By Tim Higgins

Tesla Inc. marks the beginning of a new era this week: the loss

of a U.S. tax credit that effectively lowered the price of its

vehicles and helped build interest in fledgling electric cars.

The end of the U.S. tax credit on Jan. 1 for the company's

customers comes as Tesla's future growth increasingly looks tied to

China, where it began this week delivering the first of its locally

made Model 3 compact cars.

China, the world's largest new-car market, is becoming important

in Chief Executive Elon Musk's strategy for remaking the Silicon

Valley auto maker into a global player with ambitions of selling

millions of electric vehicles a year. China is already one of

Tesla's biggest markets, and the car maker has said it could become

the largest for the Model 3.

"This is a changing of the guard, as the U.S. tax credit rolls

off and the major growth story for Tesla is moving from the U.S. to

China," said Dan Ives, analyst for Wedbush Securities.

Tesla didn't respond to requests for comment.

The U.S. remains critical to Tesla's near-term ambitions to

produce 500,000 vehicles within a year. The $7,500 U.S. tax credit

for buyers of its electric vehicles had been an important part of

its sales pitch to U.S. buyers.

"Your lips were always loaded with that," said Seneca Giese, a

former Tesla general manager who now runs a used electric-vehicle

sales business called Current Automotive. "It was certainly a

factor in Tesla's success, but I don't think it's going to affect

demand going forward," because the company has lowered the starting

price of its smaller Model 3 vehicle to about $35,000 from

$46,000.

The government introduced the tax break, passed in 2008, to help

offset the battery costs of electric vehicles and keep their prices

in line with comparable gas-powered cars. The credit, also

available to other car makers, is gradually withdrawn as a

manufacturer sells more electric vehicles. A last-ditch push by the

auto industry to extend a tax credit failed in December in

Congress.

For Tesla, the tax credit began to phase out a year ago, first

dropping to $3,750 before falling to $1,875 on July 1. It goes to

zero Jan. 1 because Tesla's total U.S. sales reached 200,000

vehicles during the third quarter of 2018, sunsetting the benefit.

General Motors Co. is the only other auto maker to reach the

milestone. Other manufacturers that haven't hit the limit can still

lure buyers with the government incentive.

The expiring tax credit spurred buyers such as 48-year-old

Carlos Santos of suburban Atlanta, who considered himself a

longtime BMW fan until he test-drove a Model 3 early this year.

"That tax credit, for us, was very important," Mr. Santos, who

works in the movie business, said.

Tesla lowered its prices as the tax credit faded, and the move

contributed to a rebound in the auto maker's deliveries after a

weak first quarter. The slow start rattled investors and put in

doubt whether Tesla could reach Mr. Musk's commitment to deliver

between 360,000 and 400,000 vehicles in 2019, an increase of at

least 47% from 2018.

With the rebound in deliveries, the auto maker needs at least

104,800 deliveries in the fourth quarter to reach the goal.

Analysts, on average, expect the company to announce 106,000

deliveries, according to FactSet. Tesla could release its

fourth-quarter delivery numbers this week.

The auto maker is expected to continue to face production

pressure in 2020. The company needs to churn out as many cars as it

can from its new China factory so customers there can take

advantage of a government subsidy granted only to locally built

electric vehicles. The incentive expires in 2020.

Tesla in December secured an agreement from a syndicate of

Chinese lenders to raise as much as $1.61 billion in borrowing for

the new facility, which broke ground in January and began trial

production in October -- an unusually quick turnaround. The first

15 China-made Model 3s were delivered to Tesla employees

Monday.

Tesla said it is able to produce more than 1,000 vehicles a week

at the facility. It aims to get to a rate of 3,000 a week in the

near future.

California-made Model 3s sold in China with a longer range have

a starting price of 439,900 ($62,861), while the locally assembled

version begins at 355,800 yuan ($50,844). The Chinese factory

allows Tesla to avoid tariffs and qualify for a 25,000-yuan subsidy

given to electric vehicles. The government has announced the

locally made Model 3 also will be exempt from a 10% consumption

tax.

The new factory also is destined to make Tesla's next vehicle,

the Model Y, a compact sport-utility vehicle that is slated to

begin production in the U.S. in 2020. The local introduction is

expected to fuel further Chinese growth.

Tesla's overall international growth has helped distract

attention from its slowing U.S. business, its largest market.

Third-quarter U.S. revenue declined 40% compared with a year

earlier. The auto maker doesn't break out vehicle deliveries in the

U.S. beyond disclosing revenue.

Sales in China and the Netherlands are expected to drive

deliveries in the October through December period, said Jeffrey

Osborne, analyst for Cowen & Co. Without those markets, he

estimated, overall deliveries would be down 7% from a year

earlier.

--Ben Foldy contributed to this article.

Write to Tim Higgins at Tim.Higgins@WSJ.com

(END) Dow Jones Newswires

December 31, 2019 11:55 ET (16:55 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

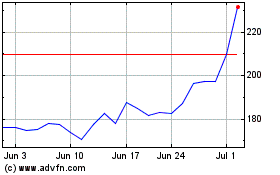

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Tesla (NASDAQ:TSLA)

Historical Stock Chart

From Apr 2023 to Apr 2024