new channels and dayparts improve the leverage of our existing shop

base, delivering strong returns on capital. Delivering a healthy

return on capital employed (ROCE) is embedded as a key element of

our performance management and we aim to continue to deliver strong

overall returns as we grow the business further. Capacity

utilisation in our supply chain is currently at a historically high

level and this will normalise as we commission new facilities in

the coming years. Whilst this is likely to have a modest impact on

ROCE in the short term, this investment supports our long-term

growth ambitions, with our plans focused on a highly-efficient

supply chain model that supports the business's long-term record of

delivering strong returns on capital.

The net financing expense of GBP1.7 million in the period (H1

2022: GBP3.2 million) comprised GBP4.2 million in respect of the

IFRS 16 interest charge on lease liabilities, GBP0.4 million of

facility charges under the Company's (undrawn) financing facilities

offset by GBP2.9 million of interest received on bank deposits and

the Company's defined benefit pension scheme surplus.

Statutory pre-tax profit was GBP80.0 million (H1 2022: GBP55.8

million), reflecting an exceptional net gain of GBP16.3 million on

the settlement of our Covid business interruption insurance claim.

The net gain is recognised after deduction of fees payable to

advisers and the GBP2.5 million advance already recognised as

income in 2020.

The effective rate of Corporation Tax on underlying profits for

the period was 24.9% (H1 2022: 17.7%) with the year-on-year change

reflecting the increase in the headline rate of UK corporation tax

from 19% to 25% from 1 April of this year and the discontinuance of

'super-deduction' enhanced capital allowances from the same date.

The introduction of temporary 'full expensing' of capital

expenditure for the period from April 2023 to April 2026 will add

c1.0% to the previously-expected effective rate for this year only

as deferred tax is provided for at 25%. Including the exceptional

net gain the effective rate of Corporation Tax on profits for the

period was 24.6%.

Underlying d iluted earnings per share (excluding the

exceptional gain) for the period were 46.8 pence (H1 2022: 44.8

pence). Including the exceptional gain diluted earnings per share

for the period were 59.0 pence (H1 2022: 44.8 pence).

Capital expenditure and financial position

Capital expenditure during the first half was GBP85.6 million

(H1 2022: GBP41.9 million) as we increased investment in line with

our estate growth and development plans, added a dditional savoury

manufacturing capacity at our Balliol Park site and commenced the

redevelopment of our Birmingham distribution centre to increase

logistics capacity. In the balance of the year we will continue the

development of our retail estate and savoury manufacturing capacity

and commence work to extend the capacity of our Amesbury

distribution centre. Our full year guidance of circa GBP200 million

capital expenditure is unchanged.

We continue to carry a higher-than-normal cash position in order

to self-fund the multi-year investment in our significant growth

programme and ended the period with a cash balance of GBP138.6

million (2 July 2022: GBP145.7 million). In addition, the Company

has access to a revolving credit facility that allows it to draw up

to GBP100 million in committed funds, subject to it retaining a

minimum liquidity of GBP30 million (i.e. maximum net borrowings of

GBP70 million). The half year cash balance does not include the

exceptional insurance settlement, which was received after the

balance sheet date.

Dividend

The Board has declared an interim dividend of 16.0 pence per

share (2022: 15.0 pence), consistent with the first-half increase

in earnings per share. The overall ordinary dividend for the year

will be proposed in line with our progressive dividend policy,

which targets a full year ordinary dividend that is around two

times covered by underlying earnings.

The interim dividend will be paid on 6 October 2023 to those

shareholders on the register at the close of business on 8

September 2023.

Outlook

The strong trading momentum of the first half has continued into

the second half of the year, with good sales reflecting the

exceptional value that Greggs offers to customers who need food and

drink on-the-go. The rate of cost inflation has started to ease and

we expect this trend to continue through the second half.

Whilst uncertainties in the economic outlook remain, we continue

to trade in line with our plan and are making good progress against

our strategic objective to grow the frequency of customer visits

through new channels. As such, the Board's expectations for the

full year outcome are unchanged.

Roisin Currie

Chief Executive

1 August 2023

Greggs plc

Consolidated income statement

For the 26 weeks ended 1 July 2023

26 weeks ended 26 weeks ended 26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 1 July 2023 1 July 2023 2 July 2022 31 December 2022

--------------------- ------------------ --------------- --------------- ------------------

Excluding Exceptional items

exceptional items (see Note 4) Total Total Total

--------------------- ------------------ --------------- --------------- ------------------

GBPm GBPm GBPm GBPm GBPm

Revenue 844.0 - 844.0 694.5 1,512.8

Cost of sales (329.7) - (329.7) (260.7) (574.5)

--------------------- --------------------- ------------------ --------------- --------------- ------------------

Gross profit 514.3 - 514.3 433.8 938.3

Distribution and

selling costs (408.0) - (408.0) (339.3) (713.2)

Administrative

expenses (40.9) - (40.9) (35.5) (70.7)

Other income - 16.3 16.3 - -

Operating profit 65.4 16.3 81.7 59.0 154.4

Finance expense

(net) (1.7) - (1.7) (3.2) (6.1)

Profit before tax 63.7 16.3 80.0 55.8 148.3

Income tax (15.9) (3.8) (19.7) (9.9) (28.0)

Profit for the

period attributable

to equity holders

of the parent 47.8 12.5 60.3 45.9 120.3

===================== ================== =============== =============== ==================

Basic earnings per

share 47.2p 12.3p 59.5p 45.2p 118.5p

Diluted earnings per

share 46.8p 12.2p 59.0p 44.8p 117.5p

Greggs plc

Consolidated statement of comprehensive income

For the 26 weeks ended 1 July 2023

26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 2 July 2022 31 December 2022

GBPm GBPm GBPm

Profit for the period 60.3 45.9 120.3

Other comprehensive income

Items that will not be recycled to profit and loss:

Remeasurements on defined benefit pension plans 0.2 2.2 0.7

Tax on remeasurements on defined benefit pension plans 0.1 0.0 1.8

Other comprehensive income for the period, net of income tax 0.3 2.2 2.5

--------------- --------------- ------------------

Total comprehensive income for the period 60.6 48.1 122.8

=============== =============== ==================

Greggs plc

Consolidated balance sheet

as at 1 July 2023

1 July 2023 2 July 2022 31 December 2022

GBPm GBPm GBPm

ASSETS

Non-current assets

Intangible assets 13.6 14.0 13.5

Property, plant and equipment 439.4 355.4 390.0

Right-of-use assets 284.3 271.1 281.6

Defined benefit pension asset 6.7 2.3 6.3

744.0 642.8 691.4

Current assets

Inventories 44.6 33.1 40.6

Trade and other receivables 64.4 37.3 50.2

Current tax 8.1 - 0.6

Cash and cash equivalents 138.6 145.7 191.6

255.7 216.1 283.0

Total assets 999.7 858.9 974.4

------------ ------------ -----------------

LIABILITIES

Current liabilities

Trade and other payables (180.9) (149.1) (191.7)

Current tax liability - (5.8) -

Lease liabilities (51.9) (49.7) (48.8)

Provisions (3.0) (3.9) (3.6)

(235.8) (208.5) (244.1)

Non-current liabilities

Other payables (2.6) (3.0) (2.8)

Lease liabilities (252.5) (241.2) (252.5)

Deferred tax liability (44.4) (12.5) (26.3)

Long-term provisions (3.0) (2.1) (2.7)

(302.5) (258.8) (284.3)

Total liabilities (538.3) (467.3) (528.4)

------------ ------------ -----------------

Net assets 461.4 391.6 446.0

============ ============ =================

EQUITY

Capital and reserves

Issued capital 2.0 2.0 2.0

Share premium account 25.1 22.3 23.1

Capital redemption reserve 0.4 0.4 0.4

Retained earnings 433.9 366.9 420.5

Total equity attributable to equity holders of the Parent 461.4 391.6 446.0

============ ============ =================

Greggs plc

Consolidated statement of changes in equity

For the 26 weeks ended 1 July 2023

26 weeks ended 2 July 2022

Issued Share Capital Retained Total

capital premium redemption earnings

reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 2 January 2022 2.0 20.0 0.4 406.8 429.2

Total comprehensive income for the period

Profit for the period - - - 45.9 45.9

Other comprehensive income - - - 2.2 2.2

Total comprehensive income for the period - - - 48.1 48.1

Transactions with owners, recorded directly in equity

Issue of ordinary shares - 2.3 - - 2.3

Purchase of own shares - - - (3.0) (3.0)

Share-based payment transactions - - - 2.1 2.1

Dividends to equity holders (83.3) (83.3)

Tax items taken directly to reserves - - - (3.8) (3.8)

--------- --------- ------------ ---------- -------

Total transactions with owners - 2.3 - (88.0) (85.7)

--------- --------- ------------ ---------- -------

Balance at 2 July 2022 2.0 22.3 0.4 366.9 391.6

--------- --------- ------------ ---------- -------

52 weeks ended 31 December 2022

Issued Share Capital Retained Total

capital premium redemption earnings

reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 2 January 2022 2.0 20.0 0.4 406.8 429.2

Total comprehensive income

for the period

Profit for the financial year - - - 120.3 120.3

Other comprehensive income - - - 2.5 2.5

--------- --------- ------------ ---------- --------

Total comprehensive income

for the year - - - 122.8 122.8

Transactions with owners,

recorded directly in equity

Issue of ordinary shares - 3.1 - - 3.1

Purchase of own shares - - - (11.0) (11.0)

Share-based payment transactions - - - 3.6 3.6

Dividends to equity holders - - - (98.5) (98.5)

Tax items taken directly to

reserves - - - (3.2) (3.2)

--------- --------- ------------ ---------- --------

Total transactions with owners - 3.1 - (109.1) (106.0)

--------- --------- ------------ ---------- --------

Balance at 31 December 2022 2.0 23.1 0.4 420.5 446.0

========= ========= ============ ========== ========

26 weeks ended 1 July 2023

Issued Share Capital Retained Total

capital premium redemption earnings

reserve

GBPm GBPm GBPm GBPm GBPm

Balance at 1 January 2023 2.0 23.1 0.4 420.5 446.0

Total comprehensive income for the period

Profit for the period - - - 60.3 60.3

Other comprehensive income - - - 0.3 0.3

--------- --------- ------------ ---------- -------

Total comprehensive income for the period - - - 60.6 60.6

Transactions with owners, recorded directly in equity

Issue of ordinary shares - 2.0 - - 2.0

Sale of own shares - - - 0.8 0.8

Purchase of own shares - - - (5.0) (5.0)

Share-based payment transactions - - - 2.3 2.3

Dividends to equity holders (44.6) (44.6)

Tax items taken directly to reserves - - - (0.7) (0.7)

--------- --------- ------------ ---------- -------

Total transactions with owners - 2.0 - (47.2) (45.2)

--------- --------- ------------ ---------- -------

Balance at 1 July 2023 2.0 25.1 0.4 433.9 461.4

========= ========= ============ ========== =======

Greggs plc

Consolidated statement of cash flows

For the 26 weeks ended 1 July 2023

26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 2 July 2022 31 December 2022

GBPm GBPm GBPm

Cash flows from operating activities

Cash generated from operations (see page 13) 114.7 100.1 272.3

Income tax paid (9.8) (5.0) (13.3)

Interest paid on lease liabilities (4.2) (3.2) (6.8)

Interest paid on loans and borrowings (0.4) (0.4) (0.7)

Net cash inflow from operating activities 100.3 91.5 251.5

--------------- --------------- ------------------

Cash flows from investing activities

Acquisition of property, plant and equipment (81.0) (34.6) (100.0)

Acquisition of intangible assets (2.2) (1.5) (3.3)

Proceeds from sale of property, plant and equipment 0.5 1.9 0.9

Proceeds from sale of assets held for sale - - 1.6

Interest received 2.9 0.3 1.4

Net cash outflow from investing activities (79.8) (33.9) (99.4)

--------------- --------------- ------------------

Cash flows from financing activities

Proceeds from issue of share capital 2.0 2.2 3.1

Sale of own shares 0.8 - -

Purchase of own shares (5.0) (3.0) (11.0)

Dividends paid (44.6) (83.3) (98.5)

Repayment of principal of lease liabilities (26.7) (26.4) (52.7)

Net cash outflow from financing activities (73.5) (110.5) (159.1)

--------------- --------------- ------------------

Net decrease in cash and cash equivalents (53.0) (52.9) (7.0)

Cash and cash equivalents at the start of the period 191.6 198.6 198.6

Cash and cash equivalents at the end of the period 138.6 145.7 191.6

=============== =============== ==================

Greggs plc

Consolidated statement of cash flows (continued)

For the 26 weeks ended 1 July 2023

Cash flow statement - cash generated from operations

26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 2 July 2022 31 December 2022

GBPm GBPm GBPm

Profit for the period 60.3 45.9 120.3

Amortisation 2.1 2.4 4.7

Depreciation - property, plant and equipment 31.8 28.2 58.0

Depreciation - right-of-use assets 26.7 25.9 52.8

Impairment charge/(reversal) - property, plant and equipment 0.7 (0.2) 1.2

Impairment charge - right-of-use assets 0.3 0.6 0.0

Loss on sale of property, plant and equipment 1.0 0.5 1.0

Release of government grants (0.2) (0.2) (0.4)

Share-based payment expenses 2.3 2.1 3.6

Finance expense 1.7 3.2 6.1

Income tax expense 19.7 9.9 28.0

Increase in inventories (4.0) (5.3) (12.7)

(Increase)/decrease in receivables (14.2) 0.3 (12.4)

(Decrease)/increase in payables (13.2) (9.7) 30.8

Decrease in provisions (0.3) (1.0) (0.7)

Decrease in pension liability - (2.5) (8.0)

Cash from operating activities 114.7 100.1 272.3

=============== =============== ==================

Notes

1. Basis of preparation

The condensed accounts have been prepared for the 26 weeks ended

1 July 2023. Comparative figures are presented for the 26 weeks

ended 2 July 2022. These condensed accounts have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the UK. They do not include all the information required for full

annual accounts, and should be read in conjunction with the Group

accounts for the 52 weeks ended 31 December 2022.

These condensed accounts are unaudited and were approved by the

Board of Directors on 1 August 2023.

The comparative figures for the 52 weeks ended 31 December 2022

are not the Company's statutory accounts for that financial year.

Those accounts were reported on by the Company's auditor and

delivered to the Registrar of Companies. The report of the auditors

was (i) unqualified, (ii) did not include a reference to any

matters to which the auditor drew attention by way of emphasis

without qualifying their report; and (iii) did not contain a

statement under section 498(2) or (3) of the Companies Act

2006.

Going concern

The Directors have considered the adoption of the going concern

basis of preparation for these condensed accounts. The Directors

have reviewed cash flow forecasts prepared for a period of 18

months from the date of approval of these condensed accounts.

At the end of the reporting period the Group had GBP208.6

million of available liquidity including GBP138.6 million cash and

cash equivalents and GBP70.0 million of the undrawn revolving

credit facility ('RCF').

In reviewing the cash flow forecasts the Directors considered

the current trading position of the Group and the likely capital

expenditure and working capital requirements of its growth plans.

The cashflow forecasts show that the Group expects to comply with

the covenants included within the RCF agreement throughout the

review period.

Taking into account the current cash level and the committed

facilities the Directors are confident that the Group will have

sufficient funds to allow it to continue to operate. After

reviewing the projections and sensitivity analysis the Directors

believe that it is appropriate to prepare the condensed accounts on

a going concern basis.

Judgements and estimates

In preparing these condensed accounts, management have made

judgements and estimates that affect the application of accounting

policies and the reported amounts of assets and liabilities, income

and expense. Actual results may differ from these estimates. In

addition to the key estimates and judgements disclosed in the

consolidated accounts for the 52 weeks ended 31 December 2022 the

following additional areas have been identified or updated for the

26 weeks ended 1 July 2023.

Impairment

Property, plant and equipment and right-of-use assets are

reviewed for impairment if events or changes in circumstances

indicate that the carrying value may not be recoverable. For

example, shop fittings and right-of-use assets may be impaired if

sales in that shop fall. When a review for impairment is conducted,

the recoverable amount is estimated based on either value- in-use

calculations or fair value less costs of disposal. Value-in-use

calculations are based on management's estimates of future cash

flows generated by the assets and an appropriate discount rate.

Consideration is also given to whether the impairment assessments

made in prior years remain appropriate based on the latest

expectations in respect of recoverable amount. Where it is

concluded that the impairment has reduced, a reversal of the

impairment is recorded.

The Group has traded profitably throughout 2022 and 2023 to

date. As such there is not considered to be a global indicator of

impairment across the Group's asset base. Where indicators of

impairment exist for specific cash generating units (CGUs), with

each individual shop considered its own CGU, then an impairment

review has been performed to calculate the recoverable value.

For those shops with indications of impairment (identified as

mature shops with low cash generation relative to the carrying

value of the associated assets), the value-in-use has been

calculated using the following assumptions:

-- Like-for-like transaction volumes for those shops have been

assumed to grow at a rate of 2.0% for the period of the impairment

review;

-- Where shops are currently used to fulfil orders for delivery,

the net cash flows for fulfilling these orders are included within

the estimated cash flows for the shop;

-- Earnings before interest, tax, depreciation, amortisation and

rent (EBITDAR) is used as a proxy for net cash flow excluding

rental payments;

-- Cash flows have been discounted at a pre-tax discount rate

that reflects the current market assessment of the time value of

money, including a risk uplift for uncertainty of future cash

flows. The discount rate as at 1 July 2023 was 10.4% (31 December

2022: 9.6%); and

-- Consideration of the appropriate period over which to

forecast cash flows, including reference to the lease term. Where

considered appropriate cash flows have been included for periods

beyond the lease probable end date (to a maximum of five years in

accordance with IAS 36).

On the basis of these calculations a net impairment charge of

GBP1.0m has been made in respect of 84 shops reflecting the higher

discount rate used in the calculation.

2. Accounting policies

The accounting policies applied by the Group in these condensed

accounts are the same as those applied by the Group in its

consolidated accounts for the 52 weeks ended 31 December 2022 other

than as disclosed below:

-- Amendments to IFRS 1 and IAS 12: Deferred Tax related to

Assets and Liabilities arising from a Single Transaction.

Its adoption did not have a material effect on the accounts.

Principal risks and uncertainties

The Directors have considered the principal risks and

uncertainties which could have a material impact on performance for

the remainder of the financial year.

The assessment of principal risks and uncertainties made in the

2022 Annual Report and Accounts remains valid and we do not believe

there to have been any material changes in the profile of those

risks since then.

We have considered whether the Company is facing any new

principal risks at each of our Risk Committee meetings so far

during 2023. All new and emerging areas of risk which have been

identified fall within the scope of our existing principal risks

and uncertainties.

We continue to consider climate risk as part of our overarching

risk discussions, and factor climate into existing risks rather

than describing it as a separate principal risk in its own right.

This ensures that climate risk is embedded within our core risk

activity, and is considered as an inherent part of our processes,

rather than as a standalone issue.

The assessment above should be read in conjunction with the

statement of principal risks described on pages 49-52 in the 2022

Annual Report and Accounts. Other than the matters described above

we believe our exposure to other principal risks faced by the

business is not significantly different to that described in that

statement.

3. Operating segments

The Board is considered to be the 'chief operating decision

maker' of the Group in the context of the IFRS 8 definition. In

addition to its company-managed retail activities, the Group

generates revenues from its business to business channel which

includes franchise and wholesale activities. Both channels were

categorised as reportable segments for the purposes of IFRS 8.

Company-managed retail activities - the Group sells a consistent

range of fresh bakery goods, sandwiches and drinks in its own shops

or via delivery. Sales are made to the general public on a cash

basis. All results arise in the UK.

Business to business channel - the Group sells products to

franchise and wholesale partners for sale in their own outlets as

well as charging a licence fee to franchise partners. These sales

and fees are invoiced to the partners on a credit basis. All

results arise in the UK.

All revenue in 2023 and 2022 was recognised at a point in

time.

The Board regularly reviews the revenues and trading profit of

each segment. The Board receives information on overheads, assets

and liabilities on an aggregated basis consistent with the Group

accounts.

26 weeks 26 weeks 26 weeks 26 weeks 26 weeks 26 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended ended ended ended ended ended

1 July 1 July 1 July 2 July 2 July 2 July 31 December 31 31

2023 2023 2023 2022 2022 2022 2022 December December

2022 2022

Retail Business Retail Business Retail Business

company-managed to company-managed to company-managed to

shops business Total shops business Total shops business Total

GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm GBPm

Revenue 755.8 88.2 844.0 622.6 71.9 694.5 1,352.3 160.5 1,512.8

================ ========= ========= ================ ========= ========= ================ ========= =========

Trading

profit* 103.0 16.7 119.7 92.2 12.6 104.8 224.6 31.3 255.9

Overheads

including

profit

share (54.3) (45.8) (101.5)

--------- --------- ---------

Operating

profit 65.4 59.0 154.4

Finance

expense (1.7) (3.2) (6.1)

--------- --------- ---------

Profit

before

tax

(excluding

exceptional

items) 63.7 55.8 148.3

Exceptional 16.3 - -

items (see

Note 4)

--------- --------- ---------

Profit

before

tax 80.0 55.8 148.3

========= ========= =========

* Trading profit is defined as gross profit less supply chain

costs and retail costs (including property and direct management

costs) and before central overheads.

4. Exceptional items

The exceptional item relates to a net gain of GBP16.3 million on

the settlement of our Covid business interruption insurance claim.

The net gain is recognised after deduction of fees payable to

advisers and the GBP2.5 million advance already recognised as

income in 2020.

5. Defined benefit pension scheme

The valuation of the defined benefit pension scheme for the

purposes of IAS 19 (Revised) as at 31 December 2022 has been

updated as at 1 July 2023 and the movements have been reflected in

these condensed accounts.

6. Taxation

The taxation charge for the 26 weeks ended 1 July 2023 and 2

July 2022 is calculated by applying the Directors' best estimate of

the annual effective tax rate to the profit or loss for the period

using rates substantively enacted by the half year date as required

by IAS34 'Interim Financial Reporting'.

7. Earnings per share

26 weeks ended 1 26 weeks ended 1 26 weeks ended 1 26 weeks ended 2 52 weeks ended 31

July 2023 July 2023 July 2023 July 2022 December 2022

------------------ ------------------ ------------------ ------------------ ------------------

Excluding

exceptional items Exceptional

items Total Total Total

(see Note 4)

------------------ ------------------ ------------------ ------------------ ------------------

GBPm GBPm GBPm GBPm GBPm

Profit for the

period

attributable to

equity holders

of the parent 47.8 12.5 60.3 45.9 120.3

================== ================== ================== ================== ==================

Basic earnings

per share 47.2p 12.3p 59.5p 45.2p 118.5p

Diluted earnings

per share 46.8p 12.2p 59.0p 44.8p 117.5p

Weighted average number of ordinary shares

26 weeks 26 weeks ended 52 weeks ended

ended 1 July 2 July 2022 31 December

2023 2022

Number Number Number

Issued ordinary shares at start

of period 102,112,581 101,897,021 101,897,021

Effect of shares issued 29,793 28,515 100,009

Effect of own shares held (849,669) (369,828) (511,370)

Weighted average number of ordinary

shares during the period 101,292,705 101,555,708 101,485,660

Effect of share options in issue 1,014,417 902,676 849,222

Weighted average number of ordinary

shares (diluted) during the period 102,307,122 102,458,384 102,334,882

============== =============== ===============

Issued ordinary shares at end

of period 102,254,826 102,046,258 102,112,581

============== =============== ===============

8. Dividends

The following tables analyse dividends when paid and the year to

which they relate:

Dividend declared 26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 2 July 2022 31 December 2022

Pence per share Pence per share Pence per share

2021 special dividend - 40.0p 40.0p

2021 final dividend - 42.0p 42.0p

2022 interim dividend - - 15.0p

2022 final dividend 44.0p - -

44.0p 82.0p 97.0p

================ ================ ==================

26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 2 July 2022 31 December 2022

GBPm GBPm GBPm

Total dividend payable

2021 special dividend - 40.6 40.6

2021 final dividend - 42.7 42.7

2022 interim dividend - - 15.2

2022 final dividend 44.6 - -

--------------- --------------- ------------------

Total dividend paid in period 44.6 83.3 98.5

=============== =============== ==================

26 weeks ended 26 weeks ended 52 weeks ended

1 July 2023 2 July 2022 31 December 2022

GBPm GBPm GBPm

Dividend proposed at period end and not included as a liability

in the accounts

2022 interim dividend (15.0p per share) - 15.3 -

2022 final dividend (44.0p per share) - - 44.9

2023 interim dividend (16.0p per share) 16.1 - -

16.1 15.3 44.9

=============== =============== ==================

9. Related party transactions

There have been no related party transactions in the first 26

weeks of the current financial year which have materially affected

the financial position or performance of the Group.

Related parties are consistent with those disclosed in the

Group's Annual Report and Accounts for the 52 weeks ended 31

December 2022.

10. Half year report

The condensed accounts were approved by the Board of Directors

on 1 August 2023. They will be available on the Company's website,

corporate.greggs.co.uk

11. Calculation of Alternative Performance Measures

One-year like-for-like (LFL) sales increase - Like-for-like

(LFL) company-managed shop sales performance against comparable

period in 2022

26 weeks ended

1 July 2023

GBPm

Current year LFL sales 692.4

2022 LFL sales 596.7

Increase 95.7

==============

LFL sales increase percentage 16.0%

12. Statement of Directors' responsibilities

The Directors named below confirm on behalf of the Board of

Directors that to the best of their knowledge:

-- the condensed set of accounts has been prepared in accordance

with IAS 34 Interim Financial Reporting as adopted by the UK;

-- the interim management report includes a fair review of the information required by:

(a) DTR4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

26 weeks of the financial year and their impact on the condensed

set of accounts; and a description of the principal risks and

uncertainties for the remaining 26 weeks of the year; and

(b) DTR4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first 26

weeks of the financial year and that have materially affected the

financial position or performance of the Group during the period;

and any changes in the related party transactions described in the

last annual report that could do so.

The Directors of Greggs plc are listed in the Annual Report and

Accounts for the 52 weeks ended 31 December 2022. On 7 March 2023

Nigel Mills was appointed as a Non-Executive Director. On 17 May

2023 Sandra Turner and Helena Ganczakowski retired from the

Board.

For and on behalf of the Board of Directors

Roisin Currie Richard Hutton

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR QFLFXXDLZBBF

(END) Dow Jones Newswires

August 01, 2023 02:00 ET (06:00 GMT)

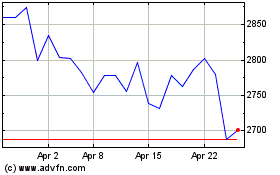

Greggs (LSE:GRG)

Historical Stock Chart

From Apr 2024 to May 2024

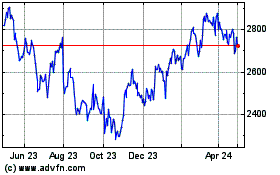

Greggs (LSE:GRG)

Historical Stock Chart

From May 2023 to May 2024