NewRiver REIT PLC Pre-sale of residential units in Burgess Hill (8165L)

24 July 2017 - 4:00PM

UK Regulatory

TIDMNRR

RNS Number : 8165L

NewRiver REIT PLC

24 July 2017

NewRiver REIT plc

("NewRiver" or the "Company")

Contracts exchanged for pre-sale of residential units in Burgess

Hill

NewRiver is pleased to announce that it has exchanged

conditional contracts for the pre-sale of the entire residential

element of its major mixed-use regeneration of Burgess Hill town

centre.

Delph Property Group, a well-established family run residential

investment company, has agreed to purchase all 142 residential

units for GBP34 million. This residential pre-sale, together with

the pre-lets already secured on the retail & leisure element of

the scheme, significantly de-risks the redevelopment which has

projected construction costs of GBP47 million. Under the terms of

the pre-sale agreement, 10% of the total consideration was placed

in escrow at exchange, and a further 20% will be placed in escrow

ahead of the commencement of construction, with the balance

remitted to the Company on completion in 2020.

Simultaneously, NewRiver also exchanged on the Agreement for

Lease with Mid Sussex District Council for a new Head Lease of the

shopping centre, which is another important milestone for the

redevelopment. As a consequence of this activity, and in line with

its risk-controlled development approach, the Company expects to

begin its phased programme of works imminently.

NewRiver acquired the 123,000 sq ft Martlets Shopping Centre in

Burgess Hill in November 2010 for GBP12 million, representing a net

initial yield of 8.5%. Burgess Hill is an affluent catchment area

located within the 'Gatwick Diamond', just 20 minutes from Gatwick

Airport and 50 minutes by train to central London.

NewRiver received full detailed planning consent for the

mixed-use regeneration of Burgess Hill town centre in March 2016.

The 465,000 sq ft redevelopment of the existing shopping centre

forms a key element of NewRiver's 1.9 million sq ft risk-controlled

development pipeline which the Company believes will be a key

driver of long term returns for its shareholders, and is in line

with the Company's strategy to redevelop existing assets within the

portfolio where appropriate.

As well as 142 new residential units, the redevelopment will

provide a 10-screen multiplex cinema, a 63-bed hotel, an improved

retail offer and new restaurant and leisure provisions, additional

car park spaces, an improved public realm and a new purpose-built

library for the Council. The retail & leisure element of the

scheme is already 50% pre-let, with high quality and long dated

income secured from Cineworld, Nandos, Next, Travelodge and

Wildwood.

Allan Lockhart, Property Director, NewRiver commented: "The

pre-sale of the entire residential component of our Burgess Hill

redevelopment to a high quality residential specialist investor

significantly de-risks the project and, in-line with our

risk-controlled approach, puts us in a strong position to begin

construction.

Having recently received planning consent for our major

mixed-use regeneration in Cowley, Oxford, we are seeing real

momentum in our risk-controlled development pipeline, which we are

confident will be a significant driver of long term returns for our

shareholders."

Nicholas Belkin, Head of Acquisitions, Delph Property Group

commented: "We are excited to be involved in the Burgess Hill

regeneration story with NewRiver as it continues to show our firm

financial commitment to residential acquisitions throughout the

UK."

For further information

NewRiver REIT plc +44 (0)20 3328 5800

David Lockhart (Chief Executive)

Mark Davies (Chief Financial Officer)

Will Hobman (Head of Investor Relations)

Bell Pottinger +44 (0)20 3772 2500

David Rydell

Eve Kirmatzis

About NewRiver

NewRiver REIT plc (ticker: NRR) is a premium listed REIT on the

London Stock Exchange and a constituent of the FTSE 250 and EPRA

indices. The Company is a specialist real estate investor, asset

manager and developer focused solely on the UK retail and leisure

sector.

Founded in 2009, NewRiver is one of the UK's largest

owner/managers of convenience-led shopping centres with assets

under management of GBP1.3 billion principally comprising 33 UK

wide shopping centres together with further nationwide retail and

leisure assets. The portfolio totals 8 million sq. ft. with over

2,000 occupiers, an annual footfall of 150 million and a retail

occupancy rate of 97 per cent. Visit www.nrr.co.uk for further

information. LEI number: 2138004GX1VAUMH66L31

This information is provided by RNS

The company news service from the London Stock Exchange

END

CNTOKDDNOBKDBOB

(END) Dow Jones Newswires

July 24, 2017 02:00 ET (06:00 GMT)

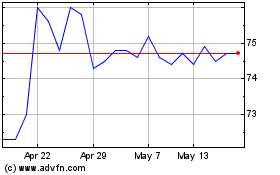

Newriver Reit (LSE:NRR)

Historical Stock Chart

From Apr 2024 to May 2024

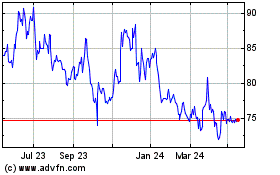

Newriver Reit (LSE:NRR)

Historical Stock Chart

From May 2023 to May 2024