As we make further progress into the final quarter of 2012, it

is worthwhile to point out that the year has been an eventful one

in terms of domestic and global economic developments. The markets

were flooded with a variety of events from across the globe that

have led us to this uncertain time in the markets (see 4

Low-Volatility ETFs to Hedge Your Portfolio).

Among some of the major events this year, arguably one of the

most important has been the ongoing European sovereign debt crisis.

This situation saw at least some progress thanks to an open ended

bond buying program by the ECB, although it remains to be seen if

this will be the cure to the malaise.

Meanwhile, on the domestic front, the much talked about

quantitative easing 3 (QE3) was implemented by the Federal Reserve

to improve the broad economic market (see Long Term Treasury ETFs:

Ultimate QE3 Play?). While this could help to spur the ongoing

housing recovery, broad growth is still elusive, suggesting that

the market outlook is still cloudy.

Similar Trends Across Risky Asset Classes

Amidst all this, a closer look at the performance of the riskier

asset classes interestingly suggests that they have been following

quarterly trends throughout the current fiscal year.

The equity markets started 2012 on a strong note as equities

across the board surged after a brief broad market slump in the

later half of last year. In fact, other riskier asset classes such

as commodities and emerging market equities also benefited from

this widespread optimism. As a result, most of the riskier asset

classes ended the first quarter in the green.

However, the tides quickly turned in the subsequent quarter

mainly thanks to lack of any concrete steps to tame the Eurozone

debt crisis and a generic slowdown in most parts of the world.

If that wasn’t enough, the U.S economy grew just by a mere 1.5%

in the second quarter. This has led to a sharp increase in

volatility in the riskier asset classes across the board and caused

investors to shift to a ‘flight to safety’ mode.

This also resulted in the U.S Treasuries (especially the long

dated ones) witnessing a significant rally as they act as the

ultimate safe haven investment avenues for investors in these

distressed times. However, the stock markets recovered

substantially in the third quarter as investors restored back

confidence in the risky asset classes.

Also, with the implementation of QE3 in the latter half of third

quarter, the markets were flooded with liquidity. The equity

markets responded well and as expected, commodity prices surged.

Thus, most of the ETFs tracking riskier asset classes witnessed

substantial inflows in their asset base and were up as the third

quarter ended (read Q3 ETF Asset Report: Investors Back in the

Market?).

Thus we see that this quarterly

“Up-Down-Up” trend within the riskier

asset classes has been nothing less than a see saw ride for the

investors.

ETFs Following Similar Trends

This phenomenon is exemplified from the ETF space as well. In

this regard we have highlighted three ETFs belonging to the typical

‘risky’ asset class, which track the broad markets within their

asset classes.

These are 1) SPDR S&P 500 ETF (SPY), which

tracks the performance of the U.S equities, 2) PowerShares

DB Commodity Index Tracking ETF (DBC), a futures backed

fund which tracks the basket performance of 14 actively traded

commodities and 3) iShares MSCI Emerging Markets ETF

(EEM), which tracks the performance of broader emerging

market equities.

Table 1: Returns Analysis and Moving

Average

|

ETF

|

Asset Class

|

1Q

|

2Q

|

3Q

|

4Q (Quarter till Date)

|

Current Market Price

|

200 Day Moving Average

|

|

SPY

|

Domestic Equity

|

12.69%

|

-2.84%

|

6.35%

|

-1.82%

|

$141.35

|

136.77

|

|

DBC

|

Commodity

|

7.30%

|

-10.59%

|

11.38%

|

-3.84%

|

$27.58

|

27.74

|

|

EEM

|

Emerging Market Equities

|

13.20%

|

-7.80%

|

5.62%

|

-0.29%

|

$41.21

|

40.62

|

4Q (QTD) Returns, ii) Current Market Price, and iii)

200 DMA as of 26th October 2012.

It is quite evident from the table above (Table 1) that all

these ETFs have exhibited similar characteristics in terms of their

quarterly movements, at least for the first three quarters. This is

interesting, especially considering the fact that most of these

ETFs do not have a very strong correlation among themselves (see

more in the Zacks ETF Center).

Of course, the equity based ETFs (i.e. SPY and EEM) have a

strong correlation of 91% among themselves, and the similarity in

their quarterly movements is justified by their strong

correlation.

However, SPY and EEM have weak correlation of 56% and 61%

respectively with their commodity counterpart DBC. Despite this,

its movement has exhibited similar trends with the equity ETFs.

Table 2: Correlation Matrix (using daily returns for

20 months)

|

ETF

|

SPY

|

EEM

|

DBC

|

|

SPY

|

100%

|

90.85%

|

56.55%

|

|

EEM

|

|

100%

|

61.79%

|

|

DBC

|

|

|

100%

|

What Lies Ahead?

The most important question at this point of time remains that

will the similarity in quarterly trends continue to remain across

these risky asset classes going into the fourth quarter? Or, will

they follow the trend and plunge again in Q4 after an uptrend in

Q3, just like the previous occasion?

Here are certain facts that hint towards the possible coming

path. In just about a month into Q4, all the three ‘risky’ asset

class ETFs have slid towards being in alignment with the persistent

quarterly trend and started showing similar signs of a downtrend.

In fact, on a Q4 quarter till date basis these three funds have

slumped, as is evident from Table 1.

Furthermore, the two equity ETFs are within striking distances

of breaching the crucial levels of the 200 Day moving Average,

whereas the commodity ETF, DBC, has already breached that level and

is trading below its 200 day MA. Thus, riskier asset classes might

not prove be a good short term play in the final quarter.

Although we are still early in Q4, the weakness in the third

quarter corporate earnings, speculation surrounding the

presidential election, the fiscal cliff and the aftermath of the

latest “Frankenstorm” Sandy are sure to

keep the riskier asset classes volatile in the near term — a trait

that is pretty much persistent with the second quarter (read Three

ETFs to Watch in Hurricane Sandy's Aftermath).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

PWRSH-DB COMDTY (DBC): ETF Research Reports

ISHARS-EMG MKT (EEM): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

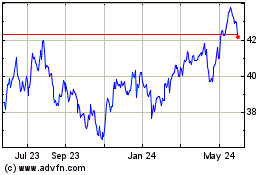

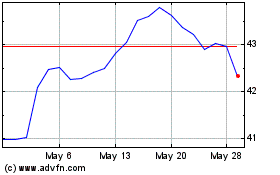

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Dec 2024 to Jan 2025

iShares MSCI Emerging Ma... (AMEX:EEM)

Historical Stock Chart

From Jan 2024 to Jan 2025