Senterra Energy PLC Possible Acquisition and Suspension of Trading (9356Y)

23 May 2016 - 4:45PM

UK Regulatory

TIDMSEN

RNS Number : 9356Y

Senterra Energy PLC

23 May 2016

For immediate release 23 May 2016

Senterra Energy plc

("Senterra", "Senterra Energy" or the "Company")

Possible Acquisition

and

Suspension of Trading

The Directors of Senterra Energy are pleased to inform

shareholders that it has signed a non-binding letter of intent

("LOI") to acquire the entire issued share capital of Oasis Smart

Sim PTE Ltd, a sim-card technology business based in Singapore

("Business") for new shares in the Company (the "Acquisition"). The

Acquisition, if completed, would result in Senterra shareholders

having around 15 per cent. of the enlarged group (the "Group")

prior to the impact of any associated fund raising.

Oasis was founded in 2010 and is a limited private company

incorporated and domiciled in Singapore where it is also

headquartered. The company's principal activities are in the

design, manufacture and distribution of telecommunication software

and other telecommunication activities. In the financial year to 31

December 2015, Oasis had an unaudited turnover of approximately

US$13 million.

Oasis's current production portfolio includes a full range of

2G, 3G and 4G compatible SIM cards, available in different sizes,

capacities, formats and using different system technologies. In

addition Oasis is also developing software and solutions to enable

entry into the market where SIM functionality will be embedded into

connected devices.

As announced in February, the Company has been approached by a

number of parties with opportunities outside that of the energy

sector who have expressed interest in working with Senterra to

facilitate a public listing. The Board believes that there are some

potentially attractive businesses and technologies amongst these

proposals and following initial due diligence the Company is

pleased to have secured this opportunity.

The Acquisition is subject, inter alia, to the completion of due

diligence, documentation and compliance with all regulatory

requirements, including the Listing and Prospectus Rules and, as

required, the Takeover Code.

As a precursor to the Acquisition, the Company has also agreed

under the LOI to provide the Business with a short-term loan of up

to GBP500,000 for working capital purposes ("Loan"). The Loan will

pay a coupon of LIBOR plus 5 per cent., and is fully repayable at

the end of six months from drawdown in the event that the

Acquisition does not proceed. It is also envisaged that the Group

will seek to raise additional funds to finance the development of

the Group going forward.

The Company intends to convene a General Meeting ("GM") as soon

as practicable in order to seek the shareholder approvals necessary

to pursue this opportunity, including widening its investment

strategy to include opportunities outside of the oil and gas sector

and to authorise the Directors to make the Loan. It should also be

noted that if the Acquisition proceeds, further shareholder consent

may also be required including to deal with any applicable

requirements of the Takeover Code.

Suspension and Application for Listing

The Acquisition, if it proceeds, will constitute a Reverse

Takeover under the Listing Rules since, inter alia, in substance it

will result in a fundamental change in the business of the

issuer.

As the Acquisition will constitute a Reverse Takeover under the

Listing Rules, trading in the Company's ordinary shares have been

suspended with effect from this morning pending the publication of

a prospectus and the application for the enlarged Company to have

its Ordinary Shares admitted to the Official List and to trading on

the main market for listed securities of the London Stock

Exchange.

The Company is working on the preparation of a prospectus in

relation to the Acquisition and will, in due course, be making

application for the enlarged Company to have its Ordinary Shares

admitted to the Official List and to trading on the main market for

listed securities of the London Stock Exchange.

The Company will update shareholders as the matter

progresses.

For more information:

Senterra Energy plc (Company)

===================================== =================

+44 (0) 20 3137

Jeremy King 1904

===================================== =================

Optiva Securities Limited (Joint

Broker)

===================================== =================

+44 (0) 20 3137

Christian Dennis 1902

===================================== =================

Dowgate Capital Stockbrokers

Limited (Joint Broker)

===================================== =================

+44 (0) 1293 517

Jason Robertson and Neil Badger 744

===================================== =================

Beaumont Cornish Limited (Financial

Adviser)

===================================== =================

Roland Cornish and Felicity +44 (0) 20 7628

Geidt 3396

===================================== =================

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCDBLFLQEFLBBF

(END) Dow Jones Newswires

May 23, 2016 02:45 ET (06:45 GMT)

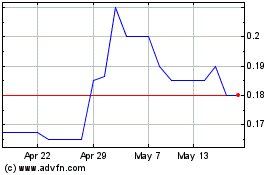

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Apr 2024 to May 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From May 2023 to May 2024