TIDMSHOE

RNS Number : 2827Q

Shoe Zone PLC

17 October 2023

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU) No. 596/2014. It forms part of United Kingdom

domestic law by virtue of the European Union (Withdrawal) Act 2018.

Upon the publication of this announcement, this inside information

is now considered to be in the public domain.

Shoe Zone plc

("Shoe Zone" or the "Company")

Full Year Trading Update

Strong sales and highest recorded profits

Shoe Zone is pleased to announce its unaudited full year trading

update for the 52 weeks to 30 September 2023 ("FY 2023").

Financial Highlights:

-- Group revenue increased by 6.1% to GBP165.7m (FY 2022: GBP156.2m)

-- Store revenue of GBP134.8m (FY 2022: GBP129.8m), digital

revenue of GBP30.9m (FY 2022: GBP26.4m)

-- Store numbers: 323 (FY 2022: 360)

-- Product margin of c.62.1% (FY 2022: 61.2%)

-- Net cash of GBP16.4m (FY 2022: GBP24.4m)

-- Adjusted profit before tax expected to be not less than GBP16.0m 1 (FY 2022: GBP11.2m)

-- Share buy-back programme continued with 3.8m shares bought back at a cost of GBP8.1m

1 Adjusted to exclude the profit on sale of one freehold

property and foreign exchange revaluations

Financial Summary

Revenue

In the 52 weeks to 30 September 2023 revenue was GBP165.7m (FY

2022: GBP156.2m). The 6.1% increase is due to strong second half

trading particularly in peak summer and our key back to school

period, and this is trading out of 37 fewer stores than last

year.

Digital revenue was GBP30.9m (FY 2022: GBP26.4m) an increase of

17.0%. This represents 18.7% of Group revenue (FY 2022: 16.9%) and

this continuing growth is validation of the ongoing investment in

our digital platform.

Product margin

Product margin increased to c.62.1% (FY 2022: 61.3%). This is

due to lower container prices part way through the year, and

improved stock management due to less market volatility.

Profit before tax

Adjusted profit before tax is expected to be not less than

GBP16.0m (FY 2022: GBP11.2m). This is adjusted for GBP0.3m profit

on sale of one freehold property and a foreign exchange revaluation

loss of GBP0.6m. Shoe Zone has traded positively during the period,

particularly in the second half of the year which included our key

Back to School period.

Net cash

The Company ended the year with net cash of c.GBP16.4m (FY 2022:

GBP24.4m). The reduction in net cash balance was due to dividends

paid of GBP8.2m, further share buy-backs in the year of GBP6.4m and

an increased level of capital expenditure to gross GBP11.3m (net

GBP9.6m), offset by the cash generated from profitable

operations.

Dividend

A 2.5 pence per share interim payment amounting to GBP1.2m was

made in August.

A final dividend, the amount of which is yet to be determined,

will be proposed in January 2024 alongside our final results.

Share Buy-back programme

The Company continued its programme of share buy-backs, and as

at the year-end had purchased in total 3.8m shares at a cost of

GBP8.1m and at an average price of GBP2.14. We have cancelled 3.75m

shares.

Store numbers

We ended the year trading out of 323 (FY 2022: 360) retail

stores. We closed 72 stores, opened 35 and refitted 15. The total

is made up of 188 original Shoe Zone stores, 42 Big Box and 93

Hybrid stores. We continue our strategy to expand the number of

Hybrid and Big Box formats through relocations and refits of

existing Shoe Zone stores.

Chief Executive Update, Anthony Smith

"I am pleased to announce that Shoe Zone has had a strong year,

continuing the momentum gained from the positive year we had in

2022. We continue our strategy to expand our Hybrid and Big Box

formats via refits (15) and relocations and new stores (35). Shoe

Zone continues to show how resilient it is, with a proven track

record of delivering robust results during times of economic

uncertainty.

We look forward to updating shareholders in more detail at the

time of our final results in January 2024.

I would like to thank all of our teams for their continued

commitment and hard work that have produced these great

results."

For further information please call:

Shoe Zone PLC Tel: +44 (0) 116 222 3001

Anthony Smith (Chief Executive)

Terry Boot (Finance Director)

Zeus (Nominated Adviser and Broker) Tel: +44 (0) 203 829

5000

David Foreman, James Hornigold, Ed Beddows (Investment

Banking)

Dominic King (Corporate Broking)

About Shoe Zone

Shoe Zone is a Town Centre, Retail Park and Digital footwear

retailer, offering low price, high quality footwear for the whole

family.

Shoe Zone operates from a portfolio of 323 stores and has

approximately 2,400 employees across the UK.

The store portfolio consists of 188 high street stores

containing the core Shoe Zone product range and 93 hybrid high

street stores and 42 larger Retail Park stores which also have

additional brands such as Skechers, Hush Puppies and Kickers.

shoezone.com, combined with the store network, ensures a full

multi-channel offering for great customer service.

During an average year Shoe Zone sells 14.1 million pairs of

shoes per annum at an average retail price of cGBP13.50.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGZMMGVVFGFZM

(END) Dow Jones Newswires

October 17, 2023 02:00 ET (06:00 GMT)

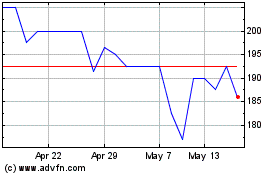

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Nov 2024 to Dec 2024

Shoe Zone (LSE:SHOE)

Historical Stock Chart

From Dec 2023 to Dec 2024