Adams Resources & Energy, Inc. (NYSE AMERICAN: AE) (“Adams” or

the “Company”) announced today that it has entered into a

definitive agreement to be acquired by an affiliate of Tres Energy

LLC (“Buyer”) in an all-cash transaction that values the Company at

a total enterprise value (including bank debt and financial leases)

of approximately $138.9 million.

Under the terms of the agreement, Adams

stockholders will receive $38.00 per share in cash for each share

of Adams common stock owned as of the closing of the transaction.

The per share purchase price represents a 39% premium to the

Company’s closing share price of $27.32 on November 11, 2024, the

last full trading date prior to the announcement of the

transaction, and a 53% premium to the Company’s three-month

volume-weighted average per share price for the period ended

November 11, 2024. Upon completion of the transaction, the

Company’s shares will no longer trade on the NYSE American, and

Adams will become a private company.

“This transaction marks the successful

completion of a profitable journey for our shareholders and

fulfills our strategic goal to restructure the Company, unlocking

more value from our assets and operations. By returning to our

roots as a private company in partnership with Buyer, we will gain

efficiencies and create new entrepreneurial opportunities for both

the Company and our employees,” said Townes G. Pressler, Chairman

of the Adams Board of Directors.

Kevin Roycraft, Chief Executive Officer of

Adams, said, “We are thrilled to be a part of Buyer’s team. This

new chapter will empower us to innovate more freely and focus on

our long-term vision without the pressures of being a public

company. We believe this partnership will enhance our ability to

deliver exceptional value to our customers and employees, and we

look forward to embarking on this exciting journey together.”

Approvals and Timing

The Adams Board of Directors has unanimously

approved the transaction and recommends that stockholders vote in

favor of the transaction. The transaction is expected to close in

the first quarter of 2025, subject to customary closing conditions,

including approval by Adams stockholders.

Advisors

GulfStar Group, Ltd. is serving as financial

advisor to Adams, Houlihan Lokey Capital, Inc. is serving as

financial advisor to the Adams Board of Directors, and Locke Lord

LLP is serving as legal counsel to Adams.

King & Spalding LLP is serving as legal

counsel to Tres Energy LLC and its affiliates.

Additional Information About the

Proposed Transaction and Where to Find It

This communication does not constitute an offer

to buy or sell or the solicitation of an offer to buy or sell any

securities or a solicitation of any vote or approval. This

communication relates to a proposed transaction between Adams and

an affiliate of Buyer. In connection with this proposed

transaction, Adams intends to file one or more proxy statements on

Schedule 14A or other documents with the Securities and Exchange

Commission (the “SEC”). This communication is not a substitute for

any proxy statement or other document Adams may file with the SEC

in connection with the proposed transaction. INVESTORS AND SECURITY

HOLDERS OF ADAMS ARE URGED TO READ THE PROXY STATEMENT AND OTHER

DOCUMENTS THAT MAY BE FILED WITH THE SEC CAREFULLY AND IN THEIR

ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. Any definitive proxy statement(s)

(if and when available) will be mailed to stockholders of Adams as

applicable.

Investors and security holders will be able to

obtain free copies of these documents (if and when available) and

other documents filed with the SEC by Adams through the website

maintained by the SEC at http://www.sec.gov. Copies of the

documents filed with the SEC by Adams will be available free of

charge on Adams internet website at

www.adamsresources.com/sec-filings or by contacting Adams’ Chief

Financial Officer by email at tohmart@adamsresources.com or by

phone at 713-881-3609.

Participants in the Solicitation of

Proxies

The directors and officers of the Company may be

deemed to be participants in the solicitation of proxies in respect

of the proposed transaction. Information regarding the Company's

directors and officers and their respective interests in the

Company by security holdings or otherwise is available in (i) the

Company's Annual Report on Form 10-K for the year ended December

31, 2023, including under the headings “Item 10. Directors,

Executive Officers and Corporate Governance”, “Item 11. Executive

Compensation”, “Item 12. Security Ownership of Certain Beneficial

Owners and Management and Related Stockholder Matters” and “Item

13. Certain Relationships and Related Transactions, and Director

Independence”, which was filed with the SEC on March 13, 2024, (ii)

the Company's definitive Proxy Statement on Schedule 14A for its

2024 annual meeting of stockholders, including under the headings

“Item 1 -- Election of Directors”, “Executive Officers”, “Summary

Compensation Table”, “Compensation Overview”, “2023 Director

Compensation”, “Transactions with Related Persons” and “Security

Ownership of Certain Beneficial Owners and Management”, which was

filed with the SEC on April 1, 2024 and (iii) subsequent statements

of changes in beneficial ownership on file with the SEC. Additional

information regarding the interests of such potential participants

is or will be included in the Proxy Statement and other relevant

materials to be filed with the SEC, when they become available,

including in connection with the solicitation of proxies to approve

the proposed transaction. These documents may be obtained free of

charge from the SEC’s website at www.sec.gov and the Company’s

website at www.adamsresources.com/sec-filings.

Forward-Looking Statements and

Information

This communication contains “forward-looking

statements” within the Private Securities Litigation Reform Act of

1995. Any statements contained in this communication that are not

statements of historical fact, including statements about Adams’

ability to consummate the proposed transaction and the expected

benefits of the proposed transaction, may be deemed to be

forward-looking statements. All such forward-looking statements are

intended to provide management’s current expectations for the

future of the Company based on current expectations and assumptions

relating to the Company’s business, the economy and other future

conditions. Forward-looking statements generally can be identified

through the use of words such as “believes,” “anticipates,” “may,”

“should,” “will,” “plans,” “projects,” “expects,” “expectations,”

“estimates,” “forecasts,” “predicts,” “targets,” “prospects,”

“strategy,” “signs,” and other words of similar meaning in

connection with the discussion of future performance, plans,

actions or events. Because forward-looking statements relate to the

future, they are subject to inherent risks, uncertainties and

changes in circumstances that are difficult to predict. Such risks

and uncertainties include, among others: (i) the failure to obtain

the required vote of Adams’ stockholders, (ii) the timing to

consummate the proposed transaction, (iii) the risk that a

condition of closing of the proposed transaction may not be

satisfied or that the closing of the proposed transaction might

otherwise not occur, (iv) risks related to disruption of management

time from ongoing business operations due to the proposed

transaction, (v) the risk that any announcements relating to the

proposed transaction could have adverse effects on the market price

of the common stock of Adams, (vi) the risk that the proposed

transaction and its announcement could have an adverse effect on

the ability of Adams to retain customers and retain and hire key

personnel and maintain relationships with its suppliers and

customers, (vii) the occurrence of any event, change or other

circumstance or condition that could give rise to the termination

of the merger agreement, including in circumstances requiring the

Company to pay a termination fee, (viii) unexpected costs, charges

or expenses resulting from the merger, (ix) potential litigation

relating to the merger that could be instituted against the parties

to the merger agreement or their respective directors, managers or

officers, including the effects of any outcomes related thereto,

(x) worldwide economic or political changes that affect the markets

that the Company’s businesses serve which could have an effect on

demand for the Company’s products and services and impact the

Company’s profitability, and (xi) disruptions in the global credit

and financial markets, including diminished liquidity and credit

availability, cyber-security vulnerabilities, crude oil pricing and

supply issues, retention of key employees, increases in fuel

prices, and outcomes of legal proceedings, claims and

investigations. Accordingly, actual results may differ materially

from those contemplated by these forward-looking statements.

Investors, therefore, are cautioned against relying on any of these

forward-looking statements. They are neither statements of

historical fact nor guarantees or assurances of future performance.

Additional information regarding the factors that may cause actual

results to differ materially from these forward-looking statements

is available in Adams’ filings with the SEC, including the risks

and uncertainties identified in Part I, Item 1A - Risk Factors of

Adams’ Annual Report on Form 10-K for the year ended December 31,

2023 and in the Company’s other filings with the SEC.

There can be no assurance that the proposed

transaction will in fact be consummated. We caution investors not

to unduly rely on any forward-looking statements. The

forward-looking statements speak only as of the date of this

communication. The Company undertakes no obligation or duty to

update or revise any of these forward-looking statements after the

date of this communication, whether in response to new information,

future events, or otherwise, except as required by applicable

law.

About Adams Resources & Energy,

Inc.

Adams Resources & Energy, Inc. is engaged in

crude oil marketing, transportation, terminalling and storage, tank

truck transportation of liquid chemicals and dry bulk and recycling

and repurposing of off-spec fuels, lubricants, crude oil and other

chemicals through its subsidiaries, GulfMark Energy, Inc., Service

Transport Company, Victoria Express Pipeline, L.L.C., GulfMark

Terminals, LLC, Phoenix Oil, Inc., and Firebird Bulk Carriers, Inc.

For more information, visit www.adamsresources.com.

About Tres Energy LLC

Tres Energy LLC is a privately held limited

liability company that invests in and operates strategic energy

assets across the United States. For more information, visit

www.tres-energy.com.

Company Contact

Tracy E. Ohmart EVP, Chief Financial Officer

tohmart@adamsresources.com (713) 881-3609

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Nov 2024 to Dec 2024

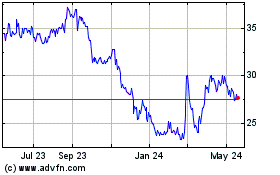

Adams Resources and Energy (AMEX:AE)

Historical Stock Chart

From Dec 2023 to Dec 2024