VPC Specialty Lending Invest. PLC Net Asset Value(s)

19 February 2025 - 8:59PM

RNS Regulatory News

RNS Number : 7015X

VPC Specialty Lending Invest. PLC

19 February 2025

19 February 2025

VPC

Specialty Lending Investments PLC

(the "Company")

QUARTERLY

NET ASSET VALUE PER SHARE

Net

Asset Value

The latest update on the net asset

value per share ("NAV") have been released by the

Company.

As at 31 December 2024, the

unaudited estimated NAV (Cum Income) per Ordinary Share (ISIN

GB00BVG6X439) was 52.76 pence.

This NAV has been calculated by

CITCO Fund Administration (Cayman Islands) Limited.

Performance

The Company also announces the

cumulative NAV total return performance as at 31 December 2024 as

follows:

|

|

QTD

Return

|

YTD

Return

|

ITD

Return

|

|

Ordinary Shares

|

-9.89%

|

-20.72%

|

30.34%

|

Quarterly Investment Highlights and

Factsheet

Below are the returns for the

three-month period to 31 December 2024:

|

|

QTD Return

(% NAV)

|

QTD Return

(pence per Ordinary

Share)

|

|

Gross Revenue Return

|

2.63%

|

1.58p

|

|

Gross Capital Return

|

-11.00%

|

-6.60p

|

|

Expenses and Fees

|

-0.86%

|

-0.52p

|

|

F/X and Other Capital

Returns

|

-0.66%

|

-0.40p

|

|

Total NAV Return

|

-9.89%

|

-5.94p

|

More details on the returns are

contained within the Company's quarterly report which will shortly

be available on the Company's website: https://vpcspecialtylending.com/.

Enquiries

For further information, please

contact:

|

VPC

Specialty Lending Investments PLC

Graeme Proudfoot

|

via Winterflood (below)

|

|

Victory Park Capital

Gordon Watson

Sora Monachino

|

via Winterflood (below)

info@vpcspecialtylending.com

|

|

|

|

|

Winterflood Securities Limited

|

Tel: +44 20 3100 0000

|

|

Joe Winkley

|

|

|

Neil Morgan

|

|

|

|

|

|

Link Company Matters Limited

(Company Secretary)

|

Tel: +44 20 7954 9567

Email:

VPC@linkgroup.co.uk

|

|

|

|

About VPC Specialty Lending Investments PLC

VPC Specialty Lending Investments

PLC (Company No. 9385218) is a UK listed investment trust focused

on asset-backed lending to emerging and established businesses with

the goal of building long-term, sustainable income generation. The

Company identifies investment opportunities across various

industries and geographies to offer shareholders access to a

diversified portfolio of opportunistic credit investments

originated by non-bank lenders with a focus on the rapidly

developing technology-enabled lending sector.

This document is for information

purposes only and is not an offer to invest. All investments are

subject to risk. Prospective investors are advised to seek expert

legal, financial, tax and other professional advice before making

any investment decision. The value of investments may fluctuate.

Results achieved in the past are no guarantee of future

results.

LEI: 549300UPEXC5DQB81P34

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

NAVUKVKRVNUUARR

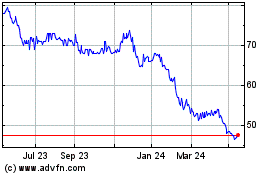

Vpc Specialty Lending In... (LSE:VSL)

Historical Stock Chart

From Feb 2025 to Mar 2025

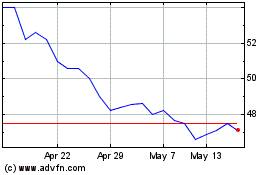

Vpc Specialty Lending In... (LSE:VSL)

Historical Stock Chart

From Mar 2024 to Mar 2025