TIDMWISE

RNS Number : 7627Z

Wise PLC

16 January 2024

Wise plc

Q3 FY24 Trading Update

16 January 2024

Customer momentum continues to power growth; FY24 income

guidance upgraded

Customers love the Wise Account features, and this is driving

active customer growth

-- Active customers grew 30% YoY to 7.5 million, driven by

increased adoption of the Wise Account and multi-feature usage.

-- Active personal customers increased 30% YoY to 7.1 million,

and active business customers increased 23% YoY to 392k.

-- 46% of Personal customers and 60% of Business customers now

use multiple features (e.g., using their Wise card as well as

sending money across borders).

-- And this is important, because we know that customers that

use multiple features transact more often and have higher retention

levels.

This growth in multi-feature customers is driving the

fundamentals of our financial performance, leading to a 40%

increase in Income to GBP375.1m

-- Cross-border volume was GBP30.6bn, an increase of 16% YoY

(18% on a constant currency basis).

-- Volume growth remains strong among customers sending

<GBP10k per month, continuing to grow significantly faster than

customers sending >GBP10k per month; as a result personal VPC

for Q3 was 1% lower QoQ.

-- Revenue increased 23% to GBP276.6m, supported by a 7bps

increase in the 'other take rate' as a result of increased card

spend.

-- Wise Account balances increased 28% YoY to GBP12.9bn; gross

yield on balances was 4.2% in Q3 FY24 (vs 3.8% in Q2 FY24), of

which 1.1% (vs. 1.0% in Q2 FY23) of balances, or GBP33.7m, was

returned to customers.

FY24 Income growth guidance upgraded to c.42-44% from previous

guidance of 33-38%

-- Reflects the continued strong growth in active multi-feature

customers, and higher levels of interest income.

-- We continue to expect our adj. EBITDA margin in FY24 to

remain elevated relative to our medium-term guidance of at or above

20% given the high net yield on customer balances.

"I am pleased to report another quarter of progress as we work

towards our mission of building the best way to move and manage the

world's money. We've sped up global USD payments by optimising

payouts with one of our banking partners and expanded our Wise

Interest Asset offering in seven European markets including France

and Spain. Customers in these markets holding USD with Wise can now

opt in to earn a return on these balances too. We also progressed

with more platform partners, adding UK business bank; Allica Bank,

leading digital travel platform; Agoda, and global spend management

solution Payhawk among others. This progress speaks to the strength

of our fundamentals, leading to continued strong financial

performance. We saw our customer base grow by 30% supporting a 23%

growth in revenue, and a 40% increase in Income.

These results are also testament to the depth of expertise of

both leadership and the teams at Wise. I want to thank Harsh for

leading the business while I took a sabbatical from September to

December to spend time with my growing family. I'm excited to be

back and to continue progressing on our mission."

-Kristo Käärmann, Co-founder and Chief Executive Officer

Q3 FY24 Q3 FY23 YoY Movement

Volume (GBP billion) 30.6 26.4 16%

------- ------- ------------

Revenue (GBP million) 276.6 225.2 23%

------- ------- ------------

Income (GBP million) 375.1 268.7 40%

------- ------- ------------

Average customer price 0.67% 0.66% +1 bps

------- ------- ------------

Instant transfers 61% 52% +9 pps

------- ------- ------------

You can read more about our progress in our quarterly Mission

Updates on wise.com.

Please see the appendix for further historical financial

information.

Enquiries

Martyn Adlam - Head of Investor Relations

martyn.adlam@wise.com

Crystal Obuck - Senior Manager, Investor Relations

crystal.obuck@wise.com

Sana Rahman - Global Head of Communications

press@wise.com

Brunswick Group

Charles Pretzlik / Sarah West / Nick Beswick / Daniel

Holgersson

Wise@brunswickgroup.com

+44 (0) 20 7404 5959

About Wise

Wise is a global technology company, building the best way to

move and manage the world's money. With Wise Account and Wise

Business, people and businesses can hold over 40 currencies, move

money between countries and spend money abroad. Large companies and

banks use Wise technology too; an entirely new network for the

world's money.

Co-founded by Kristo Käärmann and Taavet Hinrikus, Wise launched

in 2011 under its original name TransferWise. It is one of the

world's fastest growing tech companies and is listed on the London

Stock Exchange under the ticker WISE.

In fiscal year 2023, Wise supported around 10 million people and

businesses, processing approximately GBP105 billion in cross-border

transactions, and saving customers over GBP1.5 billion.

FORWARD LOOKING DISCLOSURE DISCLAIMER

This report may include forward-looking statements, which are

based on current expectations and projections about future events.

These statements may include, without limitation, any statements

preceded by, followed by or including words such as "forward

looking", "guidance", "target", "believe", "expect", "intend",

"may", "anticipate", "estimate", "forecast," , "project", "will",

"can have", "likely", "should", "would", "could" and any other

words and terms of similar meaning or the negative thereof. These

forward-looking statements are subject to risks, uncertainties and

assumptions about Wise and its subsidiaries. In light of these

risks, uncertainties and assumptions, the events in the

forward-looking statements may not occur.

Past performance cannot be relied upon as a guide to future

performance and should not be taken as a representation that trends

or activities underlying past performance will continue in the

future, and the statements in this report speak only as at the date

of this report. No representation or warranty is made or will be

made that any forward-looking statement will come to pass and there

can be no assurance that actual results will not differ materially

from those expressed in the forward-looking statements.

Wise expressly disclaims any obligation or undertaking to

update, review or revise any forward-looking statements contained

in this report and disclaims any obligation to update its view of

any risks or uncertainties described herein or to publicly announce

the results of any revisions to the forward-looking statements made

in this report, whether as a result of new information, future

developments or otherwise, except as required by law.

Appendix - Historical Financials

Quarterly Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 QoQ Q YoY QoQ Q YoY

FY2022 FY2022 FY2023 FY2023 FY2023 FY2023 FY2024 FY2024 FY2024 Movement Movement Movement Movement

Constant Constant

CCY CCY

Customers

(thousand) 4,348 4,588 4,997 5,484 5,793 6,125 6,670 7,232 7,512 4% 30% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal

(thousand) 4,095 4,319 4,711 5,182 5,475 5,784 6,307 6,847 7,120 4% 30% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business

(thousand) 253 269 286 302 319 340 363 385 392 2% 23% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Volume per

customer

(GBP thousand) 4.7 4.7 4.9 4.9 4.6 4.4 4.2 4.0 4.1 1% (11%) - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal (GBP

thousand) 3.7 3.7 3.8 3.9 3.5 3.4 3.3 3.2 3.1 (1%) (10%) - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business (GBP

thousand) 21.6 20.8 22.2 22.9 23.2 21.4 20.4 19.8 21.1 7% (9%) - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Volume (GBP

billion)(1) 20.6 21.4 24.4 27.0 26.4 26.7 28.2 29.2 30.6 5% 16% 4% 18%

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal (GBP

billion) 15.1 15.9 18.0 20.1 19.0 19.5 20.8 21.6 22.3 3% 17% 3% 20%

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business (GBP

billion) 5.5 5.6 6.3 6.9 7.4 7.3 7.4 7.6 8.3 9% 12% 8% 15%

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Customer balances

(GBP billion) 5.8 6.8 7.7 9.2 10.1 10.7 11.5 12.3 12.9 5% 28% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

1. Cross-border volume only.

Note: Differences between 'total' rows and the sum of the

constituent components of personal and business are due to

rounding.

Appendix - Historical Financials (continued)

Quarterly Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 QoQ Q YoY QoQ Q YoY

FY2022 FY2022 FY2023 FY2023 FY2023 FY2023 FY2024 FY2024 FY2024 Movement Movement Movement Movement

Constant Constant

CCY CCY

Revenue (GBP

million) 149.8 153.8 185.9 211.5 225.2 223.5 239.5 258.7 276.6 7% 23% 6% 26%

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal (GBP

million) 114.7 118.4 144.4 164.8 173.7 173.4 186.4 200.8 213.1 6% 23% 5% 25%

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business (GBP

million) 35.1 35.4 41.5 46.7 51.5 50.1 53.1 57.9 63.5 10% 23% 9% 26%

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Interest income

on customer

balances

(GBP million) 1.0 1.4 3.9 18.4 46.4 71.5 95.7 115.4 132.2 14% 185% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal (GBP

million) 0.5 0.7 2.0 9.6 24.9 38.7 53.1 65.6 76.0 16% 205% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business (GBP

million) 0.5 0.7 1.9 8.8 21.5 32.8 42.6 49.8 56.2 13% 161% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Interest income

net of customer

benefits (GBP

million)(1) (0.8) (0.8) 1.2 17.5 43.5 56.0 71.4 86.4 98.5 14% 126% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal (GBP

million) (0.4) (0.4) 0.6 9.1 23.2 29.7 39.0 48.7 56.9 17% 145% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business (GBP

million) (0.4) (0.4) 0.6 8.4 20.3 26.3 32.4 37.7 41.6 10% 105% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Income (GBP

million)(2) 149.0 153.0 187.1 229.0 268.7 279.5 310.9 345.1 375.1 9% 40% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Personal (GBP

million) 114.3 118.0 145.0 173.9 196.9 203.1 225.4 249.5 270.0 8% 37% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Business (GBP

million) 34.7 35.0 42.1 55.1 71.8 76.4 85.5 95.6 105.1 10% 46% - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Revenue Take rate

(%)(3) 0.73% 0.72% 0.76% 0.78% 0.85% 0.84% 0.85% 0.89% 0.90% +1 bps +5 bps - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Cross-Currency

(%) 0.62% 0.61% 0.61% 0.63% 0.69% 0.67% 0.67% 0.67% 0.67% +0 bps -2 bps - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

Other (%) 0.11% 0.11% 0.15% 0.15% 0.16% 0.17% 0.18% 0.22% 0.23% +1 bps +7 bps - -

------ ------ ------ ------ ------ ------ ------ ------ ------ -------- -------- -------- --------

1. Comprises interest income on customer balances, interest

expense on customer balances and benefits paid relating to customer

balances.

2. Comprises revenue and interest income net of customer benefits.

3. Revenue as a % of Volume.

Note: Differences between 'total' rows and the sum of the

constituent components of personal and business are due to

rounding

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUWAGUPCGRA

(END) Dow Jones Newswires

January 16, 2024 02:00 ET (07:00 GMT)

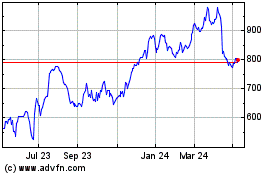

Wise (LSE:WISE)

Historical Stock Chart

From Apr 2024 to May 2024

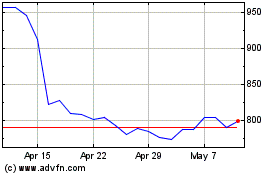

Wise (LSE:WISE)

Historical Stock Chart

From May 2023 to May 2024