PensionBee Group plc Q2 2024 Results

25 July 2024 - 1:30AM

RNS Regulatory News

RNS Number : 7077X

PensionBee Group plc

24 July 2024

|

PensionBee Group plc

|

|

Incorporated in England and

Wales

|

|

Registration Number:

13172844

|

|

LEI: 2138008663P5FHPGZV74

|

|

ISIN: GB00BNDRLN84

|

|

|

|

|

|

24

July 2024

|

|

PensionBee Group

plc

|

|

Q2 2024 Results

|

|

|

|

Successful Strategy drives

Strong Performance

|

|

Positive Adjusted EBITDA

achieved in Q2

|

|

|

|

PensionBee Group plc ('PensionBee'

and together with its subsidiary companies the 'Group'), a leading

online pension provider, today announces a trading update

(unaudited) for the quarter ended 30 June 2024.

|

|

Group Financial Highlights

|

|

●

|

Assets under Administration

increased by 40% year on year to £5.2bn (June 2023: £3.7bn),

underpinned by strong Net Flows from new and existing customers and

supportive markets.

|

|

|

|

|

●

|

Revenue for the quarter increased by

40% to £8m (Q2 2023: £6m), with Annual Run Rate Revenue having

increased by 39% to £32m (June 2023: £23m).1

|

|

|

|

|

●

|

Invested Customers increased by 19%

year on year to 252,000 (June 2023: 211,000), demonstrating strong

continued growth. Customer Retention Rate was 96%, driven by

continued strong customer satisfaction (4.7★ Trustpilot score) and ongoing

product innovation.

|

|

|

|

|

●

|

Positive Adjusted EBITDA achieved

for the Group for the quarter (Q2 2024: £0.1m vs. Q2 2023:

£(2.9)m), with the UK business remaining on track to achieve

Adjusted EBITDA profitability for FY 2024.

|

|

|

|

|

●

|

Strong cash balance of c.£10.9m as

of June 2024.

|

|

Continued Advancement of Strategic Goals

|

|

●

|

Efficient Investment in

Customer Acquisition and Growing Brand Awareness:

PensionBee's UK business continued to grow its

brand and acquire customers efficiently, investing £2.3m in

diversified marketing activities across the quarter, bringing the

cumulative marketing investment since inception to £61m. Each £1 of

marketing expenditure generated £82 of Net Flows in H1 2024 an

increase of 20% year on year (H1 2023: £69), demonstrating the

effectiveness of marketing expenditure deployed.2 Cost

per Invested Customer continued to demonstrate a downward

trajectory (Q2 2024: £242 vs. Q2 2023: £247), highlighting the

strength of the Company's marketing capability, the efficiency of

spend, and the importance of household brand awareness in driving

customer acquisition.3

|

|

|

|

|

●

|

Leadership in Product

Innovation: PensionBee has continued

to innovate to meet the needs of its UK customers. PensionBee has

released helpful, engaging tools, such as new investment-related

features providing increased transparency and educational

content.

|

|

|

|

|

●

|

Focus on Excellent Customer

Service: The delivery of excellent

customer service has continued to be prioritised, as evidenced

through the achievement of a 4.7★ Excellent Trustpilot rating from

approximately 10,900 Trustpilot reviews and the maintenance of

rapid customer response times through tax year end.

|

|

|

|

|

●

|

Investment in and Development

of Leading Technology Platform: PensionBee has continued with its ongoing investment in the

scalability of its technology platform, which continues to underpin

its competitive advantage. Efficiency improvements through internal

automation, security and pension transfer improvements, have

delivered a 23% productivity improvement year on year (Q2 2024:

1,264 Invested Customers / FTE vs. Q2 2023: 1,026 Invested

Customers / FTE).4

|

|

UK

Guidance and Outlook

|

|

PensionBee is pleased to reiterate

the guidance previously provided.

|

|

●

|

Aim to deliver sustained and high

Revenue growth by continuing appealing to the mass market,

acquiring more new customers and growing customers' pension

balances.

|

|

|

|

|

●

|

Pursue a c.2% market share of the

£1.2tr UK transferable pensions market over the next 5-10 years,

equivalent to c.1m Invested Customers (assuming an average pension

pot size of £20,000-25,000).5

|

|

|

|

|

●

|

Expect to maintain relative Revenue

margin stability, translating into a long-term Revenue ambition of

c.£150m in the UK.

|

|

UK Profitability

Objectives:

|

|

●

|

Given historical investment in brand

and technology over many years, and the achievement of ongoing

Adjusted EBITDA profitability in the final quarter of 2023 and

again in this quarter, the UK business is on track to deliver

Adjusted EBITDA profitability for the full year 2024.

|

|

|

|

|

●

|

Ambition to achieve long-term EBITDA

Margins of over 50%, leveraging the scalability of the technology

platform, through further automation while maintaining the high

quality of service, and by steadily continuing to reduce the Cost

per Invested Customer.

|

|

Update on PensionBee Launch

|

|

●

|

On 18 July 2024, PensionBee

announced the launch of its US business, confirming that its

subsidiary PensionBee Inc. had entered into a strategic partnership

with its long-standing asset management provider, State Street

Global Advisors ('State Street'). The United States is the world's

largest Defined Contribution pension market, representing

approximately 80% of the global total and $22.5tr in

assets.6

|

|

|

|

|

●

|

PensionBee will deploy its

award-winning online retirement proposition and proprietary

technology, enabling US consumers to easily consolidate and roll

over their 401(k) plans and Individual Retirement Accounts ('IRAs')

into one new PensionBee IRA. PensionBee Inc. is registered with the

Securities and Exchange Commission ('SEC') as an investment

adviser, enabling the company to operate federally and statewide

without additional registrations.

|

|

|

|

|

●

|

PensionBee Inc. offers a range of

investment portfolio options, with underlying State Street model

portfolios. Each investment portfolio is constructed exclusively

with Exchange Traded Funds ('ETFs') managed by State

Street.

|

|

|

|

|

●

|

The PensionBee IRA will be offered

under a wrap fee program, including the PensionBee advisory

service, asset allocation and management fees and custody fees. The

overall cost will be 0.85% of assets under management, of which

PensionBee will retain approximately 0.55% after asset allocation,

investment product and custody costs. The average account balance

is expected to be approximately $50,000.

|

|

|

|

|

●

|

State Street will provide meaningful

marketing support to PensionBee as it uses its data-led,

multi-channel customer acquisition approach to attract new

customers. Under the terms of the agreement with State Street, the

annual amount of the marketing support is variable based on the

achievement of certain net new asset thresholds. For example,

marketing support is anticipated to be $2m in 2024 and in 2025 the

support will be at least $4m. Marketing support is expected to

continue for 5-7 years. PensionBee expects a US Cost per Invested

Customer of similar proportions to its UK business over

time.

|

|

|

|

|

●

|

PensionBee Inc. is a wholly owned

subsidiary of PensionBee. PensionBee Inc. is financially managed

separately to PensionBee Group's UK business. PensionBee Inc. is

separately regulated by the SEC.

|

|

US

Objectives

|

|

●

|

PensionBee expects its US business

to grow rapidly, aiming to manage $20-25bn in US Defined

Contribution assets over the next decade, such that it becomes of

equal importance to its growing UK business.

|

|

|

|

|

●

|

PensionBee Group will capitalise

PensionBee Inc. with an injection from the existing resources of

its Group balance sheet (approximately $4m over 36

months).

|

|

|

|

|

●

|

PensionBee Inc. is targeting

profitability in the medium-term.

|

|

Romi Savova, CEO of PensionBee, commented:

|

|

|

|

"Our substantial growth has continued over the second quarter,

with Assets under Administration reaching £5.2 billion and 252,000

Invested Customers in the UK. As we continue to consistently

execute on all elements of our strategy, having achieved positive

Group Adjusted EBITDA for the second quarter, we remain confident

in the delivery of profitability across the UK business for the

full year 2024.

|

|

|

|

We

are delighted to expand the reach of our award-winning customer

proposition, innovative technology platform and unique marketing

approach into the US market, the world's largest Defined

Contribution pension market. This marks a significant step towards

the achievement of our vision: a world where everyone can enjoy a

happy retirement."

|

|

Analyst, Investor and Press Presentation

|

|

A copy of this Q2 2024 Results

Announcement and the accompanying Q2 2024 Results Presentation will

be made available post-market close on 24 July 2024 for download

at:

pensionbee.com/investor-relations/results-and-reports.

A recording of the presentation will follow.

|

|

|

|

There will be a live webcast

presentation of the Q2 2024 Results via Investor Meet Company

hosted by Romi Savova (CEO) and Christoph J. Martin (CFO) on

Wednesday 24 July 2024 at 5:00pm UK (BST) / 12:00pm US (EST). The

presentation is open to analysts, existing and potential investors

and press.

|

|

|

|

Attendees can sign up to the

Investor Meet Company platform for free and add to meet PensionBee

via:

|

|

investormeetcompany.com/pensionbee-group-plc/register-investor

|

|

|

As at

Period End

|

|

|

Jun-2023

|

Jun-2024

|

YoY change

|

|

AUA

(£m)7

|

3,704

|

5,196

|

40%

|

|

AUA Retention Rate (% of

AUA)8

|

>95%

|

>95%

|

Stable

|

|

Invested Customers

(thousands)9

|

211

|

252

|

19%

|

|

Customer Retention Rate (% of

IC)10

|

>95%

|

>95%

|

Stable

|

|

Cost per Invested Customer

(£)11

|

247

|

242

|

(2)%

|

|

Revenue Margin (% of

AUA)12

|

0.65%

|

0.64%

|

Stable

|

|

Annual Run Rate

Revenue1

|

23

|

32

|

39%

|

|

LTM Revenue13

|

20

|

28

|

40%

|

|

|

Over the

6-month Period Ending

|

|

|

Jun-2023

|

Jun-2024

|

YoY change

|

|

Opening AUA (£m)7

|

3,025

|

4,350

|

44%

|

|

Gross Inflows (£m)

|

612

|

695

|

14%

|

|

Gross Outflows (£m)

|

(143)

|

(214)

|

49%

|

|

Net

Flows (£m)14

|

469

|

482

|

3%

|

|

Market Growth and Other

(£m)

|

210

|

364

|

74%

|

|

Closing AUA (£m)7

|

3,704

|

5,196

|

40%

|

|

|

Over the

3-month Period Ending

|

|

|

Jun-2023

|

Jun-2024

|

YoY change

|

|

Revenue (£m)15

|

6

|

8

|

40%

|

|

Cost Base (£m)

|

(9)

|

(8)

|

(8)%

|

|

Adjusted EBITDA

(£m)16

|

(3)

|

0.1

|

n/m

|

|

Adjusted EBITDA Margin (% of

Revenue)17

|

(50)%

|

1%

|

52ppt*

|

|

|

Over the

6-month Period Ending

|

|

|

Jun-2023

|

Jun-2024

|

YoY change

|

|

Revenue (£m)15

|

11

|

15

|

41%

|

|

Cost Base (£m)

|

(19)

|

(17)

|

(8)%

|

|

Adjusted EBITDA

(£m)16

|

(8)

|

(2)

|

75%

|

|

Adjusted EBITDA Margin (% of

Revenue)17

|

(73)%

|

(13)%

|

60ppt*

|

|

Notes

|

|

*

|

A ppt is a percentage point. A

percentage point is the unit for the arithmetic difference of two

percentages.

|

|

1

|

Annual Run Rate ('ARR') Revenue is

calculated using the recurring Revenue for the relevant month

multiplied by 12.

|

|

2

|

Cumulative Net Flows over the

relevant period divided by Cumulative Marketing spend over the

relevant period.

|

|

3

|

PensionBee prompted brand awareness

tracker, April 2024. Prompted brand awareness measured through a

consumer survey asking 'Which of the following have you heard of?'

with respect to UK financial services brands: Aviva 82%, Scottish

Widows 74%, Standard Life 68%, PensionBee 55%, Hargreaves Lansdown

40%, Nutmeg 37%, AJ Bell 33%, Interactive Investor 11%

|

|

4

|

Productivity, measured using

Invested Customers per Staff Member metric, is calculated using an

LTM average for the total workforce. Management information as at

30 June 2024.

|

|

5

|

£1.2tr UK transferable pensions

market is as of 2023 while the £722bn reference previously used was

as of 2019; as such the increase is driven due to growth over that

time period (c.10% CAGR consistent with c.12.5% CAGR in the period

before that).

|

|

6

|

Investment Company Institute,

'Release: Quarterly Retirement Market Data' as at 13 December 2023.

Includes the sum of DC Plans and IRAs.

|

|

7

|

Assets under Administration ('AUA')

is the total invested value of pension assets within PensionBee

Invested Customers' pensions. It measures the new inflows less the

outflows and records a change in the market value of the assets.

AUA is a measurement of the growth of the business and is the

primary driver of Revenue.

|

|

8

|

AUA Retention measures the percentage

of retained PensionBee AUA from Transfer Outs over the average of

the trailing twelve months. High AUA retention provides more

certainty of future Revenue. This measure can also be used to

monitor customer satisfaction.

|

|

9

|

Invested Customers ('IC') means those

customers who have transferred pension assets or made contributions

into one of PensionBee's investment plans.

|

|

10

|

Customer Retention Rate measures the

percentage of retained PensionBee Invested Customers over the

average of the trailing twelve months. High customer retention

provides more certainty of future Revenue. This measure can also be

used to monitor customer satisfaction.

|

|

11

|

Cost per Invested Customer ('CPIC')

means the cumulative advertising and marketing costs incurred since

PensionBee commenced trading up until the relevant point in time

divided by the cumulative number of Invested Customers at that

point in time. This measure monitors cost discipline of customer

acquisition. PensionBee's desired CPIC threshold is

£200-£250.

|

|

12

|

Revenue Margin is calculated by using

the last twelve months of Recurring Revenue over the average

quarterly AUA held in PensionBee's investment plans over the

period.

|

|

13

|

LTM Revenue means the income

generated from the asset base of PensionBee's customers,

essentially annual management fees charged on the AUA, together

with a minor revenue contribution from other services over the last

twelve months.

|

|

14

|

Net Flows measures the cumulative

inflow of PensionBee AUA from consolidation and contribution

('Gross Inflows'), less the outflows from withdrawals and transfers

out ('Gross Outflows') over the relevant period.

|

|

15

|

Revenue means the income generated

from the asset base of PensionBee's customers, essentially annual

management fees charged on the AUA, together with a minor revenue

contribution from other services.

|

|

16

|

Adjusted EBITDA is the profit or loss

for the period before taxation, finance costs, depreciation, share

based compensation and transaction costs.

|

|

17

|

Adjusted EBITDA Margin means Adjusted

EBITDA as a percentage of Revenue for the relevant

period.

|

|

|

Enquiries

PensionBee

Press

Becky O'Connor

Laura Dunn-Sims

Steven Kennedy

press@pensionbee.com

+44 20 3557 8444

Analysys and Investors

investor@pensionbee.com

About PensionBee

|

|

|

|

PensionBee is a leading online

pension provider, making pension management easy for its customers

while they save for a happy retirement. PensionBee helps its

customers combine their old pension pots, make flexible

contributions, invest in line with their goals and values and make

withdrawals. PensionBee offers a range of investment plans,

including fossil fuel free and impact investing options, from some

of the world's largest asset managers.

|

|

|

|

Operating in the vast market of

Defined Contribution pension assets, PensionBee has grown rapidly

through its direct-to-consumer marketing activities, creating a

household brand name for the mass market. PensionBee has £5.2bn of

Assets Under Administration and 252,000 Invested Customers as at 30

June 2024. It has consistently maintained a Customer Retention Rate

in excess of 95% and an Excellent Trustpilot rating from more than

10,900 customers, reflecting its commitment to outstanding customer

service.

|

|

|

|

PensionBee is listed on the London

Stock Exchange (LON:PBEE).

|

|

|

|

Forward Looking Statements

|

|

|

|

Statements that are not historical

facts, including statements about PensionBee's or management's

beliefs and expectations, are forward-looking statements. The

results contain forward-looking statements, which by their nature

involve substantial risks and uncertainties as they relate to

events and depend on circumstances which will occur in the future

and actual results and developments may differ materially from

those expressly stated or otherwise implied by these

statements.

|

|

|

|

These forward-looking statements are

statements regarding PensionBee's intentions, beliefs or current

expectations concerning, among other things, its results of

operations, financial condition, prospects, growth, strategies and

the industry and markets within which it operates.

|

|

|

|

These forward-looking statements

relate to the date of these results and PensionBee does not

undertake any obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date of the results.

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

IR ZZLFLZDLBBBQ

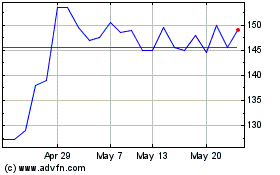

Pensionbee (LSE:PBEE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Pensionbee (LSE:PBEE)

Historical Stock Chart

From Dec 2023 to Dec 2024