SEGRO PLC: SEGRO and Schroders Complete UK Industrial Asset Swap

04 October 2021 - 5:00PM

UK Regulatory

TIDMSGRO

SEGRO plc ("SEGRO") and Schroders have completed a property swap

transaction in which SEGRO has acquired from Schroders a 256,000 sq

ft urban warehouse estate in West London for GBP140 million and

Schroders has acquired from SEGRO a portfolio of UK big box and

urban assets totalling 880,000 sq ft for GBP205 million. The

balance of GBP65 million has been paid by Schroders to SEGRO.

SEGRO has acquired Matrix Park, a fully let urban warehouse

estate in Park Royal, West London, close to existing SEGRO assets

and the A40. The estate also includes a 1.4 acre development site.

Based on current passing rent and lease reviews and renewals under

discussion the estate generates a passing rent of GBP4.1 million

and has an average WAULT of 5 years.

The portfolio acquired by Schroders consists of two stand-alone,

fully let big box assets in Hams Hall, Birmingham and Brackmills,

Northampton as well as four urban assets including multi-level

warehouse X2 close to Heathrow Airport, Oakwood in Park Royal,

Advent Way in North London and a cross-dock warehouse in Radlett.

Based on current passing rent and lease reviews and renewals under

discussion the portfolio generates a passing rent of GBP7.5 million

and has an average WAULT of 6 years.

David Proctor, Managing Director of Group Investment at SEGRO,

commented:

"This off-market transaction has allowed us to acquire a

significant multi-let industrial estate in one of our core markets,

offering strong rental growth potential as well as a medium to long

term redevelopment opportunity. At the same time we have been able

to divest a number of relatively small holdings, all of which were

ear-marked for disposal in the near to medium term."

SEGRO was advised by Montagu Evans and Gerald Eve acted on

behalf of Schroders.

ABOUT SEGRO

SEGRO is a UK Real Estate Investment Trust (REIT), listed on the

London Stock Exchange and Euronext Paris, and is a leading owner,

manager and developer of modern warehouses and industrial property.

It owns or manages 8.8 million square metres of space (95 million

square feet) valued at GBP17.1 billion serving customers from a

wide range of industry sectors. Its properties are located in and

around major cities and at key transportation hubs in the UK and in

seven other European countries.

For over 100 years SEGRO has been creating the space that

enables extraordinary things to happen. From modern big box

warehouses, used primarily for regional, national and international

distribution hubs, to urban warehousing located close to major

population centres and business districts, it provides high-quality

assets that allow its customers to thrive.

A commitment to be a force for societal and environmental good

is integral to SEGRO's purpose and strategy. Its Responsible SEGRO

framework focuses on three long-term priorities where the company

believes it can make the greatest impact: Championing Low-Carbon

Growth, Investing in Local Communities and Environments and

Nurturing Talent.

See www.SEGRO.com for further information.

CONTACT DETAILS FOR INVESTOR / ANALYST AND MEDIA ENQUIRIES:

SEGRO

Soumen Das (Chief Financial Officer)

Tel: +44 (0) 20 7451 9110

Claire Mogford (Head of Investor Relations)

Tel: +44 (0) 20 7451 9048

Gary Gaskarth (External Communications Manager)

Tel: +44 (0) 20 7451 9069

FTI Consulting

Richard Sunderland / Claire Turvey / Eve Kirmatzis

Tel: +44 (0) 20 3727 1000

View source version on businesswire.com:

https://www.businesswire.com/news/home/20211003005070/en/

CONTACT:

SEGRO plc

SOURCE: Segro plc

Copyright Business Wire 2021

(END) Dow Jones Newswires

October 04, 2021 02:00 ET (06:00 GMT)

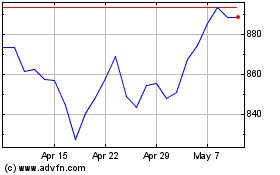

Segro (LSE:SGRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Segro (LSE:SGRO)

Historical Stock Chart

From Apr 2023 to Apr 2024