TIDMRBD

RNS Number : 5201P

Reabold Resources PLC

10 October 2019

10 October 2019

Reabold Resources Plc

("Reabold" or the "Company")

Posting of Circular and Notice of General Meeting

Further to the Company's announcements of 8 October 2019 and 9

October 2019, Reabold, the AIM investing company which focuses on

investments in pre-cash flow upstream oil and gas projects, is

pleased to announce that it is today posting a circular (the

"Circular") and accompanying Form of Proxy in relation to a General

Meeting of the Company.

The Circular contains notice of the General Meeting, which will

be held at the offices of Hill Dickinson LLP, The Broadgate Tower,

20 Primrose Street, London EC2A 2EW at 10.00 a.m. on 28 October

2019. A copy of the Circular and the Form of Proxy will shortly be

made available on the Company's website at www.reabold.com.

The Letter from the Chairman of the Company, the Expected

Timetable of Principal Events and the Placing Statistics contained

in the Circular have been extracted and included in this

announcement below.

For further information please contact:

Reabold Resources plc c/o Camarco

Stephen Williams +44 (0) 20 3757

Sachin Oza 4980

Strand Hanson Limited (Nominated and Financial

Adviser)

James Spinney

Rory Murphy

James Dance +44 (0)20 7409 3494

Stifel Nicolaus Europe Limited (Sole Bookrunner

to the Placing)

Callum Stewart

Nicholas Rhodes +44 (0) 20 7710

Ashton Clanfield 7600

Camarco

James Crothers

Ollie Head +44 (0) 20 3757

Billy Clegg 4980

Whitman Howard Limited (Joint Broker)

Nick Lovering +44 (0) 20 7659

Grant Barker 1234

Turner Pope Investments (TPI) Ltd (Joint

Broker) +44 (0) 20 3657

Andy Thacker 0050

Zoe Alexander

Extracts from the Circular

Letter from the Chairman of the Company

1. Introduction

I am writing to invite you to the general meeting of the Company

to be held at 10.00 a.m. on 28 October 2019 at the offices of Hill

Dickinson LLP, The Broadgate Tower, 20 Primrose Street, London EC2A

2EW (the "General Meeting") and to explain the resolutions to be

proposed at the General Meeting (the "Resolutions"), which are set

out in the Notice of General Meeting in Part II of the

Circular.

On 7 October 2019, the Company announced that it was in advanced

discussions with regard to the following proposed investments (the

"Investments"):

-- agreements to increase its interest in Rathlin Energy (UK)

Limited ("Rathlin") to up to 74.99 per cent., through a GBP16

million cash investment (the "Rathlin Cash Investment") and a

proposed equity swap for up to approximately GBP7 million to be

offered to existing Rathlin shareholders (the "Proposed Equity

Swap"); and

-- an agreement to increase its interest in Danube Petroleum

Limited ("Danube") to between 49 and 52 per cent. through the

exercise of an existing option to invest an additional GBP1.95

million in Danube (the "Danube Option").

On 8 October 2019, the Company announced that it had commenced,

via its sole bookrunner, Stifel, an accelerated bookbuild process,

whereby it was aiming to raise gross proceeds of, in aggregate,

GBP24 million, via a placing of 2,666,666,666 new ordinary shares

of 0.1 pence each in the capital of the Company ("Ordinary Shares)

(the "Placing Shares") with new and existing institutional

investors, at a price of 0.9 pence per share (the "Placing Price")

(the "Placing"). The net proceeds of the Placing would be utilised,

inter alia, to fund the Rathlin Cash Investment and the exercise of

the Danube Option.

On the same day, the Company also announced that it had entered

into a binding subscription agreement with Rathlin (the "Rathlin

Subscription Agreement"), conditional on completion of the Placing,

to make a cash investment of GBP16 million in Rathlin, at a

valuation of GBP2.75 per ordinary share in the capital of Rathlin

("Rathlin Shares").

In addition, the Company announced the Proposed Equity Swap,

whereby it has verbally agreed with certain existing Rathlin

shareholders ("Existing Rathlin Shareholders"), to complete a swap

of the their Rathlin Shares for new Ordinary Shares, at the Placing

Price, at the same value at which Reabold is subscribing for new

Rathlin Shares pursuant to the Rathlin Subscription Agreement, up

to a maximum of approximately GBP7 million. Further details on the

Proposed Equity Swap are set out in paragraph 4 of this Part I.

On 9 October 2019, the Company announced that it had

successfully completed the Placing, conditionally raising GBP24

million (gross) by way of the proposed issue of the Placing Shares

at the Placing Price, subject to shareholder approval. The Placing

Price represents a discount of approximately 12.2 per cent. to the

middle market closing price of the Ordinary Shares on AIM on 8

October 2019, being the latest practicable date prior to the

announcement of the Placing.

The Placing, the Proposed Equity Swap and therefore the

Investments are conditional upon, inter alia, the passing of the

Resolutions at the General Meeting, to be held on 28 October 2019,

for the purposes of authorising the board of directors of the

Company (the "Directors") to allot the Placing Shares and to

dis-apply statutory pre-emption rights in relation thereto.

Although the Company has pre-existing Shareholder authorities

approved at the annual general meeting of the Company held on 30

July 2019 (the "AGM"), these are not sufficient to implement the

Placing and the Proposed Equity Swap in full. Accordingly, the

Company is seeking new Shareholder approval to grant the Directors

authority to allot equity securities and to dis-apply statutory

pre-emption rights in respect of an allotment of equity securities

for cash in connection with the Placing. In addition, the Company

is seeking authority for the Directors to allot and issue up to

783,333,222 new Ordinary Shares pursuant to the Proposed Equity

Swap (the "Equity Swap Shares"). Such approvals will be in addition

to the Shareholder authorities granted at the AGM.

The purpose of the Circular is to set out the background to, and

the reasons for, the Placing, the Proposed Equity Swap and the

Investments. It explains why the Directors consider the Placing and

the proposed Investments to be in the best interests of the Company

and its Shareholders as a whole. It also highlights that the

Directors recommend that Shareholders vote in favour of the

Resolutions to be proposed at the General Meeting, as they intend

to do in respect of their own beneficial holdings of Ordinary

Shares.

Shareholders are reminded that the Placing and the Proposed

Equity Swap are conditional, inter alia, on the passing of the

Resolutions to be proposed at the General Meeting. Shareholders

should be aware that if the Resolutions are not approved at the

General Meeting, the Placing, and therefore the Investments, will

not proceed.

Your attention is drawn to the Notice of General Meeting

contained at the end of the Circular and sections 7 and 8 of this

letter which explain the purpose of the General Meeting and the

action to be taken by you in relation to the General Meeting.

2. Background to and reasons for the Placing and the Investments

Reabold is an investor in near-term, high growth upstream oil

& gas projects in which there has been substantial technical

de-risking and where an injection of capital can facilitate

near-term activity and unlock value. The Company offers investors

the opportunity to focus on the "Appraisal" portion of the value

chain of upstream oil & gas, which carry significantly lower

risk than early stage exploration and a greater potential for value

uplift than development and production assets.

Reabold has a proven management team that has built a diverse

portfolio of investments with significant embedded value. The

Company has deployed capital strategically to extract value and

since August 2018 has participated in the drilling of eight wells

with seven being discoveries, an 87.5 per cent. drilling success

rate.

The proceeds of the Placing will advance the Company's pathway

to cash flow generation and the Investments are expected to allow

the Company to realise its ambition to return capital to

shareholders, by way of dividends, in the short to medium term.

The Company runs a low-cost, non-operator business model and

currently has ownership positions in four investee companies:

Rathlin Energy (UK) Limited; Danube Petroleum Limited; Reabold

California LLC; and Corallian Energy Limited.

Rathlin Energy (UK) Limited

Rathin is the operator of, and holds a 66.7 per cent. working

interest in, PEDL 183 including the West Newton discovery, located

near Hull on the North East coast of England, with substantial

nearby oil and gas infrastructure. Licence partners on the asset

include Union Jack Oil & Gas PLC and Humber Oil & Gas

Limited, both holding a 16.665 per cent. working interest in the

asset. Reabold has invested GBP4 million in Rathlin to date.

Two wells have been drilled on the West Newton prospect to-date

(A-1 and A-2), with a major oil and gas discovery confirmed in the

Kirkham Abbey Formation that is potentially one the largest

hydrocarbon discoveries onshore UK since 1973. The original

Competent Persons Report ("CPR"), prepared by Deloitte LLP in 2017

for Connaught Oil & Gas Limited, a 33.3 per cent. owner of

Rathlin, certified the discovery as having 189 Billion cubic feet

equivalent (Bcfe) of gross best estimate gas resource (31 million

barrels of oil equivalent (MMboe)), with an associated NPV10 of

US$247 million.

On 29 August 2019, the Company announced that the analysis and

initial testing on the West Newton A-2 well led the operator and

project partners to believe that the West Newton project represents

a significant oil and gas discovery, rather than a gas discovery as

originally anticipated, with an approximate 45 metre gross oil

column underlying a gross gas column of approximately 20 metres.

Well logs and 28 metres of core cut from Kirkham Abbey also

indicate encouraging matrix porosity approaching 15 per cent. and

natural fracturing within the oil zone. The discovery of oil and

better than expected reservoir characteristics has the potential to

materially enhance economic value of the project. As such, the

Extended Well Test ("EWT") that was being undertaken on the A-2

well has been paused to allow the operator to re-assess the

hydrocarbon volumes and economics, in order to optimise evaluation

of the oil column. A revised EWT is planned for Q4 2019.

The West Newton A-2 well data ties to the high quality 3D

seismic that covers the entire West Newton project. The new data

allows for a revised interpretation of the seismic, incorporating

the well and the newly identified gas over oil gross hydrocarbon

column. A revised CPR will be commissioned following the EWT and

the Company will announce the results of this in due course. The

West Newton A-2 well also intersected an oil bearing section of the

deeper Cadeby formation, although as expected the reservoir quality

and porosity was poor. In line with seismic and geological model

conclusions, which indicate significantly better reservoir quality

at the West Newton B location, the next well will target the Cadeby

reef flank, as well as intersecting the Kirkham Abbey

reservoir.

Two further wells at the West Newton B site are permitted and

are planned to commence in Q1 2020, approximately 2.5 kilometres

from the A site. These wells are optimally located to define the

deeper formation Cadeby oil play.

The Rathlin Cash Investment and the Proposed Equity Swap would,

if completed, result in Reabold increasing its ownership of Rathlin

to up to 74.99 per cent., and increase its effective economic

interest in the West Newton discovery to up to 50 per cent. Should

the Resolutions be passed at the General Meeting, the Company will

increase its effective interest in West Newton through an

investment of GBP16 million in Rathlin and the Potential Equity

Swap with Existing Rathlin Shareholders, both at GBP2.75 per

Rathlin Share.

Danube Petroleum Limited

Danube is 50 per cent. owner of the Parta Exploration License

("Parta") and 100 per cent. working interest holder of the 19.4

square kilometre Sole Risk Area, including the Iecea Mare

Production licence, onshore Western Romania. The Parta licence is

located in a major gas producing basin in Romania, with near-by

infrastructure enabling rapid and cost effective monetisation, with

gas sold into developed markets interconnected with Western

Europe.

Reabold has invested GBP3.1 million to date for its current 41.6

per cent. equity interest in Danube, with ADX Energy Ltd ("ADX")

owning the residual equity in Danube. ADX is the operator of Parta.

The remaining 50 per cent. working interest in the Parta

Exploration Licence was farmed-out to Parta Energy Pty Ltd and

announced on 17 July 2019, in return for carrying Danube for the

first US$1.5 million of a planned 3D seismic acquisition programme

expected to commence in Q4 2019.

On 9 September 2019, ADX announced the successful results of the

first well in the Parta Appraisal Programme, the Iecea Mica-1

("IM-1") appraisal well, with a significant gas discovery made in

both the primary target and additional zones, with post-drill

volume estimates substantially exceeding the pre-drill estimates.

The well intersected key appraisal and exploration targets,

including the PA IV sands which are estimated to contain 11 Bcf of

gross contingent resource, new discovery zones PA III and PA V

which are estimated to contain 2.7 Bcf and 6.3 Bcf respectively.

The reservoirs were also found to have better than expected

porosity and permeability from the 14.5 metres of net pay. As a

result, the operator's assessment of volumetrics has increased

across the IM-1 intervals to 20 Bcf of contingent resource from the

pre-drill estimates 6.1 Bcf of contingent and 12.7 Bcf prospective

resource.

The IM-1 well is now being prepared for production testing with

a work over rig in Q4 2019, with the identification of high quality

reservoir in the primary target, the PA IV interval, giving

confidence around the potential for good production rates. Testing

of the deeper basement target is being deferred but prospectivity

of the play has been upgraded and can be tested with a future

well.

ADX estimates that the Parta licence as a whole contains gross

resource potential of 88 MMboe, with an associated gross NPV10 of

US$1,183 million.

On 16 September 2019, Reabold announced that, following the

encouraging results of the IM-1 well, it had entered into an

agreement to increase its interest in Danube via a subscription for

new ordinary shares in Danube. Reabold subscribed for an additional

810,811 Danube ordinary shares at an issue price of GBP1.00 per

share via two tranches, with the second tranche completed on 2

October 2019.

Should the Placing complete, Reabold intends to exercise its

existing option to invest a further GBP1.95 million at a fixed

price set at a 20 per cent. premium to the pre-discovery valuation.

Depending on whether ADX take-up a similar option, the additional

investment into Danube will increase Reabold's ownership of Danube

to between 49 and 52 per cent.

Reabold California LLC

Reabold California LLC ("Reabold California"), the 100 per cent.

subsidiary of Reabold, holds working interests or the right to earn

working interests in three licences in the Sacramento Basin,

California. The Company holds a 50 per cent. working interest in

the West Brentwood and Monroe Swell licences, and has the ability

to earn a 50 per cent. interest in the Grizzly Island licence

through the drilling of a single well. Sunset Exploration Inc. is

the other working interest holder of the various licences in

California, with Integrity Management Solutions having day-to-day

management and operatorship of the licence areas.

Four wells have been drilled across the licences to date, all of

which have resulted in discoveries and have been placed onto

production. Current gross production on the assets is 300 US

barrels of oil equivalent per day (boepd) (150 boepd net to Reabold

California). The assets are characterised by low capital

expenditures, and operating costs of US$13/US barrels of oil (bbl),

resulting in gross profits per barrel of US$40/bbl at current price

levels, sufficient to self-fund future planned development drilling

and operator G&A.

The assets have significant running room and offer a high return

on invested capital; an independent estimate by Petrotech Resources

Company Inc. values Reabold's interest in West Brentwood's proved

developed producing and proved undeveloped wells at approximately

US$19 million (NPV10), achieved with only US$2.9 million of

investment to date. These reserve estimates do not include two

producing wells at Monroe Swell (to be updated in a reserves report

currently being prepared), additional planned drilling at Monroe

Swell and West Brentwood, and there is no value being ascribed to

the Grizzly Island resource potential.

The Reabold California forward programme is focussed on growing

cash flows from the West Brentwood and Monroe Swell licences. A

facilities expansion programme is ongoing at Monroe Swell to

accommodate the higher than expected production from the Burnett 2A

and 2B wells, and a fifth oil well, VG-5, is planned to be drilled

at West Brentwood in Q4 2019. Additional low risk appraisal and

development drilling planned at West Brentwood and Monroe Swell, as

well as a high impact well on the Grizzly Island licence is planned

for 2020.

Corallian Energy Limited

Reabold holds a 34.9 per cent. interest in Corallian Energy

Limited ("Corallian"), which holds working interest positions in

five basins in the UK: Central Graben, Inner Moray Firth, Viking

Graben, West of Shetland and Wessex Basin.

Corallian has a 74 per cent. interest in a group of licenses in

the Wessex Basin, including the Colter South Discovery, offshore

Dorset in the United Kingdom. Licence partners in the Wessex Basin

licences include United Oil & Gas plc, Baron Oil plc and

Resolute Oil & Gas (UK) Limited (a subsidiary of Andalas Energy

and Power plc). In February 2019, the Colter well 98/11a-6, an

appraisal of the 98/11-3 well drilled in 1986 by British Gas, was

drilled. The well encountered oil and gas shows over a 9.4 metre

interval at the top of the Sherwood Sandstone reservoir. A

petrophysical evaluation of the logging while drilling ("LWD") data

calculated a net pay of three metres. Similar indications of oil

and gas were encountered in the 98/11-1 well within the Colter

South fault terrace. The larger-than-expected areal extent at

Colter South, which modelled a 15 million barrel PMean (being the

expected average value or risk-weighted average of all possible

outcomes) potential resource, means further work will be undertaken

to evaluate the resource size at Colter South. The data from these

well results and existing data will be incorporated to determine

the best forward plan. The licence benefits from adjacent Wytch

Farm infrastructure, significantly enhancing potential

economics.

Corallian holds a 90 per cent. interest and is exploration

operator in the P2396 licence offshore UK, including the Curlew-A

Tertiary oil discovery with Talon Petroleum holding the remaining

10 per cent. interest. A rig site survey is being carried out at

Curlew-A, with a well expected to be drilled in H1 2020 once the

well farmout process has been completed. Curlew-A has a best

estimate 2C contingent resource of 38.8 MMboe based on a CPR

completed by Schlumberger Oilfield UK.

Corallian holds a 45 per cent. interest and is exploration

operator of the Inner Moray Firth licences, with primary reservoir

intervals being sandstones of the Beatrice Formation and Dunrobin

Bay Group. Licence partners include Upland Resources and Baron

Oil.

Corallian holds a 100 per cent. working interest in both the

P2493 licence, West of Shetlands, and P2464, in the Viking Graben,

which were awarded in the 31st licencing round. The P2493 licence

contains the Unst gas prospect, an Eocene Frigg sandstone prospect

which exhibits a seismic amplitude anomaly similar to that observed

at the nearby Nuggets Fields. The prospect is estimated to contain

an upside (P10) outcome of approximately 80 billion cubic feet

(Bcf) recoverable resource and a well is planned for 2020. The

P2493 licence also contains the Quoys prospect, a Jurassic

structural / stratigraphic trap up dip of the 3/19b-2 oil discovery

which flowed in excess of 5,000 US barrels of oil per day (bopd) on

drill stem test. The prospect is estimated to contain PMean gross

prospective resources of 57.4 million US barrels of oil (MMbbl).

The P2493 licence contains the Sandvoe prospect, defined by a

seismic amplitude anomaly at an estimated depth of 2,215 total

vertical depth subsea and prognosed to be sandstones of late Eocene

age. The prospect covers an area of 600 square kilometres and has a

PMean prospective resource estimated at 12.6 trillion cubic feet

(Tcf).

On 31 July 2019, Reabold announced that Corallian had completed

an equity fundraise of GBP1,225,000, valuing the company at GBP15.5

million, or GBP5.4 million net to Reabold.

3. Details of the Placing

The Company has conditionally raised GBP24 million gross by way

of the Placing.

Depending on the level of uptake in the Proposed Equity Swap, on

Admission, the Placing Shares will represent between approximately

35.49 and 39.62 per cent of the Company's enlarged issued share

capital.

Placing Agreement

Pursuant to a placing agreement between the Company and Stifel

dated 8 October 2019 relating to the Placing (the "Placing

Agreement"), the Company appointed Stifel as the Company's agent to

use its reasonable endeavours to procure subscribers for the

Placing Shares at the Placing Price. The Company has agreed to pay

Stifel certain commissions and fees in connection with the Placing.

The Placing is not underwritten.

The Placing is conditional, inter alia, on:

-- the passing of the Resolutions to be proposed at the General Meeting; and

-- admission of the Placing Shares ("Admission") occurring on or

before 8.00 a.m. on 29 October 2019 (or such later time and/or date

as the Company and Stifel may agree, being not later than 15

November 2019);

-- the Rathlin Subscription Agreement not having lapsed or been terminated; and

-- the Equity Swap Agreement being entered into on or prior to completion of the Placing.

The Placing Agreement contains certain customary warranties

given by the Company and is terminable by Stifel in certain

circumstances prior to Admission, including the warranties being

materially untrue, inaccurate or misleading, for force majeure or

in the event of a material adverse change to the business of the

Company or the Group. The Company has also agreed to indemnify

Stifel against all losses, costs, charges and expenses which they

may suffer or incur as a result of, occasioned by or attributable

to the carrying out of their duties under the Placing Agreement in

respect of the Placing Shares.

4. Details of the Proposed Equity Swap

The Company has verbally agreed with certain Existing Rathlin

Shareholders, to complete a swap of their Rathlin Shares for new

Ordinary Shares, at the Placing Price, at the same value at which

Reabold is subscribing for new Rathlin Shares pursuant to the

Rathlin Subscription Agreement, up to a maximum of approximately

GBP7 million.

Discussions and terms are at an advanced stage and the Company

is targeting finalising the Proposed Equity Swap ahead of the

General Meeting by entering into an equity swap agreement (the

"Equity Swap Agreement") with the participating Existing Rathlin

Shareholders.

The Company requires that, as a condition to completing the

Proposed Equity Swap and under the terms of the Equity Swap

Agreement, the Equity Swap Shares be subject to a three month

lock-up period and a further three month orderly market agreement.

The maximum number of new Equity Swap Shares to be issued to

Existing Rathlin Shareholders will be 783,333,222, and following

the relevant parties entering into the Equity Swap Agreement,

application being made to the London Stock Exchange for the Equity

Swap Shares to be admitted to trading on AIM concurrently with the

admission of the Placing Shares, which is expected to be on 29

October 2019.

Assuming full take-up of the Proposed Equity Swap, the Equity

Swap Shares will represent approximately 10.43 per cent. of the

Company's enlarged share capital following the admission of the

Placing Shares.

The Company will make a further announcement regarding the final

terms of the Proposed Equity Swap and the level of take-up by the

Existing Rathlin Shareholders in due course.

5. Use of proceeds

The Company intends to use the proceeds of the Placing as

below:

Rathlin - PEDL 183 - West Newton

West Newton B-1 GBP4-5 million

West Newton B-2 GBP6-7 million

Other Capex GBP2-3 million

Seismic GBP1-2 million

G&A / contingency GBP3 million

----------------------------------- ------------------

Total West Newton GBP16-20 million

Danube - Parta

Exercise Option / Fund IM-2 Well GBP2 million

Seismic Carried

----------------------------------- ------------------

Total Parta GBP2 million

Costs / Working Capital GBP2 million

Total Use of Proceeds GBP20-24 million

6. Admission, settlement and CREST

Application will be made to the London Stock Exchange for

Admission. It is expected that, subject to the passing of the

Resolutions at the General Meeting, Admission will become effective

at 8.00 a.m. on 29 October 2019 (or such later date as the Company

and Stifel may agree, being not later than 15 November 2019) and

that dealings in the Placing Shares will also commence at that

time.

The Company's articles of association permit the Company to

issue shares in uncertificated form. CREST is a computerised

paperless share transfer and settlement system which allows shares

and other securities to be held in electronic rather than paper

form. The Company's existing Ordinary Shares are already admitted

to CREST and therefore the Placing Shares will also be eligible for

settlement in CREST. CREST is a voluntary system and subscribers of

the Placing Shares and Subscription Shares who wish to retain

certificates will be able to do so upon request. The Placing Shares

due to uncertificated holders are expected to be delivered in CREST

on the date of Admission.

The Company will make a further announcement regarding

acceptances of the Proposed Equity Swap and, subject to the passing

of the Resolutions, application will be made to the London Stock

Exchange for the admission of the Equity Swap Shares in due

course.

7. General Meeting

The Directors require the authority of Shareholders in order to

allot the Placing Shares for cash free of statutory pre-emption

rights.

You will therefore find at the end of the Circular the formal

Notice of General Meeting to consider and, if thought appropriate,

pass the following resolutions:

-- Resolution 1 will be proposed as an ordinary resolution and

seeks to approve the Directors to allot the Placing Shares;

-- Resolution 2 will be proposed as an ordinary resolution and

seeks to approve the Directors to allot up to 783,333,222 Equity

Swap Shares; and

-- Resolution 3 will be proposed as a special resolution and

seeks to empower the Directors to disapply statutory pre-emption

rights to allot the Placing Shares pursuant to the authority

conferred by Resolution 1.

None of the Placing, the Proposed Equity Swap or the Investments

will be implemented unless all of the Resolutions are passed and

become unconditional in accordance with their terms.

8. Action to be taken in respect of the General Meeting

Shareholders will find a Form of Proxy enclosed for use at the

General Meeting. The Form of Proxy should be completed and signed

in accordance with the instructions thereon and returned to Neville

Registrars Limited at Neville House, Steelpark Road, Halesowen B62

8HD by not later than 10.00 a.m. on 24 October 2019. The completion

and return of a Form of Proxy will not preclude Shareholders from

attending the General Meeting and voting in person should they so

wish.

9. Recommendation

The Directors recommend that Shareholders vote in favour of the

Resolutions proposed at the General Meeting, as they intend to do

so in respect of their own holdings of Ordinary Shares which

amount, in aggregate, to 191,808,676 Ordinary Shares representing

4.72 per cent of the issued Ordinary Shares.

Yours faithfully,

Jeremy Edelman

Non-Executive Chairman

Reabold Resources plc

Expected Timetable of Principal Events

Time and date

Announcement of the proposed Placing 4.45 p.m. 8 October

2019

Announcement of the results of the Placing 7.00 a.m. 9 October

2019

Publication of Circular and Form of Proxy 10 October 2019

Latest time and date for receipt of Forms 10.00 a.m. on 24 October

of Proxy 2019

General Meeting 10.00 a.m. on 28 October

2019

Admission of the Placing Shares and the 8.00 a.m. on 29 October

Equity Swap Shares to trading on AIM and 2019

commencement of dealings

CREST accounts to be credited for the 29 October 2019

Placing Shares to be held in uncertificated

form

Despatch of definitive share certificates by 12 November 2019

for the Placing Shares and the Equity

Swap Shares

Notes

1. All references to time in the Circular are to London (United

Kingdom) time unless otherwise stated.

2. The dates and times given in the Circular are based on the

Company's current expectations and may be subject to change. If any

of the above times or dates should change at the discretion of the

Company, the revised times and/or dates will be notified to

Shareholders by an announcement on a Regulatory Information

Service.

Placing Statistics

Number of existing Ordinary Shares

in issue 4,063,963,810

Placing Price 0.9 pence

Number of Placing Shares 2,666,666,666

Maximum number of Equity Swap

Shares 783,333,222

Maximum enlarged share capital 7,513,963,698

Placing Shares as a percentage 35.49 per cent.

of the maximum enlarged share

capital

Equity Swap Shares as a percentage 10.43 per cent.

of the maximum enlarged share

capital

Gross proceeds of the Placing GBP24.0 million

Estimated net proceeds of the GBP22.5 million

Placing

ENDS

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBXBDGLDBBGCG

(END) Dow Jones Newswires

October 10, 2019 09:45 ET (13:45 GMT)

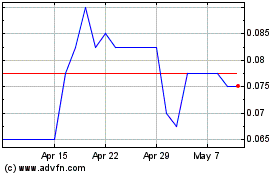

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Apr 2023 to Apr 2024