Gresham House Renewable EnergyVCT2 Amendment to Investment Advisory Agreement

25 June 2024 - 7:25PM

RNS Regulatory News

RNS Number : 7843T

Gresham House Renewable EnergyVCT2

25 June 2024

25 June 2024

GRESHAM

HOUSE RENEWABLE ENERGY VCT 2 PLC

(the

"Company")

Amendment to

Investment Advisory Agreement: smaller related party

transaction

The Board of Gresham House Renewable Energy VCT

2 PLC (the "Company")

announces a variation (the "Variation") to the terms of the

investment advisory agreement dated 7 November 2017 (the

"IAA") entered into between

the Company, Gresham House Renewable Energy VCT 1 PLC and the

Company's Investment Manager, Gresham House Asset Management

Limited (the "Manager"),

pursuant to which the Manager provides investment advisory services

to the Company in exchange for an annual advisory fee.

The annual advisory fee is a net asset value

("NAV") based fee and is

subject to a clawback depending on whether the Company's annual

running costs exceed 3% of NAV (the "Cap"). Following the adoption of a new

investment policy on 13 July 2021, the Company's principal

objective is to realise the remaining assets in the portfolio

through sales or otherwise monetisation of the assets

Following the sale of some assets in April 2023 and

subsequent dividend paid as a result of the 13 July 2021

shareholder vote to wind-down the Company (the "Managed Wind Down"), the Company's net

assets have reduced significantly to a level not anticipated when

the IAA agreement was agreed and signed. Due to this significant

reduction in the NAV as a result of the Managed Wind Down process,

the annual running costs for the financial year ending 30 September

2024 are currently forecasted to be around 4% of NAV, which would

exceed the current 3% cap. This means that running costs, many of

which are largely fixed, now exceed the Cap and the Manager's

annual advisory fee is therefore subject to a clawback (on top of

an already reduced annual advisory fee due to a lower NAV following

asset sales).

To rectify this unintended consequence of the

new investment policy, the Variation seeks to minimise the effect

of the clawback by raising the Cap to 5% of NAV or £625,000,

whichever is the lower.

The Variation constitutes a smaller related

party transaction within Listing Rule 11.1.10 R.

END

For further information,

please contact:

LEI: 213800GQ3JQE2M214C75

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

MSCQKPBBCBKKBAB

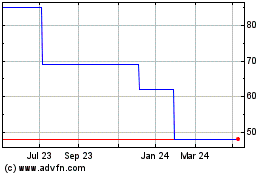

Gresham House Renewable ... (LSE:GV2O)

Historical Stock Chart

From Dec 2024 to Jan 2025

Gresham House Renewable ... (LSE:GV2O)

Historical Stock Chart

From Jan 2024 to Jan 2025