TIDMJEL

RNS Number : 7703Z

Jersey Electricity PLC

17 May 2023

Jersey Electricity plc

Interim Report

for the six months ended 31

March 2023

The Board approved at a meeting on 17 May 2023 the Interim

Management Report for the six months ended 31 March 2023 and

declared an interim dividend of 8.00p compared to 7.60p for 2022.

The dividend will be paid on 20 June 2023 to those shareholders

registered in the records of the Company at the close of business

on 2 June 2023.

The Interim Management Report is attached and will be available

to the public on the Company's website www.jec.co.uk/investors

.

The Interim Management Report for 2023 has not been audited, or

reviewed, by our external auditors, nor have the results for the

equivalent period in 2022. The results for the year ended 30

September 2022 were extracted from the statutory accounts. The

auditor has reported on those accounts and their report was

unmodified.

M.P. Magee

A. Welsby

Finance Director

Company Secretary

Direct telephone number: 01534 505201

Direct telephone number: 01534 505250

Email: mmagee@jec.co.uk

Email: awelsby@jec.co.uk

17 May 2023

The Powerhouse,

PO Box 45,

Queens Road,

St Helier,

Jersey JE4 8NY

Directors' Statement

Financial Summary

6 months 6 months

2023 2022

======================================================================================================= ===================================================================================================== ===================================================================================================

Electricity

Sales in

kWh 355.7m 359.4m

======================================================================================================= ===================================================================================================== ===================================================================================================

Revenue GBP69.4m GBP65.0m

======================================================================================================= ===================================================================================================== ===================================================================================================

Profit *GBP10.3m GBP7.0m

before tax

======================================================================================================= ===================================================================================================== ===================================================================================================

Earnings per 26.23p 17.78p

share

======================================================================================================= ===================================================================================================== ===================================================================================================

Final 10.80p 10.20p

dividend

paid per

ordinary

share

======================================================================================================= ===================================================================================================== ===================================================================================================

Proposed 8.00p 7.60p

interim

dividend

per

ordinary

share

======================================================================================================= ===================================================================================================== ===================================================================================================

* The underlying profit for 2023 was GBP8.1m when the rebate

from RTE and ex-gratia award for pensions in service are excluded,

as described in the narrative below.

Energy - turmoil in markets

In our 2022 Annual Report we highlighted that the turmoil that

beset energy markets had intensified further due to the conflict

between Russia and Ukraine, and that Jersey Electricity was not

immune to those challenges. However, despite those challenges we

have shown resilience, and largely protected our customers from the

material rise in retail prices seen elsewhere, without the need for

any Government intervention/subsidy. We continue to monitor

developments on both volatility, and security of supply, in energy

markets. Europe experienced relatively benign weather over the

winter, relatively good production from the French nuclear fleet,

and much lower gas usage in the EU industrial sector which, when

combined, have resulted in healthier than expected gas storage

levels. There are however sensitivities, such as the lack of snow

and rain in the last 6 months impacting predictions for the

availability of hydro power during the remainder of this year.

This, combined with the uncertain timing of a resolution to the

Ukraine conflict, mean volatility in European energy markets looks

set to continue. We have strong relationships with our French

partners, EDF (as supplier) and RTE (as network operator) that span

nearly 40 years and the Company benefits from legal and contractual

arrangements which cover imported electricity supplies to the end

of 2027.

Hedging of electricity and foreign exchange, and customer

tariffs

We continue to focus on delivering secure, low-carbon

electricity supplies and our goal is to maintain relative stability

in customer tariffs, despite volatility in both European wholesale

electricity and foreign exchange markets. This is however extremely

challenging in the current climate. Our electricity purchases are

materially, but not fully, price capped for the calendar years 2023

and 2024. We also have around one third of our expected 2025-27

requirements hedged at largely fixed prices. As these are

contractually denominated in the Euro, we also enter into forward

foreign currency contracts, on a three-year rolling basis, to

reduce the volatility of our cost base, and to aid tariff planning.

In January 2023 we implemented a 5% rise in customer tariffs and do

not anticipate further rises during the remainder of 2023. However,

we are planning forward, and considering options for 2024 and

beyond, as we come out of our current advantageous hedged position

and are faced with higher market prices.

Even with the rises implemented to date, the tariffs payable by

our customers continue to benchmark well against other

jurisdictions. Domestic customers in Jersey currently pay around

half what equivalent customers pay in the UK for their electricity.

Other UK Islands are implementing material rises in customer

tariffs with the Isle of Man having instigated a 25% increase on 1

April 2023, and a further 25% rise from 1 July 2023. Guernsey

Electricity has also applied to raise tariffs by 14.25% from 1 July

2023, subject to regulatory approval.

Overall trading performance in the 6 months to 31 March

Group revenue, at GBP69.4m, was 6.7% higher for the first half

of 2023 compared with GBP65.0m for the same period last year mainly

due to a rise in both Energy and Retail revenue. Profit before tax

was GBP10.3m but included an unexpected receipt of GBP3.6m which

has been classified as 'Rebate of past energy costs - non-recurring

item' for disclosure purposes within gross profit in these

financial statements. This was a rebate from the French network

operator (RTE) in respect of payments made in 2022 which they were

instructed to return to us in early 2023 as part of a regulatory

decision due to volatility in the energy marketplace during 2022.

In addition, a non-cash cost of GBP1.4m for an ex-gratia award for

pensions in service was granted. If these two items were excluded

the underlying profit before tax was GBP8.1m compared to GBP7.0m in

2022. Cost of sales, excluding the rebate of past energy costs, at

GBP46.5m was GBP3.6m higher than last year with the rise in

wholesale energy costs, and increased levels of importation from

the local Energy from Waste plant, which was out of service for

much of the comparative period last year, being the main factors.

Operating expenses at GBP16.1m were GBP1.7m higher than last year

due mainly to higher non-cash pension costs and general

inflationary pressures. The taxation charge in the period of

GBP2.2m was GBP0.7m higher than last year due mainly to the

unexpected rebate from RTE. Earnings per share, at 26.23p, were

above the 17.78p in 2022 due to higher profits. Net cash on the

balance sheet, which comprises borrowings less cash and cash

equivalents, at 31 March 2023, was GBP16.8m compared with GBP13.1m

at this time last year (and GBP17.4m of net cash at our last year

end on 30 September 2022).

Energy performance

Unit sales of electricity fell marginally by 1% from 359.4m to

355.7m kWh, compared with the same period last year. Revenue in our

Energy business at GBP54.8m was GBP4.0m higher than in 2022 with

the year-on-year increase being largely attributable to a 5% tariff

rise in both July 2022 and January 2023. Operating profit,

excluding the GBP3.6m RTE rebate, and the non-cash cost of GBP1.4m

for an ex-gratia award for pensions in service, at GBP6.5m was

GBP0.6m higher than the corresponding period last year due to the

increased revenue offset by increased wholesale import prices,

higher volumes of electricity received from the local Energy from

Waste plant, recruitment of new employees, and other inflationary

pressures. We imported 96% of our on-island requirement from France

and 4% from the Energy from Waste plant, owned by the Government of

Jersey. Only 0.4% (just over 1m units) of electricity was generated

in Jersey using our traditional oil-fired plant (which is run

during testing regimes) and our solar generation. These importation

and generation levels were materially consistent with the same

period last year, albeit the imports from the Energy from Waste

plant were back to a more historical levels, as last year

maintenance work was performed for an extended time in that

period.

Non-Energy performance

Year-on-year revenue in our Powerhouse retail business,

increased by 5% to GBP10.0m (2022: GBP9.5m) but profits were

maintained at around the same level at GBP0.7m. Profit from our

Property portfolio at GBP0.8m was GBP0.1m higher than in 2022 due

to a combination of higher rental and slightly lower maintenance

costs. JEBS, our building services unit, saw external revenue fall

marginally to GBP1.7m, with profitability at a breakeven level. Our

remaining business units produced profits of GBP0.2m compared to

GBP0.3m in 2022.

Liquidity and cashflow

A net cash outflow of GBP0.6m was experienced in the period

(2022: GBP0.0m) post the continued investment in infrastructure of

GBP4.5m (2022: GBP6.0m). The net cash figure of GBP13.1m at 31

March 2022 moved to a net cash figure of GBP16.8m at 31 March 2023

(GBP17.4m at 30 September 2022). Net cash consists of cash and cash

equivalents of GBP46.8m offset by GBP30.0m of long-term debt.

Pension scheme

The defined benefit pension scheme surplus (without deduction of

deferred tax) on our balance sheet at 31 March 2023 stood at

GBP30.1m, compared with a surplus of GBP26.4m at 30 September 2022

(and a surplus of GBP22.0m at 31 March 2022). Since the last

financial year end, scheme liabilities have increased by

approximately GBP5m to GBP91m. This rise was primarily due to a

decrease of the discount rate assumptions from 5.2% at the last

financial year end to 4.7% at 31 March 2023 associated with a fall

in UK AA corporate bond yields in the interim. Assets in the Scheme

rose by around GBP8m to GBP121m. Unlike most UK schemes, the Jersey

Electricity pension scheme is not funded to pay mandatory annual

rises on retirement. The Pension Scheme Trustees asked the Company

to consider the granting of a 3% rise to pensions in service in

light of the level of the surplus and the impact of current high

levels of inflation on the pensioner community. This was agreed by

the Board in March. The capital cost of this award was GBP1.4m and

the cash will be paid by the Scheme, rather than the Company, but

generated a GBP1.4m charge against our Income Statement. This is

reflected in the half-year surplus figure of GBP30.1m. The defined

benefit scheme has been closed to new members since 2013 and the

next triennial valuation of the scheme, as at 31 December 2024,

will be carried out in 2025.

Dividends

Your Board proposes to pay an interim net dividend for 2023 of

8.0p (2022: 7.60p). As stated in previous years, we aim to deliver

sustained real growth each year over the medium-term. The final

dividend for 2022 of 10.80p, paid in late March in respect of the

last financial year, was an increase of 5% on the previous

year.

Risk and outlook

The principal risks and uncertainties identified in our last

Annual Report, issued in December 2022, have not materially altered

in the interim period. As highlighted earlier in this report, there

is continued volatility in energy markets. This continues to be

closely monitored by the Board as it adds unpredictability into the

price we will pay for any unhedged elements of our future

electricity costs. Your Board is satisfied that Jersey Electricity

plc has sufficient resources to continue in operation for the

foreseeable future, a period of not less than 12 months from the

date of approval of this report. Accordingly, we continue to adopt

the going concern basis in preparing the condensed financial

statements.

Responsibility statement

We confirm to the best of our knowledge:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 'Interim Financial Reporting';

(b) the Interim Directors Statement includes a fair review of

the information required by the Disclosure and Transparency Rule

DTR 4.2.7R (indication of important events during the first six

months and description of principal risks and uncertainties for the

remaining six months of the year); and

(c) the Interim Directors Statement includes a fair review of

the information required by the Disclosure and Transparency Rule

DTR 4.2.8R (disclosure of related party transactions and changes

therein); and

(d) this half yearly interim report looks at certain

forward-looking statements with respect to the operations,

performance, and financial condition of the Group. By their nature,

these statements involve uncertainty since future events and

circumstances can cause results and developments to differ

materially from those anticipated. The forward-looking statements

reflect knowledge and information available at the date of

preparation of this half yearly financial report and the Company

undertakes no obligation to update these forward-looking

statements. Nothing in this half yearly financial report should be

construed as a profit forecast.

Investor timetable for 2023

2 June Record date for

interim

ordinary dividend

20 June Interim ordinary dividend

for year ending

30 September 2023

3 July Payment date for

preference

share dividends

20 December Announcement of

full

year results

C.J. AMBLER - Chief Executive M.P. MAGEE - Finance Director

17 May 2023

Condensed Consolidated Income Statement (Unaudited)

Six Six months Year

months

ended ended ended

31 March 31 March 30

September

Note 2023 2022 2022

GBP000 GBP000 GBP000

Revenue 2 69,378 64,995 117,421

Cost of sales (46,459) (42,859) (77,242)

Rebate of past 3,593 - -

energy costs -

non-recurring

item

==================================================================================================== ==================================================================================================== ====================================================================================================

Gross profit 26,512 22,136 40,179

==================================================================================================== ==================================================================================================== ====================================================================================================

Revaluation of investment properties - - 1,020

Operating expenses (16,146) (14,412) (29,293)

==================================================================================================== =================================================================================================== ====================================================================================================

Group operating 2 10,366 7,724 11,906

profit

==================================================================================================== ==================================================================================================== ====================================================================================================

Finance income 706 10 218

Finance costs (767) (764) (1,523)

==================================================================================================== =================================================================================================== ====================================================================================================

Profit from operations before 10,305 6,970 10,601

taxation

==================================================================================================== =================================================================================================== ====================================================================================================

Taxation 3 (2,208) (1,464) (2,135)

==================================================================================================== ==================================================================================================== ====================================================================================================

Profit from operations after 8,097 5,506 8,466

taxation

==================================================================================================== =================================================================================================== ====================================================================================================

Attributable to:

Owners of the Company 8,037 5,448 8,326

Non-controlling interests 60 58 140

==================================================================================================== =================================================================================================== ====================================================================================================

Profit for the period/year 8,097 5,506 8,466

attributable

to the equity holders of the

parent

Company

Earnings per share

==================================================================================================== =================================================================================================== ====================================================================================================

- basic and diluted 26.23p 17.78p 27.17p

Condensed Consolidated Statement of Comprehensive Income

(Unaudited)

Six Six months Year

months

ended ended ended

31 March 31 March 30

September

2023 2022 2022

GBP000 GBP000 GBP000

Profit for the

period/year

Items that will

not be

reclassified

subsequently

to profit or

loss: 8,097 5,506 8,466

Actuarial gain 4,307 3,805 8,976

on defined

benefit scheme

Income tax (861) (761) (1,795)

relating to

items not

reclassified

=================================================================================================== ================================================================================================= ====================================================================================================

3,446 3,044 7,181

Items that may

be

reclassified

subsequently

to profit or

loss:

Fair value (2,013) (118) 4,815

(loss)/gain on

cash flow

hedges

Income tax 403 24 (963)

relating to

items that may

be reclassified

=================================================================================================== ================================================================================================= ====================================================================================================

(1,610) (94) 3,852

=================================================================================================== ============================================================================================================================================================================================================= ====================================================================================================

Total 9,933 8,456 19,499

comprehensive

income for the

period/year

=================================================================================================== ================================================================================================= ====================================================================================================

Attributable to:

Owners of the 9,873 8,398 19,359

Company

Non-controlling 60 58 140

interests

=================================================================================================== ================================================================================================= ====================================================================================================

9,933 8,456 19,499

=================================================================================================== ============================================================================================================================================================================================================= ====================================================================================================

Condensed Consolidated Balance Sheet (Unaudited)

As at As at As at

31 March 31 March 30

September

Note 2023 2022 2022

GBP000 GBP000 GBP000

Non-current

assets

Intangible assets 654 790 967

Property, plant and equipment 215,329 216,138 216,235

Right of use assets 3,259 3,301 3,280

Investment properties 28,830 27,810 28,830

Trade and other receivables 300 303 300

Retirement benefit surplus 30,130 21,991 26,434

Derivative 6 916 79 2,640

financial

instruments

Other investments 5 5 5

=================================================================================================== ================================================================================================== ====================================================================================================

Total non-current assets 279,423 270,417 278,691

Current assets

Inventories 9,454 6,907 7,173

Trade and other receivables 28,035 23,375 19,934

Derivative financial 148 - 483

instruments

Cash and cash equivalents 46,795 43,110 47,397

=================================================================================================== ================================================================================================== ====================================================================================================

Total current assets 84,432 73,392 74,987

=================================================================================================== ================================================================================================== ====================================================================================================

Total assets 363,855 343,809 353,678

Current liabilities

Trade and other payables 22,799 19,558 21,043

Lease liabilities 81 73 69

Derivative 6 110 677 330

financial

instruments

Current tax liabilities 3,328 2,613 2,088

=================================================================================================== ================================================================================================== ====================================================================================================

Total current liabilities 26,318 22,921 23,530

=================================================================================================== ================================================================================================== ====================================================================================================

Net current assets 58,114 50,471 51,457

Non-current liabilities

Trade and other payables 25,390 24,762 25,162

Lease liabilities 3,212 3,247 3,251

Retirement benefit deficit - 575 -

Derivative 6 174 1,542 -

financial

instruments

Financial liabilities - 235 235 235

preference

shares

Borrowings 30,000 30,000 30,000

Deferred tax liabilities 32,508 30,353 32,126

=================================================================================================== ================================================================================================== ====================================================================================================

Total non-current liabilities 91,519 90,139 90,744

=================================================================================================== ================================================================================================== ====================================================================================================

Total liabilities 117,837 113,060 114,304

=================================================================================================== ================================================================================================== ====================================================================================================

Net assets 246,018 230,749 239,374

Equity

Share capital 1,532 1,532 1,532

Revaluation reserve 5,270 5,270 5,270

ESOP reserve (18) (58) (38)

Other reserves 624 (1,712) 2,234

Retained earnings 238,406 225,545 230,232

=================================================================================================== ================================================================================================== ====================================================================================================

Equity attributable to the 245,814 230,577 239,230

owners

of the Company

Minority interest 204 172 144

=================================================================================================== ================================================================================================== ====================================================================================================

Total equity 246,018 230,749 239,374

=================================================================================================== ================================================================================================== ====================================================================================================

Condensed Consolidated Statement of Changes in Equity

(Unaudited)

Share Revaluation ESOP Other Retained Total

Capital reserve reserve reserves Earnings reserves

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October

2022 1,532 5,270 (38) 2,234 230,232 239,230

Total - - - - 8,037 8,037

recognised

income and

expense for

the period

Amortisation - - 20 - - 20

of employee

share scheme

Movement on - - - (1,610) - (1,610)

hedges (net

of

tax)

Actuarial - - - - 3,446 3,446

gain on

defined

benefit

scheme (net

of tax)

Equity

dividends - - - - (3,309) (3,309)

As at 31 1,532 5,270 (18) 624 238,406 245,814

March 2023

At 1 October 1,532 5,270 (79) (1,618) 220,178 225,283

2021

Total

recognised

income and

expense for

the period - - - - 5,448 5,448

Funding of

employee

share

option scheme - - 21 - - 21

Movement on

hedges (net

of

tax) - - - (94) - (94)

Actuarial gain

on defined

benefit

scheme (net

of tax) - - - - 3,044 3,044

Equity

dividends - - - - (3,125) (3,125)

As at 31 March

2022 1,532 5,270 (58) (1,712) 225,545 230,577

At 1 October 1,532 5,270 (79) (1,618) 220,178 225,283

2021

Total

recognised

income and

expense for

the period - - - - 8,326 8,326

Amortisation

of employee

share scheme - - 41 - - 41

Movement on

hedges (net

of

tax) - - - 3,852 - 3,852

Actuarial gain

on defined

benefit

scheme (net

of tax) - - - - 7,181 7,181

Equity

dividends - - - - (5,453) (5,453)

At 30

September

2022 1,532 5,270 (38) 2,234 230,232 239,230

*'Other reserves' represents the foreign currency hedging

reserve.

Condensed Consolidated Cash Flow Statement (Unaudited)

Six Six months Year

months

ended ended ended

31 March 31 March 30

September

2023 2022 2022

GBP000 GBP000 GBP000

Cash flows from

operating activities

Operating profit

Adjustments to add

back/(deduct)

non-cash

items and items

disclosed elsewhere

on

the CFS: 10,366 7,724 11,906

Depreciation and 5,741 5,525 11,904

amortisation charges

Share-based reward 20 21 41

charges

Gain on revaluation

of investment

property - - (1,020)

Pension operating 612 462 1,303

charge less

contributions

paid

Deemed interest on

hire purchase

arrangements - - 50

(Profit)/loss on sale (1) (1) (7)

of property, plant

and equipment

Operating cash flows 16,738 13,731 23,367

before movement in

working capital

Working capital

adjustments:

=================================================================================================== =================================================================================================== ====================================================================================================

(Increase)/decrease (2,281) 2 (257)

in inventories

Increase in (8,101) (5,370) (1,926)

receivables

Increase in payables 2,136 3,127 444

Net movement in (8,246) (2,241) 2,261

working capital

=================================================================================================== =================================================================================================== ====================================================================================================

Interest paid (763) (760) (1,514)

Preference dividends (4) (4) (9)

paid

Income taxes paid (1,045) (1,510) (3,020)

=================================================================================================== =================================================================================================== ====================================================================================================

Net cash flows from 6,680 9,216 21,085

operating activities

Cash flows from investing

activities

Purchase of property, (4,541) (6,041) (11,001)

plant and equipment

Investment in (68) - (319)

intangible assets

Deposit interest 706 10 168

received

Net proceeds from 1 1 7

disposal of fixed

assets

=================================================================================================== =================================================================================================== ====================================================================================================

Net cash flows used (3,902) (6,030) (11,145)

in investing

activities

Cash flows from financing

activities

Equity dividends paid (3,309) (3,125) (5,453)

Dividends paid to - (45) (154)

non-controlling

interest

Repayment of lease (72) (35) (72)

liabilities

=================================================================================================== =================================================================================================== ====================================================================================================

Net cash flows used (3,381) (3,205) (5,679)

in financing

activities

Net (603) (19) 4,261

(decrease)/increase

in cash and cash

equivalents

Cash and cash 47,397 43,136 43,136

equivalents at the

beginning

of the year

Effect of foreign 1 (7) -

exchange rate

changes

=================================================================================================== =================================================================================================== ====================================================================================================

Cash and cash 46,795 43,110 47,397

equivalents at the

end of

the period

Of the GBP46.8m cash and cash equivalents at 31 March 2023,

GBP37.0m (30 September 2022: GBP35.0m) is on fixed term deposits

with an average of 74 days remaining (30 September 2022: 45

days)

A presentational amendment has been made to "interest paid" in

operating activities and "Repayment of lease liabilities" in

financing activities. For the year ended 30 September 2022, this

has increased interest paid by GBP134,000 and made the same

decrease to repayment of lease activities. For the six months ended

31 March 2022, this has increased interest paid by GBP68,000 and

made the same decrease to repayment of lease activities.

1 Accounting policies

Basis of preparation

The interim accounts for the six months ended 31 March 2023 have

been prepared on the basis of the accounting policies set out in

the 30 September 2022 annual report and accounts using accounting

policies consistent with International Financial Reporting

Standards (IFRS) as adopted by the EU and in accordance with IAS 34

'Interim Financial Reporting'. There have been no changes to

accounting standards during the current financial period that has

impacted the disclosures in these financial statements and the full

year financial statements that will be prepared for 30 September

2023.

Jersey Electricity plc has considerable financial resources and,

consequently, the directors believe that the Group is well placed

to manage its business risks successfully despite the current

uncertain economic outlook. The directors have a reasonable

expectation that the Group has adequate resources to continue in

operational existence for the foreseeable future. Thus, they

continue to adopt the going concern basis of accounting in

preparing the annual financial statements.

2 Revenue and profit

The contributions of the various activities of the Group to

turnover and profit are listed below:

Six months ended Six months ended Year ended

31 March 2023 31 March 2022 30 September 2022

External Internal Total External Internal Total External Internal Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Energy 54,833 46 54,879 50,782 49 50,831 89,683 100 89,783

Retail 9,955 35 9,990 9,504 21 9,525 3,365 780 4,145

Building Services 1,684 343 2,027 1,795 252 2,047 18,695 41 18,736

Property 1,226 320 1,546 1,159 320 1,479 2,345 639 2,984

Other* 1,680 264 1,944 1,755 387 2,142 3,333 625 3,958

69,378 1,008 70,386 64,995 1,029 66,024 117,421 2,185 119,606

Inter-segment

elimination (1,008) (1,029) (2,185)

============================================================================================================ =================================================================================================== =================================================================================================== ================================================================================================= ========= ================================================================================================= ================================================================================================ =================================================================================================== =================================================================================================== ==================================================================================================

Operating profit 69,378 64,995 117,421

Energy profit

before rebate 5,061 5,943 7,502

Rebate to cost 3,593 - -

of sales

------------------------------------------------------------------------------------------------- ------------------------------------------------------------------------------------------------ --------------------------------------------------------------------------------------------------

Energy profit

including rebate 8,654 5,943 7,502

Retail 672 661 1,174

Building Services 27 103 266

Property 788 717 1,436

Other* 225 300 508

Operating profit

before property

revaluation/sale 10,366 7,724 10,866

Gain on

revaluation

of investment

properties - - 1,020

Operating profit 10,366 7,724 11,906

*Other segment includes Jersey Energy, Jendev (both divisions)

and Jersey Deep Freeze Limited, the Group's sole subsidiary.

Materially, all the Groups operations are conducted within the

Channel Islands. All transfers between divisions are on an arm's

length basis.

Revenues disclosed by the business segments above are recognised

both on a point in time and over time basis. The treatment of

revenue recognition in accordance with IFRS 15 is detailed in the

30 September 2022 annual report.

3 Taxation

Six Six months Year

months

ended ended ended

31 31 March 30

March September

2023 2022 2022

GBP000 GBP000 GBP000

Current

income

tax 2,132 1,431 2,088

Deferred 76 33 47

income

tax

Total 2,208 1,464 2,135

income

tax

For the period ended 31 March 2023 and subsequent periods, the

Company is taxable at the rate applicable to utility companies in

Jersey of 20%. (2022: 20%).

4 Dividends paid and proposed

Six Six months Year

months

ended ended ended

31 31 March 30

March September

2023 2022 2022

Dividends per

share

======================================================================================================== ================================================================================================== ================================================================================================= ====================================================================================================

Paid 10.80p 10.20p 17.80p

Proposed 8.00p 7.60p 10.80p

Six months Six months Year

ended ended ended

31 March 31 March 30

September

2023 2022 2022

GBP000 GBP000 GBP000

Distribution 3,309 3,125 5,454

to equity

holders and

by

subsidiaries

in the

period

The distribution to equity holders in respect of the final

dividend for 2022 of GBP3,309,120 (10.20p net of tax per share) was

paid on 23 March 2023.

The Directors have declared an interim dividend of 8.00p per

share, net of tax (2022: 7.60p) for the six months ended 31 March

2023 to shareholders on the register at the close of business on 2

June 2023. This dividend was approved by the Board on 17 May 2023

and has not been included as a liability at 31 March 2023.

5 Pensions

In consultation with the independent actuaries to the scheme,

the valuation of the pension scheme assets and liabilities has been

updated to reflect current market discount rates, current market

values of investments and actual investment returns applicable

under IAS 19 'Employee Benefits', and also consideration has been

given as to whether there have been any other events that would

significantly affect the pension liabilities.

The Pension Scheme Trustees asked the Company to consider the

granting of a 3% rise to pensions in service in light of the level

of the surplus and the impact of current high levels of inflation

on the pensioner community. This was approved by the Board in March

2023 and the capital cost of this award was GBP1.4m. The cash will

be paid by the Scheme, rather than the Company, but generated a

GBP1.4m charge against our Income Statement.

6 Financial Instruments

The Group held the following derivative contracts, classified as

level 2 financial instruments at 31 March 2023.

Six Six months Year

months

ended ended ended

31 31 March 30

March September

2023 2022 2022

Fair value of currency hedges GBP000 GBP000 GBP000

Derivative assets

============================================================================================================== ================================================================================================== =================================================================================================== ====================================================================================================

Less than one year 148 - 483

Greater than one 916 79 2,640

year

Derivative

liabilities

============================================================================================================== ================================================================================================== =================================================================================================== ====================================================================================================

Less than one year (110) (677) (330)

Greater than one (174) (1,542) -

year

Total net 780 (2,140) 2,793

assets/liabilities

All financial instruments for which fair value is recognised or

disclosed are categorised within the fair value hierarchy. This

hierarchy is based on the underlying assumptions used to determine

the fair value measurement as a whole and is categorised as

follows:

Level 1 financial instruments are those with values that are

immediately comparable to quoted (unadjusted) market prices in

active markets for identical assets or liabilities.

Level 2 financial instruments are those with values that are

determined using valuation techniques for which the basic

assumptions used to calculate fair value are directly or indirectly

observable (such as readily available market prices).

Level 3 financial instruments are shown at values that are

determined by assumptions that are not based on observable market

data (unobservable inputs).

The derivative contracts for foreign currency shown above are

classified as level 2 financial instruments and are valued based on

using a discounted cash flow valuation technique. Future cash flows

are estimated based on forward exchange rates (from observable

forward exchange rates at the end of the reporting period) and

contract forward rates, discounted at a rate that reflects the

credit risk of various counterparties.

7 Related Party Transactions

The Government of Jersey (the "Government") treats the Company

as a strategic investment. Whilst it holds the majority voting

rights in the Company, the Government does not view the Company as

being under its control and as such, it is not consolidated within

the Government accounts. The Government is understood by the

Directors to have significant influence but not control of the

Company.

The Company has elected to take advantage of the disclosure

exemptions available in IAS 24, paragraphs 25 and 26. All

transactions are undertaken on an arms-length basis in the ordinary

course of business.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFVVEFIDLIV

(END) Dow Jones Newswires

May 17, 2023 09:35 ET (13:35 GMT)

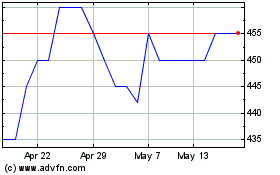

Jersey Electricity (LSE:JEL)

Historical Stock Chart

From Dec 2024 to Jan 2025

Jersey Electricity (LSE:JEL)

Historical Stock Chart

From Jan 2024 to Jan 2025