TIDMONT

RNS Number : 0754Z

Oxford Nanopore Technologies plc

09 January 2024

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

Oxford Nanopore Technologies plc

FY23 trading update

09 January 2024

Oxford Nanopore Technologies plc (LSE: ONT) ("Oxford Nanopore"

or the "Group"), the company delivering a new generation of

nanopore-based molecular sensing technology, today provides a

trading update ahead of reporting its full-year 2023 results on 6

March.

FY23 financial performance

The Group expects to report LSRT revenue for the 12 months ended

31 December 2023 of approximately GBP169 million (FY22: GBP146.8

million), representing year-on-year growth of approximately 15% on

a reported basis and 15% on a constant currency basis. Underlying

LSRT revenue growth, excluding revenue from Emirati Genome Program

("EGP") and COVID-19 sequencing, is expected to be approximately

39% on a constant currency basis. Strong performance across the

broader customer base in FY23 was driven by consumables [1] sales,

which accounted for approximately 75% of revenue.

Underlying revenue growth in the second half is expected to be

approximately 32%, impacted by slower than expected ramp up of

certain new S3 customers. Expected revenue from these customers in

FY23 will now fall into FY24. In addition, there was some slow-down

in growth in China and in the Middle East following issuance of the

recent US semiconductor trade rule further regulating sales of

advanced AI semiconductors. Product development plans within 2024

include updates that are expected to mitigate this headwind.

In addition to financial reporting, there was other evidence of

market traction and disruption. For example, the Group leased or

sold more than 700 PromethION 2 Solos (P2 Solo) in FY23; Oxford

Nanopore's most recently launched product represents a new market

area of affordable, accessible and high output sequencing. Material

associated revenue is anticipated to pull through with consumables

sales in FY24 and future periods.

Emirati Genome Program update

The Group has signed an agreement to replace and supersede the

existing purchase agreement it has with G42 Laboratories LLC

("G42") in support of the EGP. The new agreement will provide

greater flexibility to achieve the programme objectives and

reflects the parties' desire to refocus on clinical uses of the

platform, that can utilise the platform's unique benefits of richer

and faster data. G42 and Oxford Nanopore have agreed to collaborate

to leverage the richer data and speed of Oxford Nanopore's

technology in areas of unmet clinical need such as developmental

disorders, rare human genetic diseases and neonatal intensive

care.

The EGP contract, originally announced on 9 November 2021 with a

total value of approximately $68 million over a three-year period,

has generated revenues of approximately $43.5 million to date,

including amounts payable in relation to the amended contract. The

new agreement will remove the outstanding purchase commitment from

the original agreement and extends the expiration date until 31

December 2026. EGP revenue in 2024 and beyond is not anticipated to

be a material portion of revenue and as such, the Group will cease

reporting EGP revenue separately following FY23 results.

Revenue related to the EGP in 2023 (under the original and

revised agreement) was approximately GBP12 million, in-line with

guidance.

Excluding EGP, the Group's gross margin in FY23 would have been

expected to be more than 57%, in-line with guidance. However, as a

result of the agreement with G42, the Group's FY23 gross margin is

expected to be in the range 53 to 55%. Gross margin in future

periods is not expected to be affected by this amendment.

Medium-term Outlook

All medium-term (FY26) targets are unchanged:

The Group continues to expect underlying revenue growth of more

than 30% per annum on a constant currency basis, consistent with

the Group's recent performance.

The Group's medium-term gross margin target of greater than 65%

for FY26 is also unchanged. Margin expansion is expected to be

driven primarily by operational improvements already underway

and/or planned including improved manufacturing processes,

recycling of electrical components and automation.

The Group continues to target adjusted EBITDA breakeven by the

end of 2026. This will be achieved through revenue growth and

margin expansion, detailed above, and disciplined operating

expenditure.

[ENDS]

This announcement contains inside information for the purposes

of the UK version of the market abuse regulation (EU no. 596/2014),

which forms part of English law by virtue of the European Union

(Withdrawal) Act 2018. The person responsible for arranging the

release of this announcement on behalf of the Company is Hannah

Coote, Company Secretary of Oxford Nanopore Technologies plc.

For further information, please contact:

Oxford Nanopore Technologies plc

Investors: ir@nanoporetech.com

Media: media@nanoporetech.com

Teneo (communications adviser to the Company)

Tom Murray, Olivia Peters

+44 (0) 20 7353 4200

OxfordNanoporeTechnologies@teneo.com

About Oxford Nanopore Technologies plc:

Oxford Nanopore Technologies' goal is to bring the widest

benefits to society through enabling the analysis of anything, by

anyone, anywhere. The company has developed a new generation of

nanopore-based sensing technology that is currently used for

real-time, high-performance, accessible, and scalable analysis of

DNA and RNA. The technology is used in more than 120 countries, to

understand the biology of humans, plants, animals, bacteria,

viruses and environments as well as to understand diseases such as

cancer. Oxford Nanopore's technology also has the potential to

provide broad, high impact, rapid insights in a number of areas

including healthcare, food and agriculture.

For more information please visit: www.nanoporetech.com

Forward-looking statements

This announcement contains certain forward-looking statements.

For example, statements regarding expected revenue growth and

profit margins are forward-looking statements. Phrases such as

"aim", "plan", "expect", "intend", "anticipate", "believe",

"estimate", "target", and similar expressions of a future or

forward-looking nature should also be considered forward-looking

statements. Forward-looking statements address our expected future

business and financial performance and financial condition, and by

definition address matters that are, to different degrees,

uncertain. Our results could be affected by macroeconomic

conditions, the COVID-19 pandemic, delays in our receipt of

components or our delivery of products to our customers,

suspensions of large projects and/or acceleration of large products

or accelerated adoption of pathogen surveillance. These or other

uncertainties may cause our actual future results to be materially

different than those expressed in our forward-looking

statements.

[1] Consumables revenue includes the consumables included in

starter pack revenue

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKFNELLLEEA

(END) Dow Jones Newswires

January 09, 2024 02:00 ET (07:00 GMT)

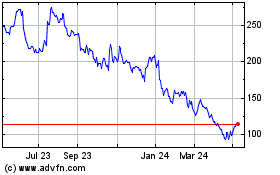

Oxford Nanopore Technolo... (LSE:ONT)

Historical Stock Chart

From Mar 2024 to Apr 2024

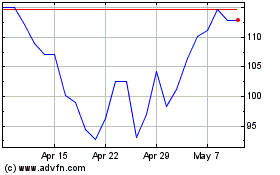

Oxford Nanopore Technolo... (LSE:ONT)

Historical Stock Chart

From Apr 2023 to Apr 2024