Brighton Pier Group PLC (The) Trading Statement (0302H)

25 July 2023 - 4:00PM

UK Regulatory

TIDMPIER

RNS Number : 0302H

Brighton Pier Group PLC (The)

25 July 2023

25 July 2023

The Brighton Pier Group PLC

(the "Company" or the "Group")

Trading Update

Brighton Pier Group PLC, a diversified UK leisure and

entertainment business, provides the following trading update for

the first half of its present financial year (26 week period ended

25 June 2023).

On 24 April 2023, the Group announced its final results for the

18 month period ended December 2022. That announcement included an

update on the Group's trading over the first quarter of this year

which, although behind the equivalent exceptional period in 2022,

was in line with market expectations.

However, the second quarter has proved more difficult. Sales

remain behind 2022, with the current macroeconomic environment

leading to a widespread decline in disposable incomes and consumer

confidence . Total sales for the 6 months ending 25 June 2023 are

expected to be in the region of GBP16.2 million.

Ongoing inflationary pressures, meanwhile, in particular in

relation to food & beverage and staff costs have adversely

affected the Group's operating margins in the current reporting

period.

The combined effect of these lower sales with the inflationary

cost pressures are expected to result in earnings after tax below

market expectations.

The Board notes that the Group is currently in the middle of its

busiest period in July and August. However, July 2023 trading has

been impacted by unseasonably poor weather, train strikes and most

significantly the impact of the fire at a major hotel opposite the

entrance to the Pier, which resulted in some disruption for about a

week. We are pleased to confirm that access to the Pier is now back

to normal.

The summer months represent a significant opportunity for the

Group, with these two months historically contributing

approximately 30% of annual Group sales, which in turn equate to a

significant proportion of the earnings of the Group for the

year.

The management team continue to mitigate the economic pressures

faced wherever possible , and all four of the Group's divisions

will remain profitable for the full year despite the

challenges.

The Board's short to medium term outlook remains cautious.

Anne Ackord, Chief Executive Officer, said:

"The Group is navigating a challenging trading environment, with

persistent high inflation and reduced footfall continuing to affect

disposable incomes across many of the Group's trading sites. When

combined with the ongoing cost pressures we face it has led to

lower than expected sales and earnings in the first half of

2023.

While we still have many of the key summer weeks to come, recent

trading in July has been impacted by a number of events outside of

our control namely weekend train strikes, stormy weather and the

hotel fire across the road from the pier which has disrupted sales.

We will still attempt to capitalise on the forthcoming school

holiday period of August, traditionally the busiest and most

profitable period in our year.

With current economic trends set to continue in the short to

medium term the outlook must continue to be one of caution".

All Company announcements and news are available at

www.brightonpiergroup.com

This announcement contains inside information within the meaning

of the Market Abuse Regulation.

Enquiries:

The Brighton Pier Group PLC

Luke Johnson, Chairman Tel: 020 7016 0700

Anne Ackord, Chief Executive Officer Tel: 01273 609361

John Smith, Chief Financial Officer Tel: 020 7376 6300

Cenkos Securities plc (Nominated Adviser and

Broker)

Stephen Keys (Corporate Finance) Tel: 0207 397 8926

Callum Davidson (Corporate Finance) Tel: 0207 397 8923

Michael Johnson (Sales) Tel: 0207 397 1933

Novella (Financial PR) Tel: 0203 151 7008

Tim Robertson

Claire de Groot

Safia Colebrook

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDBGDRDGDDGXS

(END) Dow Jones Newswires

July 25, 2023 02:00 ET (06:00 GMT)

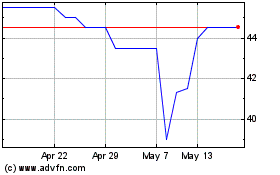

Brighton Pier (LSE:PIER)

Historical Stock Chart

From Mar 2025 to Apr 2025

Brighton Pier (LSE:PIER)

Historical Stock Chart

From Apr 2024 to Apr 2025