TIDMZEG

RNS Number : 8599Q

Zegona Communications PLC

24 June 2020

NOT FOR DISTRIBUTION, PUBLICATION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO OR FROM THE UNITED STATES

OR CANADA, AUSTRALIA, JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY

MEMBER STATE OF THE EUROPEAN ECONOMIC AREA (OTHER THAN SPAIN) OR

ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION, PUBLICATION OR

RELEASE WOULD BE UNLAWFUL.

ZEGONA COMMUNICATIONS PLC ("Zegona")

LEI: 213800ASI1VZL2ED4S65

24 JUNE 2020

ZEGONA ANNOUNCES NEW SHARE BUYBACK PROGRAMME

As previously highlighted, the value per Zegona share of its

stake in Euskaltel and net cash position is significantly higher

than Zegona's share price. On 23 June 2020, the differential

between Zegona's share price and the Underlying Asset Value per

Share(1) was 24.5%. The Board remains committed to take actions to

close this differential.

Zegona today announces a Buyback(2) programme of its Ordinary

Shares(3) for an aggregate purchase price of up to GBP10 million.

Zegona's Board has set a Buyback Policy(4) that allows shares to be

acquired at prices up to the Underlying Asset Value Per Share. The

Buyback is expected to increase the Underlying Asset Value Per

Share for shareholders who retain their holdings in Zegona.

The Buyback will commence with effect from today and share

repurchases may be undertaken until the earlier of 15 September

2020 or when Zegona has fully utilised the allocated GBP10

million(5) . The Buyback will be funded from existing capital

resources.

The Board will continue to review the progress made in closing

the differential between Zegona's share price and the Underlying

Asset Value Per Share.

This announcement contains inside information.

ENQUIRIES

Tavistock (Public Relations adviser)

Tel: +44 (0)20 7920 3150

Lulu Bridges - lulu.bridges@tavistock.co.uk

Jos Simson - jos.simson@tavistock.co.uk

IMPORTANT NOTICES

The sole purpose of the Buyback is to reduce the share capital

of Zegona.

Pursuant to, and during the term of the Buyback, Barclays(6)

may, when instructed by Zegona in accordance with the Buyback

Policy and certain other pre-agreed parameters, independently of

and without influence by Zegona, purchase Ordinary Shares on the

London Stock Exchange from time to time in its absolute discretion.

At other times, Zegona may instruct Barclays on a daily basis to

purchase Ordinary Shares in accordance with the Buyback Policy and

other parameters determined by Zegona within the scope of the

Buyback(7) . During closed periods, in accordance with certain

irrevocable instructions given to Barclays in advance of the closed

period, share purchases carried out by Barclays shall be made

independently of and without influence from Zegona. On each trading

day under the Buyback, a maximum of 25% of the average daily

trading volume of the Ordinary Shares during the 20 trading days

prior to such trading day may be purchased.

Due to the scale of the Buyback versus the level of trading in

Ordinary Shares, share repurchases on any trading day may represent

all or a significant proportion (over 25%) of the daily trading

volume in Ordinary Shares on the London Stock Exchange.

Accordingly, Zegona may not benefit from the exemption contained in

Article 5(1) of Regulation (EU) No 596/2014.

Subject to the Buyback Policy, the maximum price (exclusive of

fees and expenses) which may be paid for Ordinary Shares within the

Buyback shall be an amount equal to the lower of (i) 5% above the

average of the middle market closing quotations for such shares

taken from The London Stock Exchange Daily Official List for the

five business days immediately preceding the day on which the

purchase is made and (ii) the higher of the price of the last

independent trade of an Ordinary Share and the highest current

independent bid for an Ordinary Share as derived from the London

Stock Exchange. As at 7 a.m. on 24 June 2020, this would imply a

maximum price payable of 108 pence per Ordinary Share.

Any Ordinary Shares acquired as a result of the Buyback will be

cancelled. Zegona will announce any market repurchases of Ordinary

Shares by 7.30 a.m. on the business day following the day on which

the repurchase occurred. There can be no certainty that Barclays

will purchase any Ordinary Shares under the Buyback.

The information contained in this document is for background

purposes only and does not purport to be full or complete.

This announcement is not for release, publication, distribution,

directly or indirectly, in or into the United States (including its

territories and possessions and any state or other jurisdiction of

the United States) or to any US person. This announcement does not

constitute or form a part of any offer to sell or solicitation to

purchase or subscribe for securities in the United States or in any

other jurisdictions. The Ordinary Shares referred to in this

announcement have not been, and will not be, registered under the

United States Securities Act of 1933, as amended (the "US

Securities Act") or the securities laws of any state of the United

States or with any securities regulatory authority of any state or

other jurisdiction of the United States or any state securities

laws of the United States.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"envisages", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

variations or comparable terminology. These forward-looking

statements include matters that are not facts. By their nature,

forward-looking statements involve risk and uncertainty because

they relate to future events and circumstances. A number of factors

could cause actual results and developments to differ materially

from those expressed or implied by the forward-looking statements,

including, without limitation: adverse developments in the market

conditions on the London Stock Exchange, adverse conditions

affecting material shareholders in Zegona, volatility in stock

market trading on the London Stock Exchange, Euskaltel's failure to

work with Zegona to improve the performance of the business,

expected cost savings not being realised, changing demands of

consumers of telecommunications services, the increasing adoption

of free-to-home and direct-to-home television services, changing

business or other telecommunications market conditions, and general

economic conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this announcement. Forward-looking statements contained in this

announcement based on past trends or activities should not be taken

as a representation that such trends or activities will continue in

the future. Subject to any requirement under the Listing Rules, the

Prospectus Rules, the Disclosure Guidance and Transparency Rules or

other applicable legislation or regulation, Zegona does not

undertake any obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. Investors should not place undue reliance on

forward-looking statements, which speak only as of the date of this

announcement.

Barclays, which is authorised in the United Kingdom by the

Prudential Regulation Authority and regulated by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting only for Zegona in connection with the Buyback and is not

acting for or advising any other person, or treating any other

person as its client, in relation thereto and will not be

responsible for providing the regulatory protection afforded to

clients of Barclays or advice to any other person in relation to

the matters contained herein. Neither Barclays nor any of its

directors, officers, employees, advisers or agents accepts any

responsibility or liability whatsoever for this announcement, its

contents or otherwise in connection with it or any other

information relating to Zegona, whether written, oral or in a

visual or electronic format.

This announcement has been prepared in accordance with English

law, the Listing Rules and the Disclosure Guidance and Transparency

Rules and information disclosed may not be the same as that which

would have been prepared in accordance with the laws of

jurisdictions outside England.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about and observe such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

About Zegona

Zegona was established in 2015 with the objective of investing

in businesses in the European Telecommunications, Media and

Technology sector and improving their performance to deliver

attractive shareholder returns. Zegona is listed on the standard

listing segment of the Official List of the Financial Conduct

Authority and the Main Market for listed securities of the London

Stock Exchange and is led by former Virgin Media executives, Eamonn

O'Hare and Robert Samuelson.

The person responsible for arranging for the release of this

announcement on behalf of Zegona is Dean Checkley, whose business

address is 20 Buckingham Street, London WC2N 6EF.

As at 23 June 2020, reflecting all TR-1 and other notifications

received to date, Zegona was aware of the following shareholders

holding more than 3 percent of the total voting rights of

Zegona:

Percentage of Issued Share Capital

Marwyn Asset Management 19.16%

Artemis Investment Management 13.69%

Fidelity Management & Research

(FMR) 9.97%

Canaccord Genuity Group Inc 9.69%

Fidelity Investments Limited

(FIL) 9.21%

Capital Research & Management

Company 8.28%

Aberforth Partners LLP 6.2%

Chelverton Asset Management 5.13%

About Euskaltel

Euskaltel S.A. ("Euskaltel") is the leading converged

telecommunications provider in the North of Spain, owning a network

covering nearly 2.5 million households and has recently expanded

nationally across Spain under the Virgin Telco brand. It provides

high speed broadband, data rich mobile, advanced TV and fixed

communications services to residential and business customers under

the Euskaltel, Virgin Telco, R Cable and Telecable brands.

Euskaltel is a public company traded on the stock markets of

Bilbao, Madrid, Barcelona and Valencia.

1 The "Underlying Asset Value per Share" is defined for any day

as the value in pounds sterling on the previous trading day of

Zegona's investment in Euskaltel (using the EUR/GBP FX rate on that

day) and net cash balance divided by the number of Zegona Ordinary

Shares in issue. As at 23 June 2020, the Underlying Asset Value per

Share was GBP1.32, which was 24.5% higher than Zegona's share price

at 23 June 2020

2 The "Buyback" is Zegona's on-market share buyback programme

announced today for an aggregate purchase

price of up to GBP10 million

3 Ordinary shares of GBP0.01 each in the capital of Zegona ("Ordinary Shares")

4 Zegona's "Buyback Policy" is that shares may be acquired at

prices up to the Underlying Asset Value per Share on the day of

purchase, subject also to normal market practice as regards buyback

pricing, as set out in Important Notices

5 The maximum number of Ordinary Shares which Zegona is

currently authorised to repurchase is 21,949,273 and therefore the

Buyback will not exceed this number of shares

6 Barclays Bank PLC, acting through its Investment Bank ("Barclays")

7 Purchases under the programme are to be made either (i) as

purchases made through auctions carried out on SETSqx; or (ii)

over-the-counter purchases, for which the resultant Company

purchases from Barclays are on-market for the purposes of the rules

of the London Stock Exchange

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

POSEAAKDAELEEAA

(END) Dow Jones Newswires

June 24, 2020 02:00 ET (06:00 GMT)

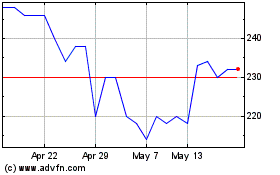

Zegona Communications (LSE:ZEG)

Historical Stock Chart

From Jan 2025 to Feb 2025

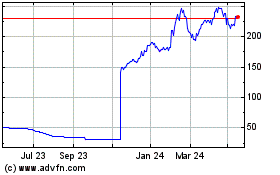

Zegona Communications (LSE:ZEG)

Historical Stock Chart

From Feb 2024 to Feb 2025