TIDMPRD

RNS Number : 2278K

Predator Oil & Gas Holdings PLC

20 December 2022

FOR IMMEDIATE RELEASE

20 December 2022

Predator Oil & Gas Holdings Plc / Index: LSE / Epic: PRD /

Sector: Oil & Gas

LEI 213800L7QXFURBFLDS54

Predator Oil & Gas Holdings Plc

("Predator" or the "Company" and together with its subsidiaries

the "Group")

Conditional acquisition of Cory Moruga; CO(2) EOR collaboration

and settlement with Challenger Energy Group Plc

Highlights

-- Settlement reached with Challenger Energy Group PLC

-- Progressing acquisition of Cory Moruga oil field in Trinidad

-- US$9 million Gross Consideration

-- Net payment of US$3 million cash, in staged payments with

US$6 million of potential liabilities and other value items offset

against Gross Consideration

-- Cory Moruga under-developed and very well suited to application of CO2 EOR

Predator Oil & Gas Holdings Plc (LSE: PRD), the Jersey based

Oil and Gas Company with near-term gas operations focussed on

Morocco, is pleased to announce that it has today entered into a

binding Term Sheet (the "Term Sheet") with Challenger Energy Group

PLC ("Challenger Energy"), providing for:

(i) the acquisition of Challenger Energy's 83.8% interest in the Cory Moruga asset; and

(ii) a mutually agreed final settlement in relation to the Well

Participation Agreement under which a CO2 enhanced oil recovery

project ("CO2 EOR") was carried out by Predator Oil & Gas

Trinidad in CEG Inniss-Trinity Trinidad Limited's (formerly FRAM

Exploration Trinidad Limited) Inniss-Trinity field in Trinidad

-

together the "Transaction".

Key terms of the Transaction

-- Predator will acquire 100% of the issued shares of T-Rex

Resources (Trinidad) Limited ("T-Rex"), an indirectly wholly owned

subsidiary of Challenger Energy that holds its 83.8% interest in,

and is the operator of, the Cory Moruga licence.

-- Gross consideration is US$9.0 million.

o US$3.0 million is payable to Challenger Energy by Predator in

cash, in instalments as follows:

(i) US$1 million upon completion;

(ii) a further US$1 million 6 months after completion; and

(iii) a further US$1 million payable once Cory Moruga field

production first reaches 100 barrels of oil per day.

o An agreed amount of US$6 million will be offset against the

Gross Consideration to reflect the aggregate agreed value of:;

(i) T-Rex's liabilities (including all contingent and potential

liabilities, whether crystallised or not); and

(ii) The option value embedded in Challenger Energy's back-in right ("Back-in Right");

(iii) the repayment of all loans and debts owed or claimed to be

owed by either party to the other in respect of the Inniss-Trinity

CO(2) EOR pilot project (recognising that absent a settlement

between the parties, such amounts would be recoverable only from

incremental production from the Inniss-Trinity CO(2) EOR pilot

project area), and

(iv) the mutual final settlement agreed between the parties in

respect of all disputes and claims in relation to the

Inniss-Trinity CO(2) EOR pilot project.

Engagement Letter with Optiva Securities Limited ("Optiva")

An Engagement Letter with Optiva has been executed by the

Company regarding any potential M & A transaction with, or an

investment by parties directly into, Predator Oil & Gas

Trinidad Limited ("POGT"), a wholly owned subsidiary of the

company, to gain specific exposure to CO2 EOR activities. Any such

external investment specifically into POGT would allow this project

to progress simultaneously with Predator's other projects, while

not diluting the value of those other projects.

Back-in Right for 25% Equity of Predator's share of Cory

Moruga

In relation to the Back-in Right, it may be exercised at

Challenger Energy's election:

o at any time in the period commencing three years after the

completion date or first commercial production from Cory Moruga

field (whichever is earlier) and ending six years after the

completion date;

o If the Back-in Right is exercised, Challenger Energy will pay

to Predator a fixed cash amount of US$2.25 million:

(i) plus a variable percentage of the costs incurred by Predator

on the Cory Moruga field subsequent to the completion date;

(ii) the percentage dependent on the P50 Resource attributable

to the Cory Moruga field at that time being:

a) 50% of costs incurred if the P50 Resource is less than 5 million barrels of oil (MMbbls);

b) 75% of costs incurred if the P50 Resource is more than 5 MMbbls but less than 10 MMbbls; and

c) 100% of costs incurred if the P50 resource exceeds 10 MMbbls.

Framework for CO2 EOR collaboration

-- Predator and Challenger Energy have agreed to establish a

collaboration in relation to CO(2) EOR activities and projects in

other areas in Trinidad, including but not limited to potential

application of CO(2) EOR techniques across Challenger Energy's

other fields ;

-- Leveraging Predator's expertise in CO(2) EOR techniques and methodologies.

Completion

-- Predator has until 31 January 2023 to complete confirmatory

due diligence, prior to which time the parties will also work in

good faith to enter into long-form transaction documentation in

respect of the Transaction.

-- Thereafter, completion of the Transaction will be conditional

on consent to the Transaction being received from the Trinidadian

Ministry of Energy and Energy Industries ("MEEI"), including

agreement from MEEI to a revised work programme proposed by

Predator:

(i) work programme to include technical work, CO(2) EOR activity, and new well drilling in 2024;

(ii) a waiver by MEEI of past dues and claims in respect of Cory

Moruga field, and a revision by MEEI of the basis of future licence

fees applicable to the Cory Moruga licence.

The parties have agreed to work together to secure the required

consents and approvals and achieve completion of the Transaction as

soon as reasonably practicable on or before 30 May 2023, with a

long stop date of 31 August 2023 after which either party may elect

to terminate the agreement or they can mutually agree to an

extension.

Independent Competent Persons Report ("CPR")

The Company will commission a CPR on Cory Moruga in the coming

weeks which is expected to be published before Completion.

Background

The Cory Moruga field in Trinidad was first identified by

Predator as a prime candidate for CO2 EOR in 2017. An option to

acquire Cory Moruga was outlined in the Company's Prospectus

published in 2018 at the time of admission to the Main Market but

was later dropped when the Company elected to focus on the Guercif

Licence in Morocco.

The Inniss-Trinity pilot CO2 EOR Project allowed the Company to

develop valuable CO2 EOR operational expertise and for it to

establish exclusivity in respect of using the surplus liquid CO2

supply in Trinidad for CO2 EOR operations with Massy Gas Products

Limited ("Massy").

The Cory Moruga field is under-developed as a result of which

higher reservoir pressures have been maintained. This makes it

relatively unique in Trinidad as it creates the possibility to

execute a miscible CO2 EOR project to generate the potential to

significantly increase the oil recovery factor.

Cory Moruga is covered by 3D seismic which shows less fault

compartmentalisation relative to many other mature fields onshore

Trinidad. It has never been water-flooded. This assists the

development of a CO2 injection strategy to potentially maximise the

effectiveness of the CO2 sweep through the reservoirs.

A small part of the Moruga West field extends into Cory Moruga.

The ex-BP field continues to produce from the same Herrera

reservoirs as have been encountered in Cory Moruga drilling to

date. In 2017 the Company unsuccessfully bid for the Moruga West

field, which was then owned by Massy. The geological understanding

of the development and extent of the Herrera reservoirs in Moruga

West has been invaluable in the Company's assessment of the growth

potential of the Cory Moruga asset.

Paul Griffiths, Executive Chairman of Predator Oil & Gas

Holdings Plc commented :

"We are delighted to have negotiated an amicable settlement with

Challenger Energy - which gives a positive footing for both

companies to move forward - and gives Predator access to the

under-developed Cory Moruga field. Cory Moruga has always been

recognised by the Company as a candidate for miscible CO2 EOR.

Since 2017, when the Company first had an option to acquire it, WTI

spot oil price has increased by 46% to improve CO2 EOR project

economics.

It is important for our shareholders that the Company is seen to

be leveraging its expertise in CO(2) EOR techniques and

methodologies developed as a consequence of executing the

Inniss-Trinity CO2 EOR Project. This allows us to capture value for

the Inniss-Trinity CO2 EOR Project that would otherwise have been

unrealised. Cory Moruga creates another exciting growth opportunity

for 2023 which the Company can operate entirely itself and can

exercise direct control over the receipt of potential future

production revenues."

For further information visit www.predatoroilandgas.com

Follow the Company on twitter @PredatorOilGas.

This announcement contains inside information for the purposes

of Article 7 of the Regulation (EU) No 596/2014 on market abuse

For more information please visit the Company's website at

www.predatoroilandgas.com :

Enquiries:

Predator Oil & Gas Holdings Plc Tel: +44 (0) 1534 834 600

Paul Griffiths Executive Chairman Info@predatoroilandgas.com

Lonny Baumgardner Managing Director

Novum Securities Limited Tel: +44 (0) 207 399 9425

David Coffman / Jon Belliss

Optiva Securities Limited Tel: +44 (0) 203 137 1902

Christian Dennis, CEO

Ben Maitland, Corporate Finance Tel. +44 (0) 203 034 2707

Flagstaff Strategic and Investor Communications Tel: +44 (0) 207 129 1474

Tim Thompson predator@flagstaffcomms.com

Mark Edwards

Fergus Mellon

Notes to Editors:

About Cory Moruga field

-- The Cory Moruga licence is a direct licence from the

Trinidadian Ministry of Energy and Energy Industries ("MEEI") in

which Challenger Energy's wholly owned subsidiary T-Rex Resources

(Trinidad) Limited ("T-Rex"), holds an 83.8 % interest, alongside

its partner Touchstone Exploration Inc. which has 16.2% interest.

T-Rex is operator.

-- The Cory Moruga licence includes the Snowcap oil discovery,

with oil previously having been produced on test from the Snowcap-1

and Snowcap-2ST wells. On the basis of the production tests, a

development plan was submitted in 2018, prior to Challenger Energy

taking control of the asset, however, the block was not further

developed. Subsequent to the acquisition of Columbus Energy

Resources PLC in 2020, Challenger Energy undertook a detailed

technical review of its Trinidad portfolio and assessed that Cory

Moruga field required further appraisal before a commercial

development decision could be made.

-- Challenger Energy considers the Cory Moruga licence to be

non-core to its cash flow generative production-focused business in

Trinidad, and therefore no further work has been planned for the

Cory Moruga field in the near-term. At the same time, Predator

considers that the Cory Moruga field represents an ideal candidate

for a CO(2) EOR project.

Predator is operator of the Guercif Petroleum Agreement onshore

Morocco which is prospective for Tertiary gas in prospects less

than 10 kilometres from the Maghreb gas pipeline. The MOU-1 well

has been completed and a follow-up testing programme is being

finalised to coordinate with a further drilling programme beginning

in 2022.

Predator is seeking to further develop the remaining oil

reserves of Trinidad's mature onshore oil fields through the

application of CO2 EOR techniques and by sequestrating

anthropogenic carbon dioxide to produce "greener" oil.

In addition, Predator also owns and operates exploration and

appraisal assets in licensing options offshore Ireland, for which

successor authorisations have been applied for, adjoining

Vermilion's Corrib gas field in the Slyne Basin on the Atlantic

Margin and east of the decommissioned Kinsale gas field in the

Celtic Sea.

Predator has developed a Floating Storage and Regasification

Project ("FSRUP") for the import of LNG and its regassification for

Ireland and is also developing gas storage concepts to address

security of gas supply and volatility in gas prices during times of

peak gas demand.

The Company has a highly experienced management team with a

proven track record in operations in the oil and gas industry.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQMZMMZNLNGZZM

(END) Dow Jones Newswires

December 20, 2022 02:00 ET (07:00 GMT)

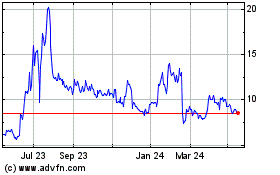

Predator Oil & Gas (LSE:PRD)

Historical Stock Chart

From Nov 2024 to Dec 2024

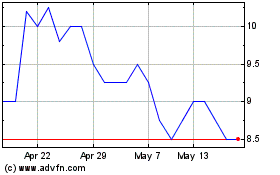

Predator Oil & Gas (LSE:PRD)

Historical Stock Chart

From Dec 2023 to Dec 2024