Litigation Capital Management Ltd Director/PDMR Shareholding

15 November 2024 - 6:00PM

RNS Regulatory News

RNS Number : 3378M

Litigation Capital Management Ltd

15 November 2024

15 November 2024

Litigation Capital Management

Limited

("LCM" or the

"Company")

Exercise of Awards

Litigation Capital Management

Limited (AIM:LIT), a leading international alternative asset

manager of disputes financing solutions, announces

that Susanna Taylor, a Person Discharging Managerial

Responsibilities (PDMR) exercised loan shares over 274,648 ordinary

shares which have been sold to the Employee Benefit Trust

('EBT').

The following table details the quantum of LSPs

exercised which have been sold to the EBT:

|

Employee

|

Position

|

Incentive

Scheme

|

Number of

Share/Options Awarded

|

|

Susanna Taylor

|

Head of APAC / PDMR

|

LSP

|

274,648

|

|

Non-PDMR Employees

|

Various / Non-PDMR

|

LSP

|

509,871

|

Employee

Benefit Trust ('EBT')

The Company has an EBT. The EBT is a

discretionary trust for the benefit of the Company's employees,

including the Directors of the Company. Following the

purchase of the LSP's detailed above, the EBT of the Company

currently holds 4,270,308 Ordinary Shares, representing 3.74 per

cent. of the of the Company's total voting rights.

The notification below, made in accordance with

the requirements of the UK Market Abuse Regulation,

provides further details.

Enquiries

|

Litigation Capital Management

|

c/o Tavistock

|

|

Patrick Moloney, Chief Executive

Officer

David Collins, Chief Financial

Officer

|

|

|

|

|

|

Cavendish (Nomad and Joint

Broker)

|

Tel: 020 7220 0500

|

|

Jonny Franklin-Adams and Rory Sale

(Corporate Finance)

Tim Redfern and Jamie Anderson

(Corporate Broking)

|

|

|

|

|

|

Canaccord Genuity (Joint Broker)

|

Tel: 020 7523 8000

|

|

Bobbie Hilliam

|

|

|

|

|

|

Tavistock (PR and IR)

|

Tel: 020 7920 3150

|

|

Katie Hopkins

Simon Hudson

|

lcm@tavistock.co.uk

|

NOTES TO

EDITORS

Litigation Capital Management (LCM) is an

alternative asset manager specialising in disputes financing

solutions internationally, which operates two business models. The

first is direct investments made from LCM's permanent balance sheet

capital and the second is third party fund management. Under those

two business models, LCM currently pursues three investment

strategies: Single-case funding, Portfolio funding and Acquisitions

of claims. LCM generates its revenue from both its direct

investments and also performance fees through asset

management.

LCM has an unparalleled track record driven by

disciplined project selection and robust risk management. Currently

headquartered in Sydney, with offices

in London, Singapore, Brisbane and Melbourne,

LCM listed on AIM in December 2018, trading under the ticker

LIT.

www.lcmfinance.com

|

1.

|

Details of the

Person discharging managerial responsibilities ("PDMR") / person

closely associated with them ("PCA")

|

|

a)

|

Name

|

Susanna Taylor

|

|

2.

|

Reason for the

notification

|

|

a)

|

Position / status

|

Head of APAC

|

|

b)

|

Initial notification / amendment

|

Initial notification

|

|

3.

|

Details of the

issuer, emission allowance market participant, auction platform,

auctioneer or auction monitor

|

|

a)

|

Name

|

Litigation Capital Management Limited

|

|

b)

|

Legal Entity Identifier

|

213800J2B5SI8F515244

|

|

4.

|

Details of the

transaction(s): section to be repeated for (i) each type of

instrument; (ii) each type of transaction; (iii) each date; and

(iv) each place where transactions have been

conducted

|

|

a)

|

Description of the financial

instrument

|

Loan shares

|

|

b)

|

Nature of the transaction

|

Exercise and sale of loan shares

|

|

c)

|

Price(s) and volume(s)

|

|

Price(s)

|

Volume(s)

|

Award

|

|

115,27p

|

274,648

|

LSP

|

|

|

d)

|

Aggregated information

- Aggregated volume

- Aggregated price

- Aggregated total

|

274,648 loan shares over ordinary

shares

115.27p

£316,586

|

|

e)

|

Date of the transaction

|

14 November 2024 (UK)

|

|

f)

|

Place of the transaction

|

Outside a trading venue

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DSHBIBDBGSBDGSS

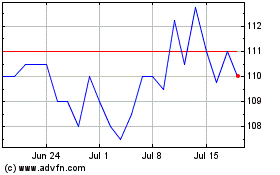

Litigation Capital Manag... (LSE:LIT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Litigation Capital Manag... (LSE:LIT)

Historical Stock Chart

From Dec 2023 to Dec 2024