TIDMKWG

RNS Number : 3071S

Kingswood Holdings Limited

15 November 2021

KINGSWOOD HOLDINGS LIMITED

Acquisition of Money Matters (North East)

Kingswood Holdings Limited ("Kingswood") announces an agreement

to acquire Money Matters (North East) Limited ("MMNE"). MMNE is a

privately owned wealth management business, primarily offering its

services to clients in the North-East.

The transaction boosts Kingswood's UK client facing advisory

team to 69 people and increases UK funds under advice/management to

GBP4.6 billion from circa 8,000 active clients.

Kingswood Group AuA now totals over GBP6.3 billion from global

retail and institutional clients.

Kingswood Holdings Limited (AIM: KWG), the international, fully

integrated wealth and investment management group, is pleased to

announce it has agreed to acquire, subject to regulatory approval,

Money Matters (North East) Limited, a privately owned wealth

management business, primarily offering its services in the North

East of England.

David Lawrence, UK CEO at Kingswood, commented:

"Since becoming UK CEO late last year, I have focused on

building momentum in the business and expanding our capabilities to

integrate and grow. I am thrilled to announce our acquisition of

MMNE and look forward to welcoming Alastair Raine, Chris Woodhams

and the whole team to Kingswood.

"Both Chris and Alastair have extensive experience as financial

advisers and started MMNE in 2010 with a vision to combine their

extensive expertise together to create a client centred business

which is a vision that we share at Kingswood.

"The Kingswood model is designed to provide a centralised,

efficient support infrastructure to manage the routine, but time

consuming tasks required across compliance, finance, human

resources, risk and technology, allowing the MMNE team to deliver a

superior level of service to their clients. I am really looking

forward to working with Chris and Alastair as we further grow the

business as part of the Kingswood Group.

"We remain committed to perpetuating our stated growth strategy

within the UK and internationally. This is our second acquisition

of 2021 and we continue to have a strong pipeline of high-quality

UK opportunities under negotiation, six of which are in exclusive

due diligence as we continue to grow our financial planning and

investment management reach across the UK. We expect to be making

more announcements over the coming weeks."

About MMNE

MMNE is an independent financial adviser firm based in Redcar,

North Yorkshire and they advise on all aspects of personal

financial planning with clients that range from private individuals

to small/medium sized businesses. MMNE currently employs 13 people,

including three financial advisers, managing c.GBP115m AUA on

behalf of c.600 active clients. In the year to 31 March 2021, MMNE

generated profit before tax of GBP425k and had net assets of

GBP499k as at that date.

Following regulatory approval, the business will be acquired for

total cash consideration of up to GBP3.4m, payable over a two year

period. GBP1.7m will be paid at closing and the balance paid on a

deferred basis, some of which is subject to the achievement of

pre-agreed performance targets.

Alastair Raine / Chris Woodhams, company principals at MMNE

commented:

"We spoke to many firms with the primary aim of finding a firm

with a very similar culture of placing the clients at the heart of

everything we do, whilst focusing on staff welfare and progression.

Kingswood fits these criteria perfectly.

"We have been searching for the right business to embrace our

culture, philosophy, and principles in continuing to provide the

highest quality, client focused financial advice.

"We feel the prospect of being part of a larger organisation

allows us to address the challenges of dealing with increasing

regulatory change whilst enhancing the service to existing clients

and creating the potential for future growth. These were the key

factors in joining the Kingswood Group.

We are delighted to have found such a firm in Kingswood, who

will further enhance our client proposition and present an exciting

new opportunity for all our staff that have helped us to grow the

business over the last 11 years."

Consideration

On completion, the acquisition will be funded from funds

recently received by Kingswood from the issue of new convertible

preference shares, under the terms of its Convertible Preference

Share subscription agreement with HSQ INVESTMENT LIMITED, a wholly

owned indirect subsidiary of funds managed and/or advised by Pollen

Street Capital Limited ("Pollen Street"). Kingswood's partnership

with Pollen Street grows in strength, and to date has provided

growth equity of GBP44.8 million to support existing and future

acquisitions.

For further details, please contact:

Kingswood Holdings Limited +44 (0)20 7293 0730

David Lawrence www.kingswood-group.com

finnCap Ltd (Nomad & Broker) +44 (0)20 7220 0500

Stuart Andrews / Simon Hicks / Abigail

Kelly (Corporate Finance)

Richard Chambers (ECM)

GreenTarget (for Kingswood media) +44 (0)20 7324 5498

Jamie Brownlee / Alice Gasson / Ellie Jamie.Brownlee@greentarget.co.uk

Basle

Stand Agency (for Pollen Street media) +44 (0) 7973 596 503

Cait Dacey pollenstreet@standagency.com

About Kingswood

Kingswood Holdings Limited (trading as Kingswood) is an

AIM-listed (AIM: KWG) international fully integrated wealth

management group with circa GBP6.3 billion of Assets under Advice

and Management. It services circa 8,000 clients from a growing

network of offices in the UK including Abingdon, Beverley,

Darlington, Derby, Grimsby, Hull, Lincoln, London, Maidstone,

Newcastle, Sheffield (2), Worcester and York with overseas offices

in Johannesburg, South Africa and Atlanta, New York and San Diego

in US.

Kingswood offers a range of trusted investment solutions to its

clients, which range from private individuals to some of the UK's

largest universities and institutions, including investment advice

and management, personal and company pensions and wealth planning.

Kingswood is focused on becoming a leading player in the wealth and

investment management market through targeted acquisitions in the

UK and US, creating a global business through strategic

partnerships.

Registered office address: Mont Crevelt House, Bulwer Avenue,

St. Sampson, Guernsey, GY2 4LH

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEANFLFEKFFFA

(END) Dow Jones Newswires

November 15, 2021 02:00 ET (07:00 GMT)

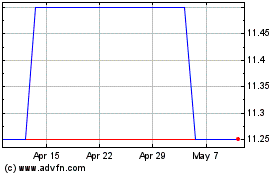

Kingswood (LSE:KWG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kingswood (LSE:KWG)

Historical Stock Chart

From Apr 2023 to Apr 2024