TIDMKEFI

RNS Number : 7682T

Kefi Gold and Copper PLC

22 March 2023

22 March 2023

KEFI Gold and Copper plc

("KEFI" or the "Company")

Quarterly Operational Update - Progress On All Fronts

KEFI (AIM: KEFI), the gold and copper exploration and

development company with a focus on the Arabian Nubian Shield and

with projects in the Kingdom of Saudi Arabia since 2008 and the

Federal Democratic Republic of Ethiopia since 2014, is pleased to

provide its Q1 2023 Quarterly Operational Update.

Highlights

-- Tulu Kapi Gold finance package of US$390 million agreed in principle

-- Working intensely with Government on few remaining security and administrative arrangements

-- Significant progress in Saudi Arabia

This update encompasses the activities of KEFI Minerals

(Ethiopia) Ltd ("KME") and Tulu Kapi Gold Mines Share Company

("TKGM") in Ethiopia, and Gold & Minerals Ltd ("GMCO") in Saudi

Arabia, since release of the Q4 2022 Quarterly Update on 2 February

2023 and is being announced ahead of the end of the quarter to

facilitate discussions at various events in Ethiopia and the Middle

East in the coming days.

The Tulu Kapi Gold Project ("Tulu Kapi" or the "Project") is

under TKGM (now planned to be 70-80% owned by KEFI). The Jibal

Qutman Gold Project ("Jibal Qutman"), the Hawiah Copper-Gold

Project ("Hawiah") and the other Saudi projects are under GMCO (now

planned to be 25-30% owned by KEFI), depending on refinements to

final financing refinements.

ETHIOPIA

As first mover for modern industrial-scale metal mining in

Ethiopia, it has been our privilege to be consulted in respect of

regulatory systems for mining and international financing. This has

taken some years as has our need to traverse the widely-publicised

security challenges in the country, which thankfully subsided last

year. Having borne the costs and delays involved over the recent

years, it is especially pleasing that we are now preparing to

trigger full project development at KEFI's first development

project, with few loose ends now expected to be imminently resolved

with the Government.

We also await Government permission to follow up our other

exploration discoveries in the Tulu Kapi district and, to that end,

based on discussions with the Government have recently re-assembled

our Ethiopian prospecting team for that and other initiatives.

Tulu Kapi Gold Project

This is KEFI's most advanced project. The Definitive Feasibility

Study has been updated for contracted terms and pricing as well as

for the outcome of a series of internal and independent reviews.

The Project is at the project financing and construction stage and

is launch-ready upon Government regulatory clearances and security

installation.

Since release of the last Operational Update on 2 February 2023,

the Tulu Kapi Gold Project financing has advanced as follows:

-- The project finance banks have, as of last week, both been

formally provided certain specific protections and benefits from

the Government of Ethiopia, which had become conditions precedent

for financing.

-- The total Project finance package of US$390 million (mining

fleet US$70 million provided by the mining contractor and US$320

million provided by debt and equity financiers) is now

conditionally in place within the syndicate.

-- Drafting of the numerous definitive agreements is either

complete or advancing well and all parties have indicated that they

intend to proceed to seek formal final approvals on satisfaction of

the conditions precedent in the hands of Government in respect of

administrative matters and security.

-- TKGM now has the intense attention of the Ethiopian Ministry

of Mines, National Bank of Ethiopia and the other Ministries and

agencies and expects to resolve all outstanding issues in the

coming weeks, so that the syndicate can then proceed to seek

all-party formal approvals including KEFI shareholder approval.

Upon all approvals being formally confirmed, we can then proceed

with drawdowns and Project launch so as to be in full production by

mid-2025.

SAUDI ARABIA

Despite making two significant discoveries in Saudi Arabia since

entering the country in 2008, our progress has only progressed

rapidly in the past 18 months as a result of Saudi Arabian

Government regulatory overhauls. The country's prospectivity for

further discovery is widely recognised and the international

industry is mobilising at the invitation of the Government.

The Jibal Qutman Gold Project

-- We applied for a mining licence in 2015 on the basis of an

assumed gold price of US$1,200/oz, and the heap leach processing

oxide ore containing c.200,000 oz within a 733,000 oz gold

Resource. This was seen as a starter project pending the proving-up

of a larger scale project warranting the higher capital investment

for Carbon-in-Leach ("CIL") process

-- As the current consensus long-term gold price of US$1,650/oz

is now significantly higher, the focus of the Jibal Qutman

feasibility study has moved to the larger CIL-based project.

-- Current activities on and around site are focused on the work

required to complete a Definitive Feasibility Study ("DFS") to the

standard required by our project finance lenders in Saudi Arabia.

This work includes:

o a 13,000 metre drilling programme (to be completed in April

2023) which is aimed at upgrading and expanding the current 733,000

oz Resource;

o metallurgical, geotechnical and hydrological drilling

programmes;

o detailed mine plans;

o metallurgical testwork;

o finalising environmental and social responsibility plans and

permitting;

o a trenching programme over the planned locations for the

processing plant and other infrastructure to ensure these areas do

not contain mineralisation;

o water source optimisation; and

o detailed costings of capex and opex.

-- We target to complete the DFS this year and, based on

encouragement from regulators and development financiers, we expect

minimal delay in closing finance within Saudi Arabia and starting

development so that we can be in production around mid-2025.

The current 13,000 metre drilling programme focuses particularly

on the South Zone, 3K Hill, 4K Hill and Red Hill areas shown on the

plan in the appendix, which can be accessed via:

http://www.rns-pdf.londonstockexchange.com/rns/7682T_1-2023-3-21.pdf.

The Red Hill deposit and nearby areas have particularly good

potential to provide additional ounces from the current drilling

programme.

Hawiah Copper-Gold Project

This deposit is a 2019 discovery of KEFI and we have so far

declared a Resource of 29.0 million tonnes ("Mt") at 0.89% copper,

0.94% zinc, 0.67 g/t gold and 10.1 g/t silver, after 54,439 metres

of drilling. We expect this Resource to increase as well as

defining additional Resources at nearby prospects including Al

Godeyer where we have already completed 4,176 metres of drilling

and expect to report its Maiden Resource Estimate and detailed

assay results in April.

We have already identified an apparently economic starter

project in 11.1Mt of open pittable Resource at 0.9% copper, 0.75%

zinc, 0.81g/t gold and 10.3 g/t silver for contained metals of:

100kt copper, 83Kt zinc, 288Koz gold and 3,685Koz silver.

Current activities include the following:

-- completing over the next 18 months the recently launched

56,000 metre drilling programme to establish Ore Reserves for

mining by both open pit and underground techniques;

-- optimising design of the process plant to maximise

metallurgical recovery and perhaps produce copper cathode (finished

copper product), water source optimisation and detailed costings of

capex and opex; and

-- the Pre-Feasibility Study is nearing completion for internal

review. We target to secure finance and launch shortly after the

start-ups at Tulu Kapi and Jibal Qutman.

Exploration Projects

During the past 15 months we have been granted 14 new

exploration licences, about three times what we were granted in the

previous 13 years, including five new licences in January 2023.

This demonstrates the seriousness of the country's commitment to

the development of the minerals sector.

We have formed regional exploration teams which have mobilised

onto all projects for initial prospecting of what we now see as 4

project areas spread over the new licences. As was the case at

Jibal Qutman and Hawiah, many of these licenses have abundant

evidence of historical workings and surface expression of

mineralisation.

CORPORATE

Over 90% of development capital for all three advanced projects

has already been conditionally arranged at the project or

subsidiary level, subject to the final feasibility studies in Saudi

Arabia confirming our expectations and to the various conditions

precedent applicable to funds drawdown on all projects.

At today's gold price and assuming an ownership level in TKGM of

say 77%, the NPV to KEFI of just our Ethiopian project is estimated

at US$251 million or GBP207 million. Comparing this potential value

indicator with current market capitalisation of c. GBP30 million

highlights the enormous opportunity to add value for shareholders

as we de-risk the Project.

KEFI's beneficial interest in our Saudi projects, at various

commodity price levels, presents an aggregate (preliminary estimate

of) NPV similar to that of the Ethiopian project, serving to

reinforce the scale of the value-adding opportunity.

Whilst the process of de-risking the projects in both countries

has involved very time-consuming security and regulatory

challenges, both countries have recently turned the corner and we

make steady progress.

Harry Anagnostaras-Adams, Executive Chairman of KEFI,

commented:

"The Company's working environment has improved significantly in

both Ethiopia and Saudi Arabia. Our teams are working intensely

with the host governments to launch the first two of our three

development projects. We start first with Tulu Kapi Gold in

Ethiopia, then Jibal Qutman Gold in Saudi Arabia. KEFI's beneficial

interest in their aggregate gold production from 2025 is estimated

to be in the order of 140,000 oz.

"At the current gold price of c. US$2,000/oz, KEFI's beneficial

interest in the estimated Net Operating Cash Flow from Tulu Kapi

alone is estimated to be c. GBP75 million average per annum and in

the NPV is estimated at GBP207 million , or respectively 1.8 pence

and 5 pence per current KEFI share in issue.

"At Tulu Kapi in Ethiopia, the project finance is conditionally

in place and, with the Government, we are ensuring that all

security and administrative arrangements are also in place.

"At Jibal Qutman in Saudi Arabia, whilst we had originally

defined a starter project at then-lower gold prices, we are

completing a feasibility study on a larger project at today's

higher gold prices."

Market Abuse Regulation (MAR) Disclosure

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

Enquiries

KEFI Gold and Copper plc

Harry Anagnostaras-Adams (Managing Director) +357 99457843

John Leach (Finance Director) +357 99208130

SP Angel Corporate Finance LLP (Nominated

Adviser) +44 (0) 20 3470 0470

Jeff Keating, Adam Cowl

Tavira Securities Limited (Lead Broker) +44 (0) 20 7100 5100

Oliver Stansfield, Jonathan Evans

WH Ireland Limited (Joint Broker) +44 (0) 20 7220 1666

Katy Mitchell, Andrew de Andrade

IFC Advisory Ltd (Financial PR and IR) +44 (0) 20 3934 6630

Tim Metcalfe, Florence Chandler

Notes to Editor

KEFI Gold and Copper PLC

Mission

The mission of KEFI is to discover and acquire economic gold and

copper mineralisation and follow through with cost-effective

responsible exploration, mine development and production in

compliance with local laws and international best practice.

Our geological region of focus is the Arabian-Nubian Shield, due

to its outstanding prospectivity, especially for gold and

copper.

Our activities provide a strong project pipeline covering the

spectrum from our Tulu Kapi Gold Project at the funding stage in

Ethiopia, to our Jibal Qutman Gold and Hawiah Copper-Gold Projects

at the feasibility study stage in Saudi Arabia, and to walk-up

drill targets in both countries.

Since incorporation 17 years ago, KEFI has invested some GBP80

million in these activities and today the Company sits with

advanced projects that have project NPV's that are many multiples

of the amount invested. KEFI has a leading position in the two

countries that contain the majority of the Arabian-Nubian Shield.

We now have three advanced projects in these now strongly

pro-development countries and are focused on a sequential mine

development path to build a mid-tier mining company over the next

few years.

Our mission now takes us to the stage of de-risking our

development project to close the gap between our stock market

capitalisation and the underlying intrinsic values.

Approach

KEFI was launched in 2006 as a GBP2.5 million initial public

offering ("IPO") on the AIM Market of the London Stock Exchange and

was then led by exploration specialists.

The 2014 acquisition of the Tulu Kapi Gold Project triggered the

appointment of management with track records in developing and

operating mines in Africa.

KEFI partners with appropriate local organisations, such as

Abdul Rahman Saad Al Rashid and Sons Limited ("ARTAR") in the

Kingdom of Saudi Arabia in our Gold and Minerals Limited ("GMCO")

joint venture and with the Federal Government and the Oromia

Regional Government in Ethiopia for our TKGM joint venture.

Our community plans are in accordance with the International

Finance Corporation (World Bank) Performance Standards and Equator

Principles. Operationally, we align with industry specialists such

as Lycopodium Limited ("Lycopodium") - our principal process plant

contractors in both Ethiopia and Saudi Arabia.

Timing

KEFI's objective is to have its two most advanced projects in

production by 2025 and the third in 2027.

The next few years will be focused on multi-pronged development

and concurrent aggressive exploration.

During this period our cash flow production should commence and

escalate.

This period coincides with the likely take-off in the minerals

sector of both of our host countries.

Notes

Explanatory Comments on the Use of NPV (Net Present Value) and

the Basis of Calculations

KEFI's advanced projects report NPV's as at today based on:

-- recoverable JORC Resources as reported up to the end of 2021;

-- net cash flows after debt service and after taxes, i.e. net cash available for shareholders;

-- 8% discount rate; and

-- nil value for potential expansion of project resources or any other discovery.

For our most advanced project, Tulu Kapi's planned open pit

mine, the modelling was built independently for use by the project

syndicate and is based on the DFS (Definitive Feasibility Study) as

updated for refinements in consultation with lenders, contractors

and input pricing updates generally. KEFI management use this

modelling as the basis for analyses from equity investors'

viewpoint.

The other KEFI projects are less advanced and are at various

stages of feasibility study. Accordingly, any statistics are based

on Preliminary Economic Assessments based on models derived with

the input of our specialist advisers and consultants. We highlight

that the integration of the preliminary plans for the Tulu Kapi

underground mine into a combined profile with the open pit mine

will be revised to DFS-stage during construction of the open pit

mine.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDPPUQGWUPWGMG

(END) Dow Jones Newswires

March 22, 2023 03:00 ET (07:00 GMT)

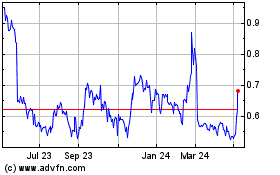

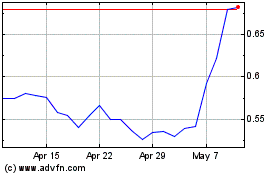

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Nov 2024 to Dec 2024

Kefi Gold And Copper (LSE:KEFI)

Historical Stock Chart

From Dec 2023 to Dec 2024